Southeast Asia is one of the regions with the biggest energy demands in the world. According to the International Energy Agency (IEA), energy demand in Southeast Asia is expected to triple by 2050. This growth is mainly attributed to Southeast Asia's high dependence on fossil fuels, which might expose the region to supply risks in the future. To address this, local governments have introduced policies to encourage low-carbon energy transformation, making SEA an attractive market for overseas brands offering tech such as such as electric bikes/scooters, solar-powered and LED products.

For the last 2 years, TMO Group has been helping brands explore and successfully enter the SEA market. Read more about our SEA eCommerce Solutions.

In addition, thanks to abundant sunshine conditions, Southeast Asia has a unique advantage in photovoltaic power generation, and the solar energy market has become a new blue ocean for cross-border eCommerce companies expanding globally.

Having collected first-hand market data from almost 610,000 SKUs across Shopee and Lazada, the two major marketplaces in the region, we analyzed the market structure, categories, best-selling brands, price ranges, and consumer trends across the 6 countries with the biggest online eCommerce markets: Indonesia, Malaysia, Thailand, Vietnam, the Philippines and Singapore.

This article is based on the Green Energy Application (Southeast Asia Outlook June 2024)This free PDF takes a look at Southeast Asia's new energy market: market segments, price ranges, popular brands, and much more.Southeast Asia New Energy Outlook, which you can download for free to see the full analysis of our research.

Now, let’s dive into the key takeaways from our research into Southeast Asia’s online retail landscape for the New Energy Applications industry. We will also cover some findings of the different subcategories within the segment.

1. SEA New Energy Tech - eCommerce Market Size by Country

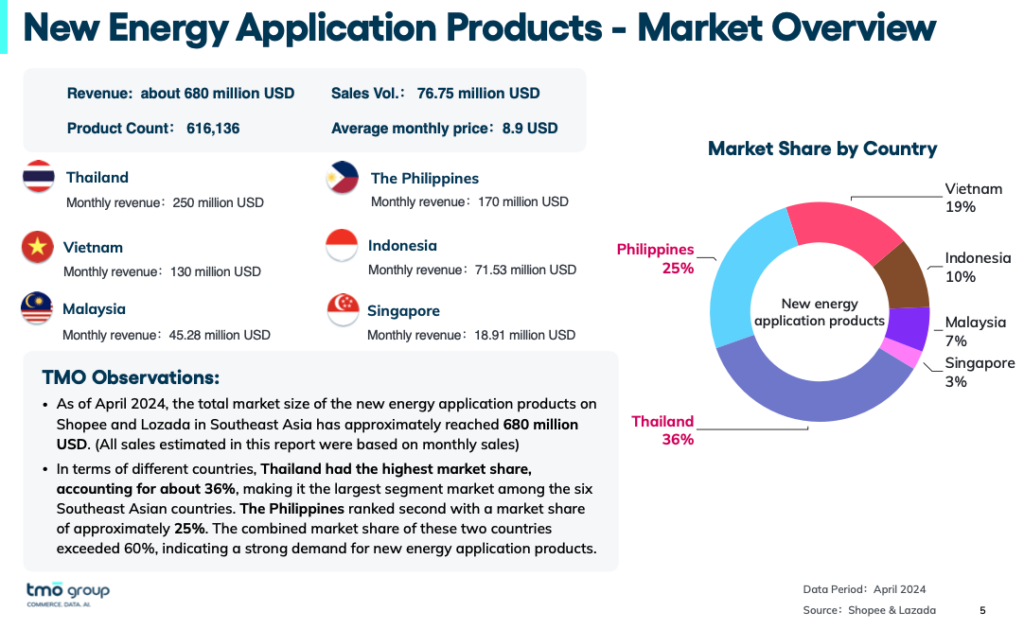

Based on the collected data from Shopee and Lazada, we estimate that the total market size of the six largest Southeast Asian economies stands at around US $680 million in average monthly sales.

On the Shopee and Lazada platforms, Thailand and the Philippines have the highest market share of New Energy products, which jointly account for more than 60% of the overall market in Southeast Asia at US $250M and US $170 respectively. Green Energy Application (Southeast Asia Outlook June 2024)This free PDF takes a look at Southeast Asia's new energy market: market segments, price ranges, popular brands, and much more.Download the free report for a full analysis

2. SEA New Energy Tech - Product Categories

For our research, we divided the Southeast Asian New Energy Tech market into 4 sub-categories, taking Shopee and Lazada's top-selling products:

- Electric transportation and their charging equipment

- Solar energy products

- LED lights and displays

- Lithium batteries

Looking at these sub-categories, LED lights and displays account for about 60% of sales on Shopee and Lazada, followed by Solar energy products.

Consumers in different countries have different preferences for new energy products. For example, in Indonesia, Malaysia and Singapore, the new energy application product market is dominated by LED lights and display screens.

Solar products performed well in Thailand and the Philippines. In April this year, solar products in both countries accounted for more than 30% of sales on Shopee and Lazada. Thailand and the Philippines have abundant sunshine and long sunshine hours each year, which are natural advantages for photovoltaic power generation. Solar products have certain development potential as well.

