B2B procurement is complex: bulk orders, multi-level approvals, deferred payments, and account-specific terms are just some of the nuances of the purchase process. What makes it even harder is that no two industries or organizations follow the same rules.

Even with built-in or plugin-based B2B features, most eCommerce platforms eventually hit limitations or dead ends that push buyers back to manual, offline ordering. Yet research shows that B2B buyers increasingly prefer self-service and expect the same seamlessness they experience as consumers.

To stay competitive, brands need checkout experiences designed around real purchasing logic, reducing manual work for sales teams, shortening order cycles, and increasing online conversions, even for high-value transactions. In this article, we’ll explore the most common B2B eCommerce friction points how checkout customization can address these challenges.

TMO has 10+ years of experience offering B2B eCommerce Solutions that simplify complex workflows and power enterprise-grade checkout experiences.

Common Friction Points in B2B Checkout

While important, B2B checkout friction rarely comes from aesthetics or speed. It comes from the platform’s logic not matching the way a business actually buys. Even within the same organization, purchase approvals, payment terms, and invoicing expectations can differ by department, region, or order size, for which standardized checkout flows can’t accommodate.

Here are some of the most frequent pain points we encounter when auditing B2B stores:

| Friction Point | Examples |

|---|---|

| Flat pricing and payment logic | Buyer-specific discounts, credit terms, or tax exemptions can’t be applied automatically, leading to manual invoicing. |

| Missing purchase order workflows | Procurement teams need to submit PO numbers or attach documents offline because checkout lacks approval or upload fields. |

| Limited payment flexibility | Buyers using invoices, deposits, or net terms can’t complete checkout when only instant payment methods are available. |

| No support for multi-user approvals | Department buyers can add to cart, but final approval must happen via email or ERP, outside the platform. |

| Rigid shipping and logistics | Orders requiring split shipments, multiple destinations, or freight terms can’t be handled in one checkout flow. |

| Disjointed integrations | ERP or CRM data isn’t synced in real time, so sales teams re-enter orders manually, causing errors and delays. |

Most of these frictions occur because mapping B2B purchase flows is far more complex than in B2C, leading to structural mismatches.

The process is rarely linear: approvals, payment terms, and compliance steps often overlap or loop back depending on order size, buyer role, or contract terms. And the more diverse your buyer base (industry, geography, purchasing model...), the more critical it becomes to build checkout logic that adapts to them, not the other way around.

Dive deeper into how to leverage your digital assets for B2B ordering in our article on B2B eCommerce: Building a Digital Product System in 5 Steps5 steps to take your B2B eCommerce from an unstructured online product presence to one that fully leverages your digital assets.Building Digital Product Systems for B2B.

7 Customizations to Improve your B2B Checkout

1. Simplify Complex Orders

In B2B, a single order can commonly include hundreds of SKUs, multiple delivery addresses, and different fulfillment requirements all handled by one single buyer. Traditional eCommerce flows built for one-time retail purchases can’t handle that level of input efficiently.

Bulk and high-frequency buyers (such as manufacturers, distributors, and franchise networks) need checkout tools that reduce manual effort without breaking operational logic. When every product, quantity, and location must be keyed in by hand, even experienced buyers revert to email or spreadsheets. Let's look at some of the opportunities for customization:

| Customization | Function |

|---|---|

| Bulk order entry tools | Let buyers upload SKUs via CSV or add multiple product codes at once, saving time on large or recurring purchases. |

| Saved drafts | Allow in-progress carts that buyers can return to later for internal approvals or budget confirmation. |

| Automatic order splitting | Route items to the correct warehouse or branch based on inventory, destination, or product type. |

| Validation rules | Enforce minimum quantities, packaging requirements, or value thresholds automatically to prevent fulfillment errors. |

Simplifying complex orders reduces administrative overhead for both buyer and seller. It shortens purchase time, cuts manual quote requests, and enables self-service for high-volume customers who would otherwise require sales team support. This results in a faster checkout completion, fewer manual interventions, and higher repeat order frequency.

