It's been almost 3 years since TMO debuted our first Data Pack series in 2020, which focus on the China Cross-border Health Supplement market, covering key data like China's best-selling supplements each month. It's been a great success so far and building on that success, we're continuing to launch new Data Packs for this market every month in 2023, and this blog acts as a one-stop hub for each new release. Check back here each month for the latest update. And in the meantime, check out some of the highlights of those we've released already below!

China Health Supplements Market Basic Data Packs (2023 Annual Collection)This collection includes the China health supplements market premium data packs from January issue to December issue 2023. In addition, source data excel sheets with comprehensive industry information are attached for your reference.December

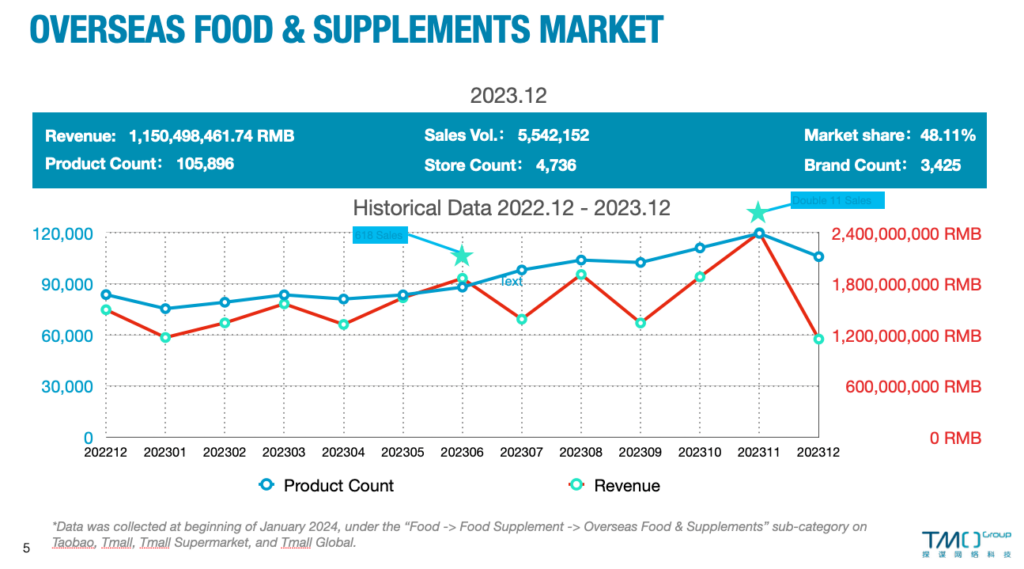

December 2023 Highlights

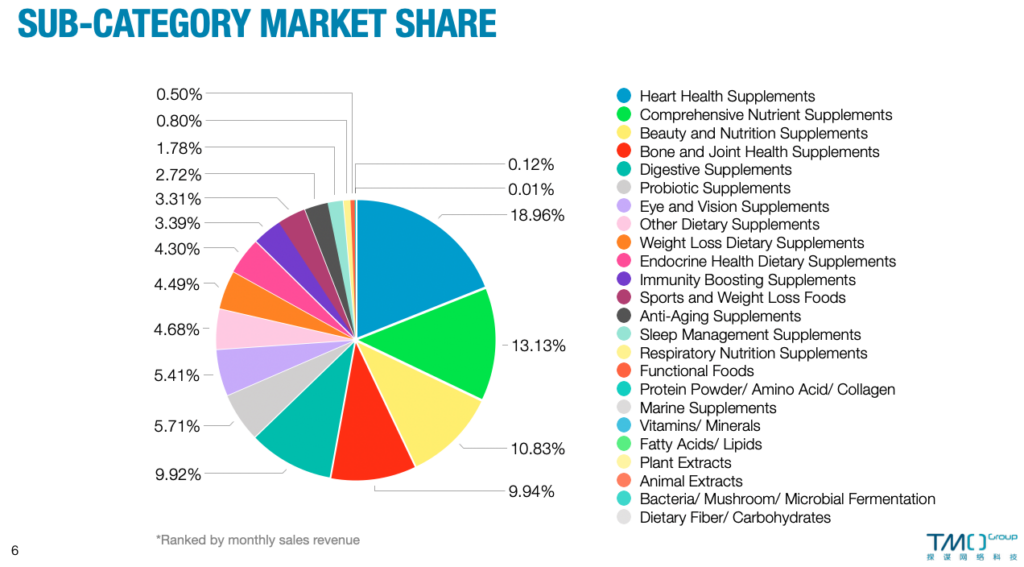

- Subcategories: Overseas heart health supplements continued to lead the overseas health supplement market with a monthly sales revenue of around 0.2 billion RMB and a market share of 18.96%. The top three best-selling subcategories in December were heart health supplements, comprehensive nutrient supplements, as well as beauty and nutrition supplements.

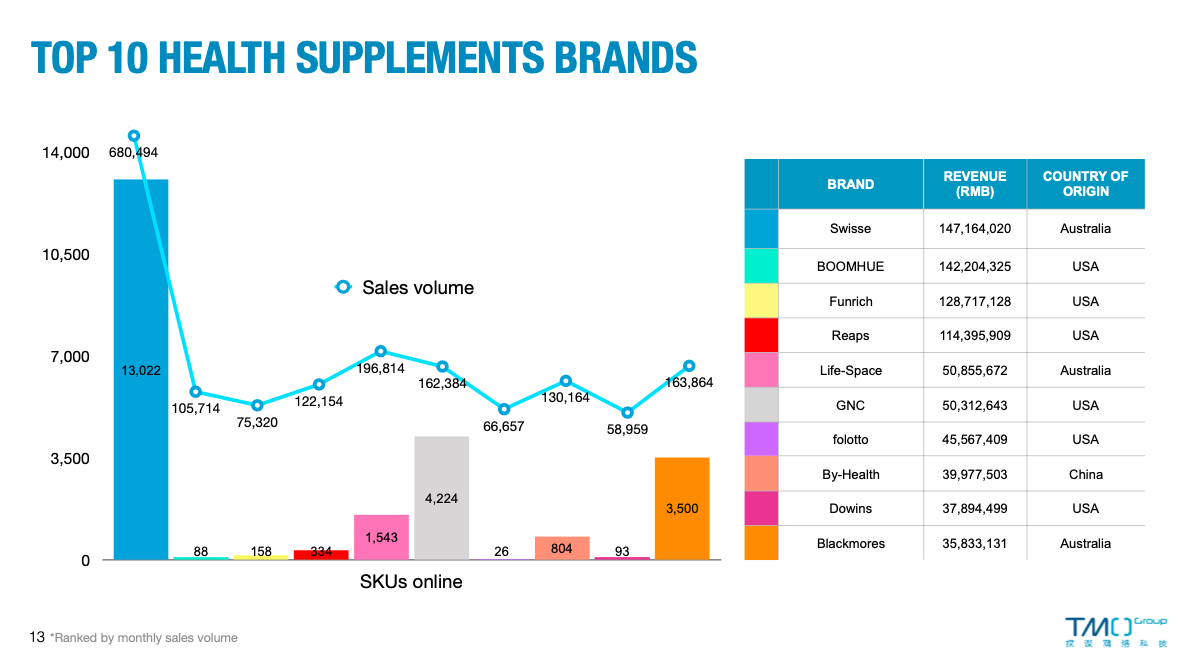

- Brands:Swisse maintained its leading position in the sales revenue rankings, with GNC and Blackmores also demonstrating stability and securing positions in the top three. Doppel Herz from Germany has consistently gone up in the sales revenue rankings since October 2023, advancing from the tenth to the fifth position. Noteworthy is the debut of Sorlife from Hong Kong and Jamieson from Canada in the rankings, claiming the eighth and ninth positions respectively.

