For every foreign business eyeing China eCommerce market, to understand Chinese customer's behavior and expectation is the task at hand. Especially during this digital era, in which ways are these digital-savvy customers changing the whole China eCommerce?

Earlier this month, worldwide management consulting firm McKinsey released a survey (How savvy, social shoppers are transforming Chinese e-commerce) which examined the extent of eCommerce penetration across five regions in mainland China. The survey included the latest changes in China eCommerce, cross border eCommerce and O2O services. Here, we sum up the top ten things we can take from the new McKinsey survey.

1. China is the world’s largest and fastest-growing eCommerce market.

China’s online retail market is no doubt the world’s largest: during 2015, China totals eCommerce sales of approximately $630 billion, nearly 80 percent bigger than the United States’. eCommerce in China accounts for 13.5 percent of all retail spending, a higher share than that of all large economies but the United Kingdom.

2. Pay attention to multidevice owners, because they are more active.

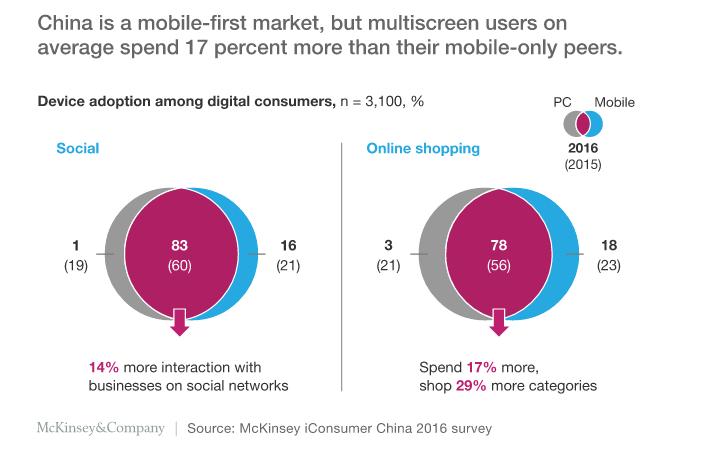

MultiDevice owners are those who use two or three connected devices, such as smartphones, tablets, and computers. Survey found that multidevice owners in China spend 17 percent more on eCommerce than their mobile-only peers, meaning they are more intense digital consumers. They also shop online in 29 percent more categories and interact 14 percent more with businesses through social networks, using such interfaces as brands’ public WeChat accounts

While mobile-first marketing strategies are important, PC-based offerings should never be neglected. One needs to find its omni-channel strategy to meet the needs from Chinese multidevice customers.

3. These are the products Chinese eCommerce shoppers buy the most.

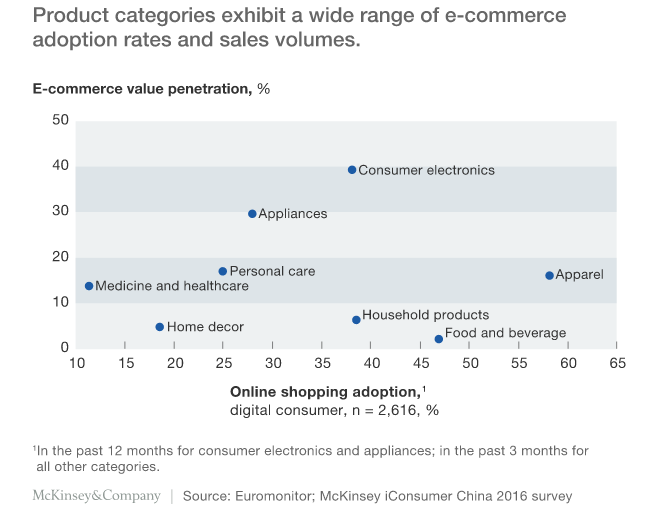

Chart shows the products with most shopping adoption and value penetration via Chinese eCommerce, separately. Consumer electronics and appliances are two categories of the most retail sales, while apparel has the highest adoption.

