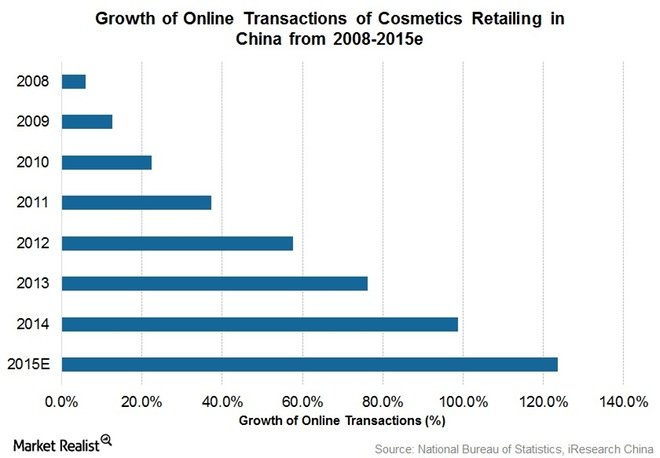

The cosmetics market in China is still booming through the year of 2015. With a high smartphone penetration rate, eCommerce is playing an increasingly important role in the cosmetics industry. Here are 5 major things we learned from cosmetics eCommerce performances this year:

1. Welcome to the era of "cosmetics eCommerce", ladies and gentlemen

China is the second largest cosmetics consumer market around the world, which means there is more than enough room for cosmetics eCommerce to grow: Right now, 70 percent of China’s cosmetic products are distributed by larger department stores and supermarkets; however, as purchasing habits change, specifically in younger demographics, more consumers are purchasing cosmetics online.

According to iResearch, the total value of China’s online cosmetics market was RMB 8.35 billion (US$1.35 billion) in April 2014, and Analysts estimate that this industry is poised for a 20.8% year-on-year growth. This will mean a shift in marketing strategy and distribution within the cosmetics industry, with increasing emphasis on e-commerce.

2. Customers in China: the love for cosmetics eCommerce is growing

When shopping for cosmetics, Chinese customers are eCommerce ready.

Chinese customers like to look up products online to gather information. The 20s-30s age group has been the key consumer group and growth driver for China’s cosmetics market, and they are as well very sensitive to prices. Chinese consumers are becoming more particular when picking cosmetic products, not only in terms of quality, but also in terms of health and safety. Larger companies can rely on an established reputation for safety, and this perhaps gives foreign investors the edge over domestic brands. Also, the Internet word of mouth (IWOM) plays a big role in the online purchase process.

3. More eCommerce Channels Competing in China's cosmetics eCommerce battle

As powerful as online marketplace giants like Taobao and JD, cosmetics players are still exploring more channels to expand their business.

Jumei.com, an online marketplace that only focus on cosmetics, has become the latest favorite for both business and shoppers. The website guarantees shoppers with the best prices available, meanwhile it has launched its Jumei Global e-commerce platform in September 2014, selling overseas cosmetics products and baby products. With Jumei, consumers can buy authentic oversea products in a faster and cheaper way.

Jumei.com

Meanwhile, foreign cosmetics ecommerce platforms have launched Chinese websites to cater the need of Chinese consumers. Gmarket, South Korea’s leading e-commerce marketplace, has set up a Chinese website to welcome Chinese consumers to buy Korean cosmetics product on its website.

Gmarket China Site

4. WeChat is not only a powerful but also an Indispensable Tool

With the rapid growth of online shopping and accelerating penetration of mobile devices, social media has become an important marketing tool for cosmetic brands to promote their products and interact with their customers.

Increasing number of foreign and domestic cosmetic brands established services accounts in WeChat to stay connected with Chinese customers. In 2015, WeChat commerce has become currently the most significant channel. Among a research from 173 brands in Chinese market, about 77% of them have set up WeChat accounts to engage their customers in 2015, surging from only 46% in 2014. Plus, WeChat is not just a social media platform anymore; it represents a new form of e-commerce, one where enterprises or individuals open shops via its platform.

The difference between WeChat commerce and online marketplace (Taobao, JD) is that WeChat commerce makes use of its parent platform's ability to connect everything – social sharing, recommendations to close friends and presentation of products to a circle of friends. This difference has become a unique advantage for Wechat eCommerce. As a result, it can target user groups more accurately and connect big data more effectively than traditional e-commerce systems. This enables business owners to substantially improve their levels of service and secure more orders.

Example: Sephora and OLAY WeChat Stores

To develop its own eCommerce platform via WeChat seem more important than ever now. There are two most popular ways for cosmetic brands to set up their WeChat eCommerce store: to use 3rd party softwares, or to build its own multi-channel shop with the help of professional eCommerce framework. (Click to know more: WeChat eCommerce Platform: The good, the Bad and the SolutionThere are several 3rd party eCommerce platforms one can use to build up its own WeChat eCommerce, both the pros and cons are very obvious.WeChat E-commerce Platform: The good, the Bad and the Solution)

5. Future for cosmetics eCommerce in China is brighter than ever

The future of China cosmetics eCommerce looks sharp. According to the China Cosmetic Market Report 2014-2017, there is also a rising opportunity in the male cosmetics market, with men’s products accounting for 4.6 percent of retail sales in 2013 and forecast to increase further in the future. Moreover, it is growing at a much faster rate than the female market.

Above all, China’s cosmetics industry represents a substantial opportunity. With a current annual growth rate of approximately 12 percent and forecast value growth set to remain profitable, the industry is undoubtedly an optimistic point of investment in China.

More about China cross border eCommerce: