With over 46,000 brands from more than 90 countries and regions around the world, Tmall Global is China’s largest cross-border eCommerce marketplaces created especifically for foreign brands looking to enter the Chinese market and serve the more than 100 million active users on the platform.

While only one piece of a successful China multi-channel eCommerce strategy, if you are looking into expand your business in China, this article will help you understand what exactly is Tmall Global, the various business models and store setups it offers, as well as the entry application process, requirements, and fees.

Other articles you might like: An Alternative to Tmall: How to Sell on JD.comIn this third article about TMO's China eCommerce Insights 2018 we will dive into the Ins and Outs of JD.com and for who it will be an alternative to TmallAn Alternative to Tmall: How to Sell on JD.com

The Chinese Cross-border eCommerce market is not particularly fragmented. While there are lots of stand alone brand shops, small-scale eCommerce sites and specialized platforms, a few giants that tower above, amassing lion’s share of the market: We are talking, of course, about Tmall and Jingdong, which make up almost 65% of cross-border retail sales (Statista, 2023).

Tmall vs Tmall Global

In China's eCommerce market, Tmall (owned by Alibaba Group Holding Ltd.) is the largest online platform. Tmall has over 800 million buyers, and over 150,000 merchants. As the largest B2C retail platform in Asia, businesses can sell directly to millions of customers throughout China. It is, at the same time, an open platform marketplace: Tmall provides the infrastructure to host your storefront and unfiltered access to hundreds of millions of shoppers. Operating such a storefront is somewhat similar to operating your own B2C eCommerce website, with a few notable differences.

To offer your products in China through regular B2C eCommerce platforms such as Tmall, the products must be imported from abroad, which requires a legal entity in China.

There is, however, an easier China market entry strategy for foreign companies to reach Chinese consumers without having subsidiary or distributor representation in the country: Tmall Global, Alibaba’s platform that is entirely dedicated to cross-border eCommerce.

Cross-border eCommerce is subject to fewer taxes and compliance checks. More specifically, products from so-called "positive lists for cross-border eCommerce" can be imported into bonded warehouse zones or overseas distribution centers linked to Chinese customs without applying for an import license or an import certificate.

To check whether your product qualifies for CBEC import, you can use our China Positive List Helper, which contains 1,476 product categories and is regularly updated according to the official policies.

How Tmall Global works

Tmall Global aimed to help overseas vendors capture Chinese consumers' booming appetite for high-quality imported products. It is the country's largest cross-border eCommerce platform, connecting over 100 million active consumers and 30.000 international brands. These brands are represented on independently-operated shopfronts (stores) or in a particular country pavilion, which bundles products of different merchants from the same country on one page. For example, the image below gives an example of the Holland Pavilion:

Holland Pavilion on Tmall Global

Leveraging Alibaba's expansive consumer analytics set, Tmall Global provides overseas vendors insights into Chinese consumers' shopping behavior and preferences. "We are committed to offering our overseas clients more personalized and customized solutions so they can receive faster and more direct assistance from the platform, which will enable and accelerate growth", said Alibaba President Jet Jing. Such information should better assist small and medium-sized businesses to make inroads in China, he added.

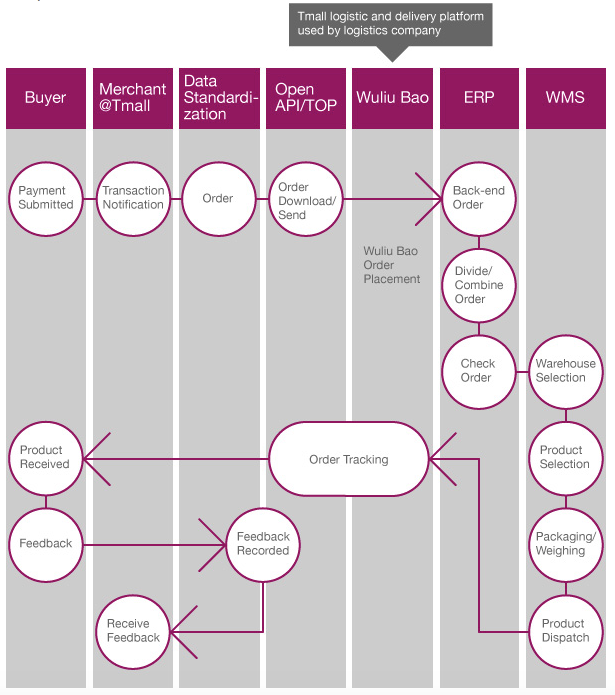

Tmall Global follows a complex merchant workflow from order to delivery, as shown in the flowchart below. Similar to Tmall's domestic B2C platform, Tmall Global offers foreign merchants the autonomy to design the storefront. It utilizes its complex online mall structure to combine flexibility and security for its customers.