On the other hand, food has also reached a high level of adoption, with nearly 50 percent of consumers making some purchases online, according to our survey. But those online purchases account for only 5 percent of consumers’ total food spending. This data suggests that consumers are not yet going online to make food purchases as large as those they make at supermarkets.

4. Consumers in low-tier cities are spending more on eCommerce.

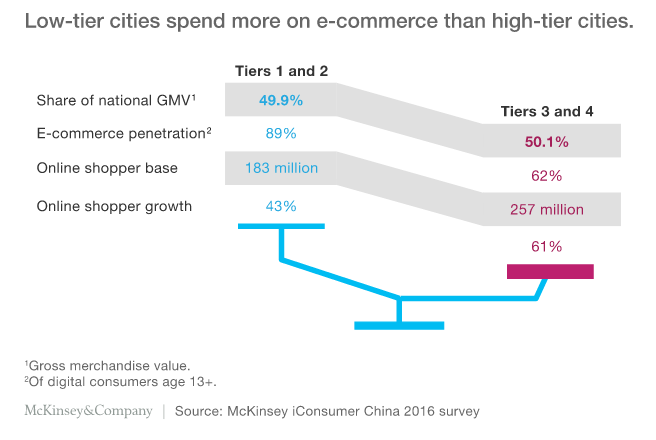

Low tier, no problem. Tier 3 and 4 cities accounted for 257 million eCommerce users last year, 74 million more than high-tier cities.

What's more, low-tier cities still have tremendous potential for eCommerce growth. Brands that have historically focused on high-tier cities may benefit from revisiting their geographic strategies and making adjustments to take advantage of opportunities in low-tier cities, where physical retail needs time to mature.

5. Social media, especially WeChat, is evolving to a very powerful eCommerce platform.

You heard it right. Beforehands, marketers hope that social media can drive more traffic to their eCommerce; nowadays, more eCommerce shoppers in China has been using social media AS an eCommerce channel.

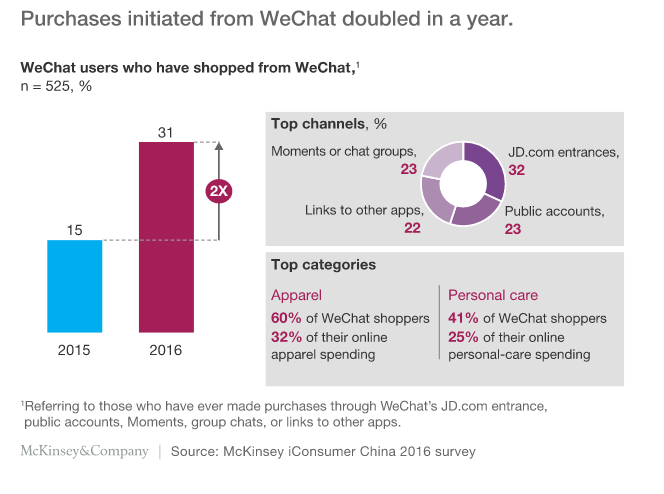

Among all social media channels, WeChat has emerged to be shopper’s favorite. Of the WeChat users surveyed, 31 percent initiated purchases on the platform—double the proportion of the previous year. These purchases begin in a range of places on the social platform, from official channels (such as JD.com entrances and brands’ public accounts) to user-generated content (such as Moments and chat groups) to links to other apps.

With that being said, WeChat store development has become vital in order to reach customers on mobile devices. Your WeChat eCommerce need to be as appealing as how it looks in physical stores, but with more mobile integrations.