2. Reflect Contract Logic at Checkout

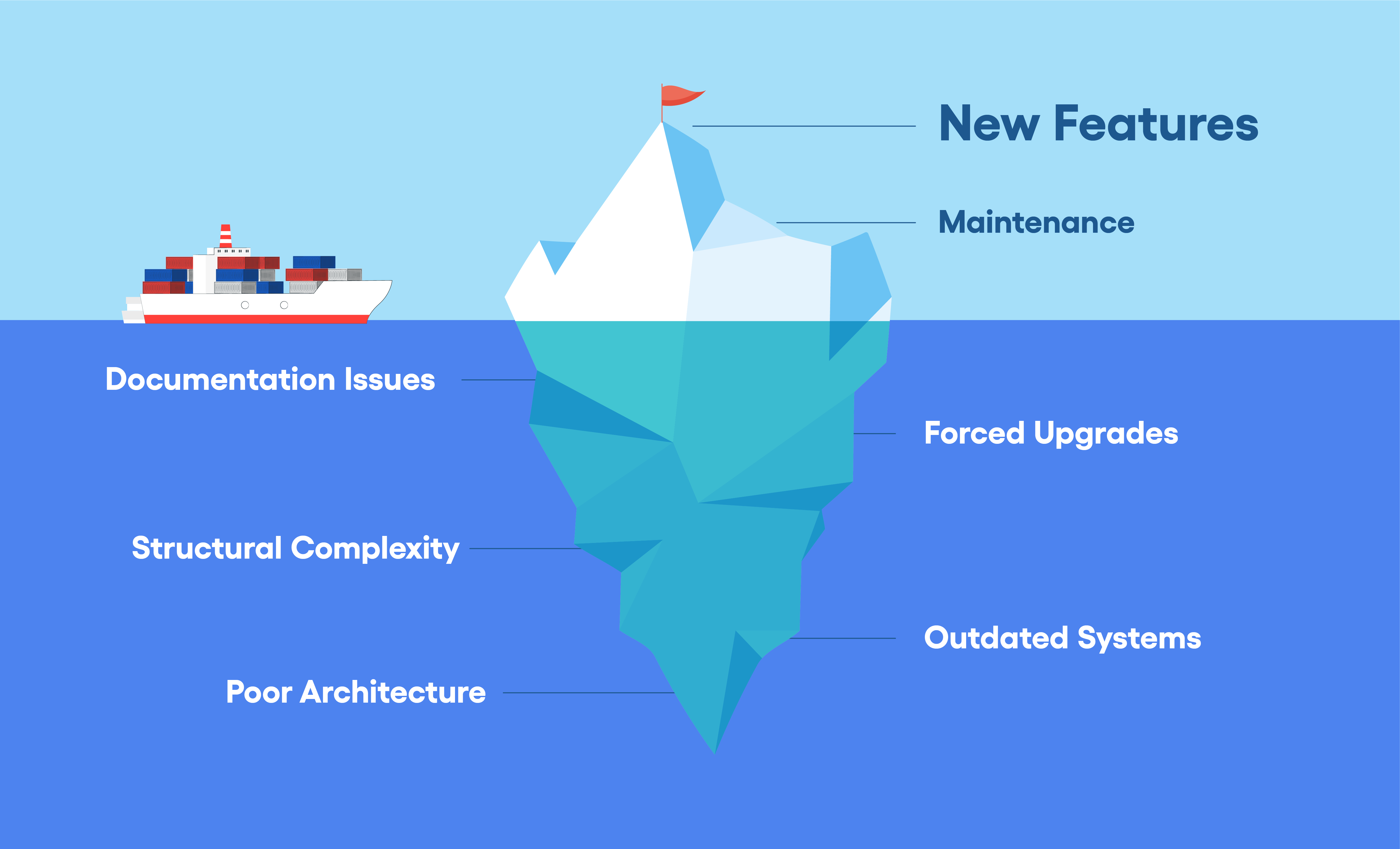

For most B2B sellers, the transaction is only the visible tip of a much larger commercial agreement. Behind every online order are negotiated prices, credit terms, freight contracts, and tax conditions that define how each buyer relationship operates.

When a buyer logs in but still sees retail pricing or is asked to pay upfront despite agreed net terms, the process slows down and causes dissonance for the user. The sale might still happen, but it will likely move offline, where manual adjustments and human oversight restore the rules that the platform couldn’t.