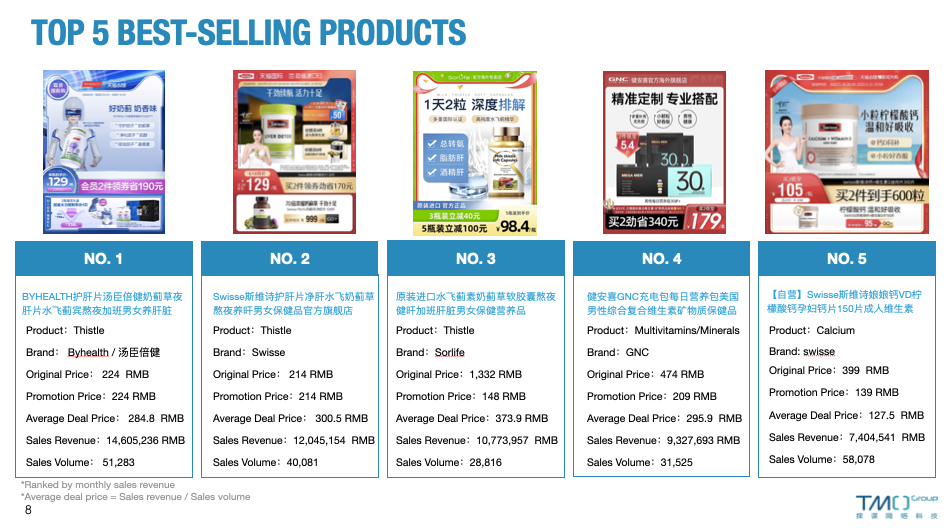

- Products: GNC demonstrated strong competitiveness with its comprehensive vitamin-mineral product, asserting dominance in both sales volume and revenue rankings. This product focuses on moisturizing, hydration, and anti-aging properties.

In the context of the fast-paced modern lifestyle characterized by overtime work and alcohol consumption, there seems to be a heightened emphasis on liver health. Among the top five best-selling products in December, liver support products from Swisse and WonderLab secured three out of the five positions.

The list of high-potential products displayed a diverse array of offerings, reflecting consumer demand for a variety of health supplements. Among these high-potential items, Bayer Australia’s Menevit, a men’s preconception capsule with 90 pills, claimed the top position in the surging products list.

In addition, deep-sea fish oil products also gained significant popularity, securing two positions in the December products list.

For more information, go download our China Health Supplements Market Basic Data Packs (2023 Annual Collection)This collection includes the China health supplements market premium data packs from January issue to December issue 2023. In addition, source data excel sheets with comprehensive industry information are attached for your reference.China Health Supplements Market Data Pack - December 2023! If more detailed market data for specific subcategories is required, please do not hesitate to contact us, and we will provide you with thorough data, customized analysis, and reports to fulfill your needs.

China Health Supplements Market Basic Data Packs (2023 Annual Collection)This collection includes the China health supplements market premium data packs from January issue to December issue 2023. In addition, source data excel sheets with comprehensive industry information are attached for your reference.November

November 2023 Highlights

- Subcategories: In terms of subcategories, overseas cardiovascular nutritional products maintained their dominant position with sales exceeding 4.8 billion RMB and a market share of 20.04%. Cardiovascular, Oral Beauty, and Comprehensive Nutrition ranked as the top three subcategories in terms of sales this month.

- Brands: Swisse remained the top-performing brand, with Blackmores and Move Free maintaining stable positions. GNC gained momentum, jumping from the seventh position last year to the second position, while Omegor from Italy achieved a commendable performance. Omegor, known for its 95% high-purity deep-sea fish oil and competitive pricing, gained favor among consumers. The enthusiasm for deep-sea fish oil in the market remains high, with many leading brands entering this market. Blackmores, with its highly concentrated pure omega-3 deep-sea fish oil capsules, entered the top 10 high-potential product list.

- Products: Swisse’s star products, Liver Protection Tablets and Vitamin D Calcium tablets, continued to demonstrate strong competitiveness. Like in November of the previous year, they led the top five best-selling products, with liver protection tablets dominating both in terms of sales volume and revenue. Notably, GNC’s newly-listed Daily Nutrition Pack achieved excellent results. Additionally, several weight management-related products containing white kidney bean extracts entered the best-selling and high-potential product lists, such as ALLNATURE’s “Quick Slimming Drink”.

- During the major promotion period, consumers showed a tendency to actively purchase star products from famous brands, and demands for recovery from staying up late, comprehensive nutrition supplementation, and weight management remained robust.

For more information, go download our China Health Supplements Market Basic Data Packs (2023 Annual Collection)This collection includes the China health supplements market premium data packs from January issue to December issue 2023. In addition, source data excel sheets with comprehensive industry information are attached for your reference.China Health Supplements Market Data Pack - November 2023! If more detailed market data for specific subcategories is required, please do not hesitate to contact us, and we will provide you with thorough data, customized analysis, and reports to fulfill your needs.

China Health Supplements Market Basic Data Packs (2023 Annual Collection)This collection includes the China health supplements market premium data packs from January issue to December issue 2023. In addition, source data excel sheets with comprehensive industry information are attached for your reference.October

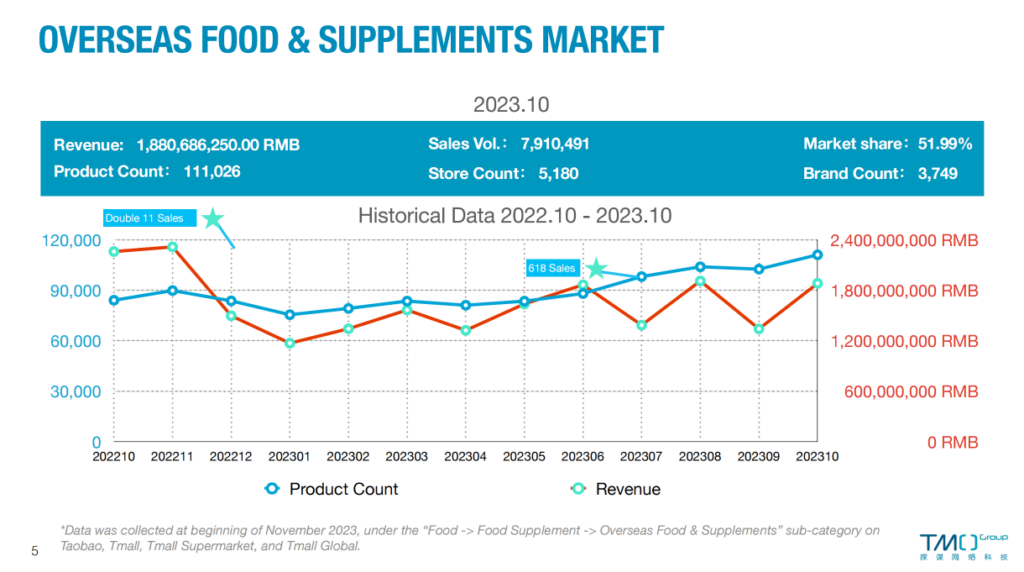

October 2023 Highlights

- Subcategories: Cardiovascular supplements led with over ¥0.44 billion in sales, capturing a 23.42% market share. Month-on-month sales rose by 70.83%, and year-on-year by 45.37%. Consumers focused more on supplements for chronic conditions and basic nutrition.

- Brands: The enthusiasm for deep-sea fish oil led to fierce competition among major brands. Omegor/Golden Caesar, Siwsse, GNC, and Blackmores were notable players in this market. Omegor/Golden Caesar, with its 95% high-purity deep-sea fish oil, secured the top spot in sales and ranked second in revenue. Siwsse’s DHA/EPA deep-sea fish oil soft capsules ranked third in sales with 45,678 units sold. Blackmores also entered the fish oil market, securing a spot in the fast-growing list. Brands like Ny-O3/Norwegian and WHC from Belgium made it to the top 10 in brand sales.