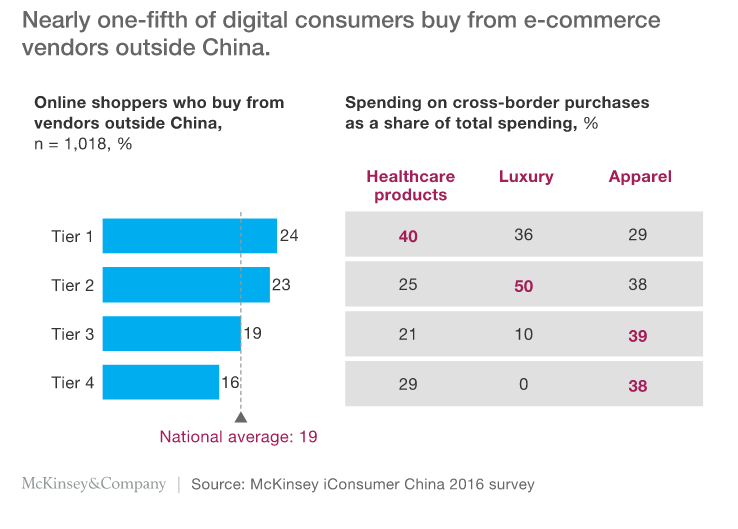

6. More Chinese consumers are embracing cross border eCommerce.

Despite the new tax policy, more Chinese customers are getting used to shop foreign goods on cross border eCommerce sites. According to the survey, nearly 20% of the digital consumers now buy some goods from vendors outside China.

eCommerce has given China’s digital consumers access to products from overseas, and a notable share of consumers appears to be taking advantage. For foreign brands that have limited reach but proven appeal in China, eCommerce offers a new way to serve Chinese consumers without adding local distribution capabilities.

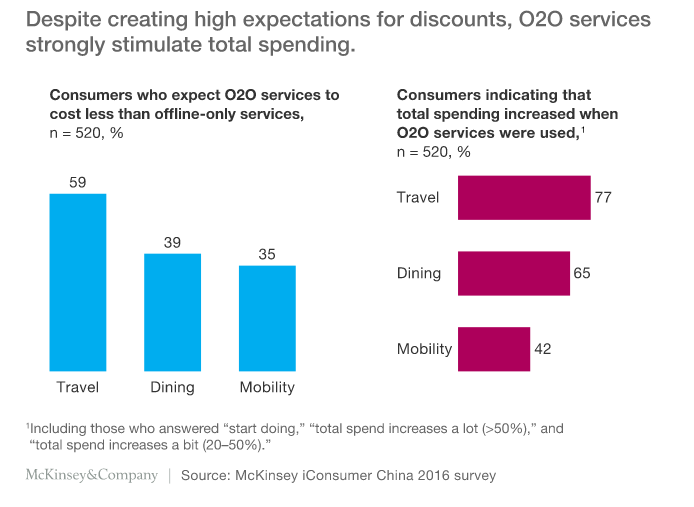

7. O2O services remain popular, among all travel ranked No.1

O2O model is no longer a new business in China. Through the years O2O gradually become part of digital consumer's daily life, because of its lower price and convenient service.

Among all O2O services, travel, dining and mobility are the most popular ones. This suggests that O2O services offering a unique value proposition could power additional growth in China’s online market over the years to come.

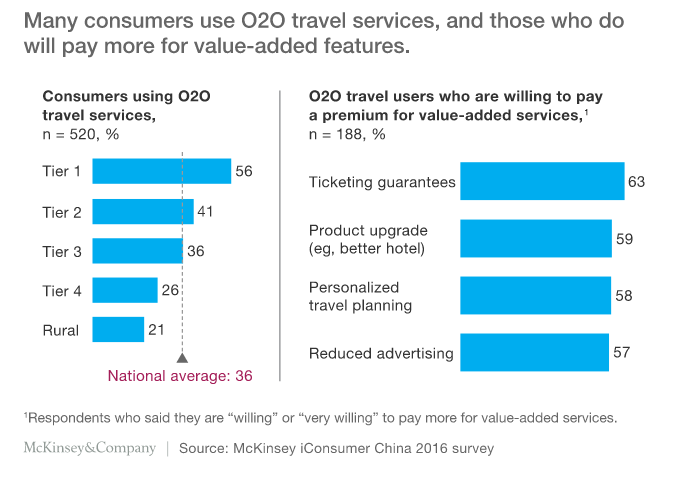

Travel is one of the most popular O2O categories, used by 36 percent of O2O consumers nationwide and 56 percent in Tier 1 cities.

