In the last few years, the June 18th shopping ‘holiday’ (also known as 6-18) has burst onto the Chinese shopping calendar, second only in importance and sales to ‘11-11.’

It has grown into such a big online shopping event across the whole of China that sales begin around a month before the big day, with June 1st actually now the biggest day for sales.

Sales were particularly strong in the China Makeup Market Data Pack June 2020June 2020 report covers China makeup market stats, trends, changes in consumer demand, while touching on brand competitiveness and product characteristics.makeup market during last year’s 6-18, when consumers were seemingly eager to get spending again in the aftermath of the outbreak of COVID-19. But what about this year? Have sales remained strong? And what products and brands have been the biggest-sellers in the makeup market? Let’s take a look!

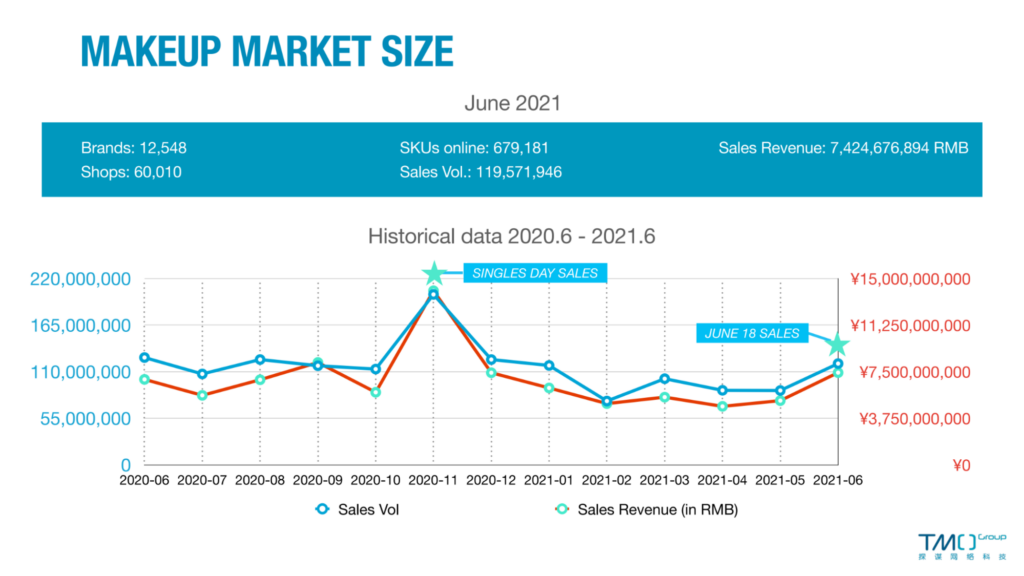

Makeup Market Size Analysis

As can be seen from the graph above, sales have remained strong for this year’s 6-18 in the makeup market. Sales volume is slightly down (119,571,946 in 2021 vs. 126,717,530 in 2020), but sales revenue is slightly up 7,424,676,894 RMB in 2021 vs. : 6,880,655,295 RMB in 2020). This suggests that consumers have been willing to pay higher prices for their products this year than last.

