Last year TMO debuted our first Data Pack series, focusing on the China Health Supplements market. It's been a great success, covering key data like China's best-selling supplements each month! (In case you missed it, here's China Cross-Border Health Supplements: A 2020 RetrospectiveWe look back over an exciting and record-breaking year for the sale of overseas health supplements in China.our wrap-up of the China Health Supplements market in 2020). Building on that success, we're continuing to launch new Data Packs for this market every month, and this blog acts as a one-stop hub for each new release. Check back here each month for the latest update. And in the meantime, check out some of the highlights of those we've released already below!

If you are interested in the latest monthly update in 2023, please click 2023 China Health Supplements Market: Monthly Updates (with FREE Data Packs Downloads)Check out the latest in TMO's series of Data Packs covering the China Health Supplements market, & including China's top selling supplements!2023 China Health Supplements Market: Monthly Updates to check out!

China Health Supplements Market Data Packs (2021 Annual Collection)This collection includes the China health supplements market data packs from January issue to December issue 2021.December

After the Double 11 extravaganza, consumers’ shopping enthusiasm has dropped sharply. The overall sales performance of the e-commerce market inevitably declined, and the health supplement industry was no exception. However, with the promotional activities launched for Double 12, quite a lot of consumers continued to purchase online, so the sales in December were still above the annual average and the data shall still be very valuable. After processing and analyzing the sales data in December, we found that there are many highlights in the top-selling products, brand performance, and sub-categories.

Key takeaways from December:

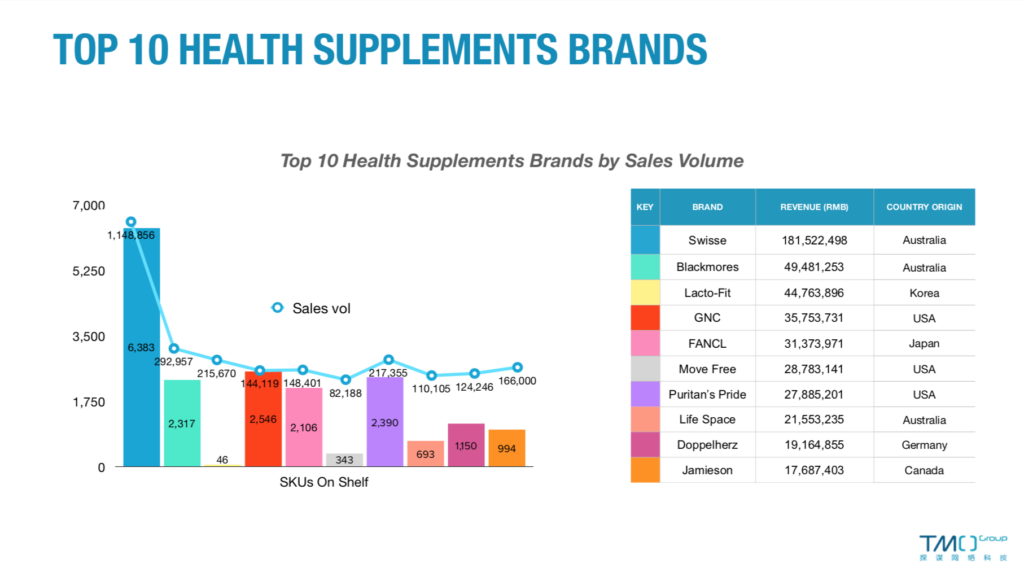

- Swisse's sales performance in December was still outstanding, ranking first among all brands, and its products took all the five places of top products by sales volumes. On the contrary, Move Free experienced a sharp drop in sales after consumers placing orders and stockpiling during Double Eleven, with its brand sales revenue falling from the second place in November to the fifth place in December. Correspondingly, the market share of the bone and joint sub-category also declined significantly in December.

- The sales revenue champion in December is Fitline’s three-in-one product set. The German brand is committed to high-quality cellular energy medicine. Its nano-nutrient powder products are said to resist free radicals, activate cells, supply cellular energy, metabolize acidic substances, and excrete toxins from the body. Among the top five best-selling products, the US brand Reaps occupies three places on the list and thus is also a brand worthy of continued attention.

- According to multi-dimensional data, the sales performance of male health products in December was very impressive. From a brand perspective, Reaps' male products sell well, and Esmond's monthly sales rank third among all brands. From the perspective of sub-categories, the sales performance of endocrine products is gratifying, ranking sixth in all sub-categories, and the top five products are all male health products.

- Respiratory nutrient supplements is a new sub-category that appeared in December. Its main product is lung health products that are rich in quercetin. In the perception of most consumers, the main ways to nourish the lungs are still foods and medications. However, with the emergence of the epidemic in 2020, people are paying more and more attention to the lung health. Therefore, the market for lung health supplements has considerable potential, and its future development is worthy of attention.

