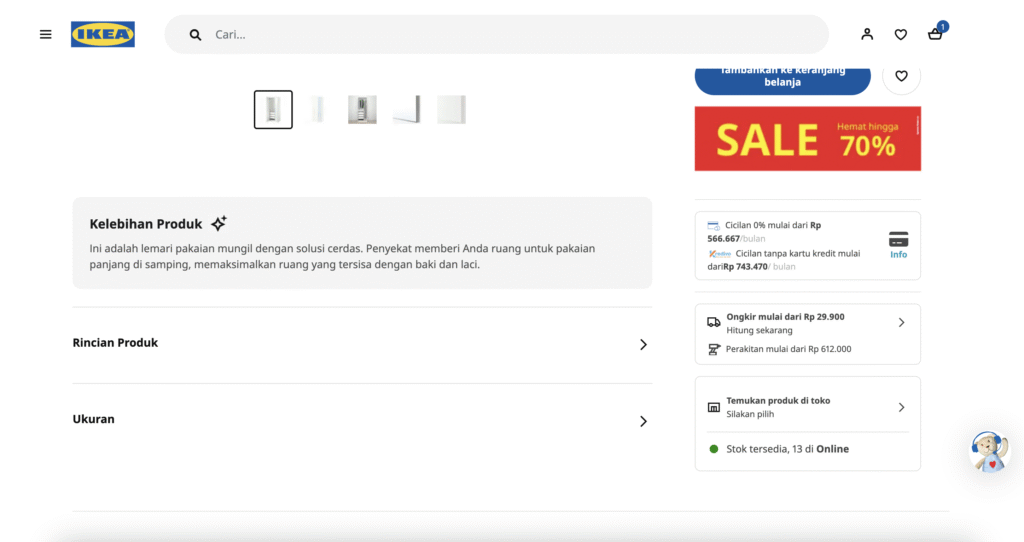

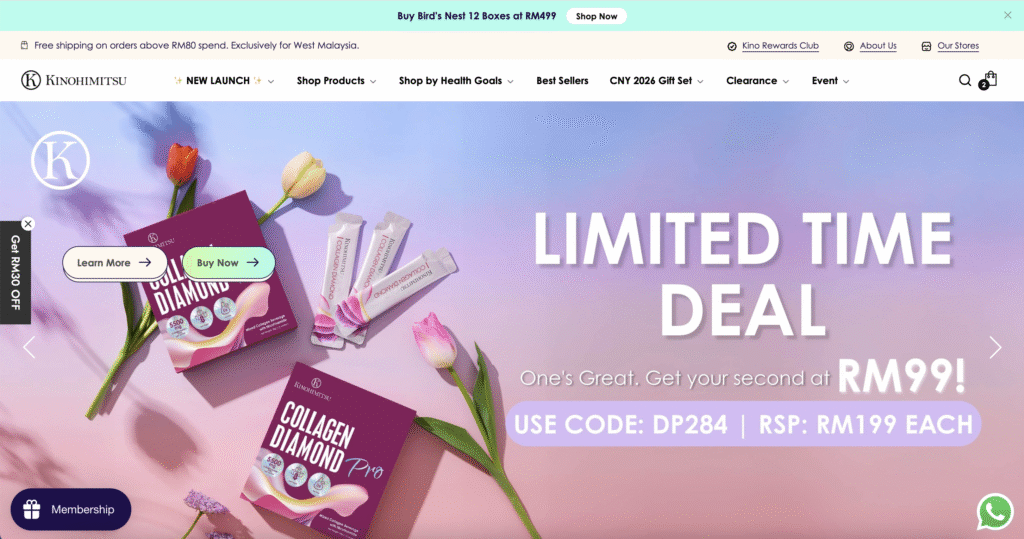

Southeast Asia is one of the fastest-growing online retail regions globally and continues to attract international ecommerce brands. While marketplaces such as Shopee and Lazada remain dominant in terms of traffic and volume, an increasing number of brands including The Purest Co, Kinohimitsu, and IKEA are also investing in direct-to-consumer websites to improve margins, retain ownership of customer data, and build long-term customer value beyond marketplace dependence.

For brands operating across multiple regions, localization is already a familiar challenge, typically centered around language, content, and UX adaptation. In Southeast Asia, this extends further due to the region’s geography and fragmented digital infrastructure, where logistics setups, delivery expectations, and preferred payment methods vary significantly from one market to another.

TMO supports global brands in localizing eCommerce operations across regions, helping them adapt platforms, payments, and fulfillment models for sustainable international growth.