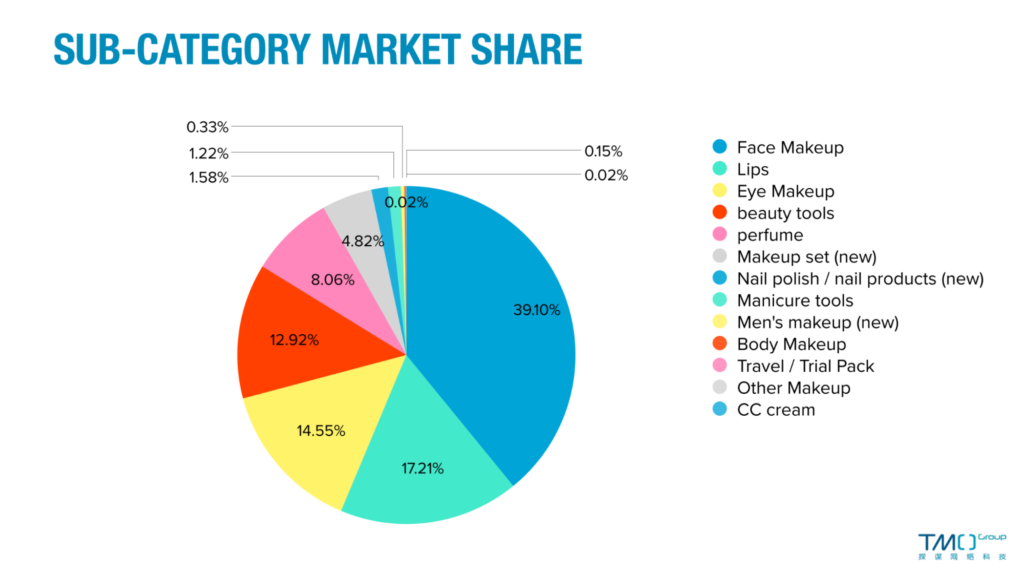

Best-Selling Makeup Product Category and Brand Analysis

Just as last year, the face make up, eye make up, and lip categories take up the majority of the market share for the sub-categories.

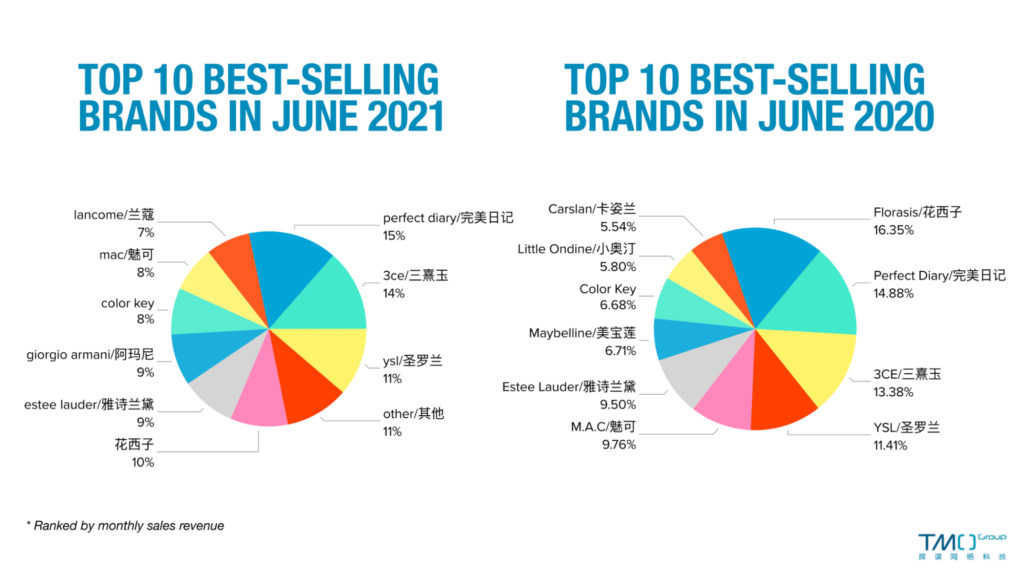

But what about brands? Well actually, the best-selling brands have remained largely the same. But what is it about some of these brands that appeals to the hearts and minds of Chinese consumers?

Sales for Perfect Diary have remained strong. Since launching in 2016, they have built up a loyal customer base thanks to their affordable pricing and marketing strategies to appeal to the youth of China, which has included collaborations with KOLs and heavy promotion on social media.