For a more detailed breakdown, go download our China Health Supplements Market Data Packs (2021 Annual Collection)This collection includes the China health supplements market data packs from January issue to December issue 2021.China Health Supplements Market Data Pack - December 2021 FREE! And starting from November's monthly report, TMO has launched premium version with richer industry information and source data excel sheets. If you are interested in the upgraded content, go and download the China Health Supplements Market Data Packs (2022 Annual Collection)This collection includes the China health supplements market premium data packs from January issue to December issue 2022. In addition, source data excel sheets with comprehensive industry information are attached for your reference.PREMIUM version!

China Health Supplements Market Data Packs (2021 Annual Collection)This collection includes the China health supplements market data packs from January issue to December issue 2021.November

It has been more than a month since the end of the China’s double 11 promotion in 2021, and all industries have ushered in the peak of their annual sales respectively. For health supplement products, an industry with unlimited potential and rapid development in recent years, there will naturally be many highlights to be explored in the sales data of November.

Key takeaways for Double 11:

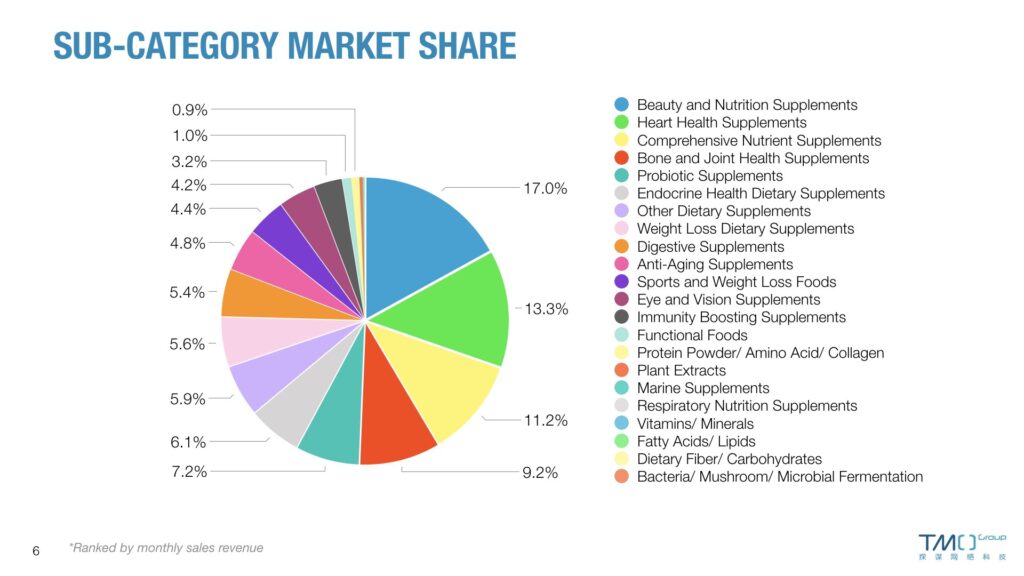

- Beauty and Nutrition Supplements still occupied the first place among all sub-categories, with its high average unit price reaching 1500-2000 RMB. In November, the sales revenue of Heart Health Supplements and Bone and Joint Health Supplements grew rapidly, and the sales volume of both even exceeded that of the Beauty and Nutrition Supplements. Among Bone and Joint Health products, Move Free (glucosamine products) and Swisse (calcium products) accounted for more than 50% of sales.

- The best-selling products (both by sales volume and by sales revenue) basically came from established and notable brands. NewSkin, which suddenly emerged in October, disappeared from the list, while the female probiotic products of Priciness Luna reached the top regarding both monthly sales revenue and volume.

- November’s top five best-selling brands this year is the same with last year. The total sales of these five brands have increased significantly this year, but with the exception of Move Free, the sales of flagship stores decreased, showing that for these brands, the sales channels have been utterly diverged. Consumers are now more willing to buy products of the same brand from lower-priced platforms such as Tmall global import supermarket, Ali Health overseas store and Taobao Global Shopping stores.

- Different from previous years, the peak sales points of nearly all brands for double 11 this year appeared on 11/1. It indicated that compared with the 11th, the selling price on 1st was even lower, and many consumers chose to place their orders in October and completed the final payment on 11/1.

Starting from November's monthly report, TMO has launched a new upgraded paid version, and more valuable additional content is waiting for you to unlock! The paid monthly report contains richer industry information. In addition, source data excel sheets with comprehensive industry information are attached for your reference:

- Upgraded report content:

- Detailed sub-category market information

- Brand case studies

- Report source data (Excel sheets):

- 65 data sheets with data from market overview to sub-categories

- Up to 2000 products for each sub-category

- Product pre-sale data, product reviews, store followers, etc.

If you are interested in the upgraded content of paid version, go and download the China Health Supplements Market Data Packs (2021 Annual Collection)This collection includes the China health supplements market data packs from January issue to December issue 2021.China Health Supplements Market Data Pack - 2021 Double 11 PREMIUM! And of course, if you're still hesitated, we still have the China Health Supplements Market Data Packs (2021 Annual Collection)This collection includes the China health supplements market data packs from January issue to December issue 2021.free version for you to download 🙂

China Health Supplements Market Data Packs (2021 Annual Collection)This collection includes the China health supplements market data packs from January issue to December issue 2021.October

There has been a shift from ingredient-based classification (such as Vitamin A,B,C) to more consumer-based classification. For example, Vitamin C is classified into immune nutritional supplements, and Vitamin K is classified into bone and joint nutritional supplements.