In this article, we look at the fulfillment, payment, and localization capabilities that matter most when expanding eCommerce operations into Southeast Asia, and how platforms such as Magento, Shopify, WooCommerce, and others support these requirements at different stages of growth.

What Localization Means for SEA Markets

As with any market expansion, localization starts with due diligence rather than platform features. Brands need to understand how their product fits local buying behavior and which operational factors directly affect conversion, cost, and customer experience. eCommerce platforms are enablers in this process, but the requirements are defined by the market much more than the tech stack.

In practice, localization typically requires brands to assess a consistent set of areas, regardless of region:

- Payments and checkout expectations: Preferred payment methods vary by country and category, with e-wallets, bank transfers, and cash-on-delivery often playing a larger role than cards. Checkout flows need to reflect these preferences to avoid unnecessary friction.

- Fulfilment and delivery models: Cross-border shipping, local warehousing, and hybrid fulfilment setups are all common approaches. Brands need to determine which model aligns with delivery expectations, cost structure, and service levels in each market.

- Language, currency, and content structure: Translation is only one component. Product content, pricing, and promotions often need to be adapted to local buying behavior and competitive context.

- Customer service and post-purchase flows: Returns, refunds, and customer communication expectations differ by market and can introduce operational complexity if not planned for early.

In Southeast Asia, these considerations become more nuanced due to the region’s geography and fragmented infrastructure. For example, logistics planning in Indonesia and Malaysia is shaped by archipelagic or cross-border delivery constraints, while payment preferences can differ sharply between markets such as Thailand, Vietnam, and the Philippines. These variations are not exceptional, but they do require platforms to express market-specific logic clearly.

The key requirement, therefore, is not a platform that “supports SEA” but one that can represent these nuances in practice, whether through native capabilities, extensions, or custom development, as brands expand from single-market entry to a broader regional footprint.

Local Payment Methods and Checkout Scenarios

In Southeast Asia, payment localization is one of the most direct drivers of ecommerce performance. Conversion rates are heavily influenced by whether shoppers can use familiar payment methods, and those preferences vary significantly by country, category, and even price range. As a result, payment strategy is rarely solved by the eCommerce platform alone. Across SEA markets, commonly required payment methods include:

- Local bank transfers and real-time payment systems, which are widely used in markets such as Thailand and Malaysia

- E-wallets, including country-specific and regional wallets that often outperform cards in mobile-first contexts

- Cash on delivery (COD), which remains relevant in certain markets and categories, especially for first-time buyers

- Buy now, pay later (BNPL) options, which are growing in adoption but vary significantly by market maturity

The table below highlights the payment methods and examples that are commonly expected in each country, based on local consumer behavior:

| Market | Common Payment Methods & Scenarios | Typical Providers / Gateways |

|---|---|---|

| Indonesia (ID) | Bank transfer and e-wallets widely used; cash on delivery still common for lower-ticket items; mobile-first checkout behavior | Xendit, local banks, wallet-specific integrations |

| Philippines (PH) | E-wallets and bank transfers dominant; cash on delivery remains relevant; card usage limited outside premium segments | Xendit, GCash, Maya |

| Vietnam (VN) | Bank transfers and local e-wallets preferred; card payments secondary | Local gateways, direct bank transfer integrations |

| Thailand (TH) | Real-time bank payments (PromptPay) and QR-based payments widely adopted | 2C2P, local banks |

| Malaysia (MY) | Online bank transfers (FPX) and e-wallets common; cards play a supporting role | ADAPTIS (formerly iPay88), local banks |

| Singapore (SG) | Credit and debit cards primary; PayNow and wallets used as convenience options | Stripe, PayNow integrations |

Across Southeast Asia, payment methods shape checkout design as much as they affect technical integration. In wallet- and bank-transfer–led markets, checkout flows need to prioritize non-card options early and clearly, especially on mobile. In markets where cash on delivery remains relevant, confirmation steps, messaging, and order validation become part of the conversion journey rather than an afterthought. These differences are less about adding more payment methods and more about aligning checkout structure with how customers expect to complete a purchase.

Payment choices also have direct operational consequences. Cash on delivery affects fulfilment workflows, return rates, and customer service handling. Real-time payments and bank transfers influence when orders can be released to logistics partners. In practice, payment and fulfilment decisions are tightly coupled, and treating them in isolation often leads to friction once order volume increases.

From a stack and rollout perspective, most brands take a phased approach. Regional payment aggregators are commonly used to support early market entry and reduce setup effort, while country-specific gateways are added later as transaction volume grows or optimization becomes a priority. This allows teams to move quickly without overengineering payment logic upfront, while still leaving room to adapt as SEA operations expand from a single market to multiple countries.

