The original version of this article was written in 2018. We monitor the situation with the bonded warehouses in China, keeping this material up to date. Latest version was updated in February 2022.

It’s never been easier to sell to China from abroad than now. The Chinese government has made a concerted effort to simplify cross-border eCommerce processes, there are clear pathways and procedures that facilitate it. Cross-border selling via eCommerce is fairly mature and there are multiple ways to expedite necessary processes.

One of these ways, the bonded warehouse model is particularly tempting for its convenience and modest cost – in addition to associated tax reductions. In this article, we break down the realities of using the bonded warehouse model to sell your products in China from overseas.

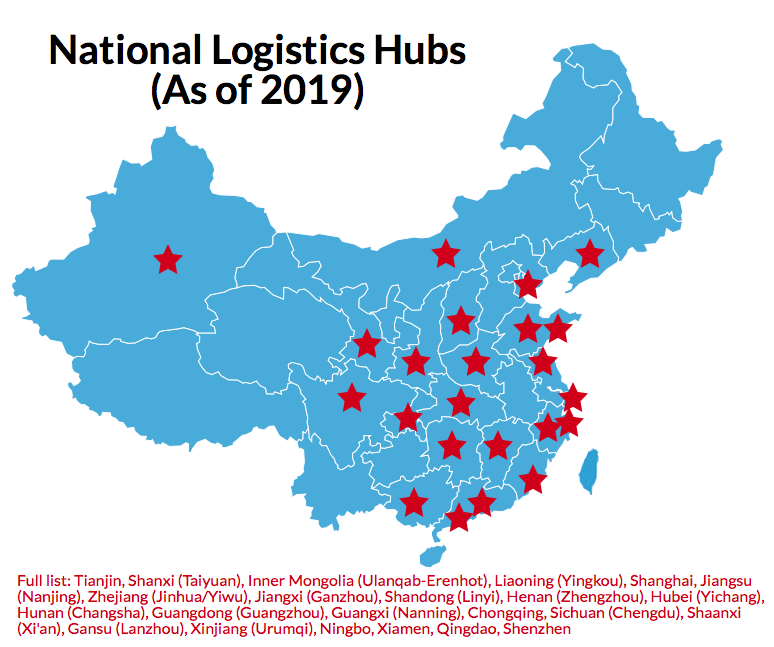

China Logistics Infrastructure

There are 70 National Logistic Hubs as of end of 2021.

In the past, an underdeveloped and inefficient logistics infrastructure brought great challenges to any foreign merchant wishing to sell in China. However, more recently the explosive growth of eCommerce and the government’s series of five year plans have resulted in huge advances in Chinese infrastructure. Today, China has a modern logistics infrastructure including more than 241 (as of the beginning of 2022) airports and an extensive high-speed rail network. Additionally, the government is setting up an ever-expanding range of officially designated National Logistics Hubs. 22 new hubs were added in 2020, and 25 more – in 2021, bringing the total to 70 and the government intends to bring this number to 150 by 2025.

Foreign merchants hoping to sell to China today must be aware that Chinese consumers have grown accustomed to and expect reliable and quick delivery. Particularly in the tier-one cities, in the East of the country, where many online consumers are concentrated, products are more and more likely to be delivered within 24 hours. Growing networks of city warehouses and advances in logistic technologies made it a norm for popular items to be delivered within hours.

Getting your goods from A to B in China is no longer very difficult. It is, however, quite challenging to find the most optimal logistics solution to serve your Chinese consumers. Below we go into greater detail about the available import models and the benefits which bonded warehousing can bring for merchants engaging in cross-border eCommerce.

Cross-border eCommerce Bonded Warehousing

As the eCommerce ecosystem in China is continuously changing, so are the logistic solutions that come with it. The main complexity for logistic solutions are import customs clearance and regulations. Once again, delivering your product to the customer is not that difficult, but things like import licenses, product registrations, and custom regulations are what make it not that straightforward.

