As Southeast Asia’s middle class expands and lifestyles accelerate, the demand for compact, functional kitchen appliances continues to soar. According to Statista, the small kitchen appliance market reached US $16.88B in 2024, with consumers in this region showing diverse preferences, and energy-saving or enviromentally friendly products being a common trend. For the last 3 years, TMO Group has been helping brands—including the Home Appliances Industry—explore and successfully enter the SEA market.

Having collected first-hand market data from over 60,000 SKUs across Shopee and Lazada, the two major marketplaces in the region, we analyzed the market structure, categories, best-selling brands, price ranges, and consumer trends across the 6 countries with the biggest online eCommerce markets: Indonesia, Malaysia, Thailand, Vietnam, the Philippines and Singapore.

This article is based on the Small Kitchen Appliances (Southeast Asia Outlook June 2025)This PDF report looks at the small kitchen appliances market in Southeast Asia: market segments, price ranges, popular brands, and much more.Southeast Asia Small Kitchen Appliance Outlook, which you can download for free to see the full analysis of our research.

Now, let’s dive into the key takeaways from our research into Southeast Asia’s online retail landscape for the Small Kitchen Appliance industry using sales data from April 2025. We will also cover some findings of the different subcategories within the segment and trends that matter to foreign brands aiming to enter and local players looking to expand.

1. SEA Home Appliances Market: Product Categories

Across six Southeast Asian markets, small kitchen appliances fall broadly into three segments, taking Shopee and Lazada's top-selling products:

- Cooking & Heating

- Food Preparation

- Beverage Makers

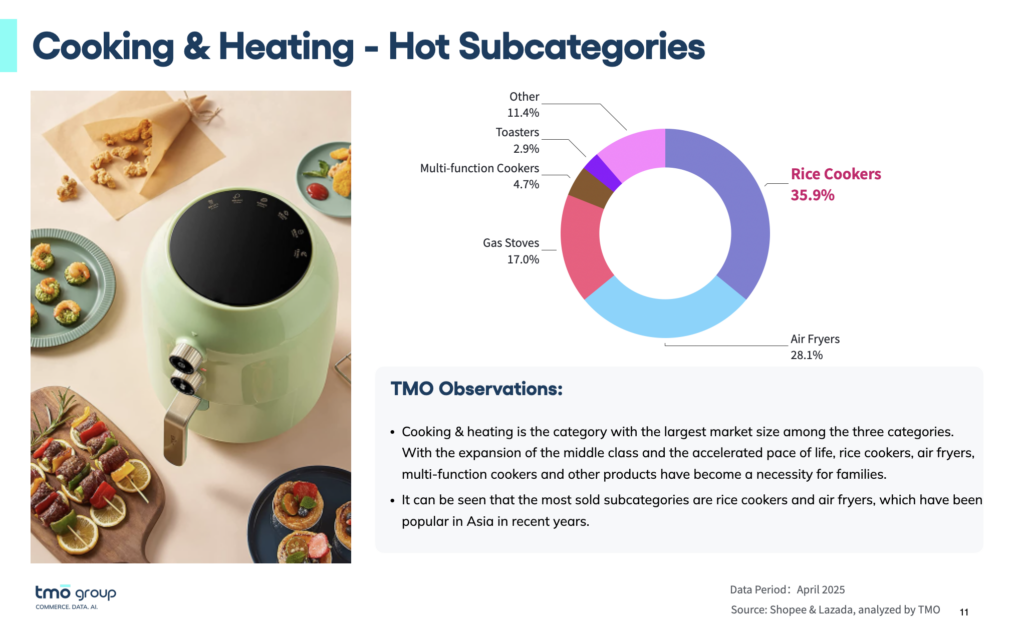

Cooking & Heating dominates the landscape with over half of all sales, led by rice cookers and air fryers, now everyday essentials across ASEAN households. The popularity of these products isn’t just about food but about deeper lifestyle shifts in the region. Urbanization and fast-paced living are driving demand for convenient, energy-efficient, and health-oriented appliances. Small Kitchen Appliances (Southeast Asia Outlook June 2025)This PDF report looks at the small kitchen appliances market in Southeast Asia: market segments, price ranges, popular brands, and much more.Download the free report for full analysis.

