It’s been 12 years since the first “Singles’ Day'' shopping festival was held in China in November of 2009. Since then it has become the staple of the Chinese commercial landscape — rivaling and eclipsing Western counterparts: Black Friday and Cyber Monday.

These days, the sales fiesta is not limited to just 11th of November. Promotions and special offers follow customers everywhere since the beginning of the month, making the “11-11” not a one-day event, but rather a period of the first two weeks of November.

In this article we will look at the sales of the segment that interest us and our clients the most — imported health supplements. This is a high-level view of what is going on in the imported health supplements market during this hottest sales period of the year. For a more detailed report, download a November Health supplements Data Pack that will be available in the first weeks of December 2021.

Top 5 products

In this article we will use the first two weeks of November (1-14.11) to look and analyze the performance of various items. Total sales volume of Imported Health Supplements category (海外膳食营养补充食品) in this period are reaching 2 bln yuan. Let’s look at what items topped the sales charts.

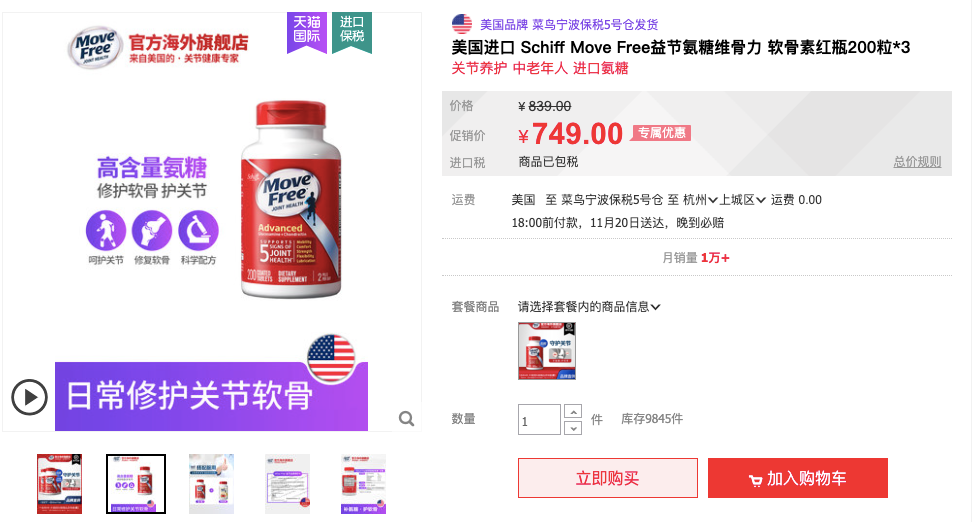

The Absolute winner, taking 1st, 3rd and 4rd place in our top ranking is american “Move Free” capsules for joint health, produced by Shiff. “Move Free” occupy three places in the list of highest selling products, as they are offered in different packages — 120 or 200 capsules, sold in sets of 2 or 3 bottles, and collectively generated over 37 mln yuan of revenue.

Second place is taken by a women’s health product “Princess Luna” from italian “Mom’s Garden”, selling for over 13.5 mln yuan.

Finally, with 10.3 yuan in revenue is liver detox tablets from australian company Swisse, which is in 5th place.

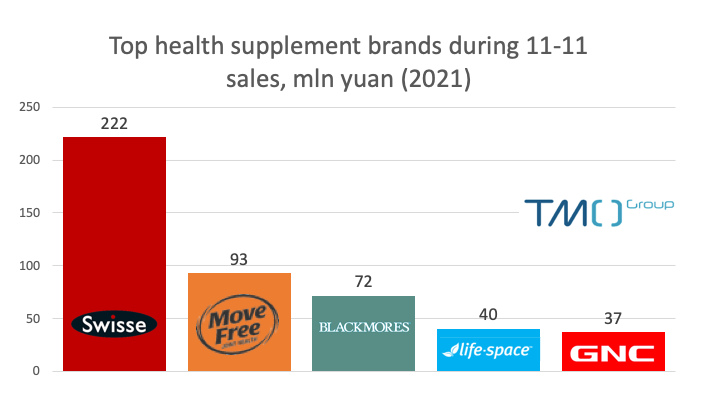

Top 5 brands

If you look at the ranking by total sales by brands, the situation is somewhat reversed.

In first place, by a huge margin outperforming any competitor, is Australian Swisse, with 266 million in sales during November sales period. Their top products are supplement complexes targeted for various consumer groups — active people, pregnant women, elderly.

American “Move Free”, whose joint health products are so successful in the individual products chart, is in second place, raking in 96 mln.

Australian Blackmores is in third place, with 71 million in sales, with their line of fish oil related products.

In fourth place, providing supplements for gastrointestinal health, is yet another Australian brand, Life Space, with 40 million in revenue.

Finally, the fifth line in this chart is taken by American company GNC and their deep-sea fish oil products. They generated revenue of 37 million yuan.

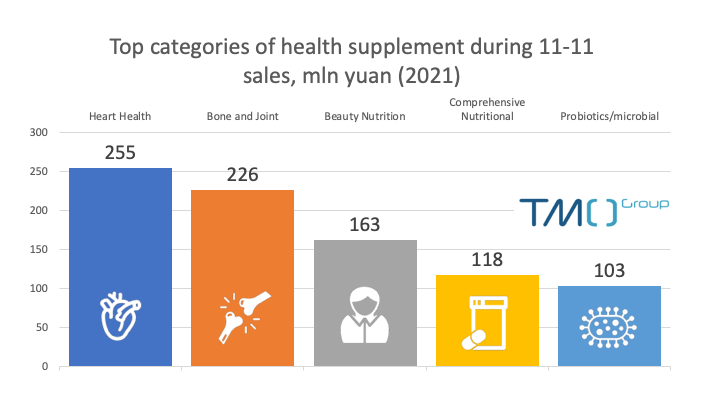

Top 5 categories

As we mentioned in the foreword of our last data pack, lately marketplaces shifted from active-ingredient based classification of products to effect based one. Which makes it very interesting to see which categories (and which health effects) are at the top on 11-11 season’s sales.

Supplements targeted at heart health and other cardiovascular issues (心血管营养补充剂) are at the top of the chart, with 255 million yuan in sales.

Bones and joints (骨关节营养补充剂) are the second priority among Chinese consumers. Supplements in this group generated 226 million yuan in revenue.

Beauty nutrition supplements (口服美容营养补充剂) are in third place with 163 million yuan in sales.

Next we have comprehensive nutritional supplements (综合营养素补充剂) with 118 million yuan.

Final line in this top 5, with 103 million yuan in sales, probiotics and other microbial supplements (微生物营养补充剂).

We hope you found this article useful for understanding of Chinese Health Supplements market, especially in the context of “11-11” sales, the biggest sales even during a year.

Check out our China Health Supplements Market Data Packs (2021 Annual Collection)This collection includes the China health supplements market data packs from January issue to December issue 2021.Health and Supplements November 2021 Datapack, with information about the market and detailed breakdowns for each category.