As a result of these changes, we have decided to use new classification methods for health products in our monthly data packs, in order to help readers understand the perspectives and market trends that Chinese consumers are concerned about.

Key takeaways for October:

- Similarly to the previous month, beauty and heart health supplements are the two leading categories by sales revenue.

- This month’s first, second and third products are all new items from Newskin. Imported from South Korea, these “dark horses” collectively generated over 90 million of revenue this month. First two are collagen based beauty supplements with unit prices 15000 and 14981 yuan. Third product is a muscle drink that costs 4800 per unit. We will continue to monitor these products and their remarkable success.

- Fourth and fifth products with highest revenue this month both are male potency supplements from brands AN and Esmond.

- Generally there is no shortage for products aimed at women’s beauty and men’s rejuvenation on the market. However, it remains to be seen if this spike in interest in such products is the new lasting trend or a fad that will be over soon.

- Some notable brands that used to focus on offline direct sales: such as Perfect (完美),Herbal life (康宝莱) and Jeunesse (婕斯) are gradually entering eCommerce space with notably good results. There is little doubt that digitalization will help them to expand by understanding and meeting the demand from younger user groups, as well as widening the reach to their existing customers.

For a more detailed breakdown, go download our China Health Supplements Market Data Packs (2021 Annual Collection)This collection includes the China health supplements market data packs from January issue to December issue 2021.free China Health Supplements Market Data Pack for October!

China Health Supplements Market Data Packs (2021 Annual Collection)This collection includes the China health supplements market data packs from January issue to December issue 2021.September

Compared to August, the sales revenue of September has declined to 1.16 billion RMB. This is likely due to the lack of big promotional days through the month. With the Chinese National Holiday ( Oct. 1- Oct. 7 ) and 11.11 annual shopping day in mid-November, we estimate that sales revenues will see an evident increase in October and November.

Key takeaways for September:

- Among the top 5 best selling products, 3 items are produced by Australian brand Swisse. It retains the spot of the top selling brand with a monthly sales revenue of 137 million RMB, which is 5 times higher than that of Blackmore, the second best seller.

- Vitamin, liver protection and protein products have received significant attention from consumers. This consumption trend indicates that Chinese customers are becoming more aware about the importance of a balanced diet and good nutrition. Also, concerns over sleeping disorders and liver-related diseases have promoted sales growth in thistle and other liver protection products.

- Vitamin D is key to the maintenance of healthy teeth and bones. Products containing this ingredient saw the biggest growth in sales revenue in the month. This may generate from the belief in China that pregnant and middle-aged women should be particularly careful about bone and joint protection.

For a more detailed breakdown, go download our China Health Supplements Market Data Packs (2021 Annual Collection)This collection includes the China health supplements market data packs from January issue to December issue 2021.free China Health Supplements Market Data Pack for September!

China Health Supplements Market Data Packs (2021 Annual Collection)This collection includes the China health supplements market data packs from January issue to December issue 2021.August

