Comparing with Paypal and Alipay, WeChat pay is still relatively new to users out of China. With the wide acceptance of WeChat the social messaging platform, WeChat Pay has gradually become China's most popular payment solutions in daily life. We talked about the latest news that Cross-border eCommerce: 3 Things You Can Expect after Adopting WeChat PayWeChat eCommerce platform supported by WeChat Pay is promising for your cross-border business. Here are top 3 things you can expect adopting WeChat Pay:WeChat Pay is going overseas and it will benefit cross-border eCommerce. If you still have any question, or simply wish to know more, here are seven most frequently asked questions about WeChat Pay:

1. What is WeChat Pay?

WeChat Pay is a payment feature integrated into the WeChat app, users can complete payment quickly with smartphones. WeChat has Quick Pay, QR Code Payments, In-App Web-Based Payments, and Native In-App Payments, all to fulfil the full range of scenarios your customers expect to fulfill different payment situation. Combined with WeChat official accounts, WeChat Pay service explores and optimizes o2o consumption experience, provides professional internet solutions for physical business. It is the best choice of mobile payments.

2. What features does WeChat Pay have?

WeChat has Quick Pay, QR Code Payment, In-App Web-based Payment, In-App Payment, to fulfill different payment situation.

3. How will overseas vendors benefit from WeChat Pay?

More and more Chinese people choose to travel abroad. When a buyer purchases a product from an overseas vendor, this spot exchange rate will be used to convert the foreign currency into CNY. The converted CNY amount will then be deducted from the buyer's account when the buyer comfirms the deal in WeChat Pay. As soon as the buyer finishes the payment, he will follow the overseas vendor’s official account. They can still make purchases through this account after they go back to China.

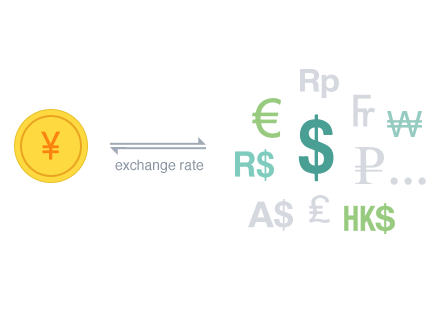

4. What currencies does Wechat Pay cover?

WeChat Pay support major currencies including but not limited to GBP, HKD, USD, JPY, CAD, AUD, EUR, NZD, KRW settlement. WeChat Pay will have settlement with vendors according to the price in local currency. For unsupported currencies, trade can be made through settlement on US dollar.

5. How is exchange rate determined?

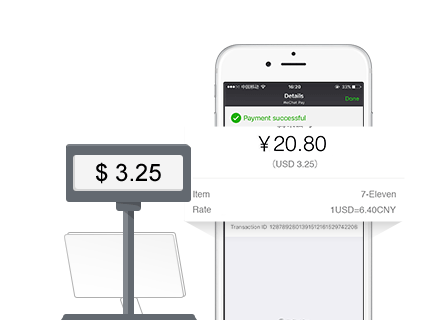

The spot exchange rate provided by partner settlement banks (China Construction Bank or China Citic Bank) is used in the WeChat Pay Cross-Border Service. When a buyer purchases a product from an overseas vendor, this spot exchange rate will be used to convert the foreign currency into CNY. The converted CNY amount will then be deducted from the buyer's account after confirming the transaction in WeChat Pay. For unsupported currencies, transactions will be settled with US dollars.

6. How to have settlement?

When the buyer has completed the payment, the amount will be allocated to a partner settlement bank for currency exchange. After collecting payment from the buyers’ account instantly, WeChat Pay will buy foreign currency in T+1 day according to the spot rate that the settlement bank provides. When vendors’ turnover accumulates to 5000 USD (lower limit), we will transfer payments to the receiving bank account of vendors immediately.

7. Who will be charged for remittance fee?

WeChat Pay will pay the remittance fee for the settlement banks. WeChat Pay is not responsible for any fee charged by the intermediary or receiving bank.

Interested in WeChat eCommerce development?

Please view TMO Group's WeChat Strategy at

WeChat eCommerce Solution

WeChat Store Development