Southeast Asia is one of the most dynamic economic engines in the Asia-Pacific region. According to Euromonitor's predictions, by the year 2030, countries like Indonesia, the Philippines, and Vietnam will exhibit stronger economic growth than the entire Asia-Pacific. For the last 2 years, TMO Group has been helping brands–especially in the Health & Dietary Supplement Industry–explore and successfully enter the SEA market.

Having collected first-hand market data from over 125,000 SKUs across Shopee and Lazada, the two major marketplaces in the region, we analyzed the market structure, categories, best-selling brands, price ranges, and consumer trends across the 6 countries with the biggest online eCommerce markets: Indonesia, Malaysia, Thailand, Vietnam, the Philippines and Singapore.

This article is based on the Health Supplements (Southeast Asia Outlook September 2023)This free PDF takes a look at Southeast Asia health supplements market: market segments, price ranges, popular brands and many more.Southeast Asia Health Supplement Outlook, which you can download for free to see the full analysis of our research.

For a more dynamic format, we also covered some insights from this article in our 7-episode series produced in partnership with HPA-China:

Now, let’s dive into the key takeaways from our research into Southeast Asia’s online retail landscape for the Dietary Supplement industry. We will also cover some findings of the different subcategories within the segment.

1. A Growing Market with Indonesia and Thailand leading the way

The Southeast Asia region’s GDP growth has consistently remained at high levels. Over the past four years–partly due to increasing concern for health since the COVID-19 pandemic began– the Southeast Asian health supplements market has experienced a hot surge in sales.

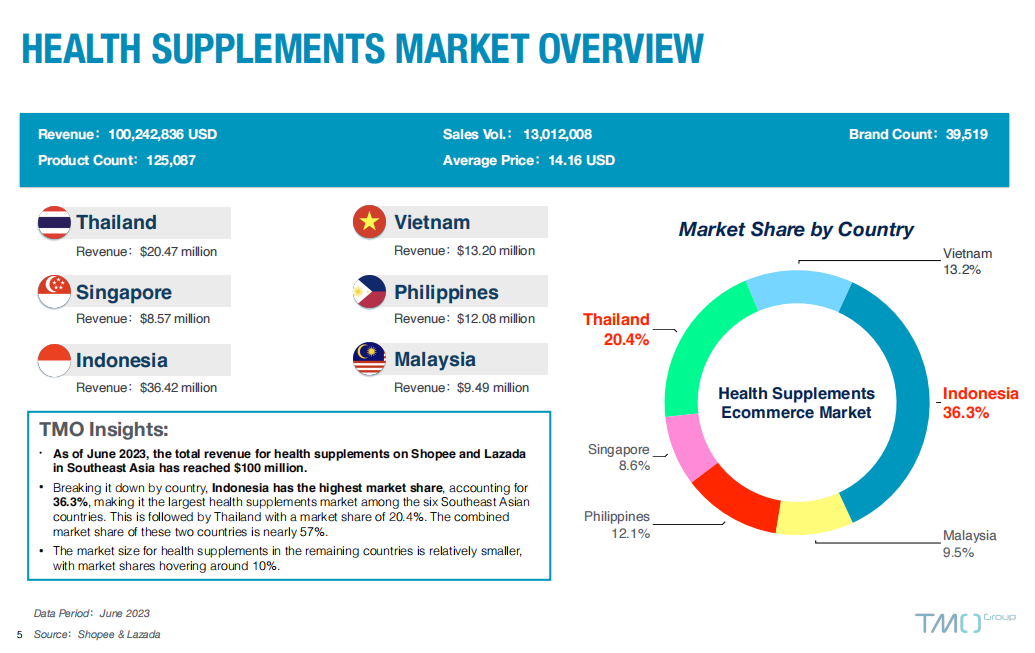

In June 2023 for our six countries of focus (Indonesia, Malaysia, Thailand, Vietnam, the Philippines, and Singapore), sales of health supplements on Shopee and Lazada surpassed US $100 million, with sales volume exceeding 13 million units!

In terms of market potential in each country, Indonesia and Thailand make up nearly 57% of the total market share, with total health supplements market sizes reaching USD 36.42 million (36.3%) and 20.47 million (20.4%), respectively.