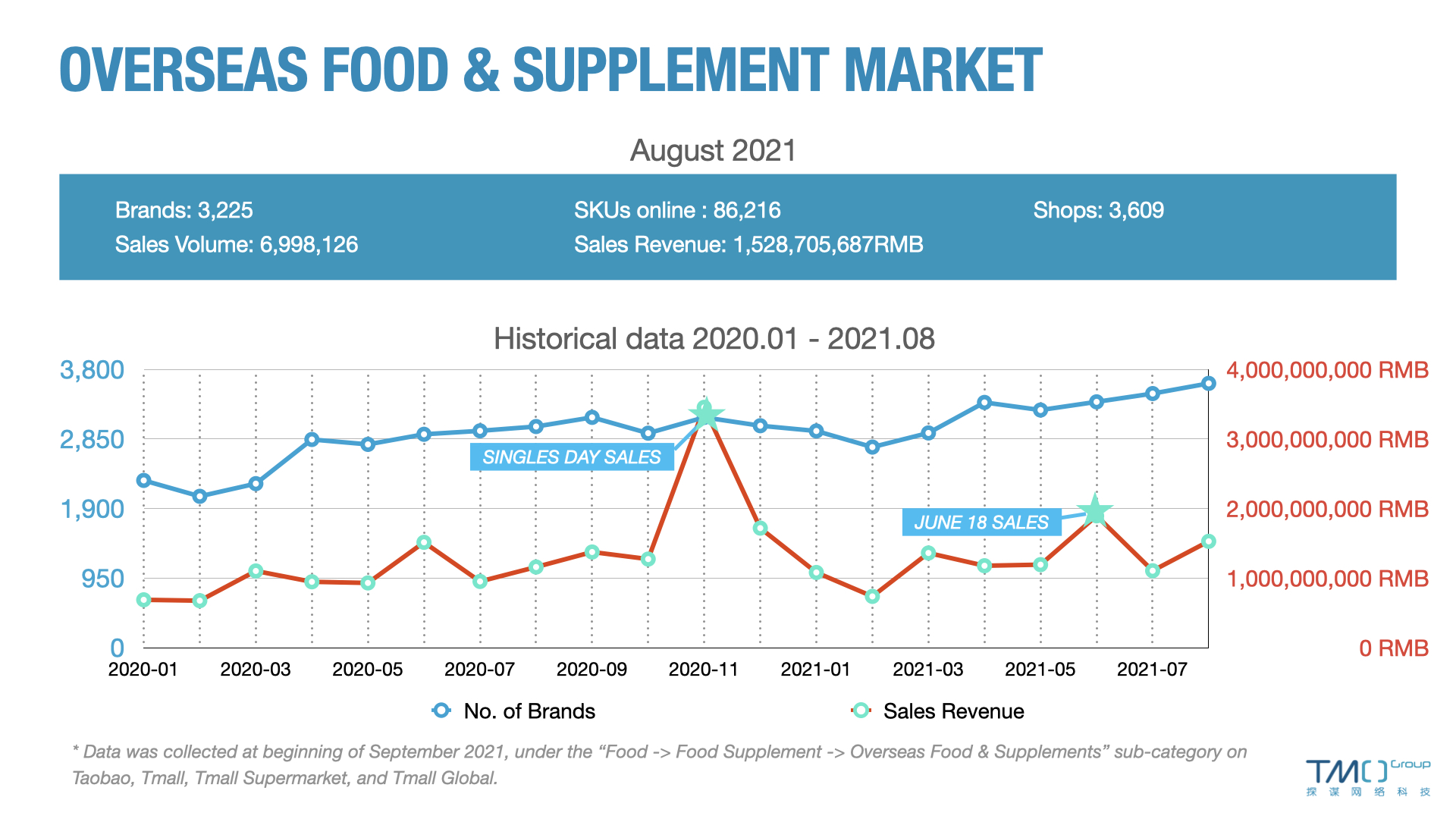

After the heady heights of the June 18th (6-18) shopping festival, one of the biggest shopping days in the Chinese calendar, sales in the health supplement market unsurprisingly took a dip in July. However, sales recovered nicely in August. This can at least be some extent be put down to two other big days in the Chinese shopping calendar occuring in the month - T Mall Global's 8.8 and Chinese Valentine's Day.

Key takeaways from August:

- The overall sales revenue of the Health supplement sector saw a recovery in August, after a dip in July following the June 18 shopping festival. With two other big shopping days in the month, it is actually second in the year in terms of sales so far in 2021 (behind June).

- Looking at the top 5 best-selling products for this month, one nicotinamide mononucleotide (NMN) product, (anti-aging supplement) remained on the list (from July), as well as a weight management product, and a 'thistle' liver protection product. However, there are two new entrants. These are related to reproductive health supplements.

- A female reproductive health supplement takes second on the list, and fourth ranked is a male fertility supplement. Also, these two products were actually the two fastest-growing products in the health supplements market for August. Of course, it remains to be seen if this is the start of a trend or not.

- Swisse, a brand focusing on vitamins and supplements, was the best-selling brand in August. Biowell, a brand focused on anti-aging and beauty products, was the second best-selling brand. This is after they were first and third most popular in July respectively.

For a more detailed breakdown, go download our China Health Supplements Market Data Packs (2021 Annual Collection)This collection includes the China health supplements market data packs from January issue to December issue 2021.free China Health Supplements Market Data Pack for August!

China Health Supplements Market Data Packs (2021 Annual Collection)This collection includes the China health supplements market data packs from January issue to December issue 2021.July

