Last year, TMO launched our China Cross-Border Health Supplements Data Pack series. And what a first year it turned out to be! 2020 was obviously tumultuous for most people and industries around the world. But for eCommerce and Health Supplements, it was a year where crisis begat opportunity. More and more consumers looked online to fulfill their shopping needs, as crowded offline shopping venues became less attractive. And unsurprisingly, consumers worried more about staying healthy than ever before.

In this article we look back at 2020 - the trends and changes that defined the year in the China Cross-Border Health Supplements market.

The Story of 2020

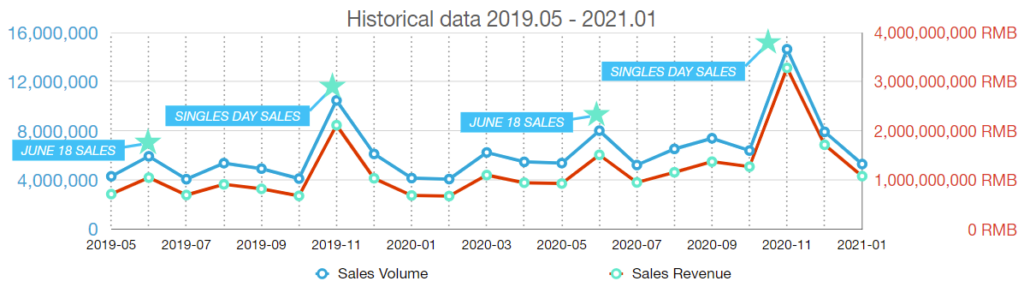

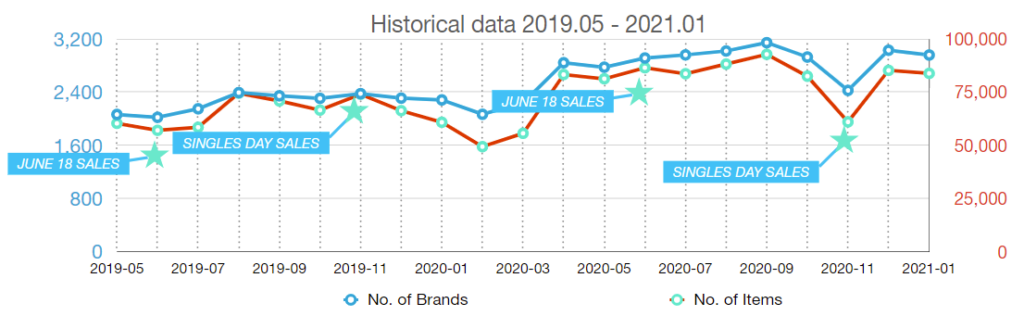

January and February kicked the year off with something of a lull. This is likely due to a combination of factors. Firstly, January followed the dizzying highs of another successful 11-11 (Singles' Day or Double-Eleven, the world's biggest sales festival) and 12-12. This pair of sales seasons once again brought big numbers across multiple categories, including health supplements. So naturally, January can be expected to have seen a relative decrease. But also, these were the early months of CoViD-19, when the pandemic was very much an unknown quantity and a uniquely Chinese issue. As such, consumers showed caution and mostly opted for essential goods like food and masks.

In March, however, this consumer caution corrected itself with a boost in sales that brought monthly revenue on Tmall to over a billion RMB. This may have been something of an over-correction as it was followed by declining sales again in April and May - though revenue still stayed above the billion RMB mark in both these months. June's 6.18 sales period saw a boost to the industry again, and following another post-sales slump in July, sales remained above 1 billion RMB for the rest of the year.

Finally, the year's recovering upwards momentum peaked (as expected!) in November, with record-breaking sales revenue during China Health Supplements Market Data Packs (2020 Archive)If you are interested in 2020 archive of China Health Supplements Market Data Packs, please contact us.the 11-11 sales festival.

Overall, the year ended up being one of significant growth despite early worries. Though the early months of CoViD-19 lockdown slowed spending, sales increased sharply throughout the rest of the year. This meant that 2020's sales success ended up buoying January 2021's sales. Revenue increased by more than 57%, while sales volume increased by over 27%. As such, for the health supplements market, 2020 was a success.