Taken together, these patterns reinforce that payment localization in SEA is not a one-time configuration task, but an evolving layer that needs to scale alongside fulfilment and operations as regional complexity increases.

Fulfillment Models and Delivery Expectations

Geography, infrastructure, and service expectations vary significantly across markets, and these differences often shape customer experience more than frontend features or design choices. Delivery speed, cost, and reliability can differ widely even within the same region, making fulfillment a core localization concern rather than a downstream implementation detail. Most brands expanding into SEA operate a mix of fulfillment models over time:

- Early-stage expansion often relies on cross-border shipping from existing warehouses to reduce upfront complexity

- More mature setups introduce local warehousing or hybrid models to improve delivery times and cost efficiency.

As a result, eCommerce platforms and supporting systems need to accommodate multiple fulfillment approaches without forcing a single, uniform logic across all markets. Lets look at the constraints and patterns that brands typically need to design around when entering or scaling in each market:

| Market | Geography & Delivery | Typical Fulfilment Model | Delivery Speed Expectations | Returns & Reverse Logistics |

|---|---|---|---|---|

| Indonesia (ID) | Archipelagic geography; long distances between islands; uneven last-mile coverage | Hybrid: cross-border for early entry, local warehousing for scale | Slower delivery acceptable outside major cities | Returns costly and complex; COD refusals common |

| Philippines (PH) | Archipelagic; inter-island shipping adds time and cost | Cross-border common initially; selective local fulfilment | Moderate expectations; speed varies by region | Returns limited; reverse logistics often avoided |

| Vietnam (VN) | Mainland geography; strong urban density in major cities | Cross-border and local fulfilment both common | Faster delivery expected in urban areas | Returns manageable but operationally sensitive |

| Thailand (TH) | Mainland; relatively strong nationwide logistics coverage | Local fulfilment common; cross-border for niche categories | Fast delivery expected, especially in metro areas | Returns feasible but cost-sensitive |

| Malaysia (MY) | Split geography (Peninsular + East Malaysia); cross-border friction | Local fulfilment preferred; hybrid models common | Moderate to fast expectations in urban regions | Returns manageable domestically, complex cross-region |

| Singapore (SG) | Compact geography; highly efficient logistics | Fully local fulfilment standard | Fast delivery expected as baseline | Returns straightforward but cost-driven |

Managing Last-mile Fragmentation

Courier coverage, service levels, pricing, and reliability vary significantly by country and even within the same market. Integrating individual couriers directly often becomes difficult to manage as operations expand.

To address this, many brands rely on logistics aggregation and orchestration layers, rather than single courier integrations. Solutions such as EasyParcel, Ninja Van, or J&T Express are commonly used to:

- Compare delivery rates across partners

- Route orders dynamically

- Centralize tracking and delivery status updates

Returns and Reverse Logistics

Cash-on-delivery markets, cross-border shipping, and long delivery distances tend to increase refusal and return rates. Poorly designed reverse logistics flows can quickly erode margins and overwhelm customer service teams. As fulfillment operations scale, brands need to:

- Design return policies by market and category

- Account for COD refusal behavior

- Plan reverse logistics alongside forward fulfillment

Which Platform Best Fits your SEA Expansion?

The table below compares the most commonly used solutions for Southeast Asia expansion. Rather than focusing on feature availability, it highlights where localization logic lives, how payments and fulfillment are handled, and how each platform scales operationally.

For most brands, the question is not which platform to choose, but how far their existing stack can be extended as SEA requirements become more complex:

| Platform | Primary Localization Mechanism | Payment Flexibility Model | Fulfilment & Inventory Complexity Tolerance | Operational Governance Model |

|---|---|---|---|---|

| Magento (Adobe Commerce) | Custom logic built into core platform, with strong native multi-store support | Direct gateway integrations with custom routing and checkout logic | High: designed to handle multi-warehouse, cross-border, and complex fulfillment rules | Centralized and structured, requires clear ownership and discipline |

| Shopify / Shopify Plus | App- and extension-driven, with some native multi-market configuration | Aggregator-first via apps, extended with custom integrations when needed | Moderate: simple to start, external systems needed as complexity grows | Lightweight and decentralized, governance needed as apps accumulate |

| Shopline | Mostly native configuration aligned with Asian market workflows | Native and regional payment integrations, limited custom routing | Low to moderate: suitable for simple cross-border and early local fulfillment | Centralized but limited, works best with standardized regional setups |

| WooCommerce | Plugin-based with custom development layered on top | Plugin-based, varies by provider and implementation quality | Moderate: flexible but requires additional systems and custom logic at scale | Decentralized, requires strong technical and operational discipline |

| BigCommerce | Native core features extended via APIs and integrations | Direct integrations with gateways, less reliance on third-party apps | Moderate to high: works well with external OMS and ERP systems | Moderately centralized, integration-led rather than app-led |