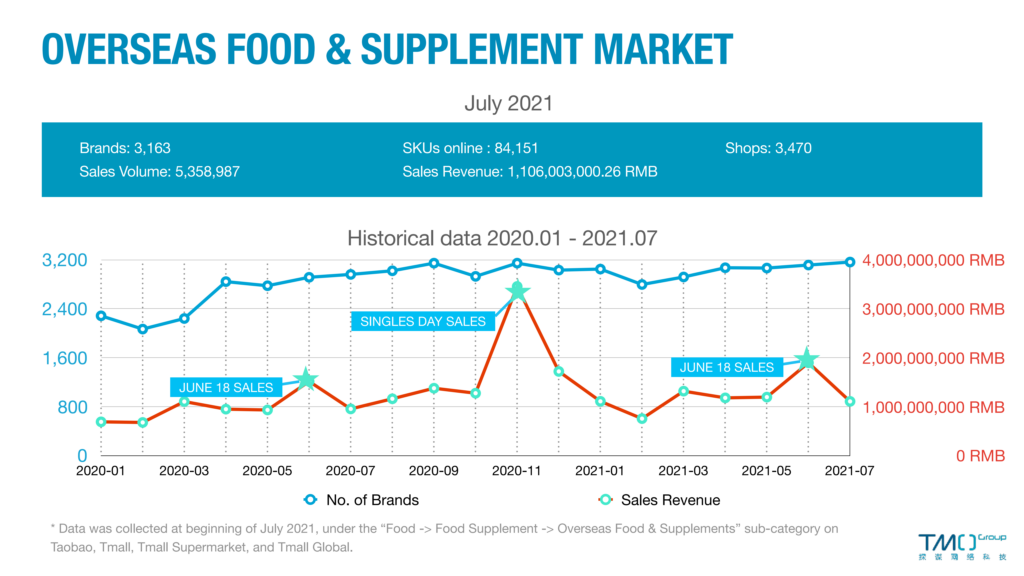

After the craziness of the June 18th shopping festival, one of the biggest shopping days of the year in China, it should come as no surprise that July saw a drop in sales. Nevertheless, sales in the health supplements market remain strong. Compared to data before the onset of the COVID-19 pandemic, it is clear that there is a trend towards Chinese consumers spending more on products promoting their health and wellbeing.

Key takeaways from July:

- Anti-aging products are the top 3 best sellers (ranked by sales revenue) among all products, among which 2 products contain NAD+precursor/ NMN ingredients.

- NMN, an anti-aging supplement, was again the biggest-selling product, having also been in June.

- Charrier immunity and refreshing spray (from France) is the fastest-growing product with regards to sales volume. Its number of sales( 41,612) is about twice that of the second-fastest-growing item( 20,390).

- Biowell is the most noteworthy brand in July. It achieved the third top sales revenue(27110238.8 RMB), only slightly behind the famous Australian brand Blackmore(27817247.79 RMB). At the same time, two Biowell products entered the top 5 selling products ranking both in June and July. One possible reason for its excellent business performance is the increasing prevalence in the Chinese market of anti-aging and beauty supplements, which are the main products of Biowell.

For a more detailed breakdown, go download our China Health Supplements Market Data Packs (2021 Annual Collection)This collection includes the China health supplements market data packs from January issue to December issue 2021.free China Health Supplements Market Data Pack for July!

China Health Supplements Market Data Packs (2021 Annual Collection)This collection includes the China health supplements market data packs from January issue to December issue 2021.June

June 18th (6-18) marks one of the biggest days in the Chinese shopping calendar. The COVID-19 pandemic in 2020 saw a surge in people taking care of themselves better, and as such, a boost in the health supplements market. The strong performance of products in this market has continued into 2021. In fact, compared to last year's 6-18, we have noticed a recovery in purchasing power, with sales volumes around 2.5 times higher.

Key takeaways from June:

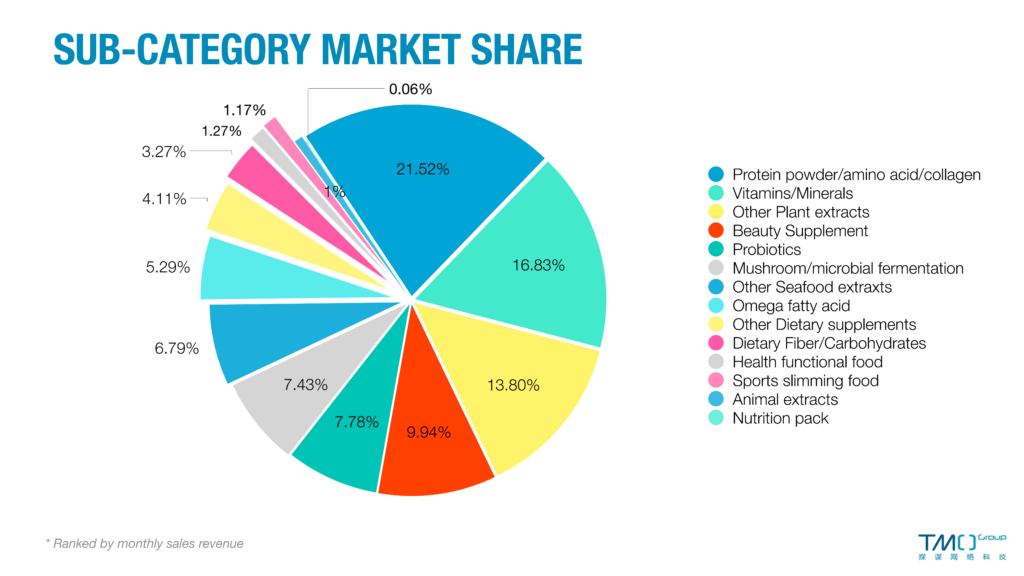

- Protein powder/amino acid/collagen was the biggest selling sub-category for June

- NMN, an anti-aging supplement, was the biggest-selling product

- Calcium and Vitamin D products are growing in popularity, taking up 2 of the top 5 fastest-growing products list

- In the protein powder/amino acid/collagen top 5 selling products, the sleeping aid melatonin took up 3 of the spots

- The most-searched-for keywords (translated) were 'stay up late', 'liver protection', and 'regulate the stomach'

For a more detailed breakdown, go download our China Health Supplements Market Data Packs (2021 Annual Collection)This collection includes the China health supplements market data packs from January issue to December issue 2021.free China Health Supplements Market Data Pack for June!