By embedding contract rules directly into checkout, businesses can ensure each buyer’s experience aligns with their existing agreement, reducing friction and errors:

| Customization | Function |

|---|---|

| Account-based pricing | Display negotiated prices, discounts, and tax rules automatically based on the buyer’s profile or contract. |

| Real-time credit validation | Sync with ERP or finance systems to enforce credit limits and payment terms before order confirmation. |

| Contract-specific freight rules | Apply carriers, Incoterms, or regional freight rates dynamically based on the buyer’s agreement. |

| Tax automation | Handle exemptions or jurisdictional tax rules automatically using company registration data. |

When checkout logic mirrors contractual reality, buyers complete orders with confidence and sellers save hours of manual reconciliation. It reduces invoice corrections, credit disputes, and fulfillment delays.

While it may seem difficult to capture every business rule perfectly within an automated system, it’s absolutely possible to build toward a process that gradually reduces manual checks and prevents policy violations.

3. Streamline Internal Approvals

Except for small organizations, in B2B purchasing the person placing an order is rarely the one authorized to approve it, and procurement teams, finance departments, and managers all play different roles in the process. Standard checkout flows (built for single-user decisions) can’t handle these hierarchies, pushing approvals back to email or offline workflows.

Modern organizations are increasingly integrating approval logic directly into checkout to keep purchasing compliant without slowing it down:

| Customization | Function |

|---|---|

| Multi-user accounts | Define company roles (e.g., Buyer, Approver, Administrator) and control who can submit, edit, or approve orders. |

| Approval routing | Trigger automatic approval flows based on order value, department, or product category. |

| Spending thresholds | Set value-based rules where smaller orders auto-approve while higher-value orders require authorization. |

| Notification and audit trails | Send alerts to approvers and maintain visibility over approvals, rejections, and pending actions. |

Embedding approval logic directly into checkout keeps the buying process compliant and efficient.

Approvers gain real-time visibility into pending orders, while procurement teams eliminate delays caused by manual communication. The result is faster cycle times and cleaner order governance with less off-platform coordination.

4. Adapt Payment Experience to Business Needs

Buyers operate under credit terms, purchase orders, and invoicing cycles defined by their organization’s finance policies. When a checkout process only supports instant payment, it disrupts that structure and often forces buyers back to offline ordering.

Checkout customization allows sellers to align payment options with real finance, procurement, and accounting processes, which remain one of the biggest conversion barriers in B2B eCommerce.

| Customization | Function |

|---|---|

| Invoice and PO payments | Let verified buyers complete checkout with a PO number, with invoices issued automatically post-order. |

| Deferred or scheduled payments | Support net terms (e.g., Net 30/60) or partial deposits for large or recurring orders. |

| Localized payment methods | Offer region-specific options like bank transfers, ACH, or domestic gateways to support cross-border operations. |

| ERP credit sync | Integrate with finance systems to update available credit in real time and prevent overextension. |

When payment logic reflects how finance departments actually operate, checkout becomes a trusted extension of business operations rather than an obstacle. Flexible terms and localized options remove friction, reduce offline invoicing, and help strengthen relationships with enterprise buyers who value control and reliability. Over time, this alignment increases checkout completion rates and streamlines the entire order-to-cash process with reduced administrative follow-up on invoices or credit checks.

5. Design for Clarity, Not Speed

In B2B, the best checkout experience is the one that minimizes doubt. Buyers aren’t impulsive shoppers; they’re accountable professionals handling budgets, compliance rules, and delivery expectations. What they value most is accuracy and transparency, not a one-click experience.

A well-designed B2B checkout should provide just enough structure to guide complex orders without overwhelming users. It needs to show what’s being purchased, why each field matters, and what happens next:

| Customization | Function |

|---|---|

| Progressive form logic | Reveal fields only when relevant to the buyer’s context, such as displaying PO fields for certain account types. |

| Inline validation and contextual help | Provide immediate feedback or guidance to reduce errors and support inexperienced buyers. |

| Dynamic summaries | Update totals, taxes, and freight charges in real time as buyers modify order details. |

| Document upload and verification | Allow buyers to attach compliance certificates, licenses, or delivery instructions during checkout. |

Clarity at checkout builds trust and confidence in every transaction. Buyers know exactly what they’re ordering, how it’s priced, and what steps remain before completion. The result is fewer errors, fewer abandoned carts, and a stronger sense of reliability across the entire purchasing journey.

Important: Don't Over-Customize!

