TMO's China Health Supplements Market Data Pack Series is released in the form of a free monthly downloadable as part of our comprehensive long-term data monitoring and collection services, and contain research data on SKUs, sales volumes, and revenue for major product groups sold on Alibaba’s family of eCommerce platforms (including Taobao, Tmall, Tmall Global, and Tmall Supermarket), with this blog post acting as a one-stop hub that summarizes highlights from each release.

China Health Supplements Market Data Pack - February 2024This data pack is the February 2024 edition free version. It covers market data, trends, and changes in consumer demand in the China Health Supplement market for February 2024.February 2024

Highlights from February 2024:

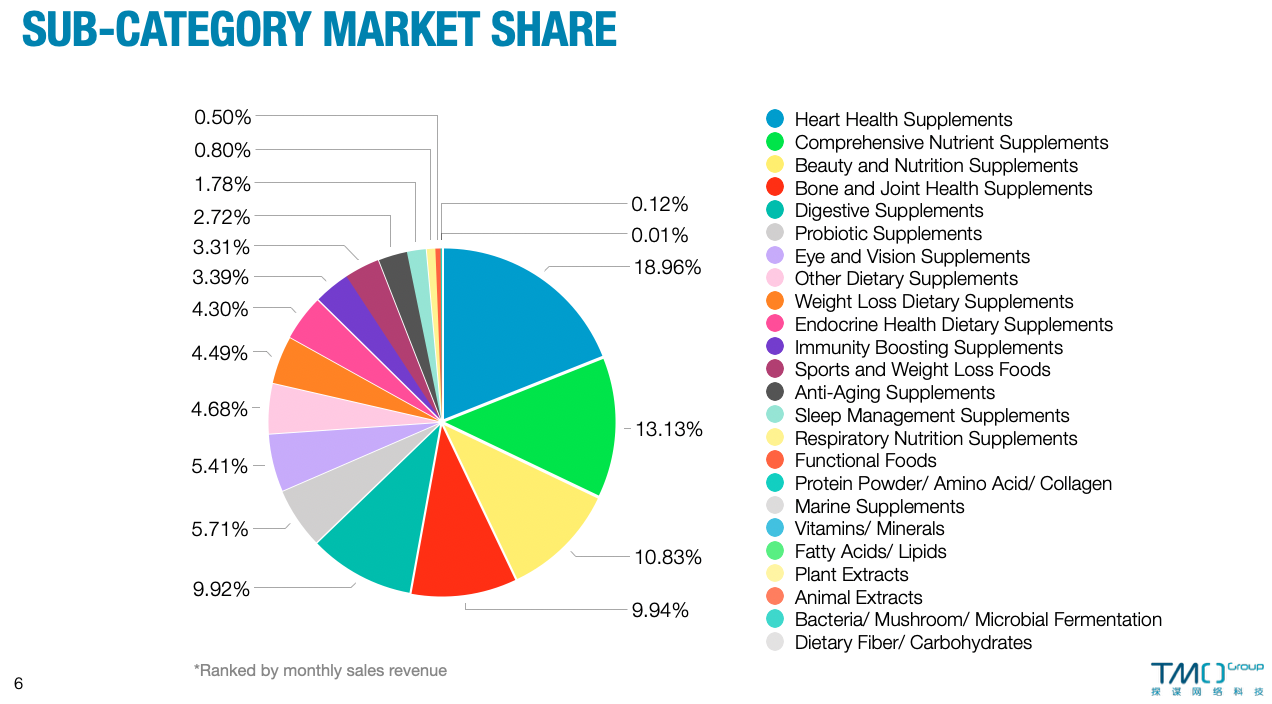

- Subcategories: Overseas heart supplements products account for a market share of 18.30% in February 2024, showing a significant increase from the previous month. Overseas comprehensive nutrient supplements and beauty and nutrition supplements products tied for second place, each with a market share of 13.37%.

- Brands: The market share of overseas health supplements on e-commerce platforms is mainly dominated by Swisse. GNC and Blackmores performed as well as that of last month, securing second and third place respectively. Spain’s Mesoestetic and Puritan’s Pride from the USA entered the top 10 list of brand sales in February, showing impressive performance.

- Products: Sales revenue of multivitamins/minerals products are booming. In the sales ranking for February, two GNC multivitamins/minerals health products entered the top five in terms of product sales, with one of them being the sales champion of the month. It is worth noting that during the Chinese New Year period in February, a beauty-related dietary supplement from Mesoestetic jumped to second place in sales through live e-commerce, indicating that consumers are increasingly favoring “pleasing oneself” in terms of health.

China Health Supplements Market Data Pack - January 2024This data pack is the December 2023 edition free version. It covers market data, trends, and changes in consumer demand in the China Health Supplement market for December 2023.January 2024

Highlights from January 2024:

- Subcategories: Overseas heart health supplements led the overseas health supplement market with a market share of 16.56%. Before the Spring Festival, the popularity of overseas beauty and nutrition supplements increased, ranking second with a market share of 12.38%, surpassing the comprehensive nutrient supplements that ranked second in December last year.

- Brands: Swisse became the champion of monthly sales, with sales exceeding the second-place GNC by twofold, and Blackmores ranked third. Australia’s Life Space had an excellent sales performance in January 2024, jumping from tenth place in December last year to fifth place this year.

- Products: Milk thistle products were the best-selling items, with Swisse’s high-concentration milk thistle liver protection tablets winning the championship in the sales rank. Apart from this product, Swisse’s other liver protection product is also among the top-selling products.

If you are looking to dive deeper into China’s Health Supplements market, look no further than our expert team! With our thorough research and analysis, as well as customized reports, you’ll gain a deep understanding of your niche, including market structure, size, and emerging trends. We’ll also provide invaluable insights on price ranges, top-selling items, and popular brands to help you stay ahead of the competition.

Get in touch today to learn more about how we can help you unlock the full potential of China's Health Supplements eCommerce market!

Related Resources

- China eCommerce Market GuideThis in-depth China eCommerce Guide can help your company rise to the challenges of the Chinese market and sell via cross-border. Updated for 2020!China eCommerce Market Localization Guide

- China Health Supplements Market Basic Data Packs (2023 Annual Collection)This collection includes the China health supplements market premium data packs from January issue to December issue 2023. In addition, source data excel sheets with comprehensive industry information are attached for your reference.2023 China Health Supplements Data Pack Collection

- China Health & Food Supplements Industry ReportThis report takes a broad view of the market for health supplements in China, and how an overseas brand can seize the many opportunities it presents.China Health & Food Supplements Industry Report