China Health Supplements Market Data Packs (2021 Annual Collection)This collection includes the China health supplements market data packs from January issue to December issue 2021.May

As vaccinations were being implemented among citizens, we witnessed a rising need for products that enhance social interactivity. For example, breath freshener products experienced the most significant increase in May. There has been healthy growth even when special sales promotions aren't so common, and the Chinese customers have demonstrated interest in pricier subcategories.

Key takeaways from May:

- Vitamins/Minerals became the most popular sub-category in May

- Charrier Breath Fresheners were both the best-selling and fastest-growing products

- Regulating intestinal flora turned out to be the most important effect that customers were looking for

- Tablet and capsule remained the top two popular health supplements’ forms

- Portable-package products tended to sell better in May

- The exact amount of CFUs (Colony Forming Units) in probiotic products attracted increasing attention among customers

For a more detailed breakdown, go download our China Health Supplements Market Data Packs (2021 Annual Collection)This collection includes the China health supplements market data packs from January issue to December issue 2021.free China Health Supplements Market Data Pack for May!

China Health Supplements Market Data Packs (2021 Annual Collection)This collection includes the China health supplements market data packs from January issue to December issue 2021.April

April kept up the strong sales we saw in March to continue a Spring sales resurgence after a slower Winter season. We saw a moderate increase in sales volume accompanying a moderate decrease in sales revenue. This suggests a mix of companies making use of discounts and sales, and consumers opting for cheaper products.

Key takeaways from April:

- Other Plant Extracts became the most popular sub-category this month

- Calcium tablets and liver protection pills designed for reducing the harmful effects of staying up late were the top-selling product types

- Products promoted by popular female actresses tended to sell better in April

- Brightening skin color overtook regulating intestinal flora to become the most important product effect consumers were looking for

- US brand Priscilla Pleasant had a substantial increase in sales volume since April, while Vitafusion and Jameison saw notable decreases

For a more detailed breakdown, go download our China Health Supplements Market Data Packs (2021 Annual Collection)This collection includes the China health supplements market data packs from January issue to December issue 2021.free China Health Supplements Market Data Pack for April!

China Health Supplements Market Data Packs (2021 Annual Collection)This collection includes the China health supplements market data packs from January issue to December issue 2021.March

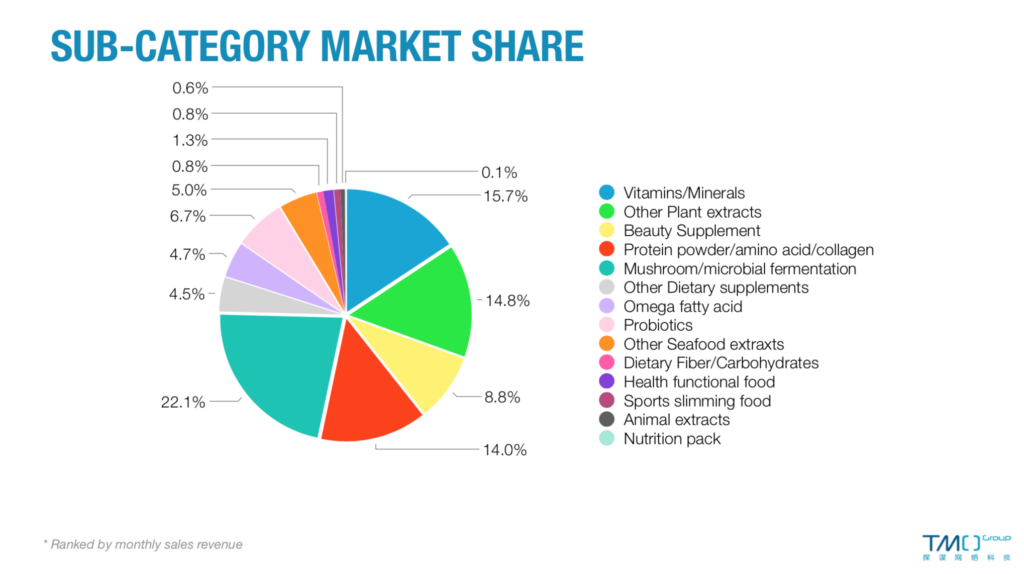

March is when the market for health supplements in China kicks back into gear, and this year was no exception. In fact, March shattered expectations as both sales volume and sales revenue came close to doubling February's numbers!

Key takeaways from March:

- The winter slump is over, and now we can start getting some real insights into where consumer interest lies for 2021.