Customization should make purchasing easier, not more complicated. Adding too many bespoke steps or conditional rules can quickly turn checkout into a confusing workflow, especially for new or infrequent buyers. Keep customization focused on solving real problems:

- Avoid unnecessary layers. Only include steps that directly support pricing, approval, or compliance needs.

- Validate each rule. If a condition doesn’t clearly remove friction or reduce errors, it’s adding noise, not value.

- Design for scalability. Build rules modularly so they can evolve with your processes, not lock you into complexity.

While excessive customization can overcomplicate the process, a thoughtful balance between structure and usability allows even new buyers to complete orders without confusion.

6. Integrate with Operations in Real Time

In B2B commerce, checkout sits at the intersection of operations, finance, and logistics. When the checkout process fails to communicate with systems like ERP, CRM, or inventory management, teams end up re-entering data, fixing mismatched orders, or manually confirming availability. That disconnect is one of the most common causes of lost efficiency in digital transformation projects.

A customized checkout can become the control center for operational alignment, linking front-end actions to backend systems in real time:

| Customization | Function |

|---|---|

| ERP integration | Sync product, pricing, and credit data to ensure accuracy and eliminate post-order reconciliation. |

| Inventory validation | Display live stock levels or region-based availability before checkout confirmation. |

| Tax and compliance APIs | Automate tax rules and documentation requirements using services such as Avalara or Vertex. |

| CRM and order routing | Direct order data to sales or account managers based on buyer profile or region. |

| Error fallback logic | Keep checkout operational even if a third-party service (e.g., tax or shipping API) experiences downtime. |

Real-time integration ensures that what buyers see during checkout matches the business’s operational reality. Orders flow automatically to the right systems, stock levels stay accurate, and manual interventions drop significantly. Over time, this level of integration increases efficiency across departments and gives buyers the confidence that their orders are processed seamlessly and without delay.

7. Enable Self-Service and Repeat Orders

B2B purchasing is a recurring process rather than a one-time event. Distributors, clinics, and manufacturers often reorder the same items at regular intervals, and forcing them to rebuild carts from scratch adds unnecessary friction. Self-service capabilities make reordering faster, more accurate, and less dependent on sales intervention.

| Customization | Function |

|---|---|

| Saved order templates | Let buyers create and reuse pre-filled order templates by department, project, or branch. |

| Reorder and edit functions | Allow duplication of previous orders with quick adjustments to quantity or delivery details. |

| Predictive reordering | Suggest replenishment based on historical order frequency or consumption patterns. |

| Multi-branch management | Enable corporate accounts to manage multiple locations or teams under one unified profile. |

A well-designed self-service checkout removes repetitive work for both sides. Buyers can complete transactions independently while sales teams focus on higher-value accounts. Over time, this approach builds loyalty, increases repeat purchase frequency, and helps standardize procurement behavior across branches or departments, turning digital ordering into the default buying method.

Steps to Approach B2B Customization

Even within a single organization, B2B purchasing behavior can differ by department, subsidiaries, markets, or hierarchy. A successful checkout strategy must be flexible enough to accommodate those variations while remaining simple enough to maintain. Customization only delivers long-term value when it’s planned, validated, scalable, and maintainable.

When approaching your B2B checkout planning, we recommend following a follow a step-by-step process:

- Map buyer personas and workflows:

Document how different buyer types (think procurement officers, finance approvers, resellers) move through the purchase journey. Identify where digital friction occurs and what can be automated. - Audit system dependencies early:

ERP, CRM, and tax integrations determine what level of customization is technically possible. Understanding these connections before development prevents expensive rework later. - Prototype and test checkout logic:

Use prototypes or controlled rollouts to validate that your flows match real buyer behavior. Adjust based on data before full implementation. - Build modularly for scalability.

Structure checkout logic in independent components or API-based services so you can evolve individual functions (e.g., pricing, payment, or shipping) without breaking the entire process. - Measure and optimize continuously:

Monitor key performance indicators such as checkout completion rate, time-to-approve, and error frequency. Use these insights to refine workflows and identify where further automation can add value.

B2B checkout should evolve alongside the organization itself. As product lines expand, new regions come online, or financial rules change, the ability to iterate on checkout logic becomes a strategic advantage. Teams that measure and refine their workflows over time not only improve conversion but also reduce internal workload and support overhead.

