The first "618" shopping festival in post-pandemic China gained high expectations with nationwide consumption recovery. Although downsizing is still a hot topic, big promotions during the shopping festival are driving consumers' interest in hoarding goods, especially high-priced essential items. We’ll analyze for you the overseas health product eCommerce market during the 2023 June 618 promotion, covering market size, popular subcategories, characteristics of popular products, popular brands and products, and more.

This article will include eCommerce sales data during the 2023 and 2022 Taobao Tmall 618 promotion periods for your reference.

6.18 Promotion Month China Health Supplements Market Recap 2023

For the best sales during 2022 "11-11", check out our new article 2022 Double 11: How did China's overseas health supplement market perform?Let's have a look at the sales data of Health Supplements sales results during Double 11 2022 in China. Here are the highlights.here.

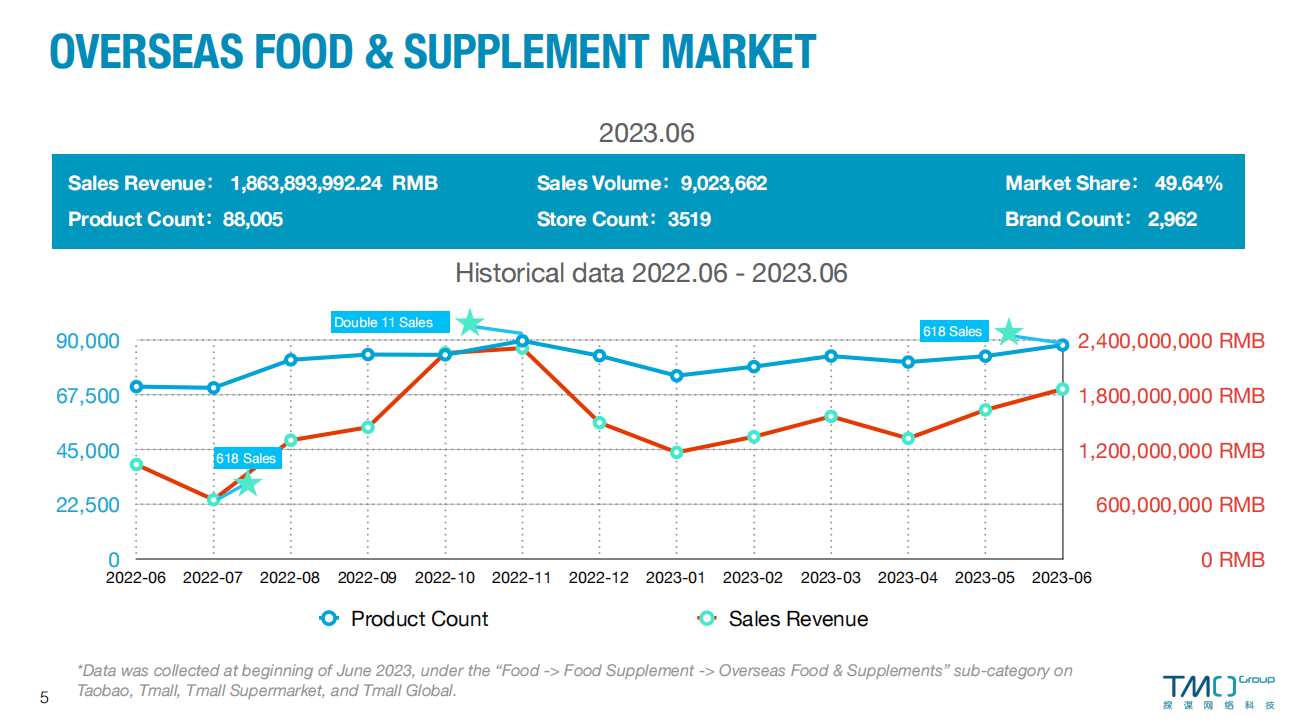

In June 2023, overseas health supplements experienced a strong recovery, with sales exceeding 1.8 billion yuan, reaching the peak since December last year, with a year-on-year growth of 14.69% and a month-on-month growth of 15.12%. However, it’s worth noting that sales and volume of overseas health supplements during this year’s “618” promotion month were lower than those of last year’s “Double 11” promotion month. In June 2023, sales on Taobao and Tmall platforms decreased by 19%, while the sales volume decreased by 7% compared to November 2022. This decline in performance highlights the challenge of attracting consumer attention amid increasing e-commerce promotion events.

So, during this year’s June 6.18, which overseas health supplements are the most popular? Which price range sees the biggest sales? What are the characteristics of the products favored by Chinese consumers? Which brands are the big winners? Let’s take a look at the answer to these questions!

Top-selling Subcategories Analysis

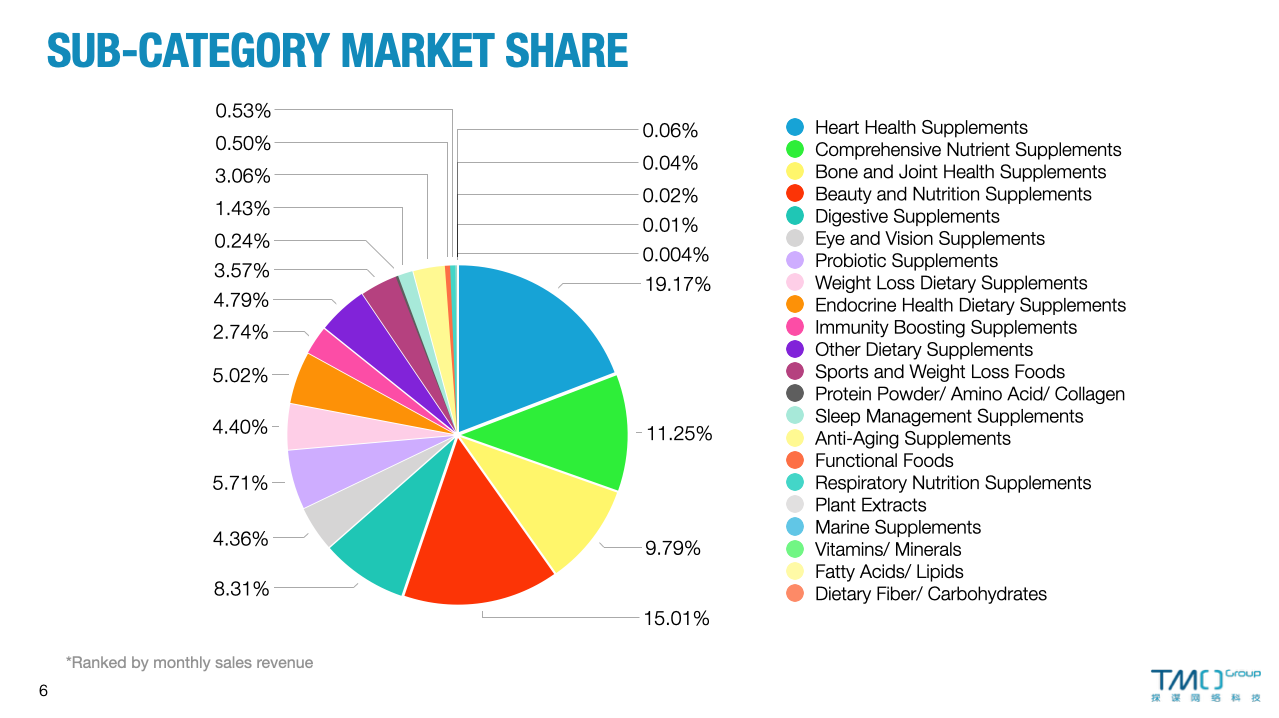

Heart Health Supplements(19.17%)

The sales of heart health supplements reached approximately 340 million yuan with a market share of 19.17%, ranking first among all subcategories. During the 618 promotion month, products priced between 300 and 400 yuan were the most popular, generating 22.4% of the sales revenue. The popular ingredients in this category include deep-sea fish oil, panthenol/ubiquinone/coenzyme Q10. In addition, the top 5 products are: WHC with its flagship high-purity deep-sea fish oil rTG structure Omega3 vitamin D3; Dacudi, a German brand, with its DHA product to enhance students' memory; Omegor's high-concentration deep-sea fish oil; Reaps' Antarctic krill oil for the heart health of the elderly.

Beauty and Nutrition Supplements(15.01%)

The sales of overseas oral beauty and nutritional supplements reached approximately 280 million yuan in June, accounting for about 15% of the market share. The most popular products in this category are the ones related to female dietary supplements and collagen. Other popular ingredients include grape seed extract and astaxanthin. During the 2023 618 mid-year promotion, besides Swisse grape seed anti-glycemic capsules and niacin collagen anthocyanin vitamin C supplements, which were sold at a lower price of 142 yuan, the other products ranged from 800 yuan to 9008 yuan, from brands such as Litozin and Athletic Greens.

Comprehensive Nutrient Supplements(11.25%)

In June, sales of comprehensive nutrient supplement products were approximately 210 million yuan, with a year-on-year increase of 57.9%, ranking third in the sub-category market share. In terms of effects and ingredients, compound vitamins/minerals and B vitamins are popular. During the 618 mid-year promotion, products priced between 100-200 yuan had the highest sales proportion, with the top 5 products dominated by brands GNC and Swisse, focusing on daily comprehensive multivitamin nutritional packs for men and women.

Bone and Joint Health Supplements(9.79%)

Bone and joint nutrition supplements reached sales of 180 million yuan, a decrease compared to the same period last year. In terms of effects and ingredients, calcium products and glucosamine products are generally popular. Products priced between 100-200 yuan were the most popular, accounting for 32.6% of sales. The top 5 best-selling products during the promotion were from Swisse and Move Free, with Swisse focusing on calcium citrate tablets and Move Free focusing on glucosamine for joint health. The US brand Bulevoice made its debut on the list, focusing on lysine calcium supplements for the skeletal health of children and adolescents.

Digestive Supplements (8.31%)

The sales of this category reached 150 million yuan in June, with a year-on-year growth of 33%. Artichoke products generally take up the largest proportion in this category, and other popular ingredients include selenium and curcumin. In terms of best-selling products, Swisse's milk thistle liver protection tablets dominated the top 5, occupying 3 positions, with the same product available through 3 different channels. Sorlife, from Hong Kong, performed well during the 618 period, ranking third.