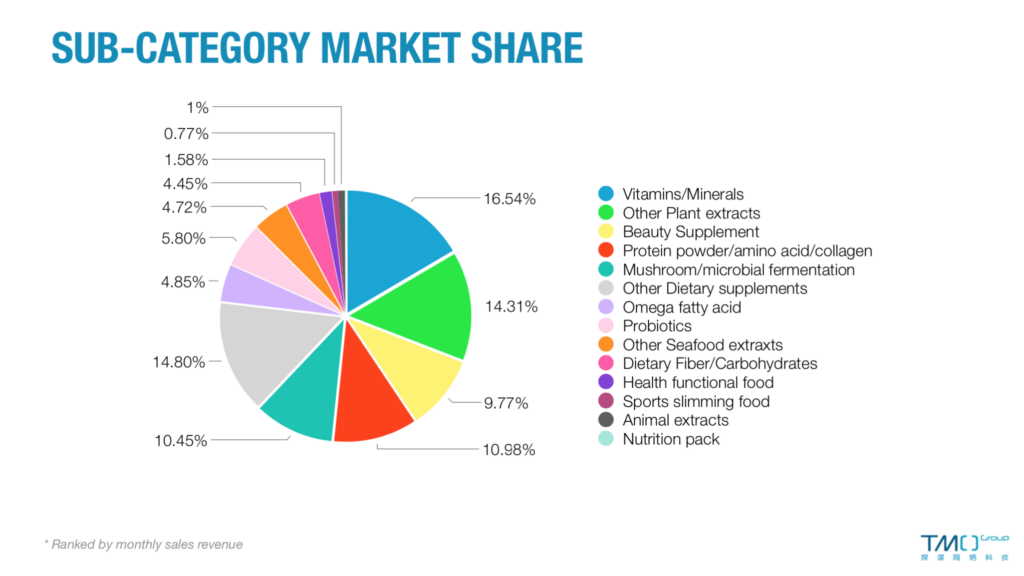

- Mushroom/microbial fermentation products took the top spot for market share in March, accounting for 22.1% of the Health Supplements market, followed by vitamins (15.7%) and other plant extracts (14.8%).

- Likely due to the recent crackdown on false advertisements for NMN, we didn't see any such products in the top 5 best-sellers this month, with vitamin products returning to the top spots.

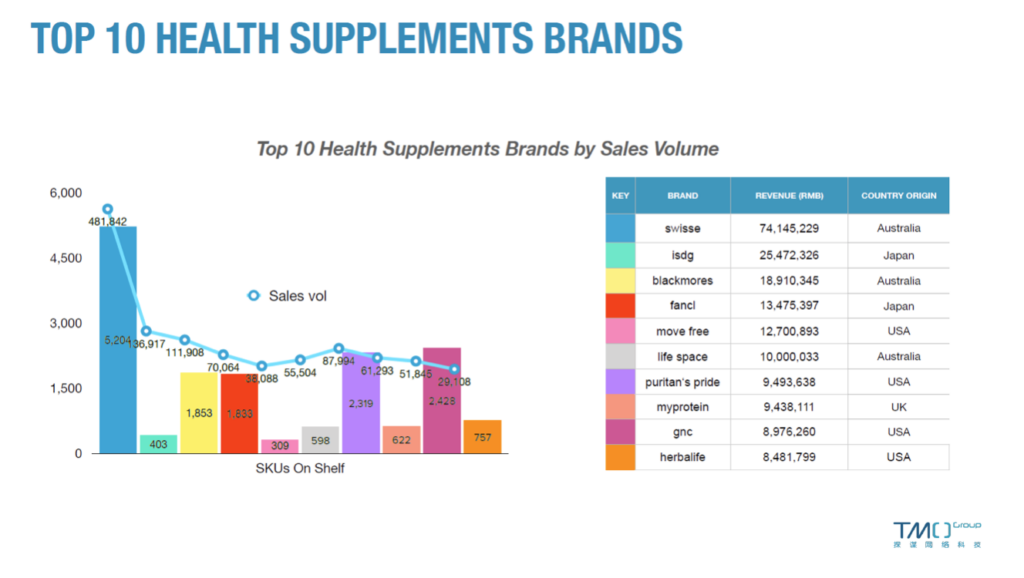

- Meanwhile, Swisse increased its already substantial lead by almost doubling its revenue from over 74 million RMB to more than 143 million RMB.

For a more detailed breakdown, go download our China Health Supplements Market Data Packs (2021 Annual Collection)This collection includes the China health supplements market data packs from January issue to December issue 2021.free China Health Supplements Market Data Pack for March!

China Health Supplements Market Data Packs (2021 Annual Collection)This collection includes the China health supplements market data packs from January issue to December issue 2021.February