Tmall Global Merchant Workflow

Tmall's Business Models for Merchants

Tmall Global offers 4 business models to choose from, all of which TMO Group can help you get started with in your journey to selling in China online:

1. Tmall Overseas Fulfillment: Low-Cost China Market Entry Option

This option is ideal for companies who want to “test the waters”, but are not ready for the full-fledged commitment yet. With the overseas fulfillment model (TOF), you only need to deliver the goods to one of Alibaba’s overseas warehouses and with Cainiao (logistics arm of Tmall) having partnered with dozens of postal services across the world, chances are it is significantly easier for you than shipping the goods to China.

Tmall Overseas Fulfillment team handles the rest–Marketing, Sales, Operations, and Delivery of the goods to the end customer. Additionally, Tmall’s Buyer team will assist you in selecting the best-selling items for your operation.

2. Tmall Direct Import: Great for Popular Overseas Products

Through this option, your goods will be sold on Tmall Direct Import (TDI) store, which selects the best-selling products and sources them from brands or suppliers. You will get access to a well-developed and mature channel, without having to run your own store. Similar to TOF, you also just have to ship your products to bonded warehouses under a CIF (Cost, insurance, and freight) Incoterms agreement.

The main downside here is that you have very limited–if any–control over the actual sales process, as everything is managed by Tmall Direct Import team, who manages the product listing and operation.

3. Tmall Global Flagship Store: The Self-Managed Approach

This is the most advanced model used by brand flagship stores, offering the optimal reach to Chinese consumers. It is therefore ideal for maximizing brand awareness, with a range of possible tools for running the store –from access to consumer insights data, to usage of powerful marketing and promotional tools, as well as your own branding identity.

This model offers maximum flexibility too, as it can be used with both bonded warehouse and direct shipping approaches. Brands can choose to run the store themselves or outsource it to a third party agency.

4. Tmall Global Ministore: Good for SMEs

This format is similar to the TDI model, and is aimed at small and medium-sized businesses, offering low entry and operation costs, as well as end-to-end assistance from the Tmall Global team. You can read more about the Tmall Global Ministore here.

team who source the goods from you.

How to sell on Tmall Global: Flagship Store Types

Within the flagship store model, several store types can be opened on TMall Global. Each type has its own requirements and opening process, let’s go through the main types.

1. Brand Flagship Store

This type of store is reserved for brands–or exclusive dealers authorized by the trademark holders– selling the products themselves. The only exception to this are group brands, which can sell multiple brands that are part of the group. Goods should also be supplied directly from the trademark owner. To open this type of store, it is required to provide a copy of the original Trademark Registration Certificate.

2. Marketplace Flagship Store

This category is used by offline supermarket chains, marketplaces, and online B2C websites. For each brand sold in the store, you need to provide relevant documents, confirming that the store is authorized to sell the goods.

3. Industrial Marketplace Flagship Store

This type of stores is used by offline chains or marketplaces that operate in specific industries, such as Clothing, Maternity & Baby, Beauty, Personal Care and so on. Such stores will have to limit its inventory to several product categories–there should be no more than 3 of them. In addition to the documents required for previous types, for goods sold in the store, this group of stores has to provide purchase invoices from trademark owners.

4. Other Store Types

Tmall provides several more options for potential store types, covering options for franchise-operated stores, specialty stores focused on one specific type of goods, stores using direct sales and so on. Please refer to Tmall’s support page for more information on this.

Tmall Global Registration Requirements

In theory, any company registered outside of mainland China is eligible to participate in Tmall Global. Practically, however, Tmall Global aims to recruit overseas merchants that can provide highest quality goods for Chinese high-end consumers. To be considered for Tmall Global, they must:

- Have a registered corporate entity outside of mainland China.