Popular Product Characteristics

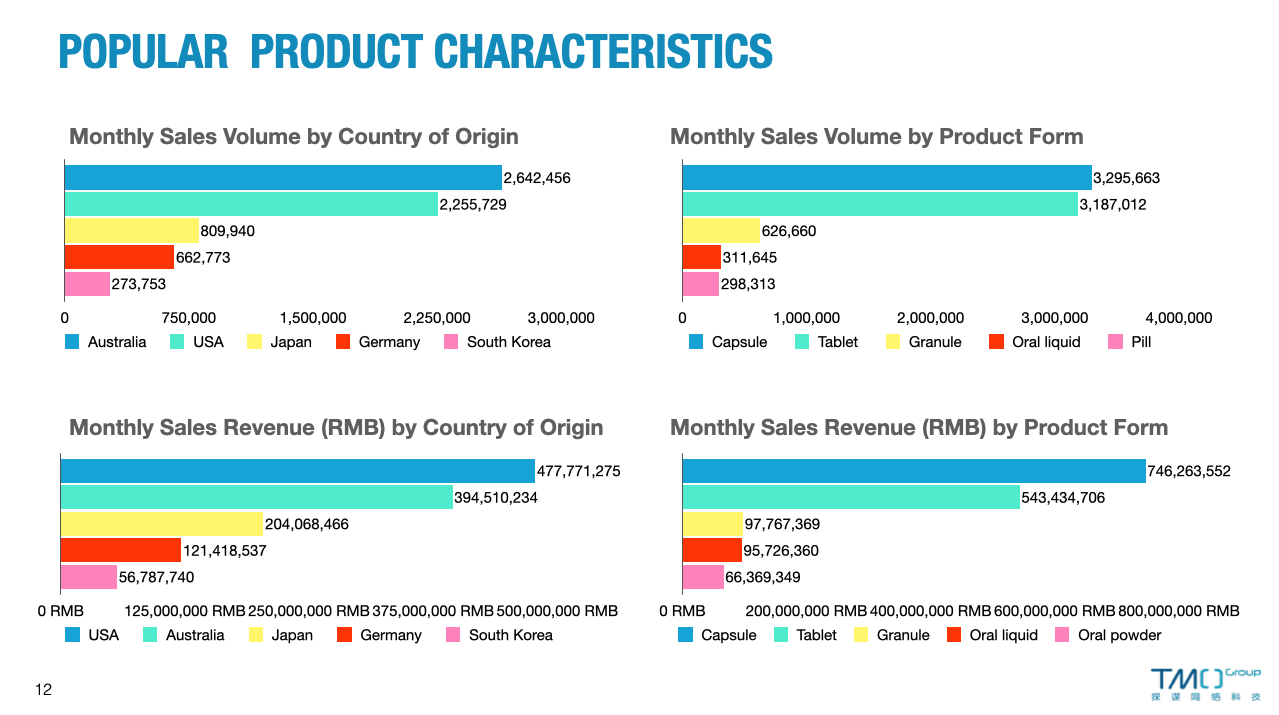

Country of Origin

Health supplements from Australia and the United States are most popular among Chinese consumers. On one hand, it is due to the characteristics of the products from these two countries: Australian products tend to be milder and more natural, while American products are known for high quality control and scientific formulas. On the other hand, the health supplement industry in these two countries went through a long evolution, developing a complete category matrix that covers almost all mainstream product categories, reflecting deeper understanding of the pain points of consumers (mild for body, easy to absorb, etc.).

Products from Japan are mainly from more specific categories such as enzymes, dietary fiber, and natto. The main functions are weight management or digestion, which cater to the market needs of Chinese or east Asian women.

Product Form

Products in the form of tablets and capsules have the highest selling numbers. It is the form in which most of VMS are presented on the market. Additionally, the modern pace of life keeps accelerating, making the form of tablets and capsules the most convenient to eat and easy to carry around. Even though powder, granule and liquid forms are perceived to have “better digestion and absorption” by some consumers, being not easy to carry around prevented them from garnering a lot of popularity.

At the same time, snack-styled products are favored by more and more young people. Compared with men, women have a higher preference for health supplements in the form of snacks, and they are more willing to pay for products with interesting and edgy designs.