Magento (Adobe Commerce)

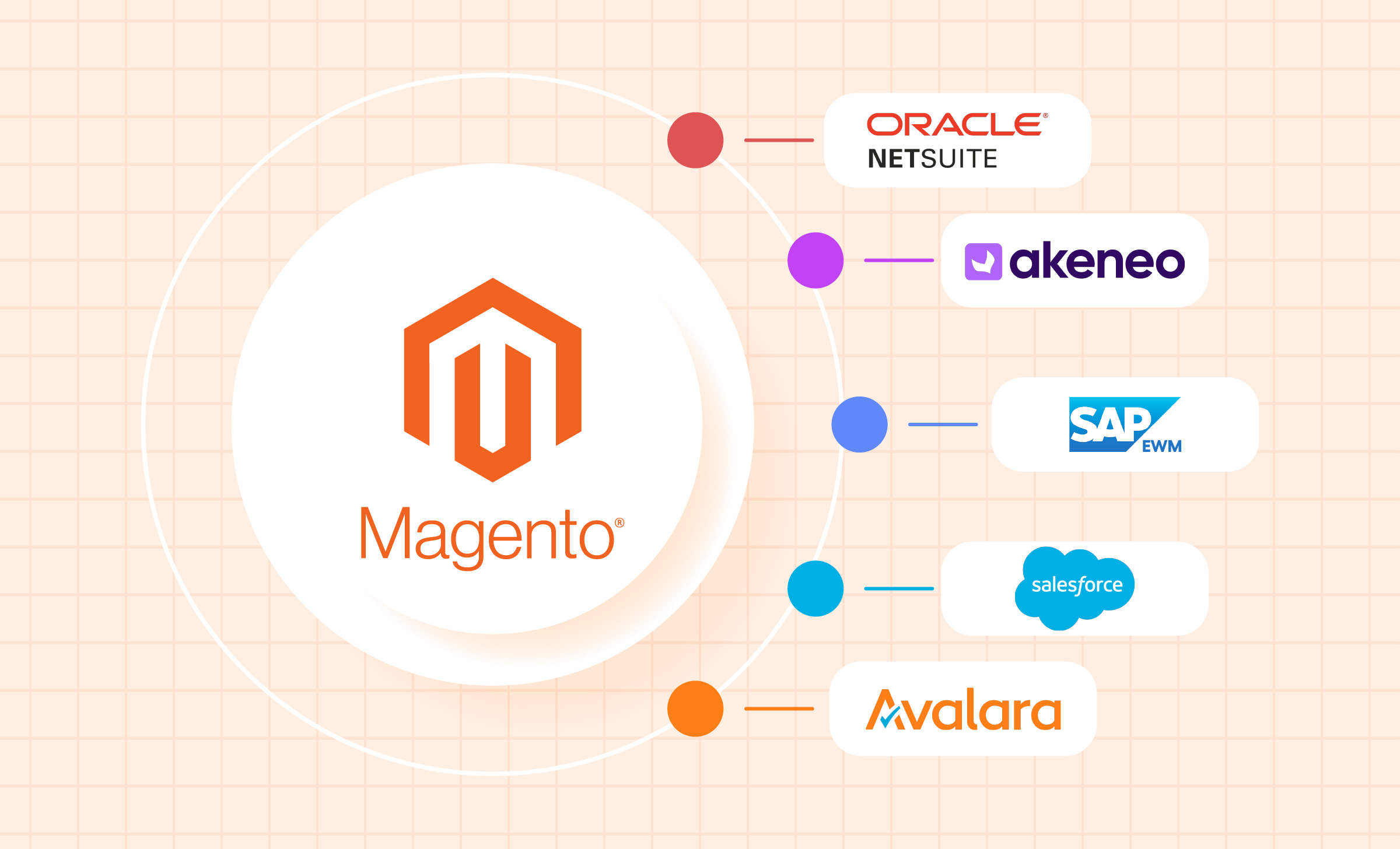

Magento is commonly used by brands that treat Southeast Asia as a long-term, multi-market region rather than a short-term test. It is often part of a broader commerce architecture, integrated with ERP, OMS, and fulfillment systems, and designed to support meaningful variation across markets. For SEA expansion, Magento is particularly effective when payment logic, pricing rules, checkout behavior, and fulfillment workflows need to differ by country while remaining centrally governed.