If you’re a brand specializing in functional cooking tools, Thailand, Malaysia, and Vietnam offer a fertile testing ground with varied pricing appetites. The rise of multi-function cookers in Vietnam and smart air fryers in Malaysia reflects evolving consumer sophistication.

Looking to boost your eCommerce competitive intelligence? Our Customized Marketplace Reports are tailored to support your brand’s data needs with detailed analysis.

2. SEA Home Appliances Market: Best-Selling Brands

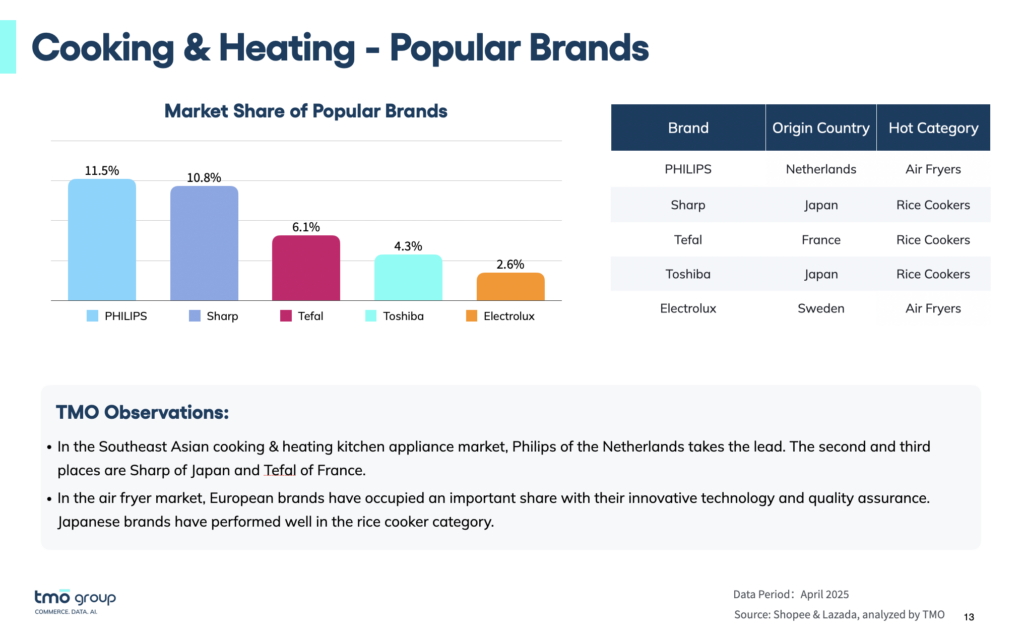

Despite the growing demand, brand concentration remains surprisingly low. In each major segment, the top 5 brands often hold less than 10% combined market share.

- European and Japanese legacy players like Philips, Tefal, and Sharp lead in innovation and trust—but local brands like SKG (Thailand) and KAW (Vietnam) are gaining traction.

- In the coffee machine segment, American brand Duchess leads in market share, outperforming even premium players like Nespresso.

For foreign entrants, this fragmented landscape means low barriers to visibility, but long-term success hinges on localization. Meanwhile, local challengers have a golden opportunity to expand regionally by leveraging their cost-competitiveness and cultural proximity. Small Kitchen Appliances (Southeast Asia Outlook June 2025)This PDF report looks at the small kitchen appliances market in Southeast Asia: market segments, price ranges, popular brands, and much more.See the free report for specific hot-selling brands in each country.

Learn how Nanfu BatteryAs a pilot for international expansion, in-depth market scans and opportunity evaluation helped Nanfu explore the potential of major markets in Southeast Asia.TMO's marketplace monitoring services informed Nanfu Battery's entry strategy into Southeast Asia with a custom data research architecture.

3. SEA Home Appliances Market: Hot Products

Brands must tailor both product strategy and pricing architecture by market. A one-size-fits-all approach across ASEAN is a recipe for failure. Instead, think portfolio segmentation: premium SKUs for Singapore, mid-tier for Malaysia, and entry SKUs for Indonesia.