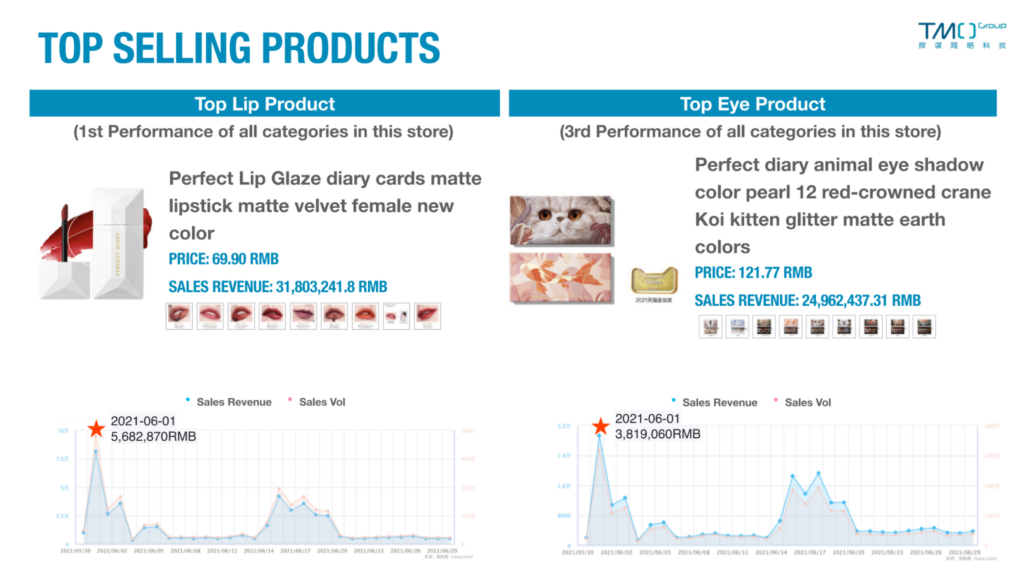

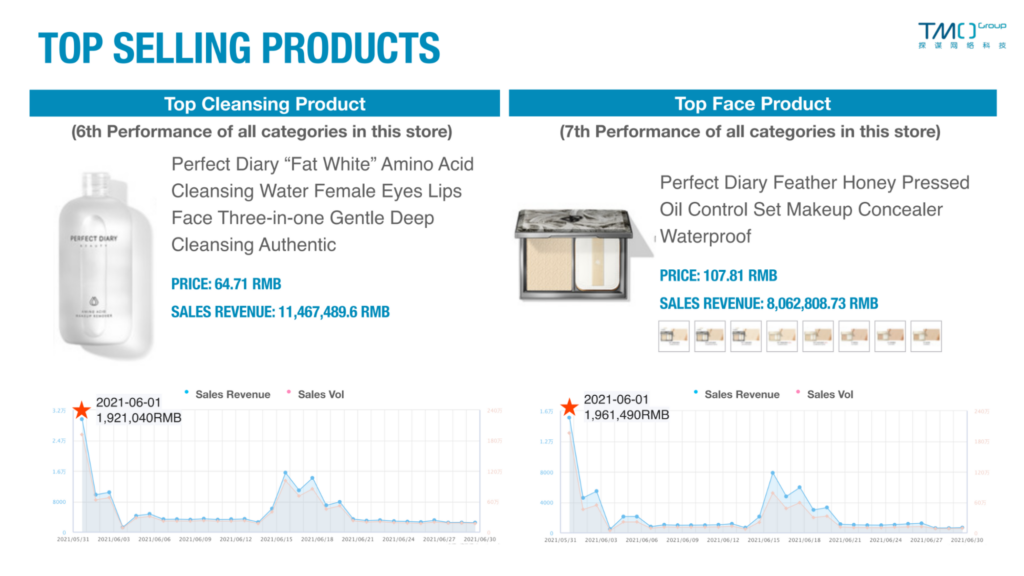

Here are the top selling products from Perfect Diary in different categories:

3CE is another strong performing brand in both 2020 and 2021 for 6-18. Hailing from South Korea, this brand plays on its roots to appeal to its key demographic. K-culture has been popular amongst Chinese youth for many years now, so it’s no surprise that a brand encapsulating this sells well in the China makeup market.