Sub-Category Winners

- Vitamins/Minerals was the best-selling sub-category

- Protein powders and beauty supplements were some of the year's biggest risers

- Anti-aging was also a big winner and a fast grower, due to the rising popularity of NMN/NAD+ products

Vitamins/Minerals was consistently the most popular sub-category of health supplements throughout 2020. Always a strong performer, the sub-category's appeal only expanded as consumers moved to reinforce their health and immune systems during the year of the pandemic. It's true that most of China was relatively safe and life returned to normal in many ways from around April. However, the threat of sudden new outbreaks stayed on people's minds for the rest of the year. Therefore, proactive preventative measures such as reinforcing health through vitamin supplements became more popular.

We also saw both protein powders and beauty supplements post impressive growth numbers over the course of the year. Between January and November last year, sales of protein powders and beauty supplements grew 247% and 629%, respectively. Protein powders are a sub-category with a lot of potential for growth, as we've seen in recent years. The idea of using such supplements to help build muscle and get stronger is a relatively new one to the Chinese market. It's something of an American import that is still gaining ground and mindshare. Beauty supplements meanwhile are less unfamiliar, but are growing in audience as the beauty industry expands and more demographics (like young men) have started to engage with it.

Shifting Product Preferences

- Q1 and Q2 were dominated by Calcium and Vitamin D products

- Q3 and Q4 saw NMN/NAD+ products rise to the top

- 50-200 RMB remains the hottest price range for health supplements

In the first half of the year, Calcium and Vitamin D supplements topped the sales charts. These, especially the latter, are strongly associated in China with a healthy constitution and immune system. Understandably they performed well at the times of highest Coronavirus anxiety. But as the second half of the year began, we saw this sales dominance falter. Instead, Anti-Aging NMN/NAD+ products took the top spots. This aligns with the growth of beauty supplements mentioned above. We're increasingly seeing some health supplements ride the same beauty wave as the cosmetics industry.

Price-wise, as in previous years, products sold for 50-200 RMB were the best-sellers throughout the year. This demonstrates a clear and stable value range that most Chinese consumers are comfortable with for their spending on health products.

NMN Products: 2020's Rising Stars

Nicotinamide Mononucleotide, or NMN, made a splash in the latter half of 2020. This was especially true over the peak sales period of November's Double Eleven festival. During that month, three of the top 5 best-selling products were NMN products aimed at boosting NAD+. Products that seek to boost NAD+ in the body tend to be marketed as anti-aging supplements. This is because NAD+ molecules help generate chemical energy for the body and repair damaged DNA. DNA damage is of course a natural result of the aging process.

2020's Leading Trend: Youth Dominance

China's surge in consumption in recent months has largely been driven by younger demographics, as confirmed in a report by China Daily. Those under the age of 35 account for some 65% of total consumption growth. And breaking from their previous habits, these young consumers are starting to buy health products with increasing enthusiasm. The average annual online spend on health supplements amongst the young has risen to 811.85 RMB. Therefore, it pays for those in the health industry to pay attention to this fast-growing demographic.

'Punk' Lifestyle

Many young consumers, especially those in Gen Z, live what some Chinese call a 'punk' lifestyle. That refers to living unhealthily (late nights, hard drinking, poor diets) and trying to compensate through the use of lots of health supplements. In fact, some specific combinations have emerged, pairing an unhealthy habit, drink, or foodstuff with a specific health supplement meant to 'offset' its effects. Such examples include fried chicken and black tea, beer and wolf-berry, and cola and ginseng.

Additionally, this has led to further knock-on effects such as increased hair loss from sleep deprivation. Surveys suggest that more than 60% of Gen Z consumers stay up past 23:00 'all the time'. Another example is frequent overtime and health effects from the accumulated stress and exhaustion. The resulting effects of these are then once again met with increased health supplement use to counteract them.

Interested in looking back at the state of Health Supplements in China this time last year? Check out last year's China Health & Food Supplements Industry ReportThis report takes a broad view of the market for health supplements in China, and how an overseas brand can seize the many opportunities it presents.Health Supplements Industry Report, and stay tuned for the upcoming 2021 edition!