- In Singapore, consumers are willing to spend upwards of $100–$200, even exceeding $2,000 for premium kitchen appliances.

- Indonesia and the Philippines lean heavily on the sub-$50 price range, favoring affordability over advanced features.

Two product examples highlight where consumer demand is heading:

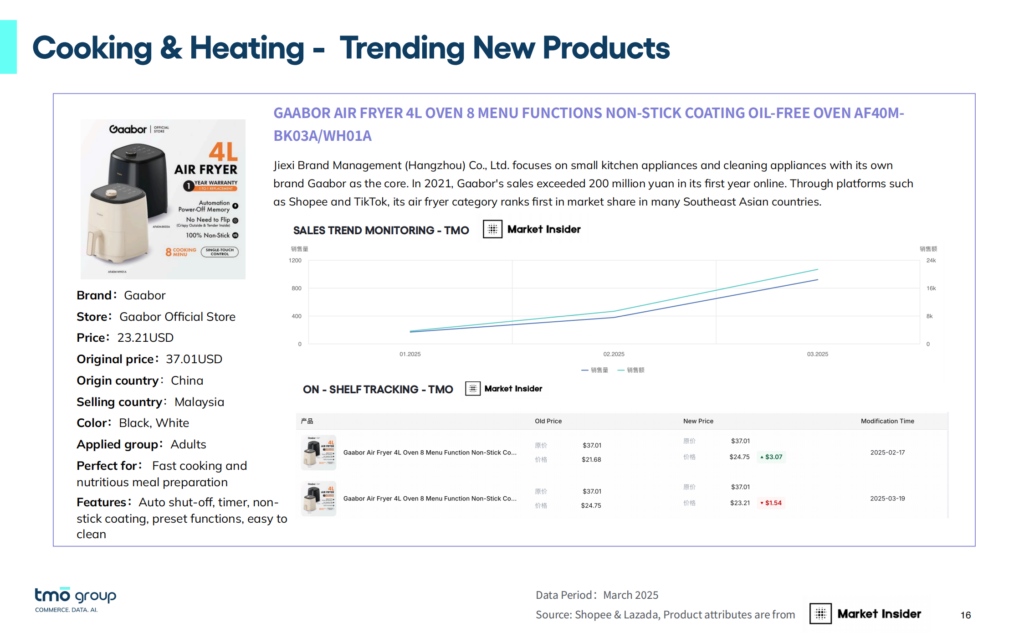

- The Gaabor 4L Air Fryer (China) is priced under $25 and excels in Malaysia, thanks to its design and health-centric marketing.

- The Simplus Meat Grinder (Thailand brand) leads in TikTok-driven sales and speaks directly to home cooks and parents—a niche but growing segment.

Both products are budget-friendly yet functionality-rich, showing how value-driven innovation outpaces pure brand equity. New entrants don’t need to be top-tier brands, they need relevance, price fit, and smart platform execution (Shopee, TikTok, Lazada). Entry-level SKUs with localized marketing can carve out meaningful market share quickly.

Growing your Business in Southeast Asia through Online Marketplace Monitoring & Research

TMO’s dataset, built on live SKU tracking across SEA marketplaces, uncovers what people are really buying, who’s selling it, and where the demand lives. For brands and distributors, this is a roadmap to market entry, product development, and competitive positioning.

Whether you’re planning to test a product line, track a competitor’s performance or benchmark your own performance across markets, this data can offer the clarity needed to make profitable moves.

SEA’s small kitchen appliance sector is large, growing, and up for grabs. But success depends on more than gut feel: it requires insightful data, category understanding, and local relevance. TMO Group’s insights are designed not just to inform, but to guide your next step.

As part of our comprehensive Southeast Asia eCommerce solutions, TMO Group helps clients dive deeper into Southeast Asia’s eCommerce market with our thorough research and analysis, as well as customized reports for various industries, providing a deep understanding of your niche, including market structure, size, and emerging trends.

If you are looking for an eCommerce agency to assist you in your Southeast Asia business expansion, or want to explore other alternatives to grow in the region, reach out to us to learn more about our Consultancy & Strategy Services, from branded eCommerce website development to social commerce and other Cross-border eCommerce Solutions.