- Products: We observed that the top-ranked and third-ranked products on the fast-growing list are both focused on white kidney bean extract/fruit and vegetable dietary fiber. They were Wdcyh’s “American Imported Fast Keto Sugar-Free Bulletproof Replacement Meal Energy Supplement” and Mom’s Garden’s “Mom’s Garden Enzyme Aloe Vera Capsules.” Additionally, Dykam/Decam from Japan performed well with a product featuring white kidney bean extract, entering the top twenty in terms of revenue.

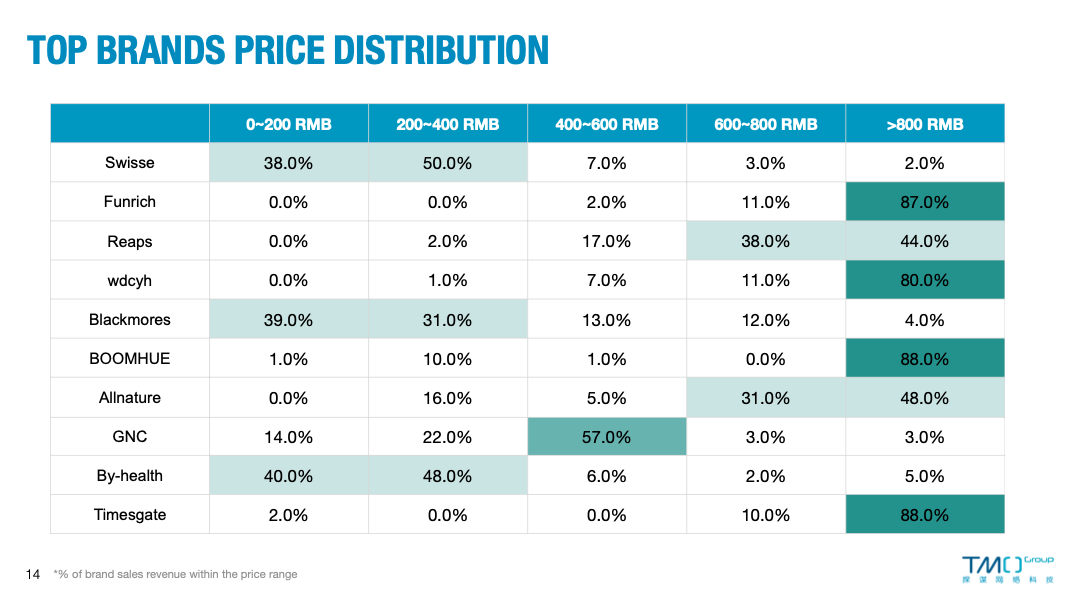

- For detailed information on pricing ranges for these brands, download our data report for the month. Stay tuned for TMO’s upcoming Double Eleven overseas food and supplement rankings and next month’s analysis!

For more information, go download our China Health Supplements Market Basic Data Packs (2023 Annual Collection)This collection includes the China health supplements market premium data packs from January issue to December issue 2023. In addition, source data excel sheets with comprehensive industry information are attached for your reference.China Health Supplements Market Data Pack - October 2023! If more detailed market data for specific subcategories is required, please do not hesitate to contact us, and we will provide you with thorough data, customized analysis, and reports to fulfill your needs.

China Health Supplements Market Basic Data Packs (2023 Annual Collection)This collection includes the China health supplements market premium data packs from January issue to December issue 2023. In addition, source data excel sheets with comprehensive industry information are attached for your reference.September

As reported by BBC News, the entire process of releasing Fukushima’s wastewater will span at least 30 years, indicating that human populations will face prolonged health risks from nuclear radiation in the forthcoming decades. Therefore, the demand for health supplements that mitigate radiation damage is expected to expand in the future.

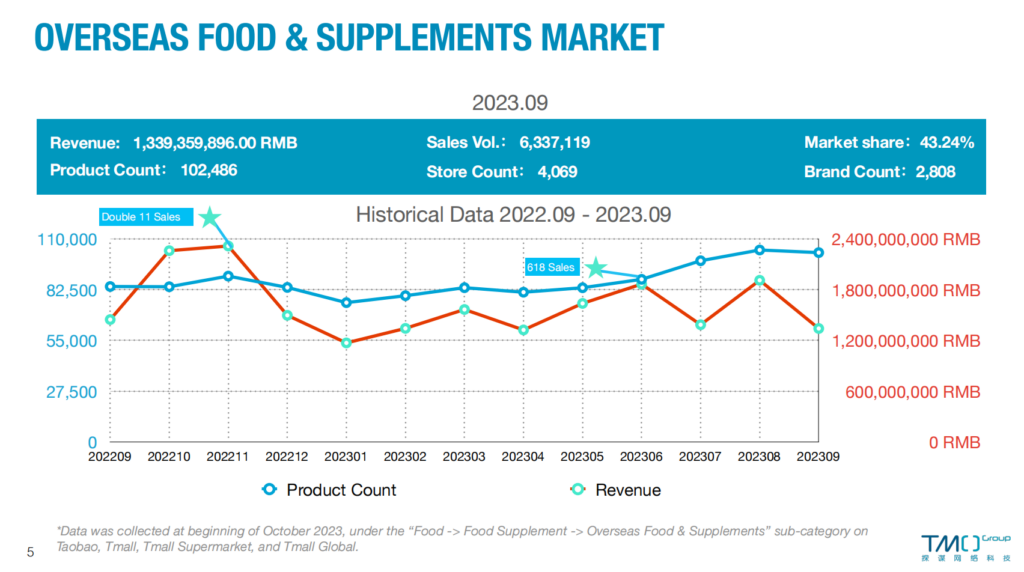

September 2023 Highlights

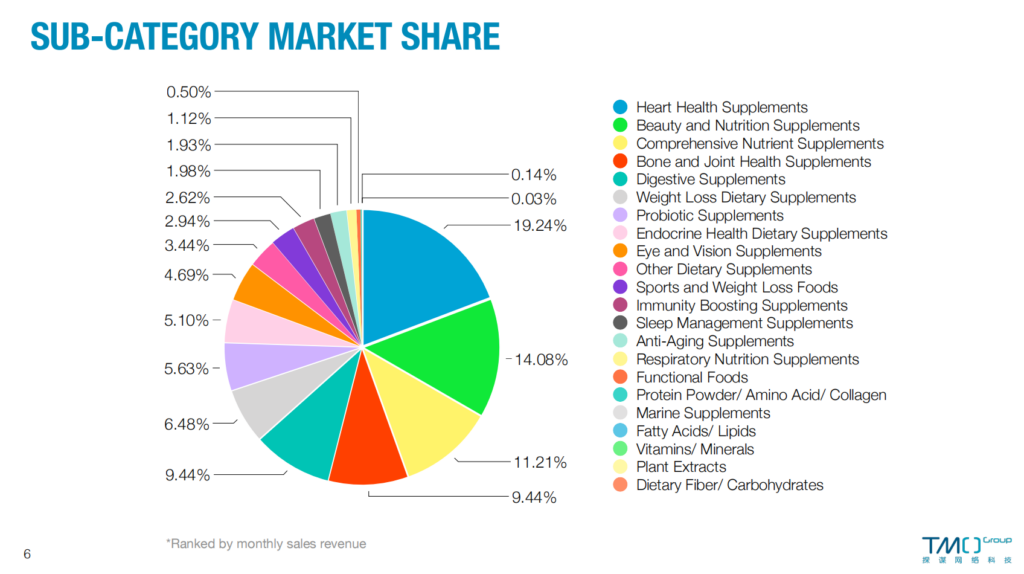

- Overseas heart health supplements experienced a sales drop following a surge in August but continued to dominate the market, with sales exceeding 258 million yuan and a market share of 19.24%. Beauty supplements ranked as the second most popular category among overseas food and supplements, with sales of nearly 189 million yuan and a market share of 14.08%. It is noteworthy that selenium supplements have garnered increasing market attention.