That level of control comes with higher operational demands. Magento-based setups require clearer ownership, stronger development discipline, and more deliberate planning around integrations. For brands with established operations or complex commercial models such as B2B or wholesale, this trade-off is usually intentional. The platform does not simplify SEA expansion by default, but it provides the structural flexibility to express market-specific requirements without fragmenting the overall setup.

Shopify / Shopify Plus

Shopify / Shopify Plus works particularly well for phased expansion into Southeast Asia, especially when speed and flexibility are priorities. For teams already operating on Shopify in other regions, SEA expansion is typically handled by extending the existing setup using multi-market features and a broad ecosystem of apps. This makes it relatively easy to add local payment methods, currencies, and shipping options without major architectural changes upfront.

As expansion progresses, the main consideration is operational coherence. Payment logic, fulfilment rules, and localization are often distributed across multiple apps and integrations, which requires deliberate governance as the number of markets grows. Shopify works well when teams are disciplined about how extensions are selected and managed, and when more complex requirements are introduced incrementally rather than all at once. For many brands, it remains a practical platform as long as the stack is treated as an evolving system rather than a one-time configuration.

Shopline

Shopline is often a good fit when ecommerce operations are anchored in China, Taiwan, or Hong Kong and Southeast Asia is approached as a natural regional extension. In these scenarios, teams benefit from familiarity with the platform and from workflows that are already aligned with Asian ecommerce practices. For SEA expansion, Shopline enables relatively fast rollout of localized storefronts, including support for local languages, currencies, and commonly used payment methods.

As operations expand beyond a small number of markets, the main consideration becomes how well Shopline supports deeper integration and regional coordination. While it works smoothly for standardized setups and early-stage cross-border or local fulfillment, more complex inventory logic, reporting, or multi-market governance often requires additional systems or custom development. For brands treating SEA as a core growth region rather than an extension, this usually prompts a clearer assessment of how the platform fits into a broader regional architecture.

WooCommerce

WooCommerce is typically used when ecommerce is closely tied to a broader content or brand storytelling strategy, often built on WordPress. In SEA expansion scenarios, it works well for teams that want a high degree of control over frontend presentation, content structure, and localization details, especially when SEO and editorial flexibility are important. In practice, many SEA websites built on WooCommerce do not always handle the full checkout flow, but instead act as brand or product hubs that redirect traffic to marketplaces such as Shopee or Lazada at the product level.

That flexibility comes with greater responsibility as complexity increases. Payments, fulfilment, and localization are largely handled through plugins and custom development, which means reliability and scalability depend heavily on implementation quality. As SEA expansion moves beyond one or two markets, brands usually need stronger technical oversight and additional systems to manage inventory, order routing, and operational reporting. WooCommerce can scale in SEA, but it does so best when supported by disciplined development and clear operational processes.

BigCommerce

BigCommerce is often used by brands that want a SaaS platform with stronger native structure than app-heavy setups, while still retaining flexibility through APIs and integrations. In SEA expansion contexts, it tends to appear in scenarios where teams want clearer separation between storefronts and backend systems, particularly when ecommerce needs to integrate cleanly with ERP, OMS, or other operational platforms.

As complexity increases, BigCommerce generally scales through integration rather than extension. Payment methods, fulfilment logic, and regional variations are often handled by connecting external systems rather than layering additional apps onto the core platform. This can result in a cleaner long-term architecture, but it also means brands may need to invest more upfront in custom integrations or partner support. BigCommerce works well when teams value structural clarity and governance as SEA operations expand across multiple markets.

Localizing D2C Commerce for Southeast Asia

TMO works with brands entering and scaling across SEA by combining deep market understanding with practical implementation experience. This includes identifying the payment methods, logistics models, and local integrations that are commonly required in each market, as well as understanding how consumer behavior, infrastructure, and operational constraints differ between countries. Rather than treating localization as a checklist, TMO helps brands design systems that reflect how these markets actually operate.

Just as importantly, TMO supports a phased approach to SEA expansion. We help brands extend their existing ecommerce platforms through localized UX and checkout design, custom integrations with payment gateways and logistics providers, and tailored development that supports growth without unnecessary rework. As operations mature, we guide teams in adapting architecture, workflows, and integrations so that early decisions remain viable at regional scale.

Looking to localize and scale your D2C commerce across Southeast Asia? Talk to TMO about how we support market-specific integrations and phased expansion.