Geography adds another layer of complexity. Regulatory requirements, tax policies, and payment preferences vary widely by market, and what works seamlessly in one region can create compliance risks in another. Testing localized checkout experiences ensures each flow aligns with regional standards and buyer expectations before rollout.

Ultimately, the goal isn’t to automate everything overnight but to build a framework that adapts with your business. A well-implemented checkout customization strategy strikes the right balance between control and flexibility, empowering teams to scale confidently while buyers enjoy a consistent, intuitive purchasing experience.

Which is the Right Platform for Your B2B Logic?

If you’re at the stage of planning a new B2B project or considering a platform switch, choosing the right foundation is one of the most impactful decisions you’ll make. Over the years, we’ve worked with a wide range of setups from SaaS environments to fully custom architectures, and have seen how each performs under real B2B conditions.

As an Adobe-certified team and Shopify Partner, our perspective comes from two contrasting operational needs: managed convenience versus full flexibility.

The right choice depends on how much control you need over pricing rules, integrations, and checkout workflows. SaaS solutions prioritize simplicity and speed; open-source architectures prioritize flexibility and deep system alignment.

a) Shopify + Plugins

This setup works well for early-stage or smaller distributors with simple workflows. Plugins can add basic wholesale features such as tiered pricing, purchase orders, or restricted catalog access, but complexity grows quickly as the number of apps increases. Managing checkout logic across separate extensions often leads to fragmented data, limited control, and higher maintenance overhead.

b) Shopify Plus

A strong SaaS option for mid-market B2B merchants seeking reliability and faster deployment.

Shopify Plus offers Checkout Extensibility, Shopify Functions, and B2B APIs suitable for moderate customization such as account-based pricing or limited workflow automation.

It is often an excellent fit for brands that primarily operate B2C stores but also manage a blended B2B or wholesale model under the same storefront. However, its hosted environment restricts low-level control. Deep ERP integrations, multi-step approvals, or region-specific compliance logic often require creative workarounds or external systems.