To capture opportunities in O2O travel, businesses need to address consumers’ stated concerns, which include ticket guarantees and doubts about product and service quality.

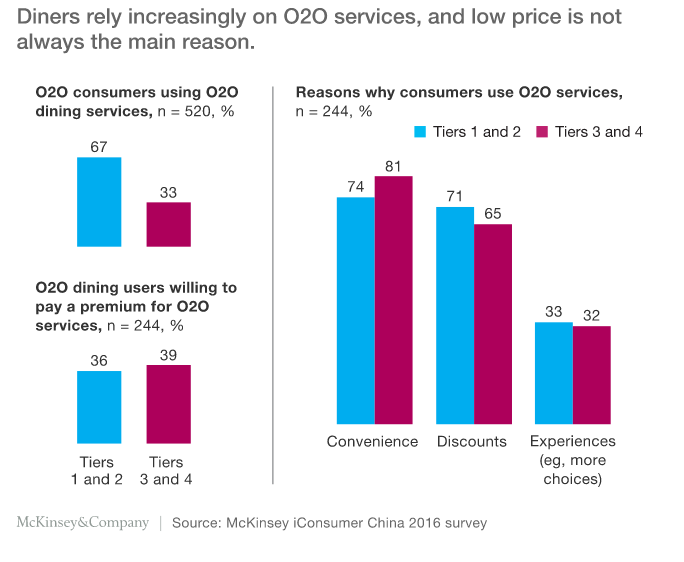

8. O2O dining: Chinese consumers are expecting more than just low price.

People usually got to know O2O dinning since it offers lower price. As time went buy, consumers’ expectations for quality and experience are rising.

Survey shows that "convenience" and "discounts" stand out as the most important reasons why consumers choose to use O2O dining services. Meanwhile, many express a willingness to pay a premium for O2O dining services. After all, "fine dinning" is what Chinese consumers are after.

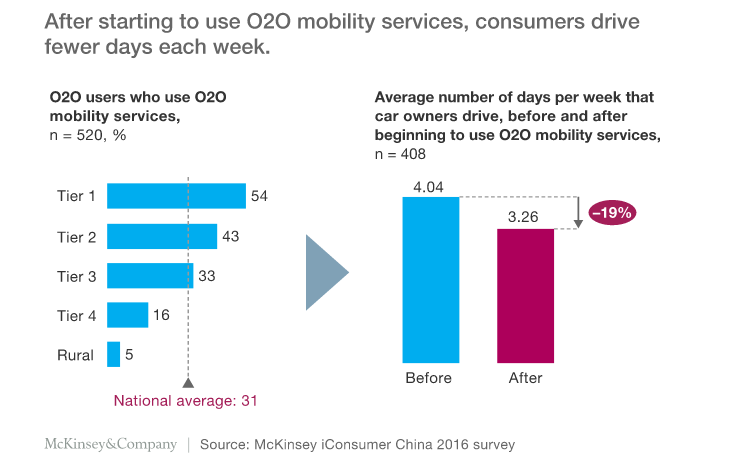

9. Chinese people are driving less because of booming O2O mobility services like Uber and Didi

Talking about how O2O services are affecting people's lives: the use of O2O mobility services is also changing consumers’ driving behavior. The more often people use O2O mobility services, the less likely people will drive, especially in tier 1 cities.

Given the possibility that some consumers will buy fewer cars as they rely more on mobility services, automakers should explore new opportunities to market vehicles through mobility services, such as targeting their drivers as frequent car buyers or using them to showcase new car models to the public.

10. eCommerce in China is always changing, your business should always act quickly.

McKinsey's survey of China’s digital consumers indicates that growth in eCommerce and O2O is shifting to new areas.

Consumer behavior in China is rapidly changing. Consumer-facing companies must look closely within these parts of the market to uncover opportunities and move quickly to take advantage of them before their competitors do.

As a result,succeeding in this market is a matter of keeping pace with changes that are playing out across geographies, product categories, and channels. Companies need to prepare for new customer segments, product categories, and sales channels to emerge as dominant sources of future growth.