Dominate China's eCommerce landscape with our localization solutions

We help businesses establish a strong online presence in China’s major retail platforms as well as through private eCommerce websites and social commerce.

We help businesses establish a strong online presence in China’s major retail platforms as well as through private eCommerce websites and social commerce.

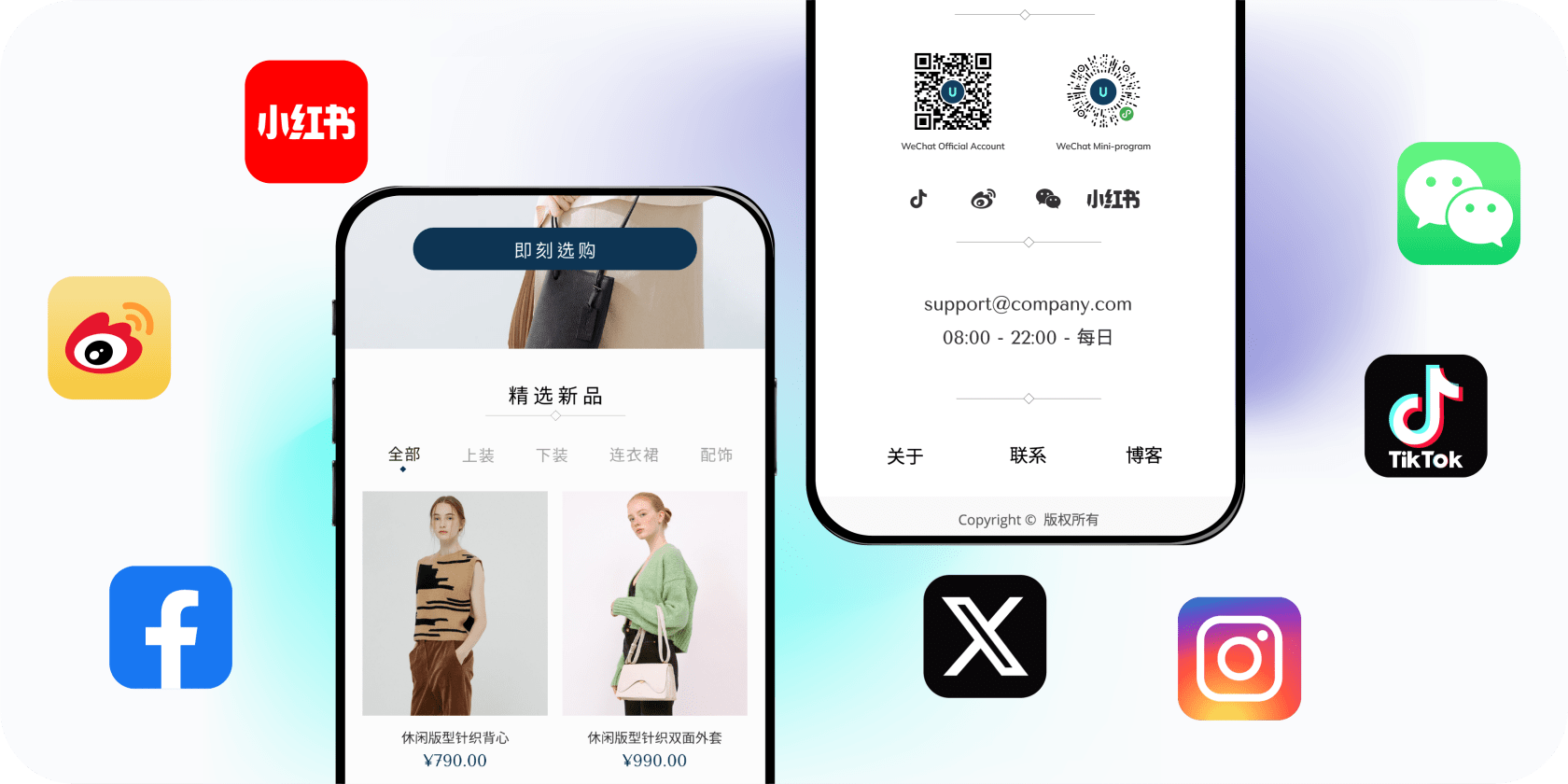

Connect to the top traffic-driving platforms—such as WeChat, Douyin (TikTok’s Chinese counterpart), Toutiao, and Zhihu—to empower your brand’s marketing decisions via Omni-channel data insights.

