This article is based on the data from our China Health & Food Supplements Industry Report. You can download the latest 2022 version of the report China Health & Food Supplements Industry ReportThis report takes a broad view of the market for health supplements in China, and how an overseas brand can seize the many opportunities it presents.for free right now.

Health Supplements Market size

As the world’s most populous nation, China is one of the biggest markets on the planet for almost any product category. China is also one of the most cutting-edge retail markets in the world when it comes to digital integration. eCommerce innovations in China are now being looked to as pioneers that can predict upcoming changes in other developed markets.

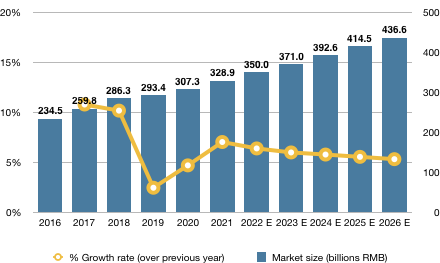

Health supplements are a massive market in China. The latest figures from 2021 put the industry as being worth some 328.9 billion RMB, while it is estimated that by 2026 this figure could rise to a staggering 436.6 billion RMB following a 2021-2026 compound annual growth rate (CAGR) of 5.8%.

China Health Supplements Market 2016-2026 and Future Predictions

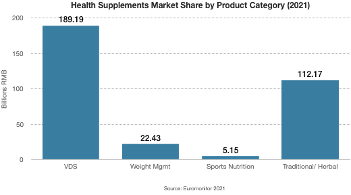

Market Segments

Out of 328.9 billion yuan market in 2021, Vitamins and Dietary Supplements (VDS) has a market share of 189.19 billion yuan, accounting for 57.52% of the total market; Herbal/Traditional Supplements has a market size of 112.17 billion yuan, taking up 34.10%; Weight Management & Wellbeing has a market size of 22.43 billion yuan, 6.82% of the total market size; Sports Supplements is 5.15 billion yuan, 1.56% of the total market.

Online Sales of Health Supplements

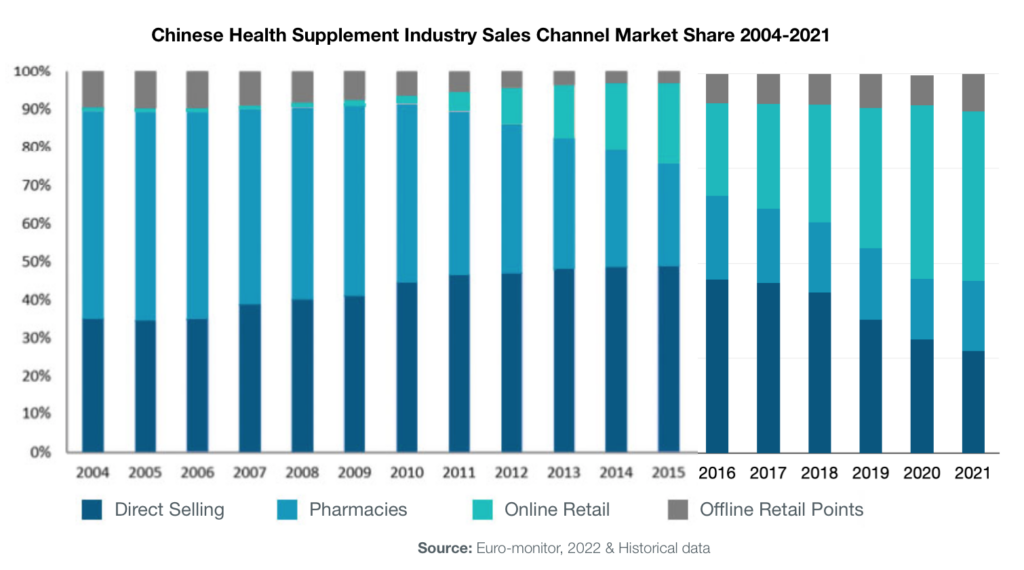

The distribution of sales channels for health supplements in China is relatively concentrated. Most of the sales of health supplements are completed through the following four sales channels: direct selling, pharmacies, offline retail and online retail. The offline retail stores here include shopping malls and supermarkets, as well as maternal stores and health supplement specialty stores; while online retail generally refers to eCommerce platforms. The chart below shows the evolution of these four channels since 2004.

According to data from Euromonitor, the distribution of major sales channels in 2021 are: 27% for direct sales, 18% for pharmacies, 45% for online retail, and 10% for offline retail. Unsurprisingly, when online shopping became a social habit, market share of direct selling and pharmacies began to be crowded out by it.