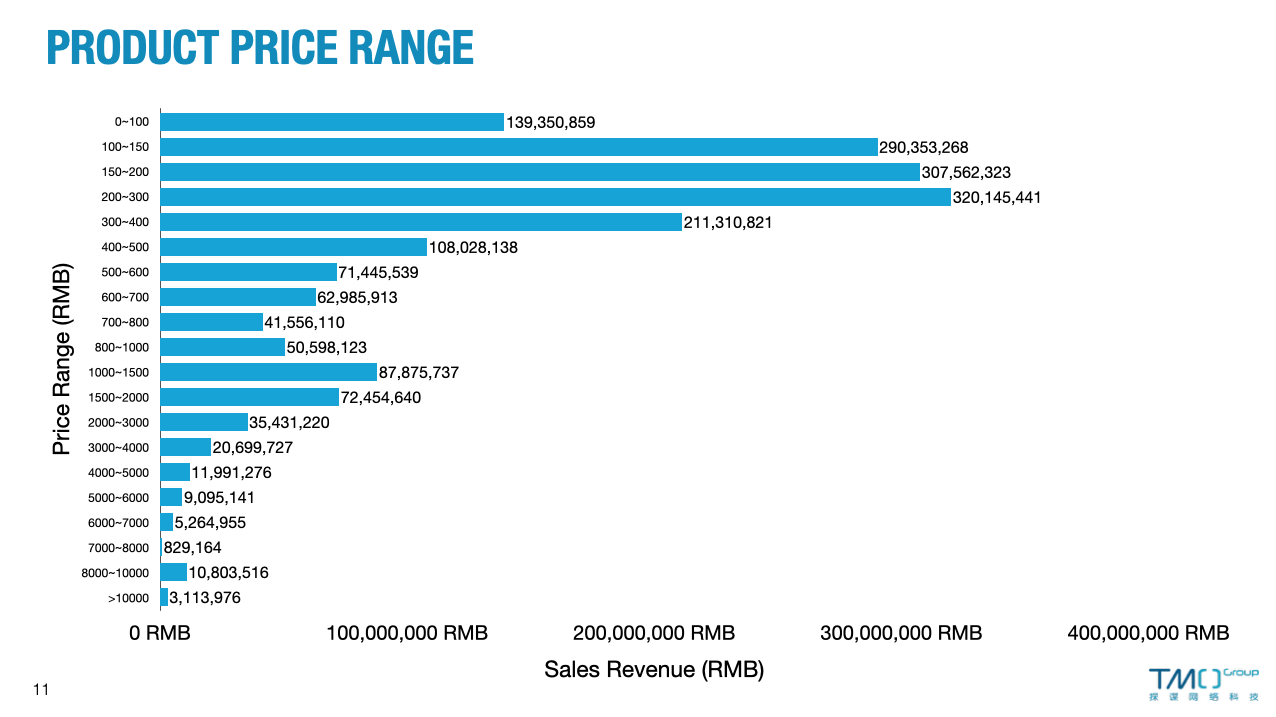

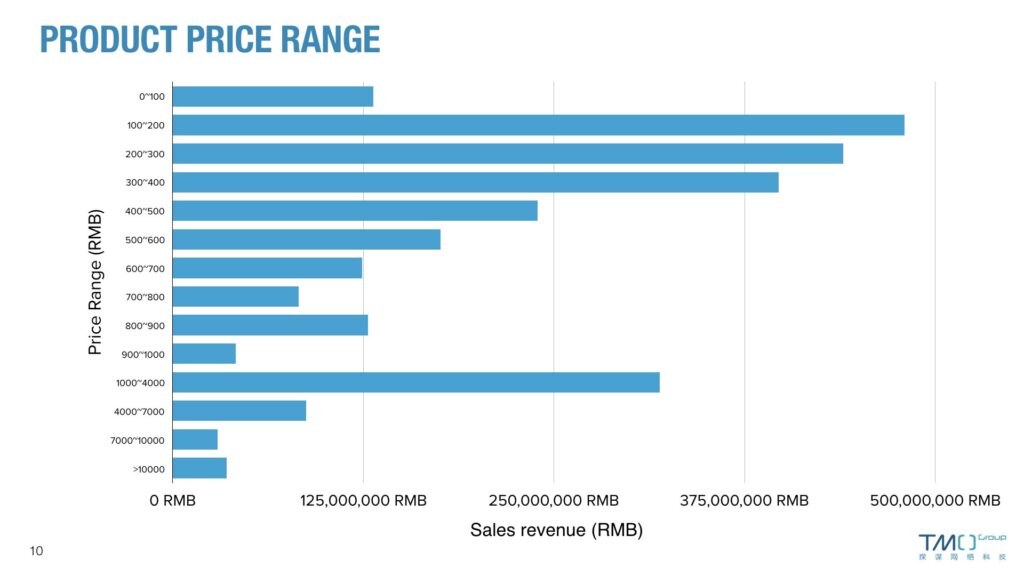

Product Price Range

The overall prices of overseas health products are concentrated in two ranges, ¥100-400 and ¥1000-2000, with the latter category mostly consisting of beauty supplements. This, on the one hand, indicates that when it comes to daily dietary supplements, consumers tend to prefer products from well-known brands as they are not only cost-effective but also have a guaranteed reputation and quality. On the other hand, it also reflects the increasing purchasing power of modern Chinese women who are willing to invest in beauty and skincare. High-end skincare and oral beauty supplements have become necessities in their lives.

Top 5 Best-selling Brands

Swisse

In June, Swisse's sales reached approximately 240 million, with its best-selling products being Women's Calcium tablets and Liver Detox tablets. Swisse consistently tops the list of best-selling brands, its sales were about four times higher than the second-ranked brand, Blackmores.

GNC

GNC, an American brand, had sales of about 64 million, significantly higher than the 42 million during the same period last year. It jumped from seventh place to second place overall. Its performance in the category of comprehensive nutrients surpassed Swisse, with its best-selling product being the Men's Daily Nutrition Pack.

Blackmores

Blackmores had sales of approximately 60 million. As Australia's leading natural health company, its products mainly cover vitamins and mineral supplements, with prices ranging from 100 to 400 yuan. Its best-selling products are daily health supplements, such as fish oil.

Move Free

Move Free had sales of about 39 million, a decrease compared to the 57 million during the same period last year. As a professional joint health brand in the United States, its product range is mainly focused on overseas bone and joint nutritional supplements, with a scientific formula that includes glucosamine and various ingredients. Its consumer group mainly consists of middle-aged and elderly people with joint issues and sports enthusiasts who need to maintain knee joint health.

FANCL

FANCL had sales of about 38 million and is a newly listed brand this year. FANCL is one of Japan's largest and most prominent "additive-free" skincare and health food brand and is highly competitive in the category of comprehensive nutrients.

Top Selling Overseas Health Supplements for June 2023(by Sales Revenue)

1. Reaps Antarctic Krill Oil

Product Category: Krill Oil

Brand: Reaps

Price in June: ¥1,590.01

Sales Revenue: ¥21,183,751.64

Sales Volume: 13,323

2. Swisse Ultiboost Liver Detox (Tmall Global Self-Operated Global Superstore)

Product Category: Thistles

Brand: Swisse

Price in June: ¥157.16

Sales Revenue: ¥11,002,200.14

Sales Volume: 70,006

3. Swisse Ultiboost Liver Detox (Swisse Overseas Flagship Store)

Product Category: Thistles

Brand: Swisse

Price in June: ¥136.99

Sales Revenue: ¥10,982,306.58

Sales Volume: 80,168

4. Swisse Calcium + Vitamin D mini tablets

Product Category: Calcium

Brand: Swisse

Price in June: ¥103.72

Sales Revenue: ¥9,426,184.48

Sales Volume: 90,876

5. GNC Men's Daily Nutrition Pack

Product Category: Multivitamins/Minerals

Brand: GNC

Price in June: ¥180.76

Sales Revenue: ¥9,247,411.44

Sales Volume: 51,156

The rest of the top 15 top-selling health supplement products can be found below:

- German brand Dacudi DHA algae oil

- Swisse Calcium Citrate Tablets

- Belgian WHC Deep Sea Fish Oil Omega3 Vitamin D60 Capsules

- MoveFree Glucosamine Chondroitin Calcium Tablets 120 Capsules*2

- Golden Caesar Fish Oil Omega3 Deep Sea Fish Oil Softgels

- BLACKMORES deep-sea fish oil omega3 soft capsules 400 capsules/bottle*4

- Funrich A60 Powermax solid beverages

- Swisse Swisse grape seed anti-sugar capsule nicotinamide collagen anthocyanin vitamin c nutrition

- Swisse imported deep sea fish oil DHA soft capsule

- GNC Deep Sea Fish Oil Softgels

If you want to access more information, feel free to download “China Health Supplements Market Basic Data Packs (2023 Annual Collection)This collection includes the China health supplements market premium data packs from January issue to December issue 2023. In addition, source data excel sheets with comprehensive industry information are attached for your reference.China Cross-border Health Supplements Data Pack – 2023 June Edition (Free Version)“! or learn about our eCommerce data services. You can also contact TMO's eCommerce experts immediately!

6.18 Promotion Month China Health Supplements Market Recap 2022

For the best sales during 2021 "11-11", check out our new article Best selling Health Supplements products during “11-11” sales in China in 2021We review best selling products, top brnads and categories in Health Supplements for Chinese sales festival "11-11" in 2021.here.