- Swisse continued to maintain its dominance in sales. The American brand Aucrioste emerged as a dark horse brand in September. This marks the first time since 2023 that Aucrioste entered the top ten list, with sales totaling 32.27 million yuan, ranking just behind Blackmores.

- There was a notable surge in demand for oral whitening supplements, with various whitening pills dominating the best-selling product list. Additionally, in September 2023, Folotto’s selenium tablet, featuring “anti-radiation” as its selling point, secured the fifth spot on the sales list. The demand for health supplements that mitigate radiation damage is expected to continue growing.

For more information, go download our China Health Supplements Market Basic Data Packs (2023 Annual Collection)This collection includes the China health supplements market premium data packs from January issue to December issue 2023. In addition, source data excel sheets with comprehensive industry information are attached for your reference.China Health Supplements Market Data Pack - September 2023! If more detailed market data for specific subcategories is required, please do not hesitate to contact us, and we will provide you with thorough data, customized analysis, and reports to fulfill your needs.

China Health Supplements Market Basic Data Packs (2023 Annual Collection)This collection includes the China health supplements market premium data packs from January issue to December issue 2023. In addition, source data excel sheets with comprehensive industry information are attached for your reference.August

Recently, the Japanese nuclear wastewater discharge incident has attracted high attention from all sectors of Chinese society, causing concerns about nuclear radiation as well as the quality and safety of marine food in the future, and leading to the hoarding of DHA, krill oil on other related products. In turn, merchants on the platform have launched a large number of multi-bottle packaging products such as “annual packaging” and “periodic packaging,” which have further pushed the sales trend up. In terms of brands, Reaps saw a fourfold increase in sales and became the second-highest-selling brand in August, showing strong momentum in catching up to the leading overseas brand Swisse.

August 2023 Highlights

- Overseas heart health supplements continue to maintain their leading advantage, with sales exceeding 500 million yuan and market share reaching 26.34%. Additionally, it is worth noting that sales of overseas respiratory nutrition supplements, which care for lung health, have reached a new high, with sales totaling 27.83 million yuan, demonstrating a significant increase of 394% compared to the previous year.

- Swisse continues to lead the sales ranking, with sales of approximately 200 million yuan in August 2023, a 39.17% increase compared to July 2023. It is worth mentioning that the sales of the second-ranking brand, Reaps, skyrocketed from 29.58 million yuan in July to 130 million yuan, significantly narrowing the gap with Swisse. American brands Allnature and Folotto continue to maintain good sales performance since entering the top ten sales ranking in July.

- There is a surge in demand for fish oil, seaweed oil, and krill oil products. Under the influence of the Japanese nuclear wastewater discharge incident, Chinese consumers have started to stock up on marine-related health supplements. The most outstanding product in sales in August is Folotto’s DHA seaweed oil, which occupies two positions on the top five sales list. Also in high demand in August was Reaps’ Antarctic krill oil, with the launch of multi-bottle packaging products driving sales.

For more information, go download our China Health Supplements Market Basic Data Packs (2023 Annual Collection)This collection includes the China health supplements market premium data packs from January issue to December issue 2023. In addition, source data excel sheets with comprehensive industry information are attached for your reference.China Health Supplements Market Data Pack - August 2023! If more detailed market data for specific subcategories is required, please do not hesitate to contact us, and we will provide you with thorough data, customized analysis, and reports to fulfill your needs.

China Health Supplements Market Basic Data Packs (2023 Annual Collection)This collection includes the China health supplements market premium data packs from January issue to December issue 2023. In addition, source data excel sheets with comprehensive industry information are attached for your reference.July

July 2023 Highlights

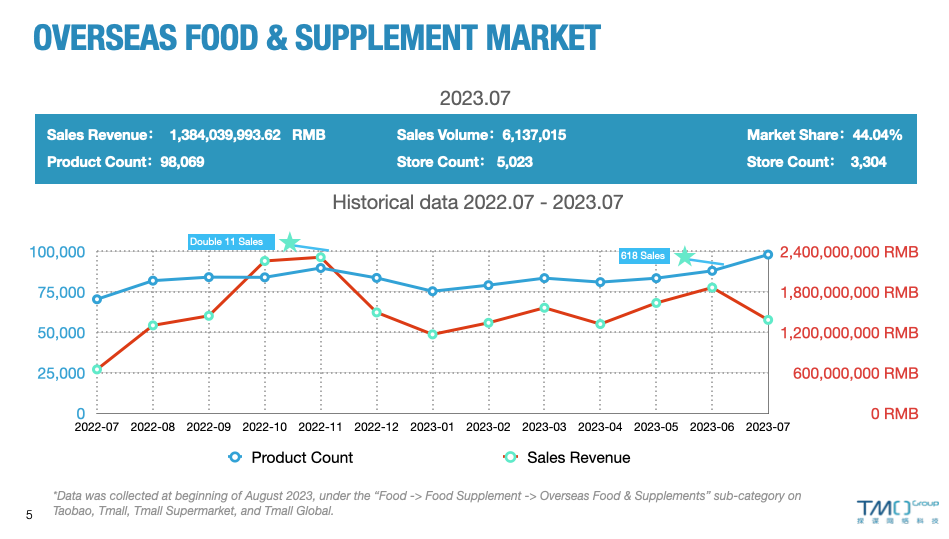

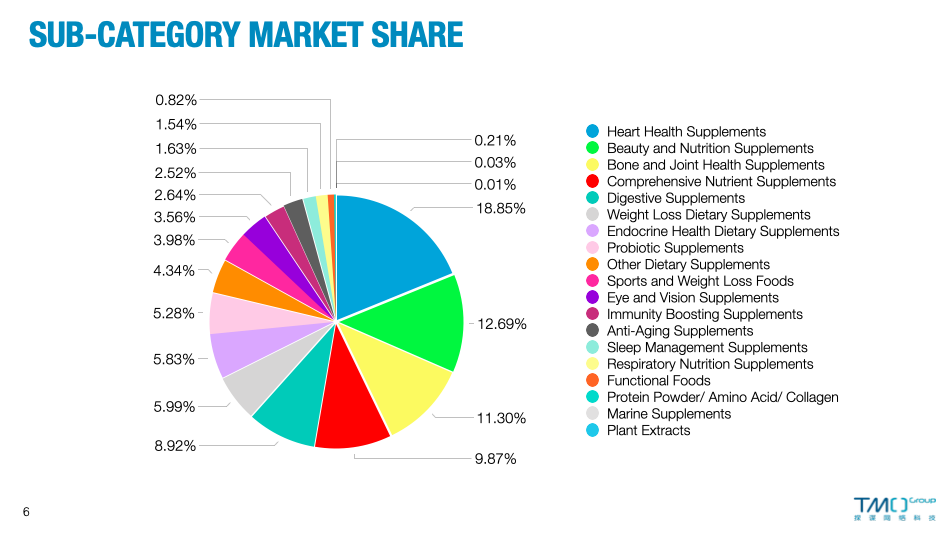

- Heart health supplements had the highest market share in sales, accounting for 18.85%, with sales reaching 260 million yuan. In addition, TMO observed that while the overall sales trend of overseas health supplements dropped, overseas respiratory nutrition supplements for lung health experienced a significant increase. In July 2023, the sales of overseas respiratory nutrition supplements reached their peak in May 2022, with a month-on-month increase of 113.76% and a year-on-year increase of 467.25%.

