More and more brands are looking to expand their business abroad. Especially now, at a time when brands with international reach are doing better at weathering the Coronavirus storm. We can see that brands that operate in multiple market can spread and reduce the risks from national crises. Thailand is one of the larger, more developed nations in the exciting Southeast Asian region. The country acts as a regional hub thanks to its enviable geographical position. Additionally, it frequently catches the eye of overseas investors due to favorable FDI policies. But as foreign brands consider jumping into Thai eCommerce, it bears asking - is the time right to sell online in Thailand?

If you're already sure you want to launch an eCommerce presence in Thailand, check out our comprehensive Thailand eCommerce Market GuideThis in-depth primer aims to be your one-stop guide to the Thai eCommerce market, including how to take your business there and succeed.Thai Market Guide or its abridged Thailand eCommerce Market Starter GuideStarter guide to the Thailand eCommerce market: statisics, market analysis, major trends, entry and marketing strategies overview.free Starter version.

The State of eCommerce in Thailand

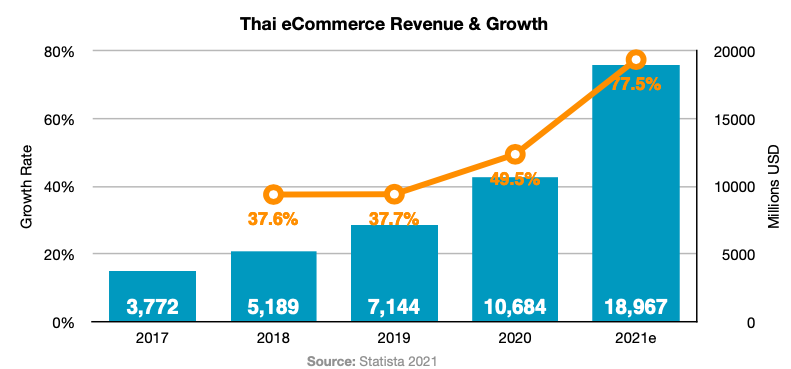

Thailand has an estimated 36.6 million eCommerce users (in terms of total number of people who have bought consumer goods via eCommerce), or around 52.3% of the total population. According to data from Statista, Thai eCommerce sales account for around 8% of total retail in 2021. Given a rapid rate of development, experts predict this to jump to 10% by 2023. Additionally, it is expected the eCommerce market size in Thailand will reach a CAGR of 14.62% between 2021-2025.

So it's plain to see that while Thai eCommerce currently makes up a modest portion of total retail, those in the know expect great things from the country in a very short timeframe. This does suggest that companies that got in now would be well-positioned to take advantage of the expected boom.

Economic and Trade Relations with China

In terms of bilateral trade, according to data from the Ministry of Commerce of Thailand, from January to December 2020, the bilateral trade volume between China and Thailand was US$79.61 billion, a year-on-year increase of 0.22%, which was basically the same as in previous years. Among them, Thailand's exports to China were US$29.81 billion, an increase of 2.2%; imports from China were US$49.80 billion, a decrease of 0.93%.

But the reasons that have attracted so much Chinese investment can also make Thailand attractive to others. Namely, less competition from American investors, cheap labour, relaxed regulations, and a maturing state of development.

Thai Consumers Today

More than 50% of Thailand's population of 69 million are classified as "middle-class and affluent consumers", or MACs. Generation Z are gradually becoming the dominant consumer group, with the female portion of this generation of particular interest. As a whole, this group is considered optimistic, trusting, and passionate about shopping.

Thai consumers are also noted to be emotional shoppers. They demonstrate strong stickiness and brand loyalty, as well as more strongly favoring local goods over imports. This can make it more challenging for overseas brands, but also means that customer loyalty is fairly stable once won.

One factor that some experts note about Thai consumers is that, compared to their neighbors, they aren't too concerned with information security or data privacy. Thai consumers tend to be happier to allow companies and platforms access to their information, or to have their preferences tracked online. This means that Thai consumers are much more likely to respond positively to tailored, personalized and targeted marketing.

Thailand has a strong and growing health product market, as consumers there have a keen interest in health. However, sporting goods is not an area that demonstrates strong sales performance for now. So the interest in health seems mostly to be based around nutrition and wellbeing, or else exercise is not yet well-commodified there. Therefore it is worth investigating specific industries when considering market entry right now.

Thai Women: A Buying Force to be Reckoned With

Thai women have a long history of greater independence or even social and political power in Thailand. This persists to this day, and these days manifests in higher social status for women and societal acceptance of independent women. There are 1.1 million more Thai women than men, and numbers of female white collar workers are on the rise also. Education levels are high as well, and the average marriage age is higher than many other Southeast Asian countries. All the above contributes to Thai women making up a formidable buying force in the country.

Thai women's per capita disposable income is increasing at a rate of about 10% a year. Their per capita consumption using online shopping channels is already around 30% higher than men's.

For now, no brands can boast a truly commanding share of customer loyalty among Thai women in most market segments. This means that there's still everything to play for, for brands looking to enter the market now.

Online Shopping Habits

Thai consumers' attitudes towards online shopping vary a great deal, according to differences in education and age. Generation Z shoppers are more accepting of the Internet as a shopping channel. However, they do still tend to prefer offline channels, in great part due to product quality and false advertising concerns.

Older people staunchly prefer offline shopping. They are not only unfamiliar and often uninterested in online options and processes, but also find it difficult to access online channels due to payment gateway barriers.

As such, as of now, Thai consumers remain wary of eCommerce, or simply are more than satisfied with their existing offline habits. This is looking to change as eCommerce penetration efforts continue. We may also see an uptick as a result of the global Coronavirus crisis, as more consumers resort to online purchasing during self-quarantine, becoming more familiar with the channels.

If you're considering entering the Thai market via eCommerce, check out our recent and comprehensive Thailand eCommerce Market GuideThis in-depth primer aims to be your one-stop guide to the Thai eCommerce market, including how to take your business there and succeed.Thai eCommerce Market Guide! If you'd rather read more before making any commitments, try our free Thailand eCommerce Market Starter GuideStarter guide to the Thailand eCommerce market: statisics, market analysis, major trends, entry and marketing strategies overview.Starter Guide.