China eCommerce has witnessed numerous rises and falls: While many cross border eCommerce businesses have achieved great success in China, a number of businesses had to finally shut down.

Different cross border eCommerce companies failed for various reasons. Below, TMO Group put together stories of three once-popular cross border eCommerce that closed for business in 2016 already:

蜜淘 Metao

2013.10 - 2016.02

Bio:

Metao was an eCommerce platform principally engaged in cross border eCommerce and the special sales of overseas brands.

Highlight;

Only a year after launch, Metao secured US$30 million of Series B financing led by Vertex Venture with participation of Morningside Ventures, Greenwoods Investment and Series A investor Matrix Partners.

Metao on Mobile

Lowlight:

Despite receiving various investments since 2014, Metao went out of business earlier this year. Metao’s Beijing headquarter space is deserted, with massive round of layoffs and resignations in Metao’s team.

Reason:

1) Lost in the price war.

China eCommerce ecosystem is full of price wars. Competitions and new comers attempt to win customers by offering lower prices. Many of the players eventually fail because they can't generate the cash flow to sustain this discounting strategy. Unfortunately, Metao is one of them.

Prior to 2015, low price was Metao’s major advantage. But with big eCommerce players like Tmall and JD competing with lower prices, Metao seemed shorthanded. Popular as it was, Metao just couldn’t keep up with those eCommerce giants in the price war.

Price war seems inevitable, so to come up with a best strategic plan during the start is important to all cross border eCommerce business in China.

2) Rapid change of business models

Originally, Metao started as a C2C model, which allowed customers to find overseas individual buyers (A.K.A Daigou agents) selling foreign products. However, in 2014 the company pivoted into a B2C cross border ecommerce platform that relied on daily popular items sales to attract customers.

By late 2015, the company pivoted again to focus exclusively on Korean products, but this Korea-only shift had limited Metao’s customer base.

Three major changes through three years gradually made Metao’s customers unfamiliar with Metao itself, and finally cause itself lose its own users.

美味77 Yummy77

2013.05 - 2016.04

Bio:

Yummy77.com, provides online retail services of perishable groceries and gourmet food including seasonal fruit, eggs, meat, dairy products and etc. The company was founded in 2013 and is based in Shanghai, China. It was regarded as a leading grocery eCommerce company in Shanghai, by offering prompt delivery services and generous discounts.

Highlight;

In May 2014, Amazon invested US$20 million in Yummy77. This was the first time Amazon has ever invested in a Chinese company. The company’s sales reportedly exceeded 100 million Yuan (around $16 million) in December 2013, and its registered users reportedly surpassed 1 million as of Feb. 2014.

Lowlight:

Only two years after Amzon’s investment, Yummy77 is reported to go bankrupt. It was estimated that Yummy77 was more than RMB 30 million in debt.

Reason: Fast-growth fail

The higher you climb, the harder you fall. Yummy77’s fall was largely because it was “growing too fast”. More exactly, it failed to catch up on logistics and storage, while the expansion of sales network went way too fast.

For example, there was one time that Yummy77 offered as many as 5,000 SKUs, which was almost for a grocery eCommerce business to manage in every single steps (packaging, logistics, storage, etc.) Soon enough, Yummy77 faced the challenge of maintaining quality with the increase in quantity.

When you’re growing quickly, it’s really important to make sure your customers are happy. Too bad Yummy77 failed on that.

荷花亲子 Hehua.cn

2014.08 - 2016.08

Bio:

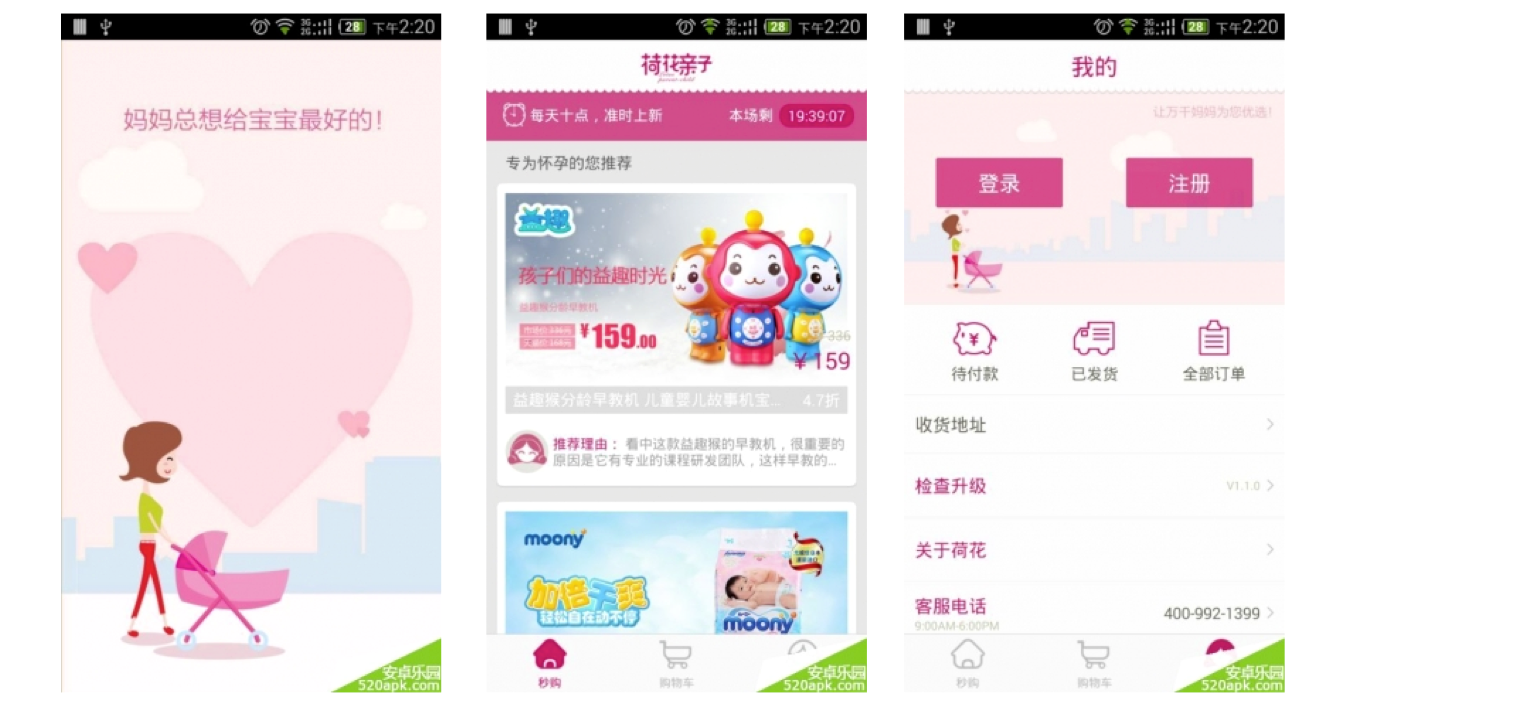

Hehua is a vertical cross border eCommerce mobile application focusing on baby products. It is targeting at parents of newborns in China and it recommends baby products to users daily. Meanwhile, Hehua has social function that allows users to engage and communicate with each other.

Highlight:

In 2015, Lamabang, a social network for moms and to-be moms, acquired Hehua. Lamabang, China’s biggest mobile social network for women has attracted 60 million users and a valuation of USD one billion.

Lowlight:

On Aug. 4th, a farewell letter was posted on Hehua’s WeChat public account, meaning Hehua will be officially shut down.

Hehua on Android

Reason: Limited options

While vertical eCommerce business can specialize on serving their specific needs, it also brings certain risks by serving limited products to a smaller customer base.

Vertical eCommerce make profits by focusing niche markets where vendors serve a specific audience and their set of needs. In Hehua’s case, the mobile app was mainly focusing on baby formula and diapers.

Soon enough, every other eCommerce business realized that baby product market is worth investing and started to sell baby products. Since more eCommerce platforms are targeting newborn’s parents, the used-to-be niche market already becomes a mass market.

To promote its baby products and attract customers, eCommerce giants like Tmall and JD are willing to cut the price surprisingly low. Stilling pushing products like baby formula and diapers to a price-concerned customer base, Hehua failed to catch up either on capitals or logistics. if the specialized market decreases in size, the business will suffer.

As a developing pioneer in China, TMO Group know China eCommerce ecosystem well, and we are open to give you the service and quality workmanship that is well expected.

Please feel free to contact us with any questions regarding cross border eCommerce questions that you may have!

More on Cross Border eCommerce:

How Would 'Brexit' Affect China’s Cross Border eCommerce?The UK voted to leave the European Union, and it will even affect the cross border ecommerce industry in China. Here we will explain how.How Would ‘Brexit’ Affect China’s Cross Border eCommerce?

Did You Know: Chinese ID Needed When Shopping on Cross Border eCommerce in ChinaChinese shoppers are requested to validate their Chinese ID when shopping on cross border eCommerce. eCommerce business owners - how should you react?Did You Know: Chinese ID Needed When Shopping on Cross Border eCommerce in China

Time to Bring Your Grocery Business to China via eCommerceNow, more foreign grocery supplier/wholesaler are exploring cross border eCommerce as a method of selling their products into China.Bring your grocery business to China via eCommerce? It’s happening.