- Swisse maintained its lead in sales with 148 million yuan in July 2023, representing a decrease of 42.32% compared to the previous month. It is worth noting that in July 2023, American brands Allnature and Folotto emerged as unexpected successes, entering the top ten list of sales for the first time since 2023 and ranking 5th and 6th respectively. This achievement can be attributed to the concentrated listings of related products by merchants. During the period from the end of June to July 2023, Allnature had 23 SPUs listed on Taobao and Tmall, including high-purity PQQ+ coenzyme Q10 mitochondrial beauty capsules, white kidney bean CLA citrus fiber, among others. Similarly, the brand Folotto also had 10 SPUs listed.

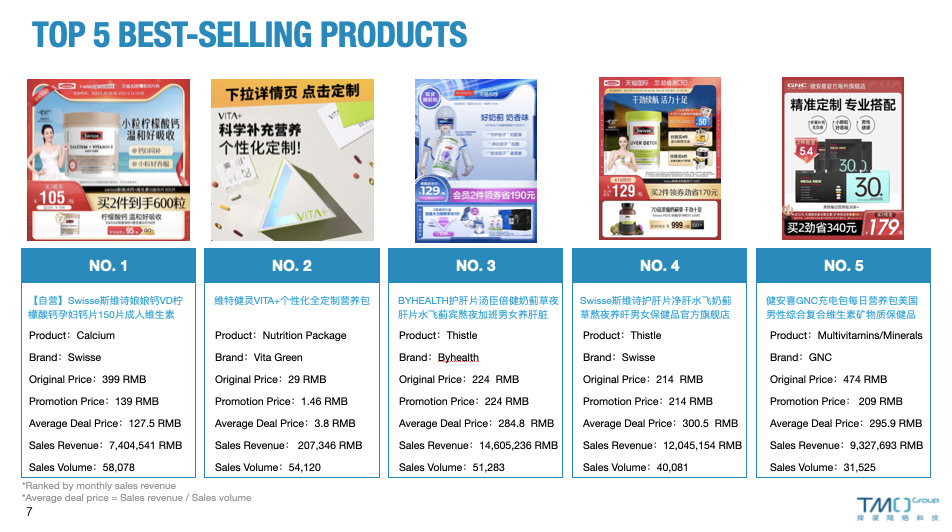

- The July sales report revealed a clear trend towards health supplements for kids and teens as the champion products in terms of both sales and sales volume. Among the top-ranking products, a children’s fish oil product and a children’s calcium tablet secured the highest positions on the monthly sales and monthly sales volume lists. Another notable product was a liver detox tablet by the American brand GNC, securing a position in the top five on both the monthly sales and monthly sales volume lists.

China Health Supplements Market Basic Data Packs (2023 Annual Collection)This collection includes the China health supplements market premium data packs from January issue to December issue 2023. In addition, source data excel sheets with comprehensive industry information are attached for your reference.June

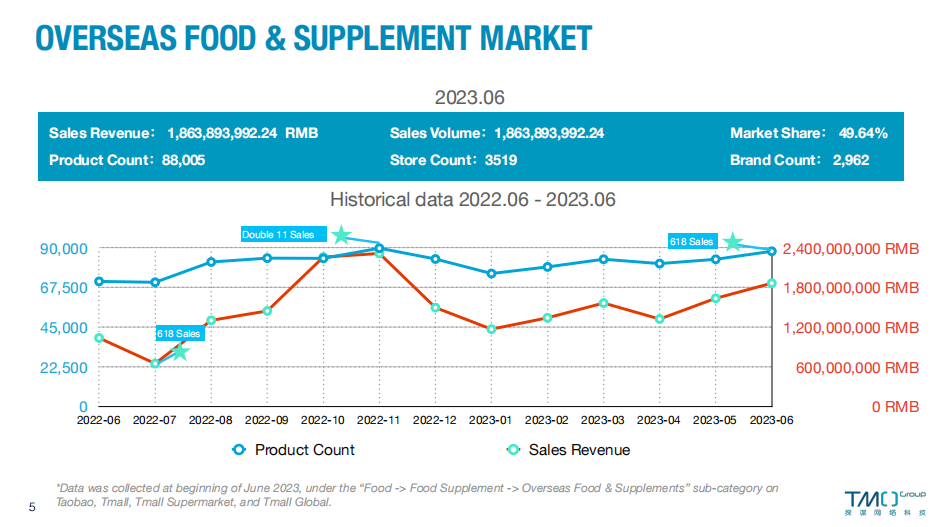

Strong Recovery in Consumption of Overseas Health Supplements During '618' Promotion

According to a recent survey by the People’s Bank of China, residents’ inclination towards “more consumption” increased by 1.2% in the second quarter on a quarter-on-quarter basis, signaling a rebound in consumer willingness. Retail data from the National Bureau of Statistics also confirms the recovery in consumption. National online retail sales of physical goods reached 4.81 trillion yuan, accounting for over one-fourth of total retail sales and showing a year-on-year increase of 11.8%.

Against the backdrop of consumption recovery, as the first post-pandemic “618” shopping festival in China, this year’s Taobao “618” has lived up to expectations. Although downgrading consumption has become a recent hot topic, significant promotions during shopping festivals can still pique consumers’ interest in hoarding goods. Consumers are enthusiastic about purchasing high-priced essential items during major promotional periods. In the post-pandemic era, there has been an explosive demand for “health consumption,” with health supplements being increasingly recognized as essential products by a growing number of consumers. Health supplements have emerged as one of the prominent consumer hotspots during the “618” promotion. In June 2023, overseas health supplements experienced a strong recovery, with sales exceeding 1.8 billion yuan, reaching the peak since December last year, with a year-on-year growth of 14.69% and a month-on-month growth of 15.12%. Among them, multiple overseas brands such as Swisse, GNC, and Blackmores achieved impressive success.

June 2023 Highlights

- Cardiovascular nutrition supplements dominate the overseas health product market. As cardiovascular health management gains more public attention, sales of cardiovascular nutrition supplements on Taobao and Tmall platforms reached nearly 360 million yuan in June 2023, with several fish oil products ranking as best-sellers.

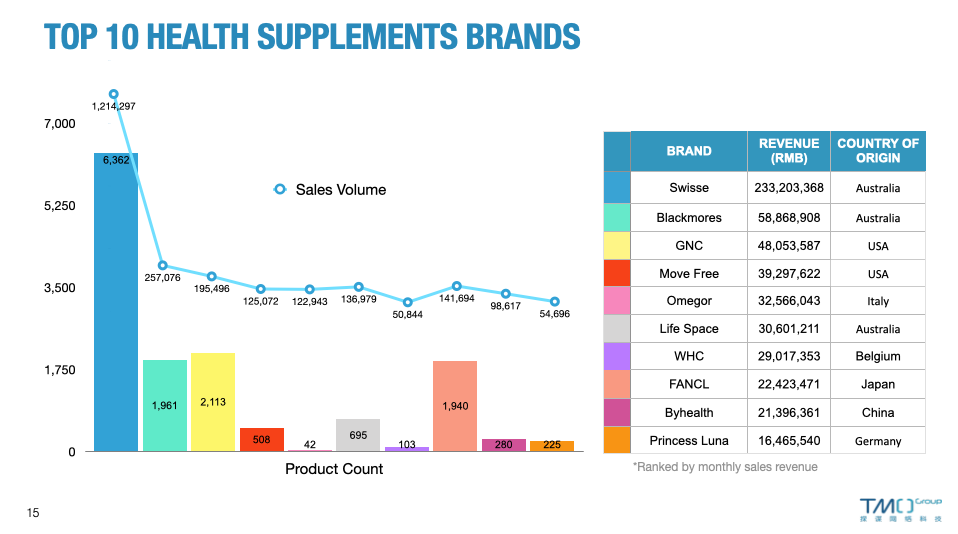

- Swisse maintains a significant lead in sales, surpassing GNC and Blackmores. During the “618” promotion, Swisse gained a large fan base on the Tmall platform through fan interactions in live streaming rooms.