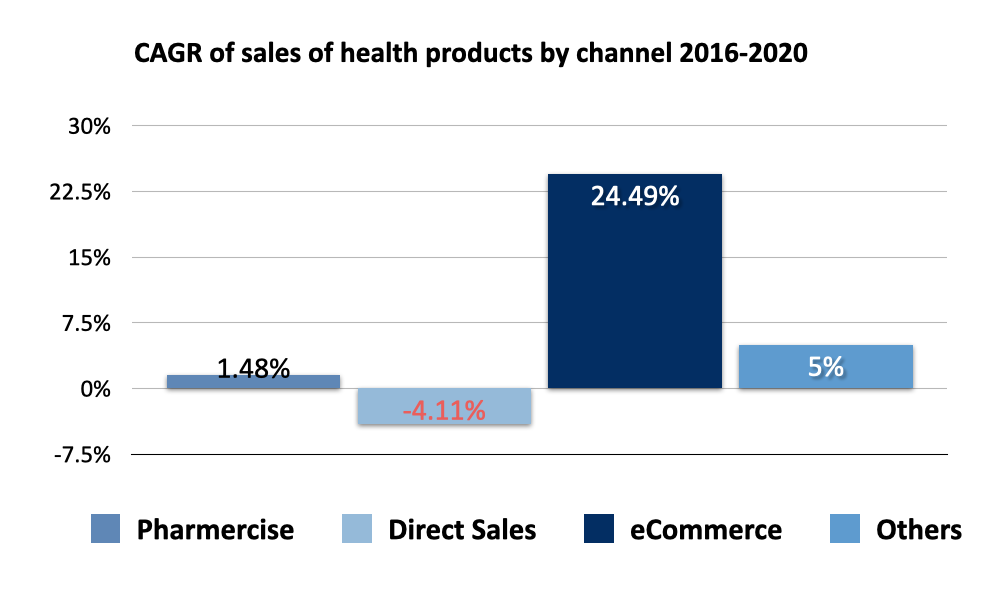

From the perspective of sales growth rate, the CAGR of eCommerce from 2016 to 2020 is 24.49%, that of offline retail is 5%, for pharmacy it’s 1.48%, and direct sales is the only channel that declines, with CAGR of -4.11% .

Competitive Environment

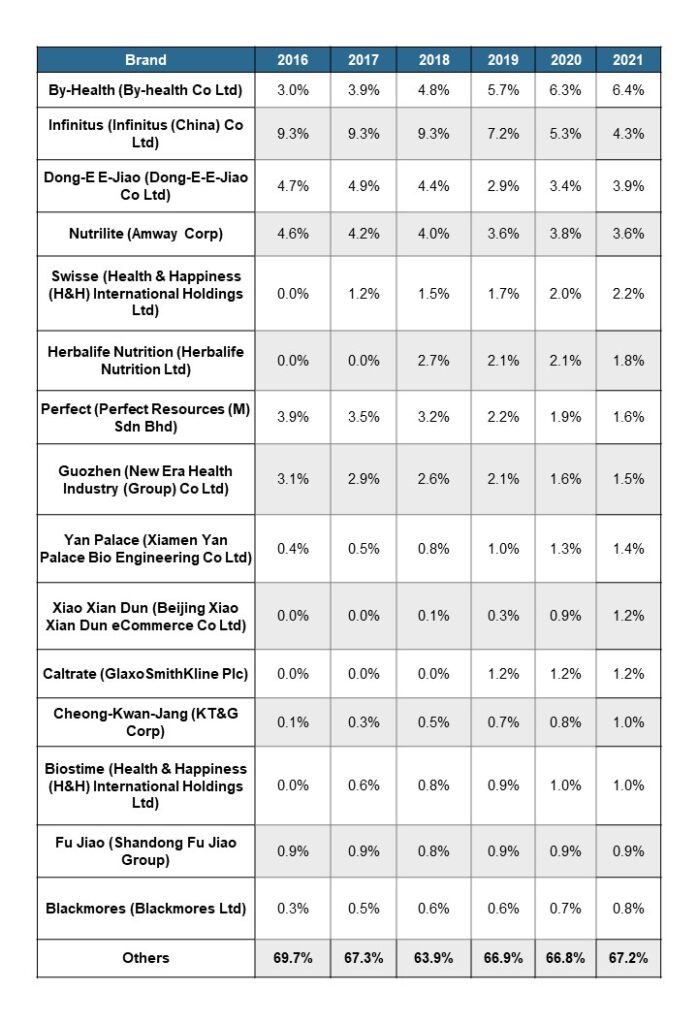

According to Euromonitor data, the best-selling brand in China's health supplement market in 2021 is BY-HEALTH, accounting for 6.4% of the market share. In recent years, through youth marketing, BY-HEALTH has gradually penetrated into all age groups, prompting its market to continue to expand. From 2020, it has surpassed Infinitus and become the market leader. While the major established direct selling brands, including Infinitus, Amway Nutrilite and Herbalife, have experienced varying degrees of decline in their market shares from 2016 to 2021. Another notable brand is Swisse, which has quickly gained a foothold in the market in just five years since it was acquired by Biostime's parent company H&H at the end of 2016, with a market share of 2.2% in 2021.

Overall, there is no brand that can monopolize the market in China's health supplement market. In 2021, the top 15 brands only occupied 32.8% of the market share, and no brand can own more than 10% of the market. This is undoubtedly good news for new brands or companies interested in entering the market. For leading brands, they must always pay attention to market trends and constantly adjust their strategies in order to be in a favorable position in the continuous competition with these rising stars.

Top brands of China health Supplements market

To get more detailed information about China Health Supplements market, download our latest China Health & Food Supplements Industry ReportThis report takes a broad view of the market for health supplements in China, and how an overseas brand can seize the many opportunities it presents.China Health & Food Supplements Industry Report.