Cosmetics and makeup is a huge market in China. It is predicted to surpass 450 billion yuan in 2021 (about 70 billion USD). China is still behind the biggest makeup market in the world (that would be the US with about 80 billion USD), but it is catching up quickly.

About 70% of sales are estimated to happen through eCommerce. And the high point for sales in China — for any products, not only cosmetics, is 11-11, or Singles’ Day. This shopping festival became the prominent feature of Chinese online sales since 2009 and by now transformed into a couple of weeks of promotions, flash sales and other marketing activities, starting from the 1st of November and lasting all the way until 14th.

In this post we will look at sales statistics for main Chinese marketplaces, and analyze what were the best selling products, brands, categories during these sales festival days.

Top products

As 11-11 sales are no longer limited to just 24 hours, we will be looking at the performance of products during the first two weeks of November 2021 — 1st to 14th. Let’s start by the top products that generated the highest revenue.

Most revenue was generated by Estee Lauder’s Double-Wear foundation, generating 135 million yuan in sales.

American company Estee Lauder indeed showed really strong performance, as the second line in the list is also taken by their product — this time it is a primer Futurist Aqua Brilliance. This product generated almost 83 million in sales.

Shanghai-based Blank ME occupies third place with 66 million yuan in revenue with their aptly named foundation product.

Another Chinese brand, this time from Guangzhou: Colorkey — is in fourth place. Their lipstick/lipgloss product generated almost 62 million yuan in sales. It is by far the cheapest product in the top five — with an effective price as low as 64 yuan. Yet it has sold a staggering amount of 950 thousand units, making it the absolute leader by the number of items sold.

Finally, in the fifth place is makeup powder from another Chinese brand, HuaXiZi (花西子), also known under its westernized name Floralis. This product generated 60 million yuan in sales.

Top Brands

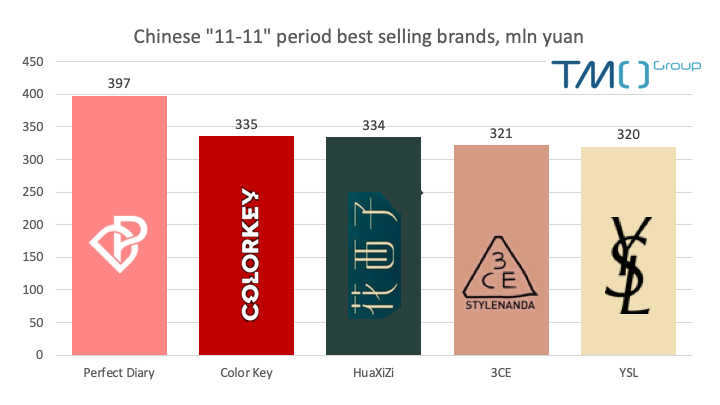

It is quite crowded near the top of the brand chart — all 5 leaders generated between 300 and 400 million yuan in revenue, sometimes with only a million or two setting competitors apart. Let's look at those brands.

Brand, generated the most revenue is Guangdong based Perfect Diary (完美日记) — 397 million yuan. The most successful product that brought the highest numbers is their lipstick/lipgloss line.

In second place, the brand we already saw in the top products - ColorKey, finishing at 335 million yuan mark. Same with their neighbours Perfect Diary, best selling items are lipsticks and lipglosses.

Number three is HuaXiZi (花西子) with 334 million in sales. HuaXiZi has a diverse set of different products, but it is makeup powder that brings the brand to this high position. It is also impossible not to notice outstanding design of their products — based on traditional Chinese motives with a “premium” twist.

Fourth place is taken by Korean 3CE (the name actually stands for “3 concept eyes”) with 321 million in sales. Top products that generated that amount are lipsticks and eyeshadows — of course, of 3CE’s iconic pink, orange and beige.

Closing the list is the only non-asian brand: YSL. Famous French brand generated 320 million yuan in sales and their leading products are concealers and lipsticks.

Top Categories

TaoBao’s catalogue is full of unusual items that can either be familiar to western customers (for example, “lipstick for men”) or quite unique for the asian market (such as “double eyelid glue”). However, most of the revenue comes from more traditional categories. Let’s look at which product types are the most popular among Chinese consumers.

Most popular products are lipstick and lipgloss, generating 1.8 bln yuan in sales. Technically, it is two separate categories in the catalogue, but a lot of items have both designation in their description, making the line a bit blurry.

Chinese ColorKey and Perfect Diary are clear leaders in this category, by far outperforming any other brand that offers lip products.

At the second line of the list we have liquid foundation — with 1.23 billion yuan in sales in this category. Most prominent brands here are American Estee Lauder and Italian Giorgio Armani.

These two groups, lip products and foundations, are by far the most significant categories from the sales revenue perspective. Let’s quickly look at the runner-ups product groups.

- “Makeup sets”, a category featuring sets of different types of products, registered 648 million yuan in sales.

- Primers/isolation creams came in with 610 million in sales.

- Makeup powder generated 550 million in sales.

- Finally, we have a “Makeup tools” category, that includes various items, like face towels, sponges, cotton swabs and similar products. It totals at 540 million yuan in sales.

We hope this overview of “Singles’ day” (or weeks, to be exact) was interesting to you. You can also check out our recent data pack about the Chinese Makeup and Cosmetics industry. China Makeup Market Data Pack November 2021November 2021 report covers China market data, trends, and changes in consumer demand during double eleven sales period.The latest issue, focused on the whole month of November", is already available on our website.