According to Statista, the Southeast Asia Snack Food market is expected to exceed US $19 billion in revenue by 2025, with online sales accounting for over US $763 million—roughly 4% of total market share, and growing fast. This rise is fueled by the region’s large, young population, increasing mobile-first shopping behavior, and evolving dietary preferences.

Consumers across the region are showing greater openness to international brands, alongside a rising demand for health-oriented snacks from low-sugar and low-fat products to high-protein and high-fiber options. For global and regional brands entering platforms like Shopee and Lazada, understanding not just what sells, but why, is essential to building a successful, scalable presence.

Drawing on SKU-level sales data from TMO Group’s Market Insider platform for marketplace intelligence, this article breaks down the top-performing categories, market-by-market sales differences, and the product-level strategies behind snack eCommerce growth across six SEA countries.

This article is based on the Snacks (Southeast Asia Outlook July 2025)This PDF report looks at the online snacks market in Southeast Asia: market segments, price ranges, popular brands, and much more.Southeast Asia Snacks Outlook, which you can download for free to see the full data from our research.

1. The 4 Major Snack Product Categories in SEA

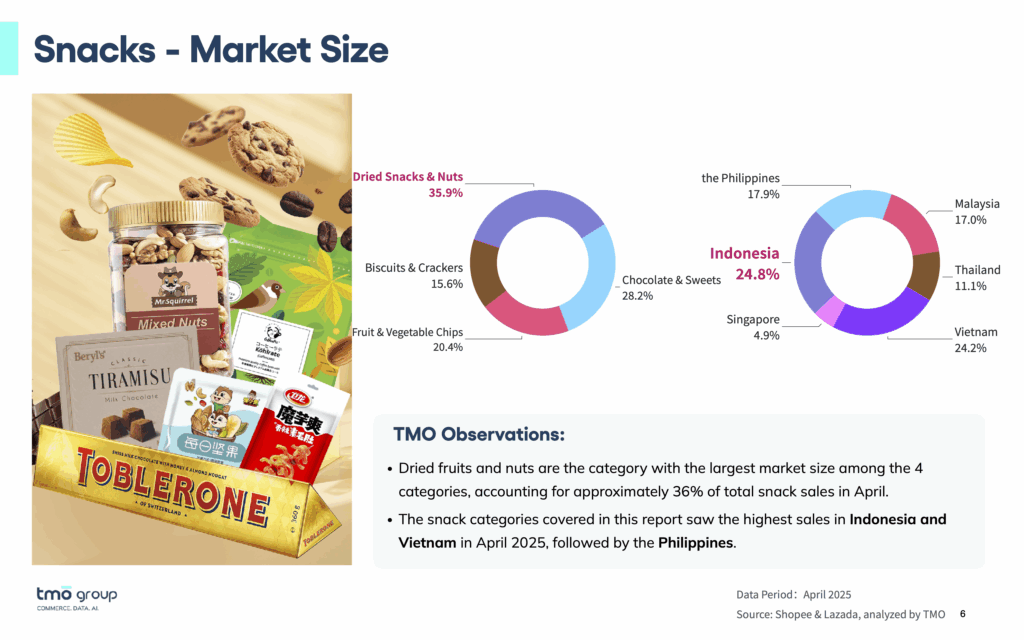

Despite wide variation in snack culture across Southeast Asia, we can broadly identify four core categories across Indonesia, Malaysia, Philippines, Thailand, Vietnam, and Singapore:

- Dried Snacks & Nuts:

- The largest category, contributing 35.9% of total snack sales across SEA.

- Top subcategories: Dried Vegetable & Fruit, Nuts, and Jerky.

- Strongest performance in Vietnam, accounting for over 45% of Dried Vegetable & Fruits' GMV.

- Positioning tip: Brands can leverage health and convenience messaging, particularly in urban, working-class demographics.

- Chocolate & Sweets

- Ranked second overall, contributing 28.2% of SEA snack GMV.

- Particularly dominant in Malaysia, where it claimed around 25% of snack sales.

- Strong crossover appeal across age groups and regions.

- Brand opportunity: This segment continues to favor established global players, but demand for novel and localized flavors remains high.

- Fruit & Vegetable Chips, Potato Chips

- Accounted for 20.4% of total snack sales in the region.

- Notably strong in Indonesia (45% of total region category sales).

- Consumer appeal lies in perceived “better-for-you” positioning and diverse formats (banana, taro, lotus root, etc.).

- Differentiation angle: Packaging and product storytelling are critical in this category, especially when targeting urban health-conscious shoppers.

