As the CoViD-19 pandemic crisis comes under control in mainland China, things are going back to normal across most industries. Consumers too are emerging and resuming their usual behaviors. But after months of distorted sales figures and unusual spending patterns, what will this new normal look like? To remind ourselves of what normal looked like for the cosmetics industry in a pre-CoViD world, we take a look at the best sellers on Tmall during last year's biggest sales event - Singles Day, or 'Double Eleven'.

2019 came at the end of a full decade of incredible growth for the sales holiday. In 2009, the occasion was associated with activities done by groups of single friends, and not much else. Within a few years, Alibaba had firmly established the day in most consumers' mind as a shopping holiday without equal. Indeed, Singles Day has now grown into the world's biggest sales holiday - dwarfing even America's Black Friday sales. In 2019, this translated to a total of 410 billion RMB in transactional value. Of that, 268 billion RMB went through Alibaba's Tmall alone (not including any of Alibaba's other lucrative platforms!).

Singles Day 2019 and the Cosmetics Market Segment

The cosmetics market segment has risen to become one of Singles Day's true stars. Obviously cosmetics is an industry that does a good job of standing front and center promoting anything, but this relationship is more than skin deep. 299 brands topped 100 million RMB in Singles Day turnover in 2019, twice that of 2018, with the cosmetics industry accounting for an impressive 63. This demonstrates how important a piece of the Singles Day puzzle cosmetics brands have become.

L'Oreal, Lancome, Este Lauder, and Olay are the four international names that broke the one billion RMB mark on Tmall in 2019 - a feat no cosmetics company achieved in 2018. Domestic brands performed well too, with 19 posting turnovers of more than 100 million RMB, nine more than 2018. These included Hansoon, Afu, Herborist, and Aupres.

Unsurprisingly, some of the most prominent brand products saw considerable turnover. Lancome's Tonique Confort, Shiseido's Ultimune Power Infusing Concentrate, and L'Oreal's Revitalift Filler Eyecream were all among the best-sellers on Single's Day. Meanwhile, numerous others including Olay's Spot Fading Essence were able to break two billion in sales.

Next, let's take a look at the some of the highlights of top ten best-performing cosmetics brands on Tmall during Singles Day 2019.

Tmall's Top Cosmetics Brands During Singles Day 2019

1. L'Oreal

While several other brands opted for interactive game experiences to engage consumers, L'Oreal took a different path. It instead unveiled "L'Oreal Hall", a complete transformation of the brand's Tmall store, integrating omnichannel advantages with precise category promotion to capture consumer attention.

L'Oreal invited stars like Chu Yilong, Xin Zhilei, and Li Yuchun to serve in a variety of brand ambassador roles such as "mad R&D directors" and "glow artists". This gave the brand a unique and memorable image during the promotion. Meanwhile, L'Oreal also provided a product experience opportunities to let users try out products in the brand's offline locations before deciding to buy.

As a digitalization pioneer among cosmetics brands, L'Oreal has long been forging its own way when it comes to digital marketing. Livestreaming has been a powerful weapon in L'Oreal's arsenal for a while now, and Singles Day saw them wheel it out once more. L'Oreal reuinited with Li Jiaqi (a male celebrity known for his numerous lipstick promotions, whose early career saw cooperations with L'Oreal) and brought Wei Ya - a KOL who recently made headlines selling an actual rocket ship online - into the mix to form the brand's live-streaming anchor pair for Singles Day.

2. Lancome

Impressively, L'Oreal Group's Lancome brand secures the second spot - a Double Eleven double-win for L'Oreal! As L'Oreal chose major influencers Li Jiaqi and Wei Ya on board to promote their products, Lancome too opted for a youth-oriented approach. Alongside Yu Feihong and Liu Tao (who sought to capture the elegant and mature woman audience), Lancome drafted in stars that are popular with the young, such as Zhou Dongyu and Wang Junkai.

Alongside its more typical marketing fare, Lancome also launched its "Clear Your Shopping Cart" campaign. The brand would pick one lucky participating fan each day during the pre-sale period, and give them every Lancome product in their cart for free. This encouraged a frenzy of shoppers adding Lancome products to their carts, many of which would then translate into sales on the day itself and before. The campaign was a hit, with shoppers responding well to the interactive excitement.