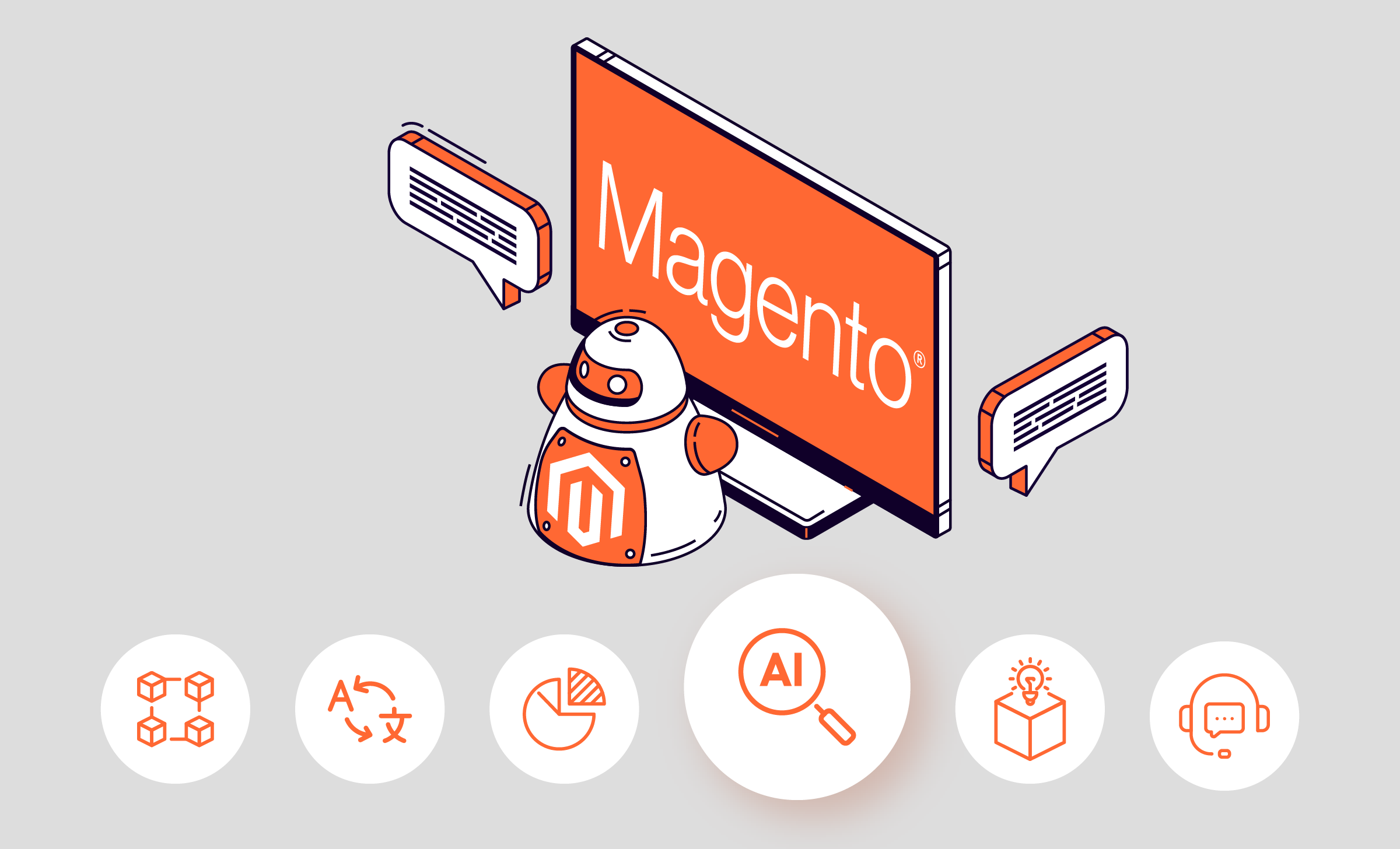

c) Magento Open Source

A flexible, open framework ideal for businesses treating eCommerce as an extension of their operations. Magento allows full customization of checkout logic from approvals, to credit validation, and order routing, while maintaining ownership of code and data.

It demands greater technical oversight, but for teams with development resources or specialized partners, the payoff is long-term scalability and process fidelity. Established B2B sellers needing control over every aspect of pricing, approval, and integration often have Magento as their top choice.

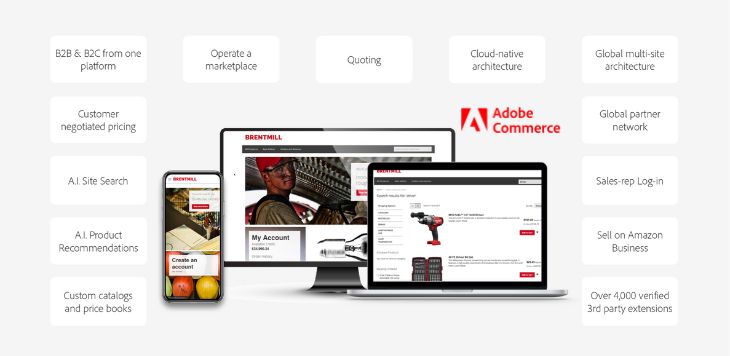

d) Adobe Commerce

For enterprises, Adobe Commerce (Magento Enterprise) combines Magento’s flexibility with prebuilt B2B modules: company accounts, shared catalogs, and negotiable quotes, plus managed cloud hosting.

It’s one of the few platforms capable of fully replicating complex internal purchase workflows online, aligning digital orders with existing ERP and compliance structures while maintaining upgrade stability. For enterprises with multi-region operations, deep integration needs, and a clear ROI case for automation, we typically find the higher investment to be worth it.

10 Outstanding B2B Magento / Adobe Commerce SitesWe cover 10 B2B eCommerce websites built on the Adobe Commerce (Magento) framework, from multi-vendor to self-operated platforms.

Building Smarter B2B Experiences with TMO

In B2B eCommerce, there is no such thing as a universal checkout flow. Taking the above strategies into account puts you one step closer to creating a purchasing journey that meets the expectations of today’s business customers.

Reducing administrative costs, shortening approval cycles, and increasing conversion rates by removing friction that buyers can’t control are just some of the benefits of a well-structured checkout can help achieve. If you are looking for inspiration for your specific industry, our Customer Showcases feature many examples of B2B customers that have transformed their business through platform customization.

Ready to take the next step in B2B Digital Transformation? Talk to TMO about building a checkout experience that reflects how your buyers actually shop.