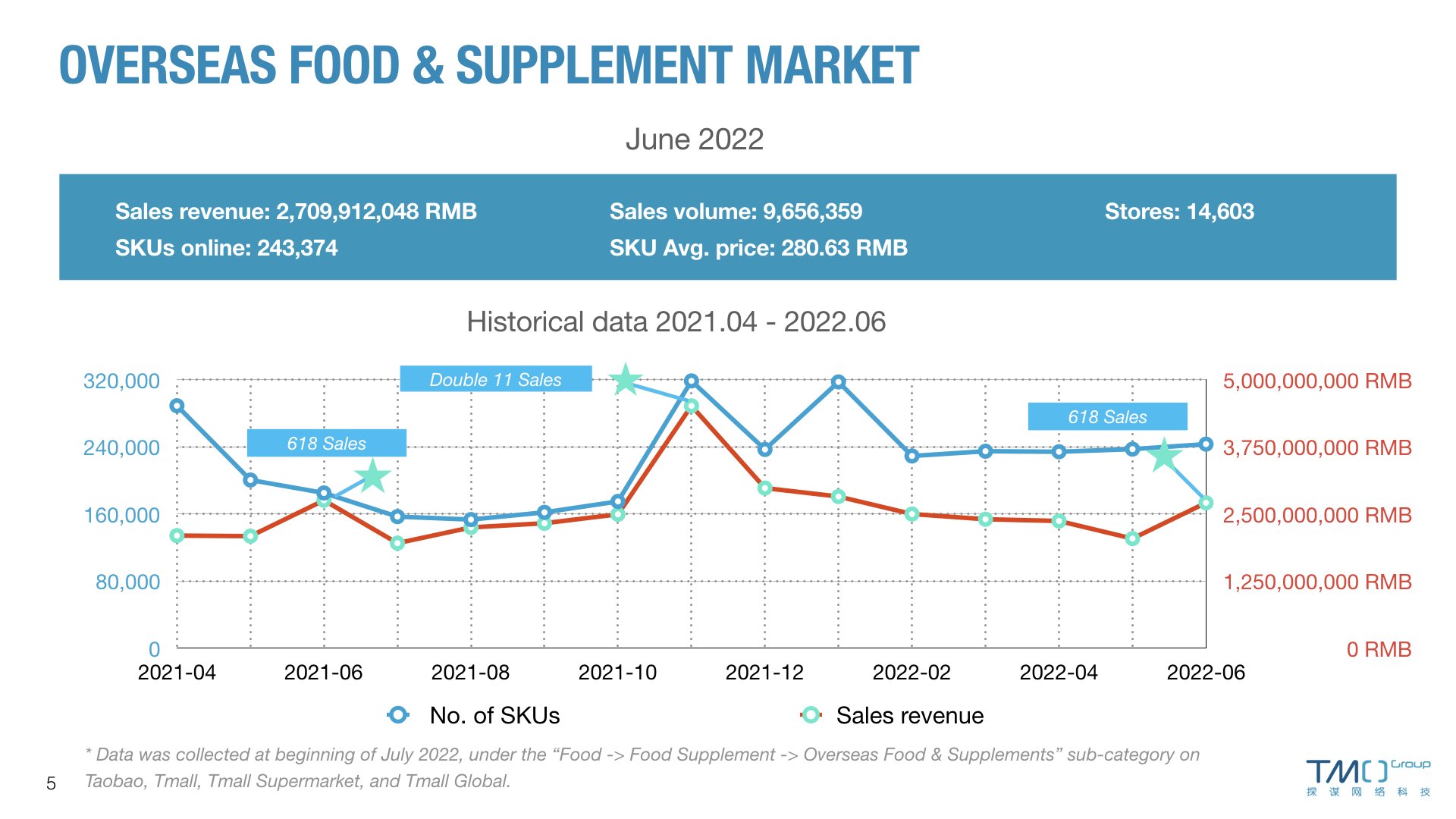

Influenced by the epidemic situation since April, this year’s 618 promotion is very challenging for both merchants and consumers. On one hand, consumers would pay more attention to their physical health, with increasing demand for health supplements. On the other hand, the delay or even stagnation of customs and logistics might make many impatient consumers choose to give up purchasing. Faecd with this dilemma, how did the overseas health supplements market perform in June?

Overall, surprisingly, the pandemic hasn’t caused any tangible negative effect upon the performance of the overseas health supplements market during June 18th this year. The sales in June were about 2.71 billion yuan, only slightly lower than last year's 2.76 billion yuan. And even in April and May, the months that were severely affected by the epidemic, sales did not see a significant year-on-year decline. We can guess that those who didn’t find themselves stuck in the quarantine, decided to take precautions and stock up on some health supplements in the past two months, bringing the market into a relatively stable state.

So, during this year’s June 6.18, which overseas health supplements are the most popular? Which price range sees the biggest sales? What are the characteristics of the products favored by Chinese consumers? Which brands are the big winners? Let’s take a look at the answer to these questions!