History of Bonded Warehousing in China

Cross-border eCommerce started mainly via sales of Chinese individuals living abroad, and offering foreign products on Taobao. In response to the outburst of this semi-legal cross-border shipments from overseas individuals, the Chinese government assigned 6 cross-border eCommerce comprehensive pilot cities in 2012. These comprehensive pilot zones are designated areas, generally near large trading ports, which provide a favorable business environment and infrastructure for cross-border eCommerce. The main feature of these pilot zones are the so-called bonded warehouses.

Since then, the number of cross-border eCommerce pilot zones has grown substantially, with more zones regularly being added. The latest wave was announced in April 2020, with 46 new zones being added for a total of 105 pilot zones across more than 30 of China’s provinces, autonomous regions, and municipalities.

The current full list can be found in the table below:

Import Models

Currently there are two main import models for cross-border eCommerce to China: the bonded imports model and the direct purchase imports model. The bonded imports model may then be further divided into the bonded warehouse model and the direct mailing model. Before we can explain the recent cross-border eCommerce tax reforms it is important to clearly define bonded warehousing and the differing import models.

A bonded warehouse is a building or secured area in a special customs supervision area in China in which dutiable goods are stored before payment of duties. This usually ensures products arrive more quickly.

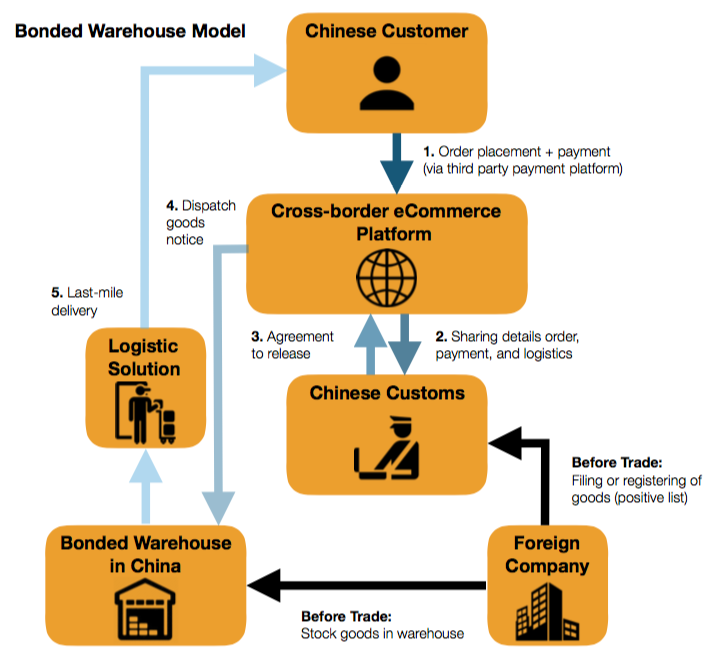

Under the bonded warehouse model, products are imported in bulk into approved cross-border eCommerce warehouse zones across China. After this, the products clear customs once Chinese consumers place an order on a registered cross-border eCommerce site/platform. Products which are listed on the Positive List may be imported and the benefit is that faster product registration and easier customs clearance will apply. Additionally, foreign merchants can conveniently postpone import duty and VAT charges until the actual time of sale.

The image below presents a graphical overview of the processes in the bonded warehouse model.