3. Estee Lauder

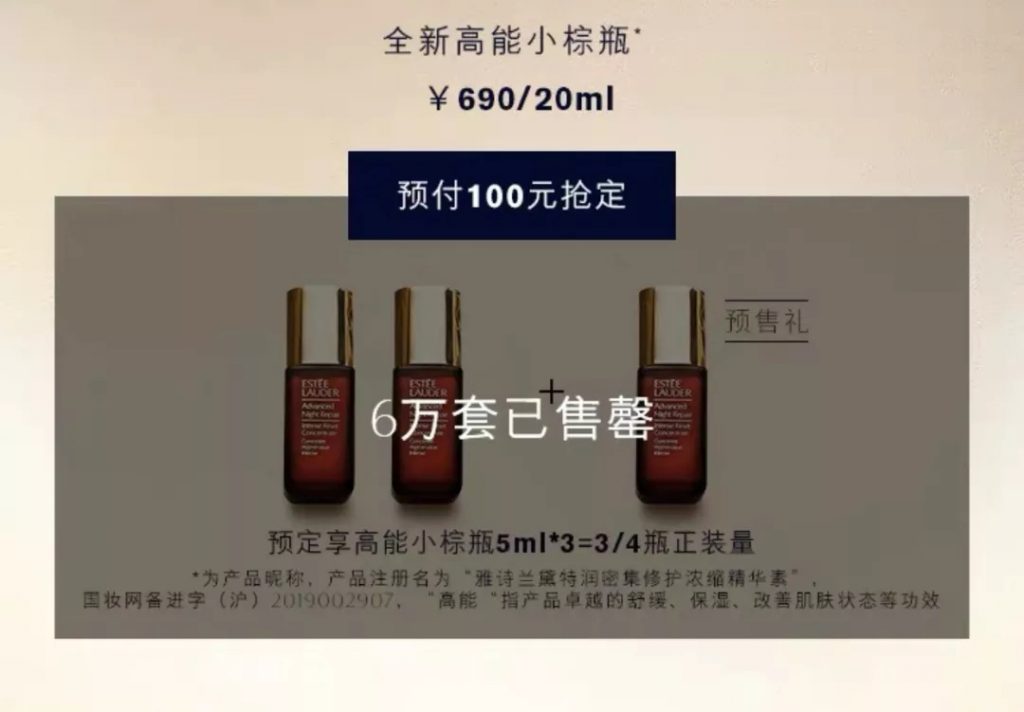

Estee Lauder had been beaten on Singles Day by Lancome in both 2017 and 2018 and so redoubled its efforts in 2019. Unprecedented discounts, 'buy one get one free' deals, and pre-sale packages helped the brand reach the Top 3, but the victory over its rival Lancome failed to materialize.

This was despite fierce demand. On the first day of the pre-sale, Estee Lauder sold out of Advanced Night Repair Eye cream in China, and had to quickly redirect global stocks to meet local demand.

On November 3rd, Estee Lauder's pre-sales reached a transactional value of one billion RMB. That made it the first cosmetics brand to break one billion on Singles Day 2019.

6. Chando

Chando has consistently been China's best performing domestic cosmetics brand on Tmall's Singles Day for years now. The brand kept this up for another year in 2019, and then some. Chando reportedly made more than 100 million RMB in the first 39 minutes. It went on to make 200 million in 62 minutes, and 300 million in just under 8 hours. Chando also came away from the event being able to claim the best-selling domestic cosmetics product on a Tmall flagship store, on Tmall as a whole, and on the entire internet.

Where international big names found success through massively slashing prices, Chando's success can mostly be put down to continuous efforts to improve its product line. Chando stuck to a very clear digital strategy enhanced by a social media push to build momentum before the event. A strategy of continual product upgrade and marketing updates with themed products throughout the year, while focusing on customer needs and feedback.

This drive for continual improvement has also been reflected in the offline sphere. Chando has expanded into major malls across the country as well as duty-free sections of airports and ports. These expansions allow more consumers than ever to experience the brand's store-exclusive services and try products for themselves.

7. Pechoin

Another leading domestic cosmetics brand, Pechoin broke the 100 million RMB mark within just ten minutes on Double Eleven 2019. By the end of the day, this figure had grown to 865 million RMB.