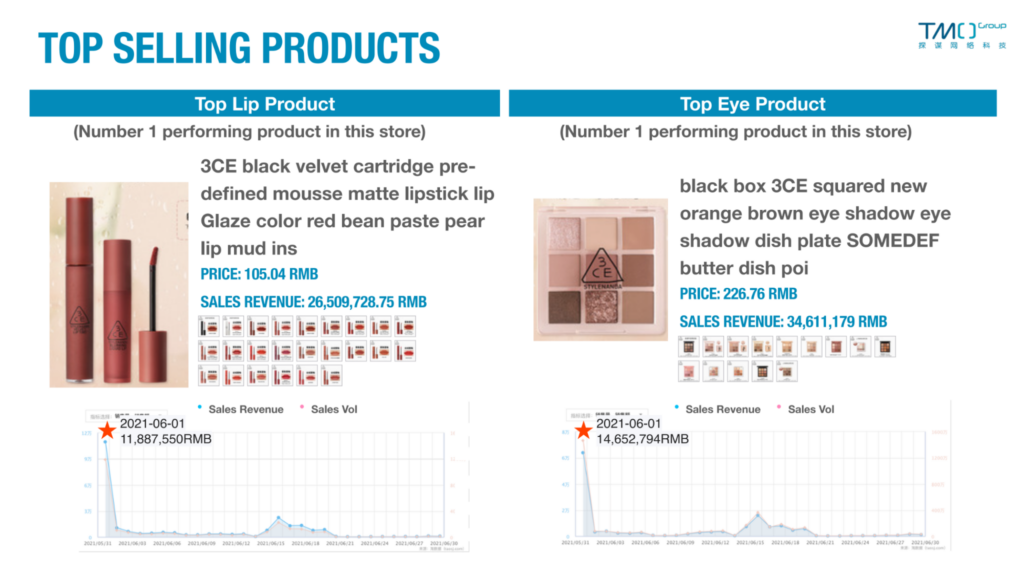

Here are the top selling products from 3CE in different categories:

YSL has also been a strong performing brand for 6-18 in 2020 and 2021. It’s popular amongst consumers who are looking for a bit of luxury in their lives. It’s positioning as a luxurious brand can be seen in the average selling price of their best-selling products - considerably higher than the other two brands we have looked at.

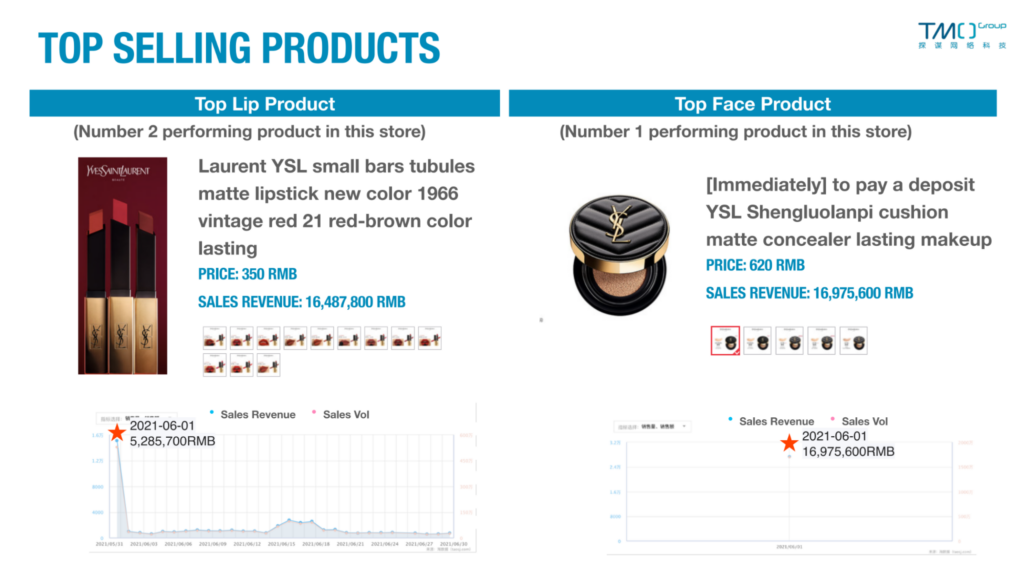

Here are the top selling products from YSL in different categories:

Product Characteristics

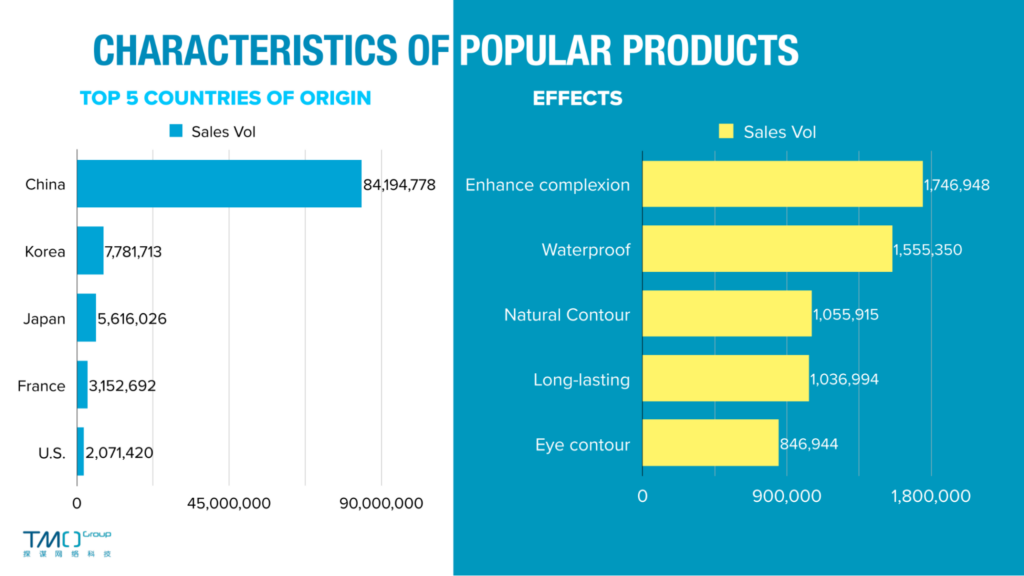

Looking at what product characteristics have proven popular amongst Chinese consumers, it can be seen domestic products still lead the way, with ‘enhance complexion’ and ‘waterproof’ the most popular effect characteristics.

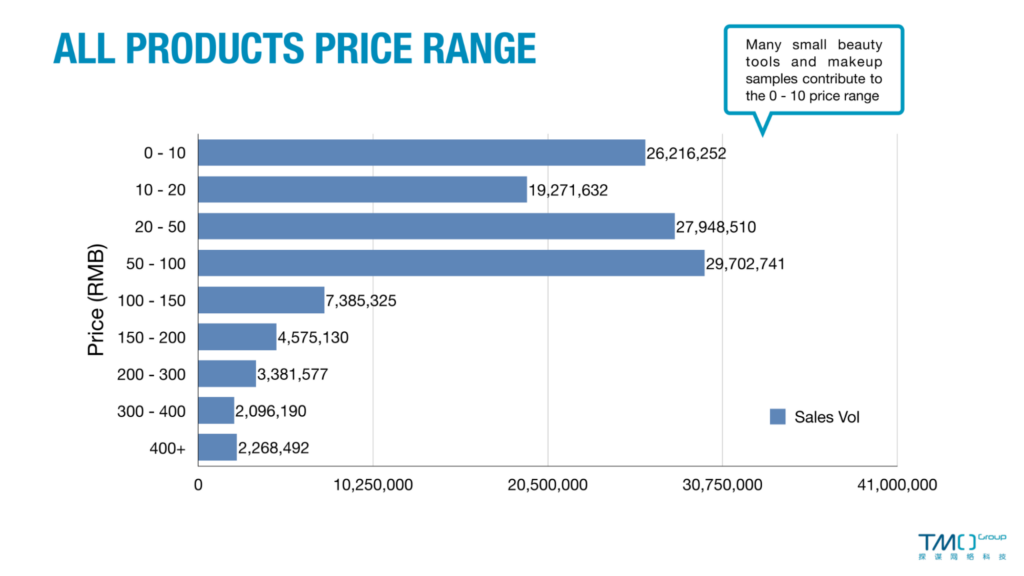

Price Range

Amongst all products, those in the 50 - 100 RMB product price range sold the most. This is actually different to last year’s 6-18, when products in the 10-20 RMB price range sold the most. This possibly reflects the higher disposable income consumers have this year compared to last. It should also be pointed out however that many small beauty

tools and makeup samples contribute to the 10 - 20 RMB price range.