2. Low Concentration of Brands shows Ample Opportunities

By combining the classifications in the health supplement industry and e-commerce sectors in Shopee and Lazada, TMO has categorized the health supplements sold in these 2 marketplaces into five major segments:

- Nutrition Supplements

- Beauty Supplements

- General Health Supplements

- Specialty Supplements

- Herbal Supplements

Among these, Nutritional and Beauty Supplements have the largest market shares, accounting for 23.4% and 18.7% respectively.

Looking to boost your eCommerce competitive intelligence? Our Customized Marketplace Reports are tailored to support your brand’s data needs with detailed analysis.

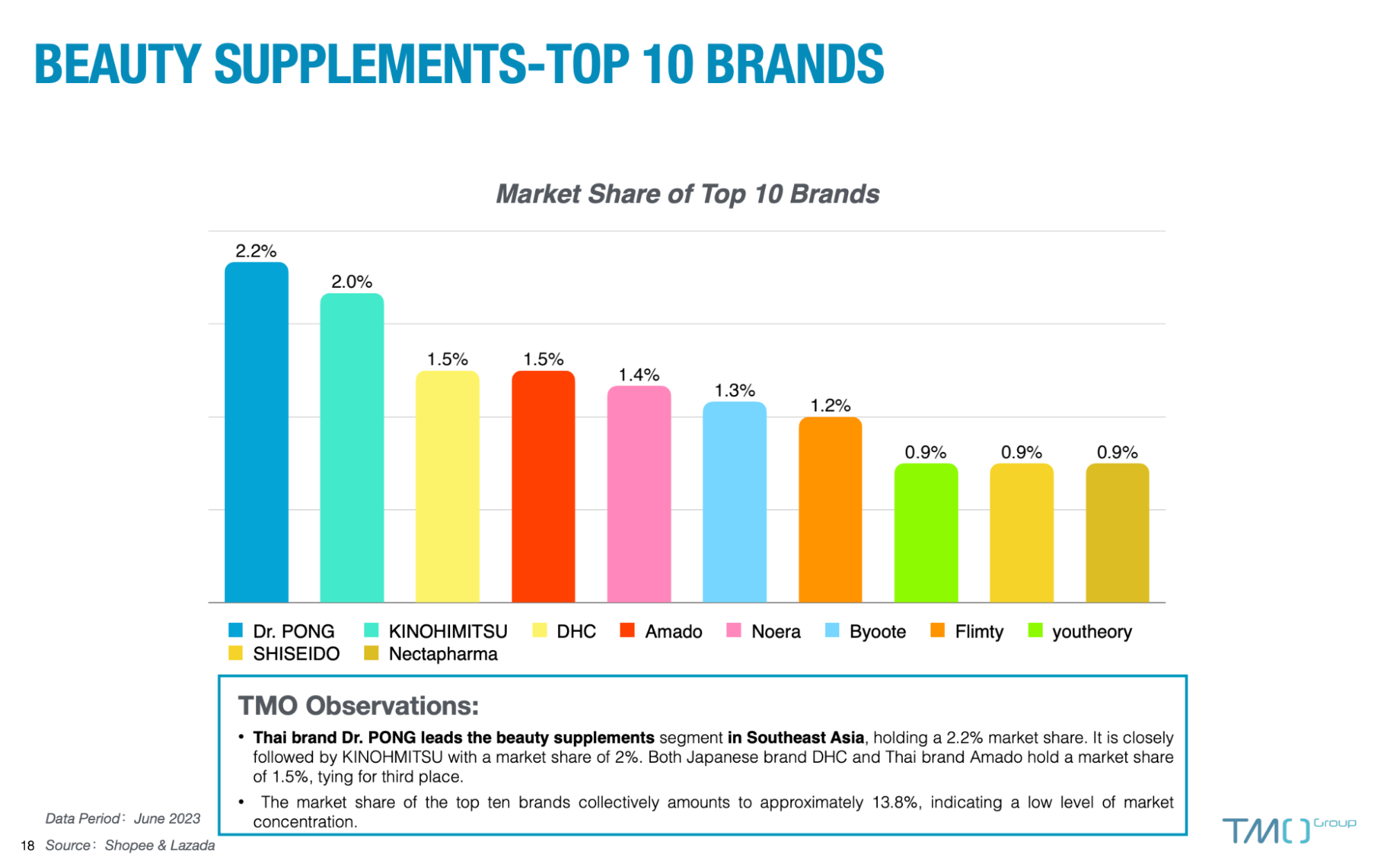

It's worth highlighting that the health supplement industry in Southeast Asia doesn't exhibit high market concentration, with the combined market share of sales from the top 10 brands representing only 4.6% of the market. This indicates that the entire market remains highly dynamic, especially offering significant market expansion opportunities for new entrants. The phenomenon is particularly evident in the subcategory of Beauty Supplements, where the largest brand, Dr. PONG, holds only a 2.2% share, and Singaporean brand KINOHMITSU, ranked second, differing by just 0.2%.