Top-selling Subcategories Analysis

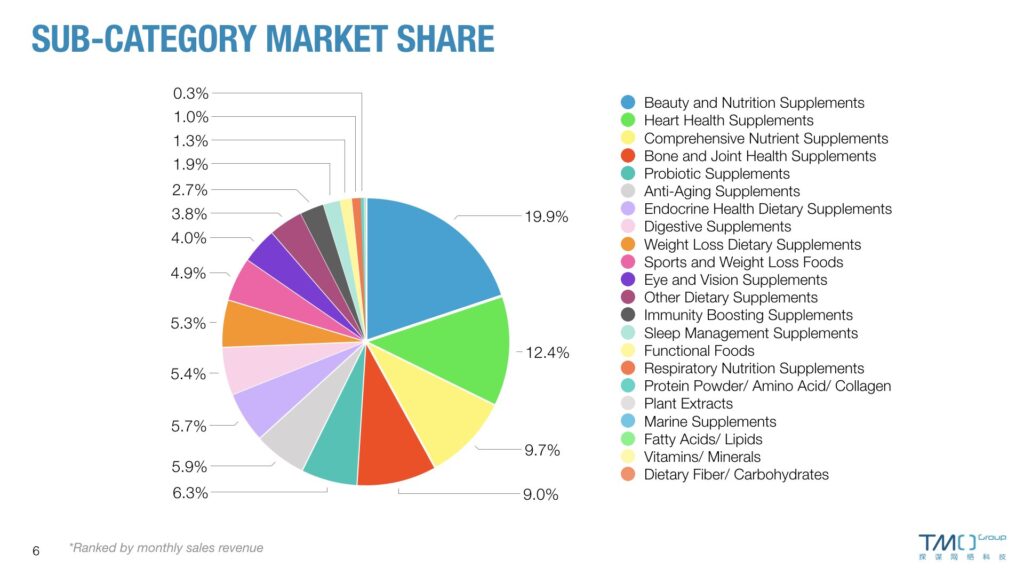

Beauty and Nutrition Supplements

June sales revenue of the best-selling sub-category, beauty and nutrition supplements was about 540 million yuan. Beauty supplements have been the No.1 on the sub-category sales list for a long period of time. From the perspective of price distribution, the unit price of many products is as high as more than 1,000 yuan. With the growing market size of beauty supplements, more niche and high-end products have begun to emerge, such as astaxanthin. This supplement has been popular among beauty lovers in recent years because its antioxidant properties are much higher than those of grape seeds and vitamin C.

Heart Health Supplements

The sales of heart health supplements were at about 330 million, and its market share ranked second among all sub-categories. Compared with the sales in the two months of April and May, the 618 sales of cardiovascular products increased significantly. As these products are consumed on a daily basis, people are more willing to purchase a lot and stockpile heart supplements during promotion periods. The main products in this category include fish oil and coenzyme Q10.

Comprehensive Nutrient Supplements

The sales of comprehensive nutritional supplements in June exceeded 260 million yuan, with a month-on-month increase of 58.9%, and a market share of about 10%. Affected by the continuous impact of the epidemic, the main products of this sub-category, multivitamins and B vitamins, have become the daily essential health supplements for many consumers because of their immunity-enhancing effects. Among them, the sales of multivitamins in June increased by 26.2% compared with last year.

Bone and Joint Health Supplements

The sales of bone and joint products were about 240 million, increasing by about 50% compared to the previous month. These products’ market share ranked fourth among all the sub-categories. The main products of this category are calcium and glucosamine, and the main consumer groups are the middle-aged & elderly people and adolescents. During the big sale, many families choose to shop for their elders or children.

Probiotic Supplements

The sales of probiotics supplements were about 170 million, basically the same as last year's sales. People's enthusiasm for purchasing probiotic products has not been affected by the epidemic. Probiotics for stomach and women's probiotics, which are the two most common products in this category. In addition, B420 probiotics, that have the weight loss effect, are also popular among Chinese consumers, indicating great market potential.

Anti-Aging Supplements

The sales of anti-aging products were about 160 million, a small increase from those of last year. According to forecasts, China's NMN health supplement market will grow at an annual rate of 74%: from 5.1 billion in 2020 to 27 billion in 2023. Most of the consumers who buy NMN products are young and middle-aged women with certain financial ability and concerns about their health and quality of life. The majority of them are white-collar workers in first-tier and new first-tier cities.

Popular Product Characteristics

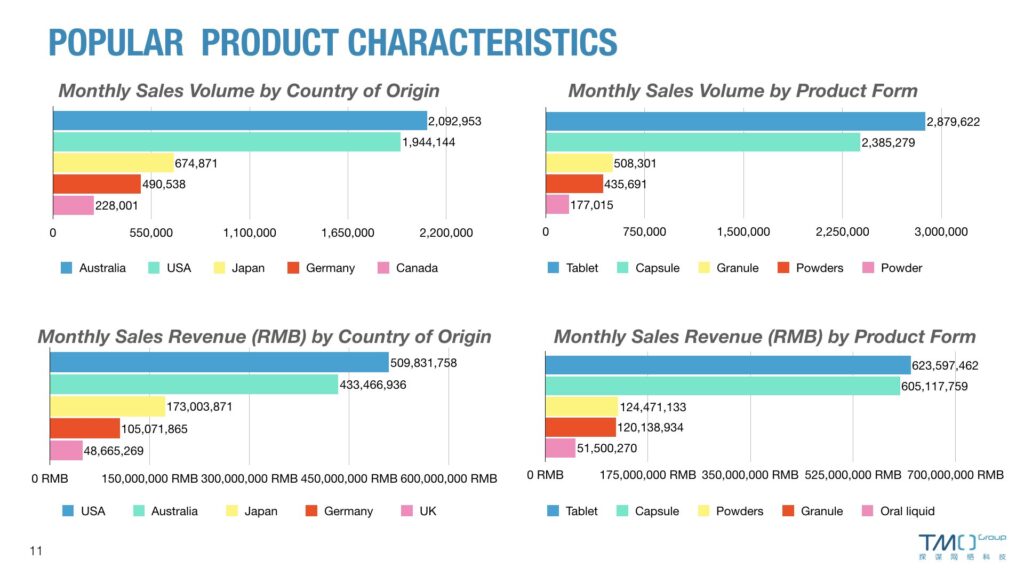

Country of Origin

Health supplements from Australia and the United States are most popular among Chinese consumers. On one hand, it is due to the characteristics of the products from these two countries: Australian products tend to be milder and more natural, while American products are known for high quality control and scientific formulas. On the other hand, the health supplement industry in these two countries went through a long evolution, developing a complete category matrix that covers almost all mainstream product categories, reflecting deeper understanding of the pain points of consumers (mild for body, easy to absorb, etc.).

Products from Japan are mainly from more specific categories such as enzymes, dietary fiber, and natto. The main functions are weight management or digestion, which cater to the market needs of Chinese or east Asian women.

Product Form

Products in the form of tablets and capsules have the highest selling numbers. It is the form in which most of VMS are presented on the market. Additionally, the modern pace of life keeps accelerating, making the form of tablets and capsules the most convenient to eat and easy to carry around. Even though powder, granule and liquid forms are perceived to have "better digestion and absorption" by some consumers, being not easy to carry around prevented them from garnering a lot of popularity.

At the same time, snack-styled products are favored by more and more young people. Compared with men, women have a higher preference for health supplements in the form of snacks, and they are more willing to pay for products with interesting and edgy designs.