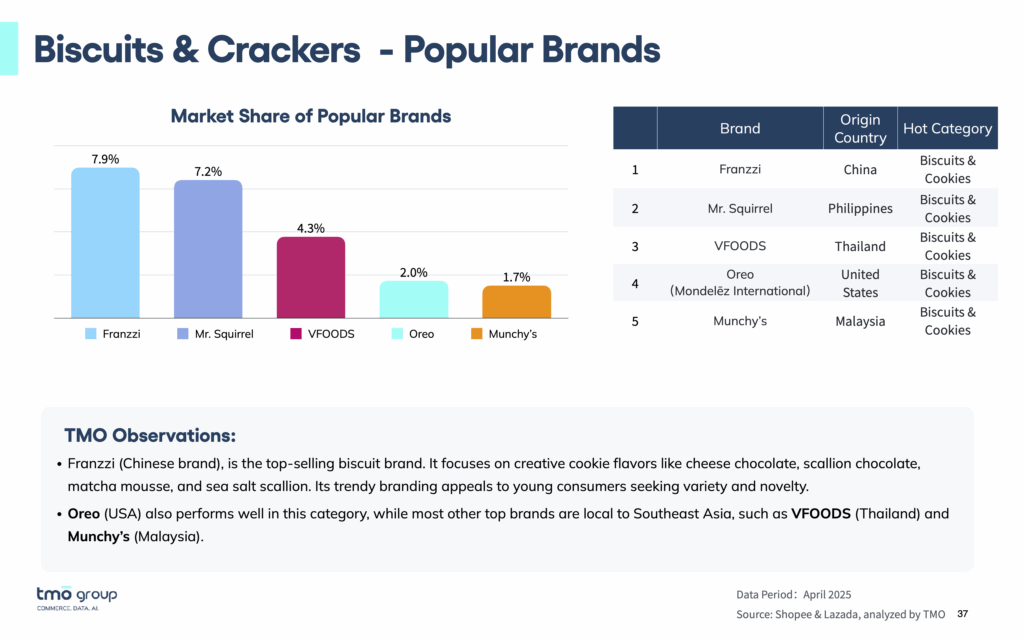

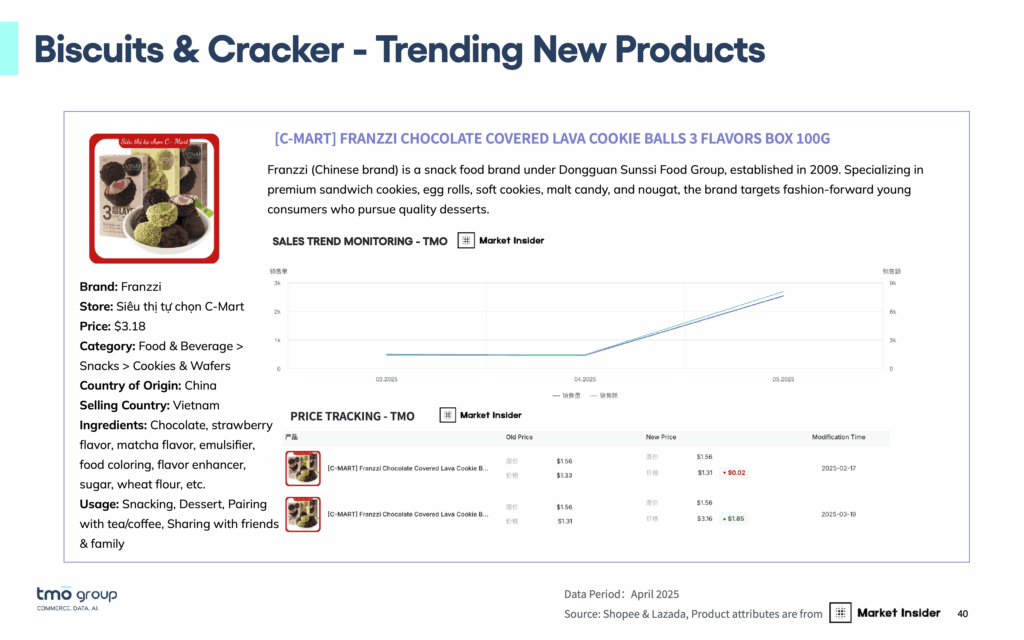

- Biscuits & Crackers

- Made up 15.6% of overall snack GMV, with high variation in subcategory presence by country.

- This category is more fragmented, with a mix of mass-market players and innovative upstarts.

- Strategic insight: Youth-oriented formats (e.g., sandwich cookies, novelty flavors) are winning formats in Vietnam and Thailand.

Looking to boost your eCommerce competitive intelligence? Our Customized Marketplace Reports are tailored to support your brand’s data needs with detailed analysis.

While the four core snack categories dominate region-wide, performance drivers vary significantly by market. For example, Vietnam’s dominance in dried snacks is linked to local agricultural supply and rising health trends, while the Philippines' snack basket skews indulgent, with chocolate and crackers leading sales. Price sensitivity also plays a major role: Indonesia favors lower-priced options, whereas Malaysia and Singapore show stronger demand for premium and imported goods.