- Among the top-selling products, the krill oil product from Reaps emerged as the bestseller, affirming the public’s growing focus on cardiovascular health. Swisse’s calcium product and liver detox product exhibited a strong sales performance, securing three positions on the monthly sales list and four positions on the monthly sales volume list. GNC Men’s Vitapack claimed the fifth spot on the monthly sales list. Since its launch in July last year, GNC Men’s Vitapack has garnered consistent popularity, maintaining its position in the top five monthly sales list of overseas health supplements for the past four months. This sustained success highlights the product’s appeal to customers in the market.

China Health Supplements Market Basic Data Packs (2023 Annual Collection)This collection includes the China health supplements market premium data packs from January issue to December issue 2023. In addition, source data excel sheets with comprehensive industry information are attached for your reference.May

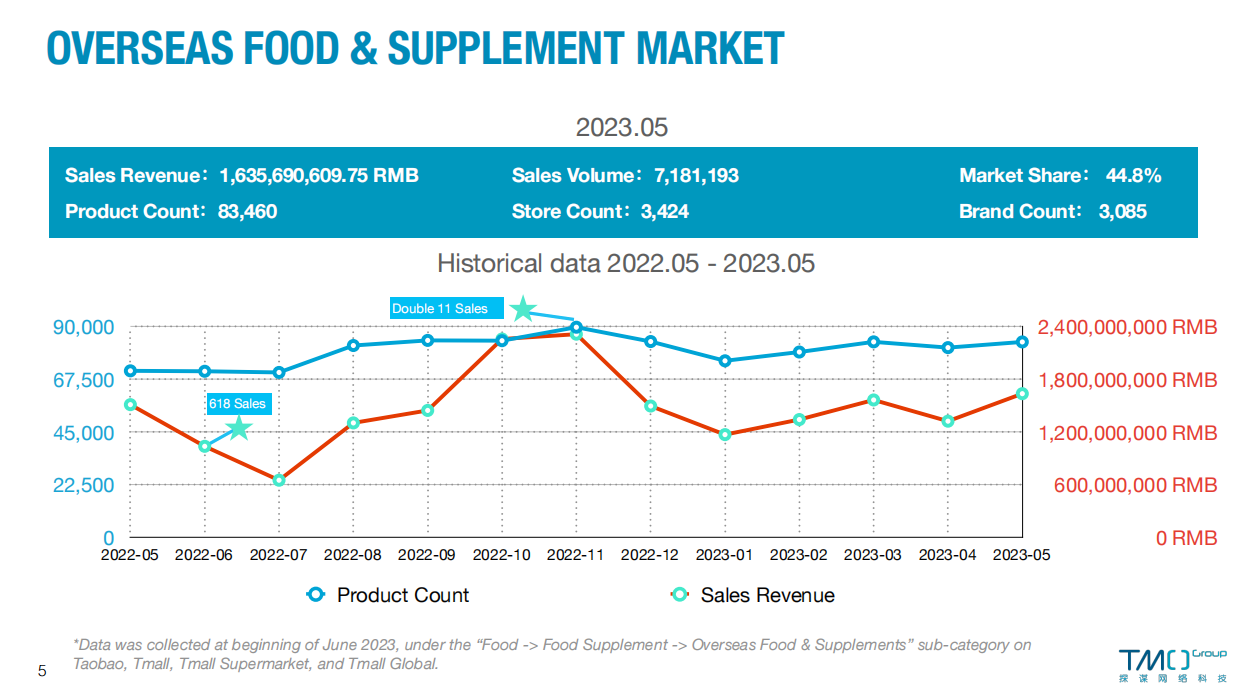

In May 2023, there was a notable increase in sales of overseas food and supplements on Chinese e-commerce platforms, generating revenue of over 1.6 billion Yuan, representing a 23.7% month-on-month growth. TMO suggests that the resurgence in health supplement sales can be attributed to several factors, including the improving state of China’s national economy, the influence of the ‘618 Pre-sale Event’ that started on May 24th, and the increasing health awareness among the population. Recent research conducted by CCTV (China Central Television) indicates that health and wellness have now surpassed tourism as the most preferred choice among consumers.

May 2023 Highlights:

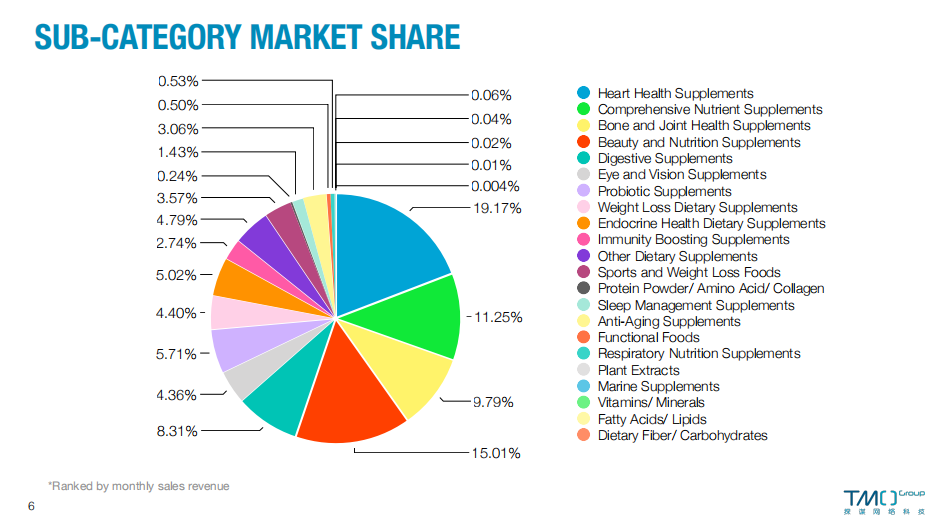

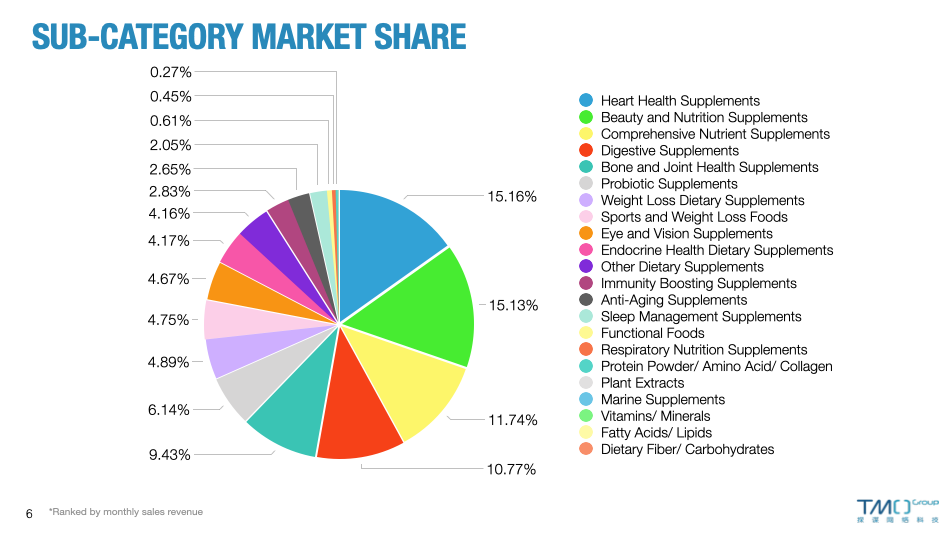

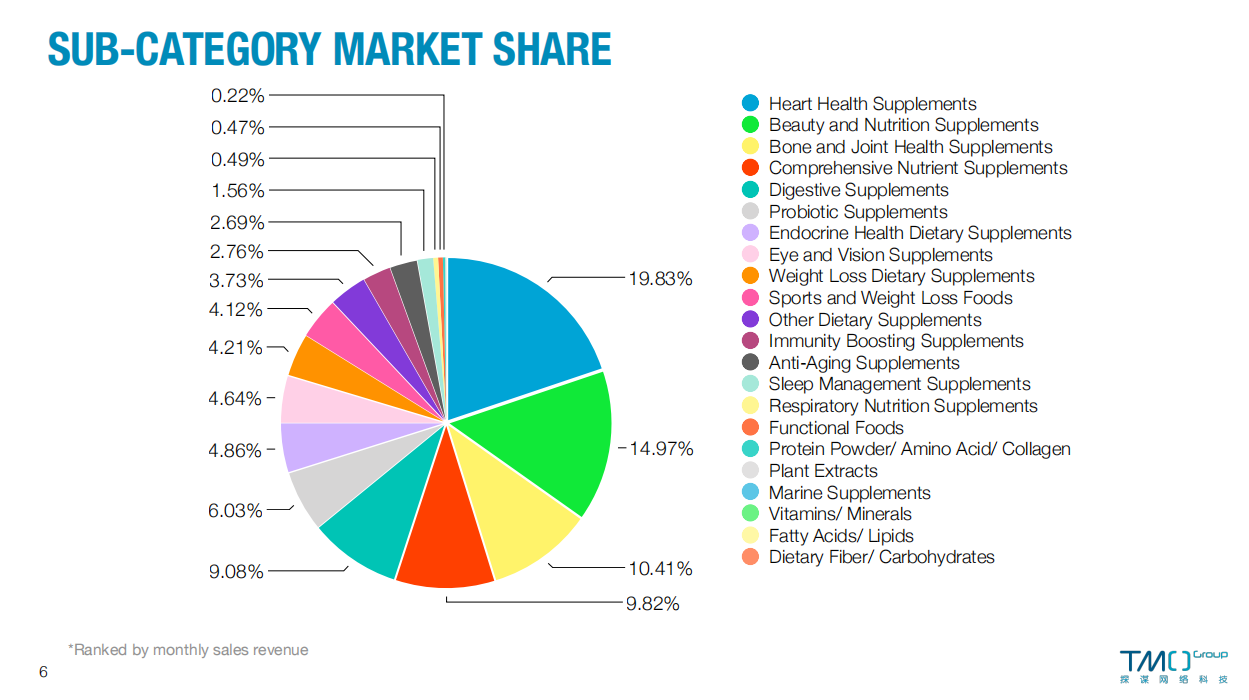

- In April 2023, cardiovascular nutrition supplements and beauty supplements had the highest market shares among cross-border health supplements in he Chinese market, reaching 15.16% and 15.13% respectively, followed by overseas comprehensive nutrient supplements with a share of 11.74%. This data indicates that Chinese consumers have a high level of concern for cardiovascular health and beauty.

- Among the overseas brands, the Australian brand Swisse emerged as the top-selling brand on Taobao and Tmall platforms in May 2023. It achieved remarkable sales revenue, surpassing the second-ranked brand, Blackmores, by nearly four times. Swisse’s calcium and liver products have experienced significant sales success in China. The American brand GNC secured the third position on the sales revenue list. According to TMO’s observation, the success of Australian and American brands in China can be attributed to their strong brand recognition, extensive product variety, and wide availability at different price points in the Chinese market.

- Fish oil products were very popular in May, securing the top two positions on the sales revenue list. Notably, the highest-grossing product in May was a fish oil product from the Belgian brand WHC. This particular fish oil product is known for its benefits in improving eye health, brain function, and bone strength. WHC has also made its way into the top 10 overseas brands based on sales revenue, indicating a promising growth trajectory.

- In terms of price distribution, products in the 200-300 yuan range are the most popular in the market, accounting for more than one-fifth of the total market’s monthly sales revenue.

China Health Supplements Market Basic Data Packs (2023 Annual Collection)This collection includes the China health supplements market premium data packs from January issue to December issue 2023. In addition, source data excel sheets with comprehensive industry information are attached for your reference.April

health supplements still occupied an important position in China’s health supplement market, accounting for 40.34% of the total revenue in April, amounting to 1.32 billion yuan. It is worth noting that starting from the monthly data pack of April 2023, we have excluded data related to fake orders and returns, and optimized the transaction data involving multiple categories. Therefore, the sales data in this report is more accurate compared to previous periods.

April 2023 Highlights:

- In April 2023, cardiovascular nutrition supplements and beauty supplements had the highest market shares among cross-border health supplements in the Chinese market, reaching 15.16% and 15.13% respectively, followed by overseas comprehensive nutrient supplements with a share of 11.74%. This data indicates that Chinese consumers have a high level of concern for cardiovascular health and beauty.

- There was a strong demand for liver protection pills (thistle-based products) in April 2023. Three out of the top five best-selling products by sales revenue in April were liver protection pills. Furthermore, liver protection pills also occupied a prominent position in the best-selling list based on sales volume, with By-Health and Swisse being the most popular brands in this category.

For more information, go download our China Health Supplements Market Basic Data Packs (2023 Annual Collection)This collection includes the China health supplements market premium data packs from January issue to December issue 2023. In addition, source data excel sheets with comprehensive industry information are attached for your reference.China Health Supplements Market Data Pack - April 2023! If more detailed market data for specific subcategories is required, please do not hesitate to contact us, and we will provide you with thorough data, customized analysis, and reports to fulfill your needs.

China Health Supplements Market Basic Data Packs (2023 Annual Collection)This collection includes the China health supplements market premium data packs from January issue to December issue 2023. In addition, source data excel sheets with comprehensive industry information are attached for your reference.March

In the past March, the overall Health Supplement market has increased across the board. Sales were up 6% compared to February and 18% year-over-year. The number of newly opened stores increased by 13% month-on-month, and the number of new products increased by 20%. The number of products was almost the same as that of last year’s Double 11. It can be seen that new overseas merchants are actively entering the market and have not been affected by the overall domestic business environment. After all, maintaining health is everyone’s lifelong pursuit, and it is also the general trend in the later stage of medical insurance reform.

March 2023 Highlights:

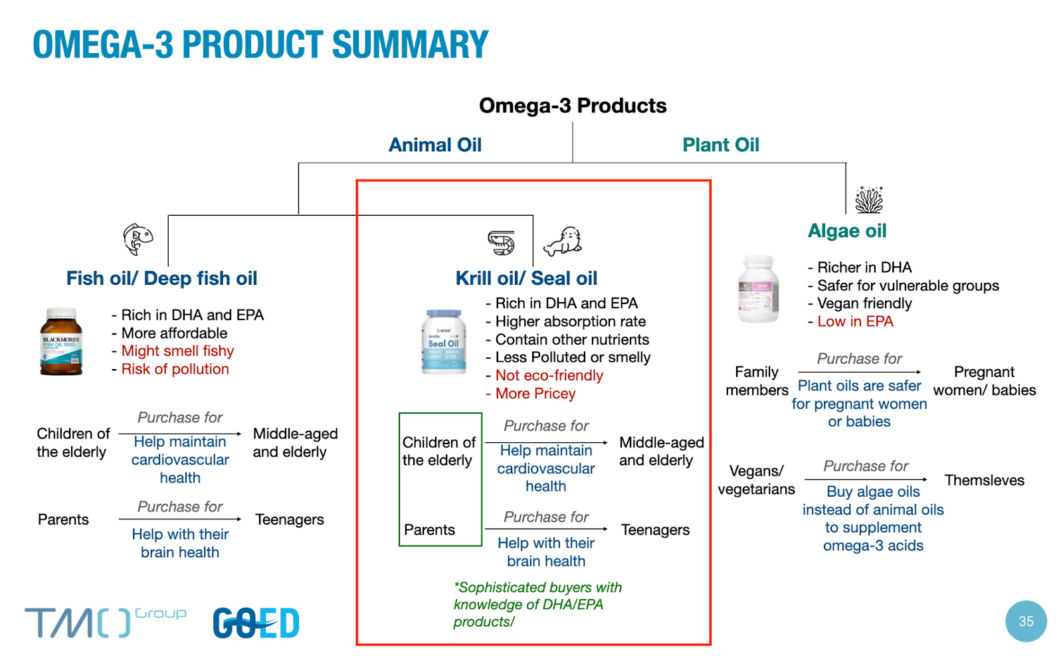

The top four products in the sales revenue list are all Omega 3 products that focus on krill oil. As an Omega 3 product, krill oil is richer in DHA and EPA, which reduces the fishy smell compared to fish oil and is easier to absorb and rich in other nutrients. The disadvantage is that it is expensive and not environmentally friendly.