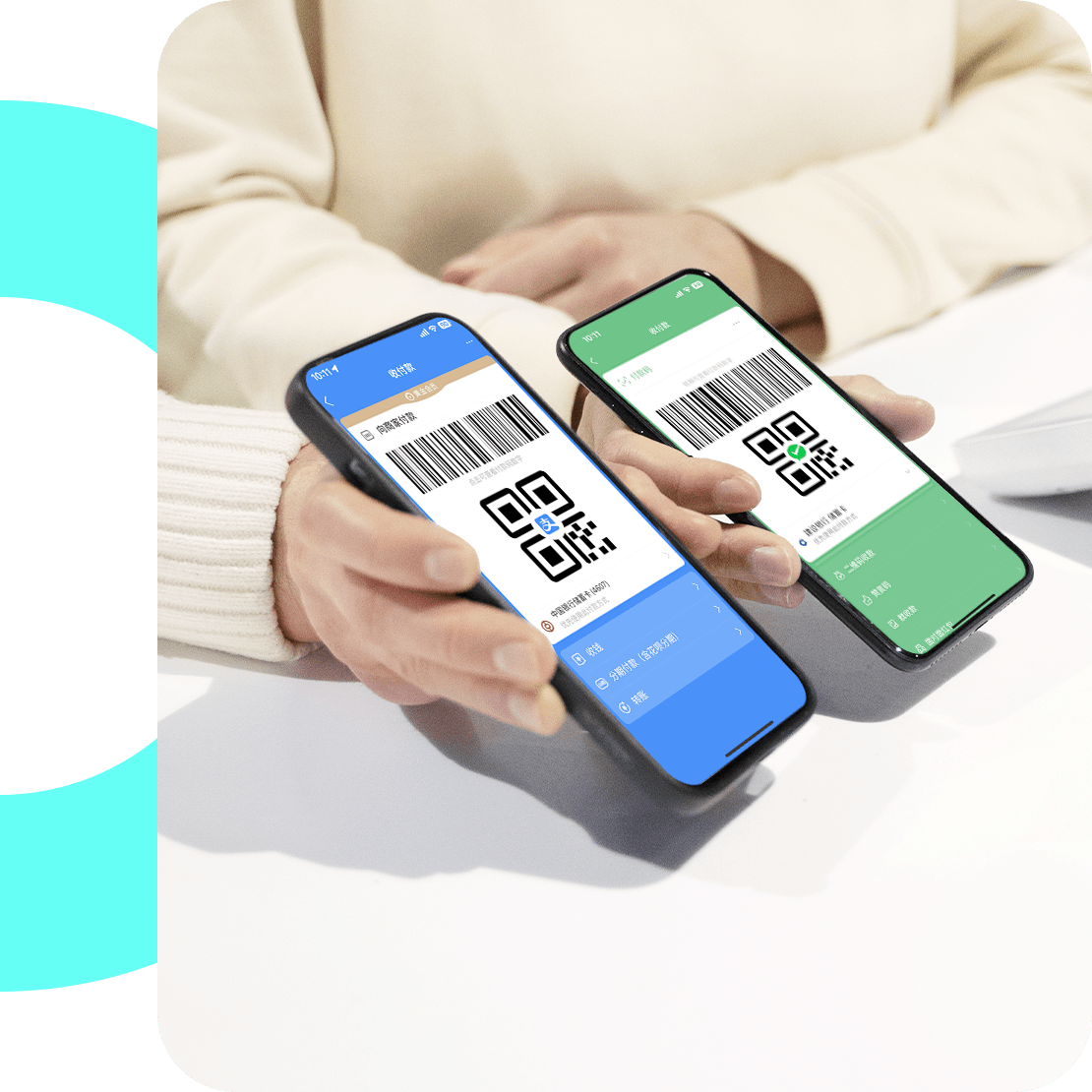

Simplify checkout and boost sales with the integration of top Chinese payment options like WeChat Pay, Alipay, UnionPay, and Huabei installment payments.

Utilize QR codes, in-app purchases, cross-border payments, and more to offer a localized payment experience that caters to Chinese customer preferences.

Monitor user volume in real-time and prepare for high-traffic eCommerce peak season and at a minimal cost with an efficient, scalable system, with ongoing maintenance services that guarantee uninterrupted operation and new feature development.

Our expertise in Chinese data processing and cybersecurity regulations ensure your digital commerce presence is fully aligned with the most up-to-date data and facilities protection, safety tests, user verification, access management, and data auditing laws.

Monitor user volume in real-time and prepare for high-traffic eCommerce peak season and at a minimal cost with an efficient, scalable system, with ongoing maintenance services that guarantee uninterrupted operation and new feature development.

Our expertise in Chinese data processing and cybersecurity regulations ensure your digital commerce presence is fully aligned with the most up-to-date data and facilities protection, safety tests, user verification, access management, and data auditing laws.