Looking to boost your eCommerce competitive intelligence? Our Customized Marketplace Reports are tailored to support your brand’s data needs with detailed analysis.

3. SEA New Energy Tech - Best-Selling Brands

In terms of brands, there is no brand with absolute market dominance in Southeast Asia's new energy application products. Although consumers generally prefer European, American, Japanese and Korean brands, many Chinese brands also perform well. In addition to Xiaomi ranking third in the overall brand best-selling list, we also observed that many Chinese brands performed well, especially in the categories of solar energy, electric vehicles, and their charging equipment.

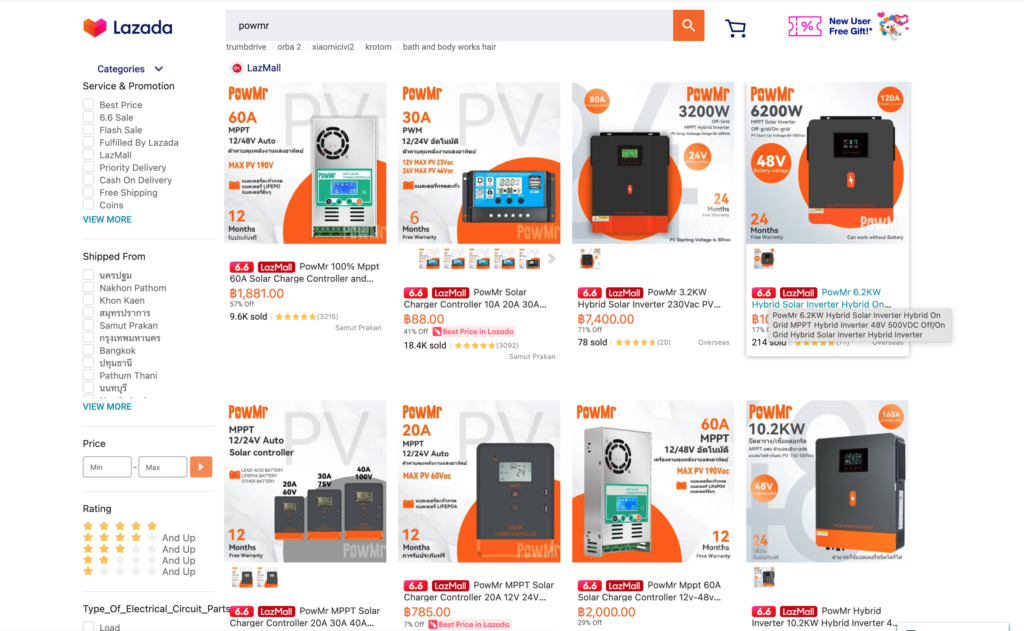

In the field of solar products, four Chinese brands, PowMr, NSS, Modi, and KKSKY, all entered the top ten best-selling brands. In the category of electric vehicles and their charging equipment, in addition to the Chinese brand Xiaomi winning the sales champion of Shopee and Lazada Malaysia and Vietnam in April, the sales performance of Chinese brands Yamato, BESTON, and ANCHI on e-commerce platforms is also quite impressive. Green Energy Application (Southeast Asia Outlook June 2024)This free PDF takes a look at Southeast Asia's new energy market: market segments, price ranges, popular brands, and much more. See the free report for specific hot-selling brands in every country.

European and American brands are more popular with consumers on Lazada. In the top ten brands list, brands from these regions occupy 9 spots in the ranking.

Learn how Nanfu BatteryAs a pilot for international expansion, in-depth market scans and opportunity evaluation helped Nanfu explore the potential of major markets in Southeast Asia.Nanfu Battery partnered with TMO for its Southeast Asia Market Entry Research and Business Model Strategy Definition.

PowMr: A successful cross-border SEA market entry

PowMr is a successful case of a brand going overseas that deserves attention. Behind it is a Shenzhen company with more than 10 years of experience in the solar energy-related industry. In 2018, the company settled in Lazada and opened two stores to sell solar energy-related products.

Today, PowMr is now the leading merchant in the new energy tool category on Lazada. In 2023, during the platform's 9/9 promotion, PowMr exhibited a year-on-year sales growth of 226% in Thailand. From a merchant in vertical emerging categories to a leading brand in Southeast Asian eCommerce, PowMr's brand overseas development path has a high reference value for cross-border eCommerce in Southeast Asia.

Growing your Business in Southeast Asia through Online Marketplace Monitoring & Research

We believe that the Southeast Asian market is open and inclusive. However, due to varying cultural and economic levels among countries, consumer preferences also exhibit notable differences. By understanding the market in each country, brands and businesses can better explore Southeast Asia as a destination for expansion.

As part of our comprehensive long-term data monitoring and collection services, TMO Group helps clients dive deeper into Southeast Asia’s eCommerce market with our thorough research and analysis, as well as customized reports for various industries, providing a deep understanding of your niche, including market structure, size, and emerging trends.

If you are looking for an eCommerce agency to assist you in your Southeast Asia business expansion, or want to explore other alternatives to grow in the region, reach out to us to learn more about our Consultancy & Strategy Services, from branded eCommerce website development to Social Commerce and other Cross-border eCommerce Solutions.