- The most common uses for krill oil are: Parents buy them for teens, support kids in school, help with brain health, and enhance memory. Seeing that the college entrance examination is approaching, the mood of the parents is also reflected in the sales list. Another purchase purpose is for the cardiovascular health of the elders in the family.

- In the past, most people would buy deep-sea fish oil and fish oil, and the popularity of krill oil this time also shows that Chinese consumers are constantly deepening their knowledge of Omega3 ingredients. We expect that DHA-rich and ECO-friendly plant-based algae oil will be accepted by everyone. If you are interested in Omega 3 industry report, pls click here for more information.

- In their categorization, 2 products are listed in Endocrine nutritional supplements > Blood sugar regulating food, while the other 2 products are listed in Cardiovascular nutritional supplements > Fish oil/deep-sea fish oil. Although it is a bit illogical to put the Omega 3 products into Blood sugar category, however, it is a strategic matter to choose which category to display products. If you are interested, download the copy and check out how brands make their product stand out.

Nutrition facts of this month’s best-selling products:

- In the top 5 products by sales volume. probiotics, glucosamine hydrochloride, B420, Lactobacillus, Lactobacillus salivarius AP-32 1.5 billion, Lactobacillus johnsonii MH-68 1.5 billion, Lactobacillus rhamnosus F-1 1.5 billion are common nutrients.

- Among the products with high sales revenue, are stem cells, nicotinamide mononucleotide, β-nicotinamide mononucleotide supplement NAD+, spermidine, resveratrol, collagen, small molecule hyaluronic acid, gamma aminobutyric acid, blueberry extract, etc. These ingredients related to anti-aging and beauty are among the top nutritional ingredients.

The top 5 popular effects of this month:

Enhanced resistance, smooth breathing, improved resistance, healthy blood lipids, improved immunity.

For more information, go download our China Health Supplements Market Basic Data Packs (2023 Annual Collection)This collection includes the China health supplements market premium data packs from January issue to December issue 2023. In addition, source data excel sheets with comprehensive industry information are attached for your reference.China Health Supplements Market Data Pack - March 2023! If more detailed market data for specific subcategories is required, please do not hesitate to contact us, and we will provide you with thorough data, customized analysis, and reports to fulfill your needs.

China Health Supplements Market Basic Data Packs (2023 Annual Collection)This collection includes the China health supplements market premium data packs from January issue to December issue 2023. In addition, source data excel sheets with comprehensive industry information are attached for your reference.February

February is the first month after the Spring Festival. After the Spring Festival, many people realize that the high-calorie and high-fat foods they consumed during the New Year period may have a negative impact on their health. Therefore, February is usually considered a time to start a healthy lifestyle. Additionally, the last month of winter may affect the body’s immune system, making it even more necessary for people to take health measures. If you want to learn more about the overseas health product market, please download our February 2023 data pack.

Key Takeaways from February:

- In February, the overseas health product market sales reached 2.68 billion RMB, showing a rebound trend. Oral beauty products once again became the most popular category, with a market share of 17.4%. This indicates that the demand for beauty and health among consumers remains strong. In terms of product ingredients, products containing collagen and grape seed extract have a significant upward trend and are highly favored by consumers.

- Overseas digestive supplements are growing, with thistle products leading the market. By-health’s thistle liver protection tablets and Swisse’s milk thistle liver protection tablets were top sellers (in terms of the sales volume) in February, showing consumers’ high importance placed on liver health due to unhealthy habits of many people, such as staying up late to watch dramas and eating high-fat and high-oil diets.

- The overseas respiratory supplement market has expanded to include a new category of elderberry products. Previously, the market mainly consisted of products containing quercetin. Research suggests that elderberry has immune-boosting properties and may help alleviate respiratory symptoms such as colds and flu. Sambucol, a brand from Australia, is the main player in this category, with its product line primarily targeting families and children. The addition provides more options for consumers to maintain respiratory health, especially in the context of the post-pandemic.

- Affordable health products have become a popular choice for consumers, while the middle and high-end markets still have development potential. Most of the popular commodity unit prices are concentrated below 200 RMB, but the market sales for unit prices over a thousand RMB this month were close to 700 million RMB, indicating that while affordable health products are popular, there is also an opportunity in the high-end market.

For more information, go download our China Health Supplements Market Basic Data Packs (2023 Annual Collection)This collection includes the China health supplements market premium data packs from January issue to December issue 2023. In addition, source data excel sheets with comprehensive industry information are attached for your reference.China Health Supplements Market Data Pack - February 2023! If more detailed market data for specific subcategories is required, please do not hesitate to contact us, and we will provide you with thorough data, customized analysis, and reports to fulfill your needs.

China Health Supplements Market Basic Data Packs (2023 Annual Collection)This collection includes the China health supplements market premium data packs from January issue to December issue 2023. In addition, source data excel sheets with comprehensive industry information are attached for your reference.January

Key Takeaways from January:

- In January, the overall performance of the cross-border health supplement market experienced a certain decline. The total sales volume was down 26% year on year. This year’s Spring Festival coincided with January, and most logistical companies were out of service. Furthermore, the Double Eleven and Double Twelve major promotional festivals had just passed, contributing to the coldness of the eCommerce market in the first month of this year.

- Life-space’s probiotic supplements supporting stomach health were the monthly sales champion, with a sales volume of up to 50,000 units. Gatherings of relatives and friends are common during the Spring Festival, and symptoms such as stomach pain and indigestion emerge regularly as a consequence. At this point, some people would choose to take probiotics and other methods for supplementary prevention.

- Lung health supplements still remain hot in January. Three of the top five products in monthly sales are BOOMHUE’s quercetin products. In terms of subcategories, sales of Respiratory Nutrition Supplements containing quercetin increased by 42% month on month in January.

- The popularity of coenzyme Q10 preparations has surged. Coenzyme Q10 preparations’ sales soared by 84% month on month as it was rumored online to be helpful in avoiding myocarditis after recovering from COVID-19 infection. The product with the highest sales of coenzyme Q10 supplements is GNC’s Coenzyme Q10 Soft Capsules, whose major function is to sustain the heart muscle on a regular basis.

For more information, go download our China Health Supplements Market Basic Data Packs (2023 Annual Collection)This collection includes the China health supplements market premium data packs from January issue to December issue 2023. In addition, source data excel sheets with comprehensive industry information are attached for your reference.China Health Supplements Market Data Pack - January 2023! If more detailed market data for specific subcategories is required, please do not hesitate to contact us, and we will provide you with thorough data, customized analysis, and reports to fulfill your needs.

If you are interested in previous year's monthly update, please click 2022 China Health Supplements Market: Monthly UpdatesCheck out TMO's series of Data Packs covering the China Health Supplements market in 2022.2022 China Health Supplements Market: Monthly Updates to check out!

If you are interested in the monthly update in 2021, please click 2021 China Health Supplements Market: Monthly Updates (with FREE Data Packs Downloads)Check out the latest in TMO's series of Data Packs covering the China Health Supplements market in 2021: stats, insights and analysis2021 China Health Supplements Market: Monthly Updates to check out!