For brands, this means category entry is only step one. To succeed in Southeast Asia, SKUs must be localized in format, flavor, and pricing strategy. Using country-specific sales data ensures you're not just entering the right category, but doing it the right way.

2. Who's Winning? Top Snack Brands in SEA

Despite the fragmented nature of the Southeast Asian snack market, a few brands are finding consistent success, although no single player dominates. In fact, across all categories, even the leading brands hold less than 6% market share, suggesting low concentration and high opportunity for newcomers.

Top-Performing Brands by Category

- Toblerone (Switzerland) led chocolate with a 5.8% share, followed by Japan’s Coffeepii and Mondelēz-owned Halls in the candy segment.

- In chips, Lay’s (PepsiCo) was the only brand with more than 5% category share, boosted by its success in Indonesia and Thailand with localized flavors like Tom Yum and Hot Chili Squid.

- For nuts and dried fruits, most of the top-selling brands like Rich Food (Vietnam) and Mr. Squirrel (Philippines) were local or regional, suggesting strong domestic sourcing and packaging advantages.

The data shows that trusted global names thrive in indulgence categories (chocolate, chips), while local or regional brands excel in health-oriented or culturally rooted categories like jerky, dried fruit, and nuts.

Winning Product Formats & Store Types

- Multi-brand snack stores, especially those selling bulk or variety packs, performed strongly across all categories. For example, Vietnam’s Shop Mẹ Mai Tây Bắc and Red Apple Shop ranked among the top for dried snacks.

- Flagship stores like PepsiCo Official Shop and Cadbury/OREO Official saw high conversion in chocolate and chips, where authenticity and gifting appeal matter more.

- Popular SKUs tended to highlight functional or novelty benefits: e.g., “no additives,” “protein-rich,” “limited-edition flavors,” or “gift-ready packaging.”

Shoppers are drawn to convenience, novelty, and perceived authenticity. Brands should pair strong product-market fit with the right retail format, whether launching via curated multi-brand shops or reinforcing presence through official stores.

Learn how Nanfu BatteryAs a pilot for international expansion, in-depth market scans and opportunity evaluation helped Nanfu explore the potential of major markets in Southeast Asia.TMO's marketplace monitoring services informed Nanfu Battery's entry strategy into Southeast Asia with a custom data research architecture.

3. What the Best-Sellers Have in Common: SKU-Level Trends

Looking beyond brands and categories, a few clear patterns emerge at the SKU level. Across segments, best-selling snack products in Southeast Asia share common traits in packaging, pricing, format, and positioning—and these traits vary slightly depending on whether the product falls into indulgent or health-focused categories.

Winning SKUs Hit the Right Price Points

- The $2–$5 USD range dominated across most snack segments, particularly in Indonesia, Thailand, and Vietnam. Premium markets like Singapore and the Philippines saw a larger share of purchases in the $5–$10 and $10–$20 brackets, especially for chocolate, nuts, and giftable biscuit boxes.

- Brands should match price bands to local purchasing power and product positioning: affordable formats for mass-market categories, premium bundles for high-income segments.

Packaging & Format Drive Discovery

- SKUs that emphasize resealable jars, gift-ready boxes, or individually wrapped units perform better—especially for nuts, biscuits, and candy. High-performing products often include “plus” messaging such as "no salt added", "resealable pouch", and "limited edition"

Searchable Keywords & Store Presentation Matter

- Best-sellers often featured optimized product titles including key attributes like “low-fat,” “protein,” “party size,” or “combo pack”.

- Stores that consistently ranked high had high volumes of positive reviews, clear ingredient descriptions, and local language keyword targeting (especially in Vietnam, Thailand, and Indonesia).

4. Growing your Brand in SEA through Data-backed Localization

Regardless of brand scale, the best-selling SKUs succeed by combining cultural fit, price accessibility, and retail clarity. Fine-tuning these variables based on country and subcategory can significantly improve conversion rates, even for new or lesser-known brands. For brands and distributors, this is a roadmap to market entry, product development, and competitive positioning.

- Start with the Right Category, and Tailor It Market by Market

- Segment SKUs by Price Band and Channel Strategy

- Localize Flavors, Packaging, and Listings for Visibility

- Let Data Guide, Then Refine with Testing

Whether you’re planning to test a product line, track a competitor’s performance or benchmark your own performance across markets, this data can offer the clarity needed to make profitable moves.

With Market Insider, brands gain access to real sales data across six countries, hundreds of snack subcategories, and SKU-level performance trends: Request a Guided Demo.

As part of our comprehensive Southeast Asia eCommerce solutions, TMO Group helps clients dive deeper into Southeast Asia’s eCommerce market with our thorough research and analysis, as well as customized reports for various industries, providing a deep understanding of your niche, including market structure, size, and emerging trends.