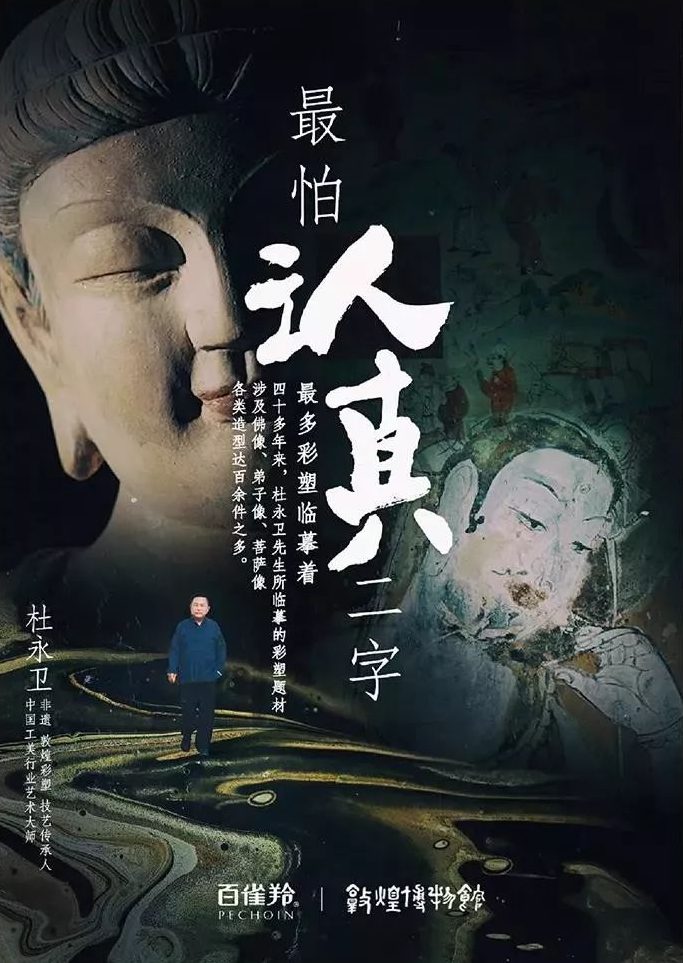

Founded in 1931, Pechoin represents the first generation of modern Chinese skincare products. The brand has succeeded in recent years of staying true to this storied history and cultural appeal while keeping up with the times through product innovation.

On Singles Day 2019, the brand teamed up with famed traditional artist Du Yongwei and the world-famous Dunhuang Museum. This lent Pechoin's marketing a classy, cultured aesthetic.

Additionally, the brand held a star-studded 'New Forbidden City' variety show to promote the 'Oriental Beauty' of its product range. This proved to be a smash hit with consumers online.

8. Whoo

The only Korean brand to break into the Top 10 in 2019 was Whoo. Whoo snatched that title away from Innisfree, who achieved the same in 2018.

Unlike the Western brands that made the Top 10, Whoo adopted a 'crowd-focused' strategy for Singles Day 2019. The brand carried out a marketing push through offline exhibitions and focusing on the existing 'super fans'. Consumer surveys found that 21% of respondents had learned about the Korean brand through these offline exhibitions. 19.3% credited trade shows and other events, 16.4% friends' recommendations, and just 14.4% the Internet.

Whoo, like many Korean brands, likes to lean into the widespread popularity of Korean period dramas in China. It does this by using similar imagery and associations in its marketing and visual language. This lends the product a traditional and premium veneer while still tapping into contemporary audiences and interests.

9. Perfect Diary

Perfect Diary breaking into the Top 10 was one of the biggest surprises from Singles Day 2019. The company was only two years old, and yet has quickly become a domestic market leader. Experts have put this meteoric rise down in no small part to the brand's deep content and consumer cultivation.

The brand first set about establishing itself on social media eCommerce platform Xiaohongshu. There it engaged consumers through 'grassroots' strategies, including KOL connections and community interaction. Perfect Diary artfully leveraged word of mouth to become an overnight sensation on that platform and beyond.

Not resting on its laurels, the brand then moved to embrace the live-streaming and short video trends. Focusing firmly on the youth market, it used cutting-edge campaigns like short video color and makeup tests. With its finger firmly on the pulse, Perfect Diary became the nation's most eye-catching dark horse in years.

Interested in the Chinese cosmetics market? Watch this space for our upcoming China Cosmetics Industry Report, and in the meantime check out our comprehensive China eCommerce Market GuideThis in-depth China eCommerce Guide can help your company rise to the challenges of the Chinese market and sell via cross-border. Updated for 2020!China eCommerce Market Guide!