3. Overseas Global Supplement Brands remain Popular

Despite facing competition from local brands, overseas brands such as Herbalife, Life Space, DHC, Swisse, and Blackmores have secured their positions as the top five best-selling brands in various Southeast Asian countries. They are particularly popular in the General Health Supplement subcategory. This indicates a relatively high acceptance of imported dietary supplements among Southeast Asian consumers.

Southeast Asian consumers also have a preference for Japanese brands in the beauty nutritional supplements subcategory. Brands like DHC and SHISEIDO have made it into the top five best-selling brands list for this subcategory in Thailand and Vietnam.

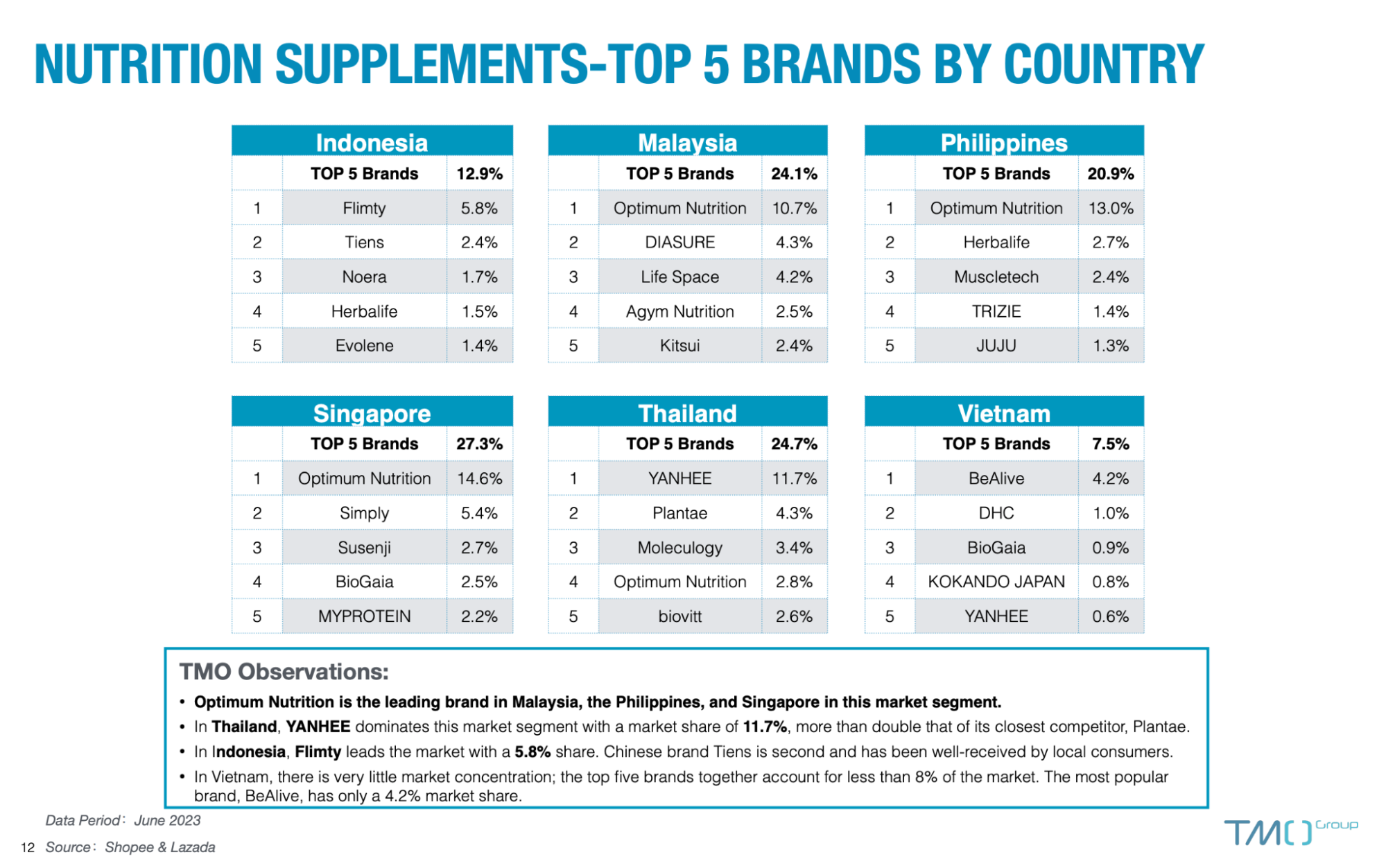

Meanwhile, Chinese products also have a presence in the market. The Chinese brand Tiens (天狮) has achieved notable success in Indonesia’s nutritional health supplements segment, ranking second in terms of sales.

Learn how BYHEALTHThrough online retail sales data analysis, TMO helps BYHEALTH monitor product categories with a custom data structure that guides overseas expansion.BYHEALTH monitors product categories with a custom data architecture that their guides overseas expansion.

Insights from each Health Supplement Product Category

1. Nutrition Supplement Trends

Nutrition supplements is the biggest segment of the overall health supplement market in Southeast Asia. In the overall market across 6 countries, Optimum Nutrition is the leading brand in the nutrition supplements sector in Southeast Asia, followed by YANHEE and Flimty in second and third places.

Among the top ten brands, only three hold a market share exceeding 1%, indicating that the market concentration rate in this segment is remarkably low, suggesting high market vitality and opportunities for further market expansion

2. Beauty Supplement Trends

Beauty Supplements are the second-largest segment, constituting 18.7% of the overall Health Supplement market in Southeast Asia with the biggest markets being the Philippines and Vietnam.

Collagen supplements form the largest sub-category, accounting for 50% of the Southeast Asian beauty supplements market. These supplements are especially popular in Thailand, with 59.7% of the market share.

3. General Health Supplement Trends

General health supplements account for 17.4% of the Southeast Asian health supplements market; in Thailand, it's 23.4%.