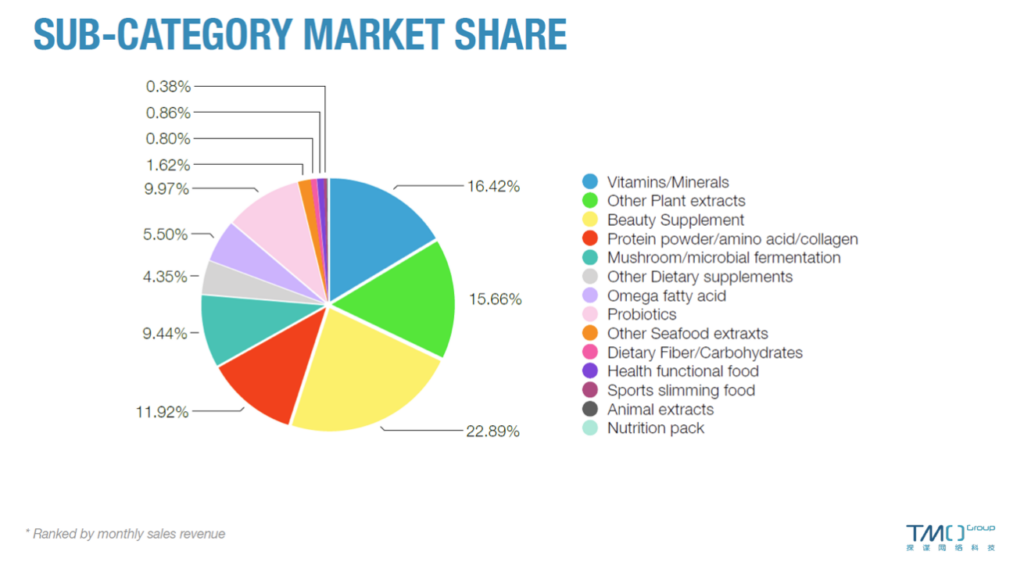

The month of Chinese New Year is typically the off-season for the China Health Supplements market. Consumers are spending more on travel (though less so following the pandemic) and less on stocking up on such products. Therefore, in line with previous years, we saw sales gently decrease from January.

We also saw the effects of false advertisement regulations being enforced in the China Health Supplements market. Late 2020's rising star, NMN (Nicotinamide Mononucleotide) products, felt the brunt of this, particularly higher-priced examples. Companies were marketing such products as anti-aging, which is fine by itself. Problems arose when some of them made claims that were ultimately considered false advertising.

The month's biggest market share losses came from Dietary Fiber/Carbohydrates (which shrunk back to below December's levels after a surge in January), Other Dietary supplements, and Other Seafood extracts.

In more positive news, we can see the start of a rise in body-shaping and slimming product sales. This is likely in anticipation of summer, when consumers want to look their best! In fact, February saw a big surge in the market share of Beauty Supplements in general. The category went from under 10% in January to almost 23% in February. This came alongside the share of Probiotics almost doubling, too.

Below are China's best-selling supplements for February. Some NMN/NAD+ anti-aging products remain strong sellers, but Japanese enzyme products have surged to take three top spots too!

Key takeaways from February:

- Beauty supplements overtook vitamins to claim the largest market share in February, accounting for 22.89% of the Health Supplements market, followed by vitamins (16.42%) and other plant extracts (15.66%).

- Although the best-seller is a Canadian NMN product, this Health Supplements category is no longer as popular as in previous months. This is partially due to the crackdown on false advertisements for NMN, using phrases like “Eternal Youth”.

- Instead, Japanese enzymes became popular again, used for slimming and body-shaping. As with Christmas in the West, most people enjoyed grand feasts over the Chinese New Year. So people often start to look for different ways to lose weight around this time of year!

- Australian and US brands continue to dominate the overseas Health Supplement market in China. Nevertheless, because of the popularity of the enzymes category, Japanese brand ISDG took second place in terms of sales volume in February.

For a more detailed breakdown, go download our China Health Supplements Market Data Packs (2021 Annual Collection)This collection includes the China health supplements market data packs from January issue to December issue 2021.free China Health Supplements Market Data Pack for February!

China Health Supplements Market Data Packs (2021 Annual Collection)This collection includes the China health supplements market data packs from January issue to December issue 2021.January

January typically kicks off the year quietly in Health Supplements sales. This follows the dizzying highs of November's Double-Eleven sales and the lesser but increasingly important Double-Twelve sales in December. In that respect, this year is no different. Nonetheless, January 2021 surpassed January 2020's figures by a significant margin, breaking 1 billion RMB in sales revenue - a new high for the first month of a year.

January saw small market share losses in most of the top categories, as sales of Mushroom/microbial fermentation and Other Dietary supplements grew significantly. The former seems to be part of an ongoing trend of growth in that category, while the latter may be a seasonal or temporary surge.

Below are China's best-selling supplements for January. It was another strong month for NMN/NAD+ anti-aging products, but one product from the Probiotic category managed to top them all!

Key takeaways from January:

- Vitamins/Minerals kept hold of the top spot in market share. This is despite a trend of gradually shrinking which might see Other Plant extracts match its share soon.

- The month's best-selling product is something of an anomaly! Lacto-Fit's Probiotic product was such a huge success that it beat all the popular NMN products to the top spot. This is most likely thanks to a steep discount in January to around half the listed price, at a time when other brands have ended their sales.

- This also had an effect on the month's top brands. Lacto-Fit came in third despite offering far fewer SKUs than its competitors.

For a more detailed breakdown, go download our China Health Supplements Market Data Packs (2021 Annual Collection)This collection includes the China health supplements market data packs from January issue to December issue 2021.free China Health Supplements Market Data Pack for January!