- Already have an established retail business outside of China

- Be a brand owner / authorized distributor

- Own the relevant certificates

- Be an authentic products manufacturer

Furthermore, Tmall Global generally targets companies, operating for over 2 years and with annual sales of over 10 million USD.

When a company decides to enter the Chinese market through TMall Global, to comply with Chinese consumer laws, it needs to follow a number of the procedures and requirements. There are Tmall Global’s Third-Party services providers that can help with these processes.

Here are some of the requirements:

- Products must be genuine and complemented with a certificate of origin. They must clear both Chinese international customs and Tmall Global security.

- Product descriptions, as well as labels, must be provided in Chinese, with the international metric system adopted as the unit of measurement. Chinese language customer support must be available, for which Tmall recommends employing Chinese Alitalk customer service.

- Products should be dispatched within 120 hours and delivered directly through personal packages or delivered from China Bonded Warehousing and Cross-border eCommerce Tax ReformThe bonded warehouse model of selling cross-border to China is more accessible and convenient than ever. Check out how to use this model in 2022.China’s bonded warehouses to mainland Chinese consumers.

- Merchants must set locations for handling returns in mainland China, Hong Kong, and Taiwan if you sell commodities to those respective regions.

Tmall for Cross-border: Entry Process

Between 2015 and 2019, Tmall had an invitation-only policy for Tmall Global registration. Foreign companies had to use authorized third party service (so-called Tmall Partners, or TP’s), who had an existing relationship with Tmall, to gain an invitation to the site.

In 2019, the rules were relaxed. Since then, anybody can go ahead and visit openshop.tmall.hk to leave an application for becoming a TMall Global’s merchant. All information is conveniently available in both Chinese and English, the application process is described in quite a detail.

1. Application

To begin application foreign companies need to have an activated Alipay account in advance – to be able to send and receive payment.

In 2019, the rules were relaxed. Since then, anybody can go ahead and visit tmall.hk/merchant/reg to leave an application for becoming a Tmall Global’s merchant. All information is conveniently available in both Chinese and English, the application process is described in quite a detail.

2. Review

After all required documents are submitted, TMall will review the application. Official website it would take up to 7 days for the application to go through, but it is not unusual to have it under consideration for a bit longer.

3. Activation, Agreement, and Deposit

If your application is approved, you would proceed to the next stage where there are a few more things that need to be done. You will receive your TMall Global account in which you can start filling basic store information. You will have to sign all relevant legal agreements with TMall Global. Finally, you will have to submit your deposit, for which you need to have your Global Alipay account verified and topped up.

4. Going live

At this stage you basically get your store started: you have to ship goods to CaiNiao’s warehouse (or whatever is applicable under the model you have chosen). This is when you can customize your store’s appearance, configure the catalog, etc. Finally, as you pay an annual fee, your store can go online.

Tmall Fees and Costs

Although Tmall Global offers a convenient mechanism for gaining entry into the Chinese market, you should be aware of the Tmall Global marketplace's costs. The costs associated with operating on Tmall Global can be divided into a Security Deposit, Service and Technology Fees, and an Annual Software Service Fee:

- Security deposit ranging from 50k and 30k RMB (8-25k USD) and depends on the type of store, type of trademark, and sold product.

- The annual fee (Technical service fee, as Tmall calls it) ranges from 35-70k RMB (5-10k USD) depending on the particular product category.

- On top of the Technical service fee, Tmall charges a fee based on the percentage of the goods sold - and it largely ranges between 2% and 5%

- In addition to these fees, a Cross-border transaction fee is charged by Alipay for each transaction.

Selling to China Online with Tmall Global: Conclusion

Tmall Global allows domestic Chinese online consumers to purchase overseas imported products, and may be considered a convenient entry strategy option to reach Chinese online consumers although, given the nature of the entry requirements, combined with the costs associated with establishing a presence on the platform, it can be a high entry barrier. Here at TMO Group, we recommend entry through Tmall Global for larger, internationally established firms with an established brand or sufficient financial assets to stimulate traffic to drive sales and revenue.

Keep in mind, however, that Tmall is just one of China Cross-border eCommerce entry channels. If you are looking for a Tmall partner agency, or want to explore other alternatives for a China Market entry strategy, reach out to us to learn more about our CBEC services, from branded eCommerce website development, to social commerce solutions and other China eCommerce solutions.