Product Price Range

The overall price of overseas health supplements is concentrated in the two ranges of ¥100-400 and ¥1000-4000, and the latter is mostly due to the contribution of beauty and anti-aging supplements. It shows that for health supplements consumed on a daily basis, consumers still tend to choose big brands, which are not only cheaper, but are also with guaranteed reputation and quality. At the same time, it shows that nowadays in China, more and more women with strong purchasing power are willing to invest in their external and internal beauty, with high-end skin care products and oral beauty supplements becoming their daily necessities.

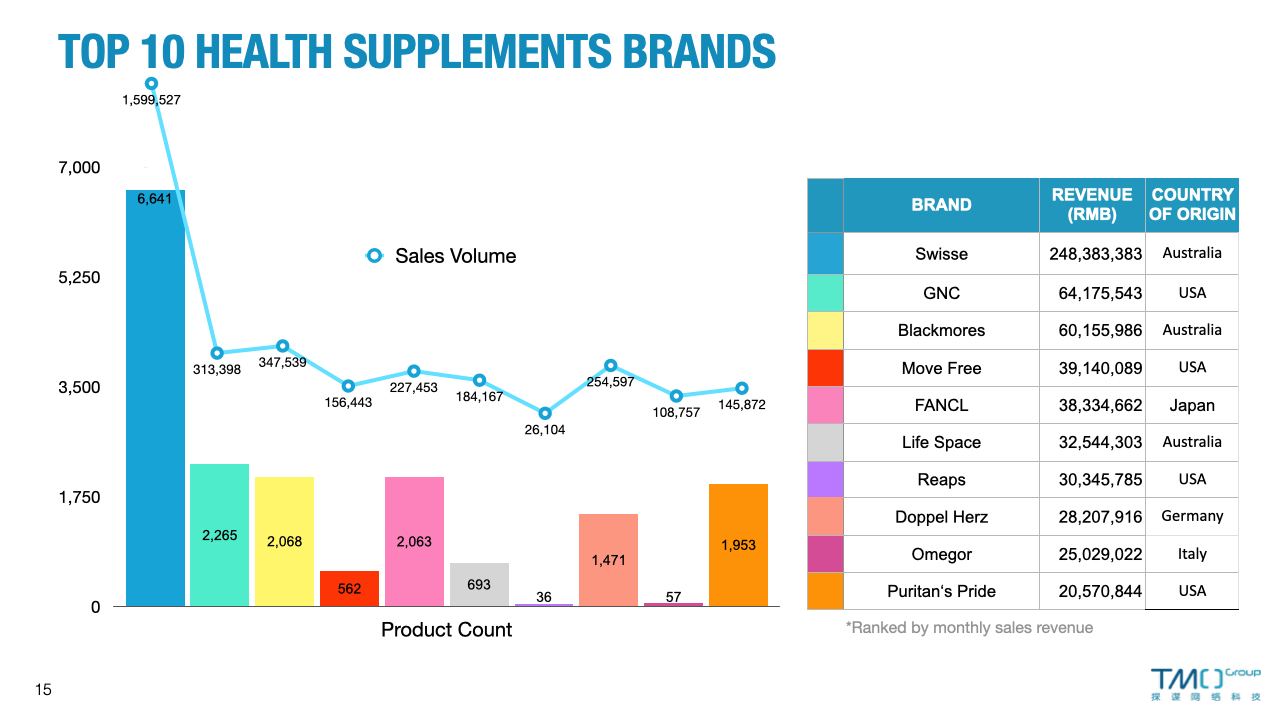

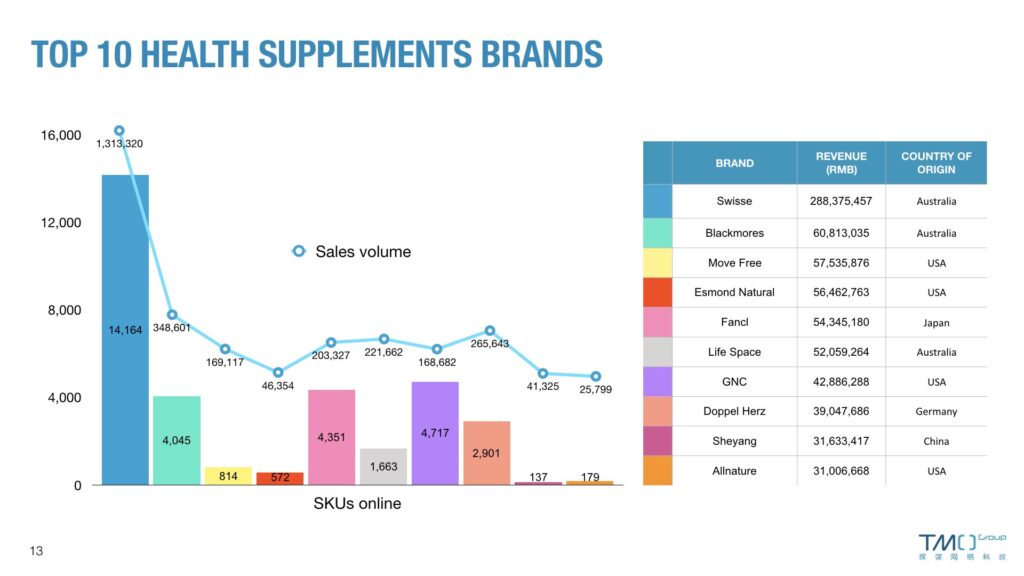

Top 3 Best-selling Brands

Swisse

During June, Swisse's sales were about 280 million. Its best selling products include calcium + vitamin D tablets and liver detox thistle tablets. Consistently at the top of the best-selling brands list, Swisse's sales in June were four times higher than second-place Blackmores.

Blackmores

Blackmore's sales were about 60 million. As Australia's leading health supplement brand, its products cover a wide range of VMS. The price of its products is mainly concentrated in the 100-400 yuan range, and the hot-selling products are mainly daily consumption items, such as deep-sea fish oils.

Move Free

The sales of Move Free were about 57 million. As a professional joint health brand from the States, Move Free’s products are backed by scientific formulas and contain glucosamine, along with other active ingredients such as Chondroitin. Its products are proven to be effective and have good word of mouth. Its main consumer groups include middle-aged and elderly people with joint problems and sports lovers who need to maintain the health of their knee joints.