Search Keywords Analysis

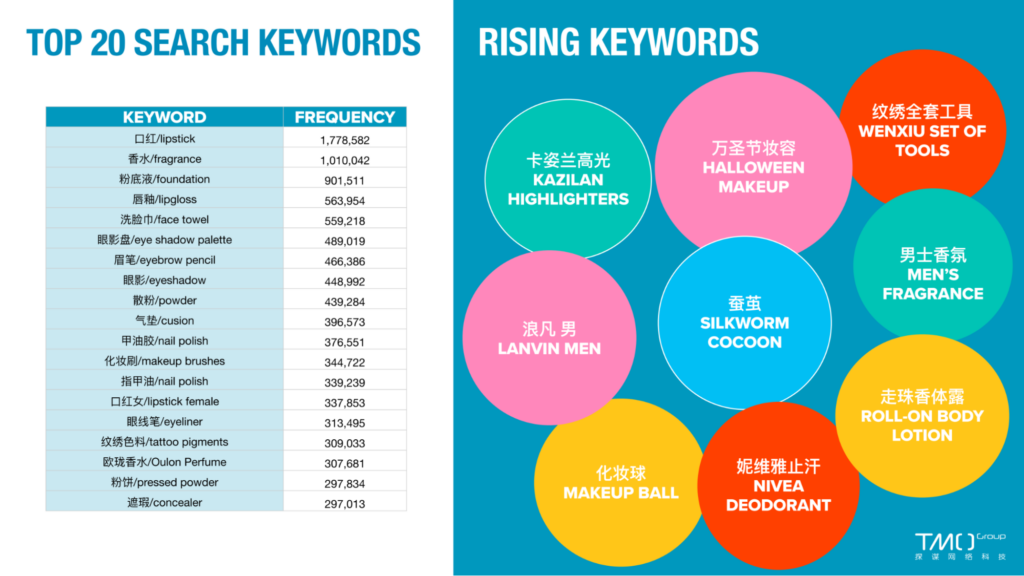

Analysing the most searched for makeup related keywords on Baidu for 6-18 doesn’t really reveal any big surprises, with the list dominated by evergreen products. 口红 (lipstick) was the most searched for keyword, with nearly 1.8 million searches. This was followed by ⾹⽔ (fragrance) with just over 1 million searches. Next came 粉底液 (foundation) with just over 900,000 searches. In terms of rising keywords, 万圣节妆容 (halloween makeup) came out top, suggesting that consumers are already looking ahead to the halloween party season. Another popular rising keyword was Nivea Deodorant (妮维雅⽌汗), probably because consumers are looking at ways to stop themselves sweating in the hot summer weather conditions.

Top 5 Makeup Products (by Sales Revenue)

1.

雅诗兰黛DW持妆粉底液 油⽪亲妈持

久不脱妆遮瑕控油防晒 官⽅正品Estee Lauder Double Wear long-lasting makeup liquid foundation

Product: Foundation

Brand: Estee Lauder

Listed price: 410 RMB

Selling price: 410 RMB

Sales revenue: 41,088,150 RMB

Sales: 100,215

2.

⼩⿊盒预售】3CE九宫格眼影新品

橘棕盘眼影芋泥盘SOMEDEF⻩油盘

3CE Eye Shadow

Product: Eye Shadow

Brand: 3CE

Listed price: 230 RMB

Selling price: 226.76 RMB

Sales revenue: 34,611,179 RMB

Sales: 152,632

3.

花⻄⼦蚕丝蜜粉饼/⼲粉粉饼定妆控油

持久防⽔遮瑕散粉饼⼲⽪油⽪

Florasis Pressed Setting Powder

Product: Pressed Setting Powder

Brand: Florasis

Listed price: 219.9 RMB

Selling price: 212.62 RMB

Sales revenue: 33,899,038 RMB

Sales: 159,435

4.

完美⽇记名⽚唇釉⼥丝绒⼝红雾⾯哑

光新⾊唇彩唇蜜持久显⽩学⽣

Perfect Diary Lip Gloss

Brand: Perfect Diary

Listed price: 69.9 RMB

Selling price: 69.9 RMB

Sales revenue: 31,803,242 RMB

Sales: 454,982

5.

Pinkbear⽪可熊琉光镜⾯⽔唇釉

⼩布丁⼝红⼥学⽣唇蜜官⽅持久正品

Pinkbear Lipgloss

Product: Lip Gloss

Brand: PinkBear

Listed price: 79 RMB

Selling price: 59 RMB

Sales revenue: 28,534,819 RMB

Sales: 483,641

A ‘long lasting’ make up product was the biggest-seller for 6-18 in 2021. This was also the case in 2020. The reason for this could be the onset of the summer, so consumers are looking for products that will be durable in the heat. Other evergreen products including lipgloss, eye shadow, and pressed setting powder make up the rest of the top 5 selling products.

Conclusion

Sales in the makeup market for this year’s 6-18 remained high, following on from last year’s strong performance. Although sales volume was slightly down, sales revenue was up, suggesting consumers have more disposable income, as the economy in China continues to recover from the COVID-19 pandemic.

The top selling brands this year were largely the same as last year, suggesting that these brands have consolidated themselves in the hearts and minds of Chinese consumers, and have established brand loyalty.