Multivitamins and Vitamin Supplements dominate the market, accounting for more than 70% of sales in the overall Southeast Asian market. Interestingly, though, Bee-related Supplements is the leading category in Indonesia, making up 41.5% of the market. When analyzing the revenue contributions of general health supplements across countries, Indonesia holds the highest market share at 34.2%, Thailand follows with 27.5%; Singapore has the lowest share at 6.6%.

4. Specialty Supplement Trends

Among the different market segments in each country, Specialty Supplements are notably popular in Indonesia, making up 21.1% of the overall Health Supplement market. A significantly larger share than in other Southeast Asian countries.

Bone & Joint supplements (31%) and Cardiovascular & Brain supplements (23.7%). are the leading sub-categories in most Southeast Asian countries. Sex & Men's Health supplements perform exceptionally well, ranking as the third most popular category overall. This category sees notable demand in Malaysia and Indonesia, constituting approximately 26% and 19% of sales, respectively.

5. Herbal Supplement Trends

Herbal Health Supplements are the smallest segment of the overall Health Supplement market in Southeast Asia. but includes more than 80 types of herbal ingredients with each country having its own unique ingredients that are popular among consumers.

Apart from other Herbal Supplements which do not specify one ingredient in particular, Caffeine Health supplements have the highest market share, reaching 8.2%. Chlorophyll ranks third in the Herbal Supplement market, with a share of 6.4%. They are closely followed by Stevia and Evening Primrose, with market shares of 4.3% and 3.5%, respectively.

Growing your Business in Southeast Asia through Online Marketplace Monitoring & Research

We believe that the Southeast Asian health supplements market is open and inclusive. However, due to varying cultural and economic levels among countries, consumer preferences also exhibit notable differences. By understanding the market in each country, brands and businesses can better explore Southeast Asia as a destination for expansion.

As part of our comprehensive long-term data monitoring and collection services, TMO Group helps clients dive deeper into Southeast Asia’s eCommerce market with our thorough research and analysis, as well as customized reports for various industries, providing a deep understanding of your niche, including market structure, size, and emerging trends.

If you are looking for an eCommerce agency to assist you in your Southeast Asia business expansion, or want to explore other alternatives to grow in the region, reach out to us to learn more about our Consultancy & Strategy Services services, from branded eCommerce website development to social commerce and other Cross-border eCommerce Solutions.