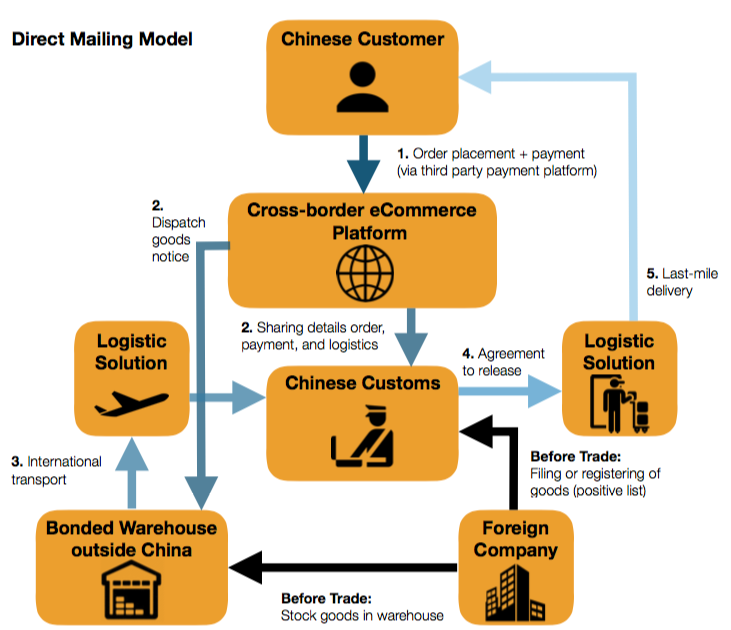

On the other hand, under the direct mailing model, the process begins when Chinese consumers place an order on a registered cross-border eCommerce website/platform. After which, these platforms will submit the records of the order, shipment, and payment to customs. After VAT and customs duties have been paid, the goods will be released from an overseas warehouse via direct mailing, where they will pass through customs more efficiently before being taken for last-mile delivery (as shown in the flowchart below).

The above flowchart also represents the direct purchase imports model, which is more or less applicable to products that are not on the positive lists and must also be shipped directly from overseas merchants via the postal and courier system. One difference however is the speed. This is because products sent through direct purchase imports might be subject to more difficult product registration and customs clearance.

Cross-border eCommerce Tax Reforms

The Chinese government has recognized cross-border eCommerce as a special import channel, and so the General Administration of Customs established several pilot zones in 2014. In cooperation with the Ministry of Finance, the policy was then revised in 2016 and multiple times since.

Prior to the policy revision, purchases through cross-border eCommerce for ‘personal use’ were subject to personal parcel tax. The parcel tax was exempted if the tax payable amount was below 50 RMB.

However, on March 24, 2016, the “Tax Policy for Cross-Border eCommerce Retail Imports” was issued. After which, consumers who purchase goods totaling a certain value or more through cross-border eCommerce, of which the electronic information can be accessed by customs, must pay import taxes including tariffs, VAT, and consumption tax. The specific thresholds and parcel rates were altered again in late 2018 when the Ministry of Finance, General Administration of Customs, and the General Administration of Taxation issued a circular on the subject.

Currently, the aforementioned products enjoy a reduced 70% VAT and consumption tax rate and a 0% duty when they fall under the thresholds of 5,000 RMB for single transactions and 26,000 RMB per person per year.

On the other hand, if customs is unable to access the electronic information of goods imported through cross-border eCommerce, the goods will be subject to new parcel tax rates. The parcel rates currently stand at 13%, 20%, and 50%, with exemptions still available for payable tax amounts below 50 RMB.

Positive List

In combination with the tax policy reform the Chinese authorities published two versions of the “Positive List”, replacing the previous “Negative List”, which limits the scope of goods that can be sold through cross-border eCommerce. In accordance with the positive lists only goods with HS codes can be imported and sold via CBEC, whereas all other goods must be imported under the general trade model.

After a few updates, the current version of the Positive list contains 1,413 product categories which can be imported into one of 15 approved, and aforementioned, pilot zones across China. The product then can be stored in one of the bonded warehouses in the zone.

Check whether your product is on the Positive List by clicking here.

Direct Selling model is also possible for products from the Positive List, so, alternatively, they can be shipped from an overseas distribution center linked to Chinese customs without applying for an import license or an import certificate.

Would you like to know more about the impact of the new cross-border eCommerce tax reforms for your business? Or would you like to know what eCommerce strategy would fit you best taking into account these reforms, then please check our services for strategy development.

Keen to learn more about doing business in China using eCommerce? Check out our China eCommerce Market GuideThis in-depth China eCommerce Guide can help your company rise to the challenges of the Chinese market and sell via cross-border. Updated for 2020!China eCommerce Market Localization Guide!

Check out this article about warehousing and storage services in China from out our partner Sino Shipping.