Other Popular Brands Analysis:

Esmond Natural

Esmond's sales were about 56 million. Its main product category, anti-aging supplements, accounted for about 67.5% of its sales. The price of the products was mainly between 2,500-3,000 yuan and 5,000-7,000 yuan. Its top-selling products all fell into the subcategory of NAD+ precursor nutritional supplements.

Life Space

The sales of Life Space were about 52 million. Its main product category, probiotics supplements, accounted for about 99.7% of its sales. The price of the products was mainly between 200 and 250 yuan. Its top-selling products all fell into the subcategory of probiotics.

Doppel Herz

The sales of Doppel Herz were about 52 million. Its main product category, eye health supplements, accounted for about 52.6% of its sales. The price of the products was mainly between 100 and 400 yuan. Its top-selling products all fell into the subcategory of lutein.

WHC

The sales of WHC were about 52 million. Its main product category, heart health supplements, accounted for about 95.9% of its sales. The price of the products was mainly concentrated between 300-400 yuan and 700-800 yuan. Its top-selling products all fell into the subcategory of fish oil/deep-sea fish oil.

Pola

The sales of Pola were about 52 million. Its main product category, beauty and nutrition supplements, accounted for about 90.9% of its sales. The price of the products was mainly between 1000 and 1400 yuan. Its top-selling products all fell into the subcategory of beauty supplements.

Top Selling Overseas Health Supplements for June 2022 (by Sales Revenue)

1. Nanjing Tongrentang Ginseng Ejiao Peptide Tablets

Product Category: Beauty Supplements

Brand: Tongrentang

Price in June: ¥857.6

Sales Revenue: ¥17,332,096

Sales Volume: 20,210

This product belongs to the beauty supplement category. It is in the form of tablets. It is recommended to be consumed once a day, two tablets at a time to achieve the effect of beauty enhancement and freckle removal.

2. Swisse Calcium + Vitamin D mini tablets (300 tablets)

Product Category: Calcium

Brand: Swisse

Price in June: ¥168.73

Sales Revenue: ¥16,469,229

Sales Volume: 97,607

"Lack of Calcium" has always been a common health issue for Chinese people. Adolescents need calcium at the stage of growth; for adults before the age of 35, calcium supplementation is needed to prevent osteoporosis when getting older; for the elderly, calcium supplements are needed to slow the progression of bone problems. As a result, calcium tablets are one of the regular health supplements in every family.

The target consumer group is not only ordinary adults, but also pregnant women and the elderly. The product adopts the formula of calcium citrate and vitamin D, focusing on mildness and easy absorption and addressing consumers’ pain points.

3. BioBlast NMN 18000 (120 capsules)

Product Category: Nad+ Precursor Supplements

Brand: BioBlast

Price in June: ¥5,166.41

Sales Revenue: ¥15,990,039

Sales Volume: 3,095

NMN is the precursor of coenzymes (NAD+) in the human body. The NAD+ content in the human body will decrease with age, and supplementing NMN can increase the NAD+ content in the human body and play an anti-aging effect. The number “18000” refers to the amount of NMN in one bottle. Apart from anti-aging, NMN products can quickly increase the body's metabolism, accelerate waste removal, improve cellular energy levels, restore brain and body vitality, and improve sleep quality.

4. Princess Luna Vaginal Probiotics (30 capsules)

Product Category: Probiotics

Brand: Princess Luna

Price in June: ¥506

Sales Revenue: ¥12,567,016

Sales Volume: 24,836

Princess Luna Vaginal Probiotics acidify the vagina by producing H202 and lactic acid, lowering vaginal pH, which together promote normal vaginal flora growth and a healthy microbial environment.

5. Swisse Ultiboost Liver Detox (120 tablets)

Product Category: Thistles

Brand: Swisse

Price in June: ¥221.13

Sales Revenue: ¥12,259,668

Sales Volume: 55,441

Swisse's Milk Thistle Liver Tablets are herbal based, and contain three major herbal extracts: milk thistle, artichoke and turmeric. This supplement relieves the burden on the liver and at the same time has a positive effect on the stomach. In the social environment where Chinese young people are under increasing pressure, liver protection tablets have gradually become "life-saving" essential health supplements for many office workers.

The rest of the top 15 top-selling health supplement products can be found below:

- Esmond NMN 10500 (70 tablets)

- Esmond NMN 10500 (70 tablets)

- Move Free Glucosamine Advanced (120 tablets*2)

- Swisse Ultiboost Liver Detox (120 tablets)

- Life Space Shape B420 Probiotic (60 capsules)

- Life Space Broad Spectrum Probiotic (60 capsules)

- Esmond NMN 10500 (70 tablets)

- Baiyunshan Deer Blood Collagen Polypeptides (30 tablets)

- Meherb Whitening Pills (60 capsules)

- Sheyang Bird’s Nest Collagen Peptide White Shot Tablet (10 capsules)

Conclusion

Judging by this year’s 618, the overseas health supplements market, despite the pandemic, sees a steady upward trend. There are several contributing factors. First, China's policies on health supplements incentivise this market to become more transparent and mature. Second, recovering from the lockdown, the speed of logistics and customs clearance is gradually increasing. Finally, the ever-increasing per capita disposable income in China makes consumers pay more attention to themselves, make investments in their own health. Many brands have proved the feasibility of successfully entering the Chinese market through cross-border eCommerce. In the future, as the scale of the industry grows and support from national policies increases, the penetration rate of CBEC will continue to increase too.

For more content, please download the free "China Health Supplements Market Data Packs (2022 Annual Collection)This collection includes the China health supplements market premium data packs from January issue to December issue 2022. In addition, source data excel sheets with comprehensive industry information are attached for your reference.China Cross-border Health Supplements Data Pack - 2022 618 Special Edition (Free Version)"! If you want to get more market information such as brand cases and sub-category details, please click to download the China Health Supplements Market Data Packs (2022 Annual Collection)This collection includes the China health supplements market premium data packs from January issue to December issue 2022. In addition, source data excel sheets with comprehensive industry information are attached for your reference.premium version of data pack!