China's mobile payments industry has entered a new and exciting phase, by reaching approximately 16.3 trillion yuan ($2.5 trillion) in 2015. Convenience, speed of transaction and discounts are the main factors encouraging the use of mobile payments over traditional payment options. Whether it's buying plane tickets or ordering food deliveries or even paying utility bills, using mobile payment will be the No.1 choice of Chinese consumers.

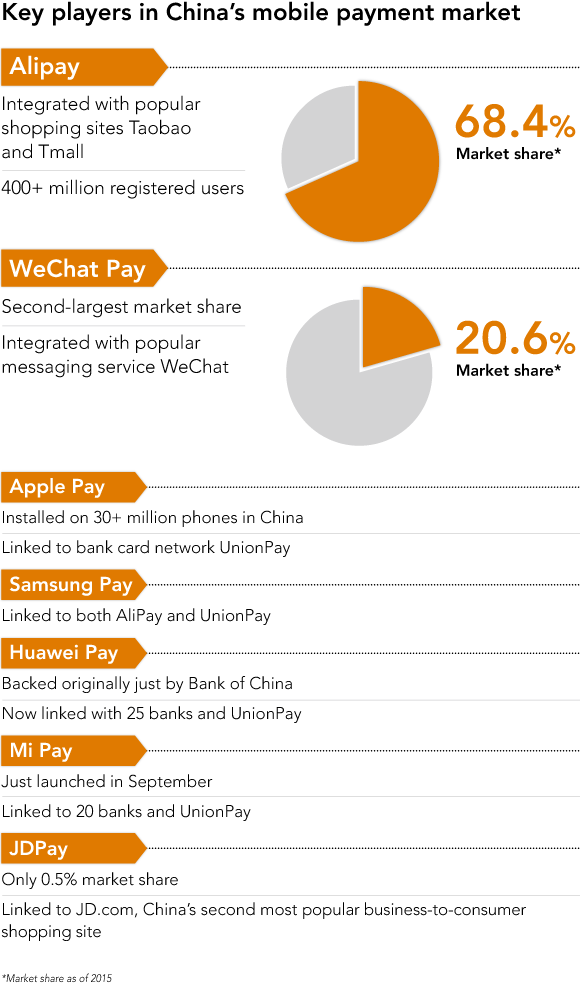

There are various mobile payment options for Chinese mobile users to choose from. Alipay and WeChat pay are two dominants, while new challengers like Apple Pay and Samsung Pay join the game in the past year.

Front Runners: Alipay & WeChat Pay

Alipay, owned by Chinese eCommerce giant Alibaba, remains the largest mobile payments player in China. It had a market share of 68% at the end of 2015 and has more than 400 million registered users, thanks to its links with Alibaba's Taobao and Tmall shopping sites.

Meanwhile, WeChat Pay FAQs: Everything You Need to KnowGood news: WeChat Pay is going overseas and it will benefit cross-border eCommerce. If you wish to expand your business to China, this is a must read.WeChat Pay is a growing threat to Alipay, which now boasts about 700 million users. It is linked to WeChat, China's largest instant messaging and social media platform. WeChat Pay users are increasingly using WeChat Pay to transfer money and make payments. Its convenience has boosted adoption rates and has given Tencent a massive advantage as it looks to boost mobile payment market share. Currently, WeChat Pay's market share was 20%, making it a distant second to Alipay. But WeChat's growing number of users and the increasing popularity of social media are helping it gain huge market share.

Besides, both Alipay and WeChat are widely available in China’s offline stores, from giant shopping mall to small corner shops, covering even more facets of the Chinese urban lifestyle.

The competition between Alipay and WeChat Pay has reached new heights as both are transforming into global cross border payments, not just for Chinese domestically but also overseas. Both services have been building partnerships with foreign retailers and eCommerce platforms allowing customers to This Cross Border Solution by Alibaba Will Help You Make a Splash with China’s Online ShoppersCross-border eCommerce to China looks intriguing to retailers, but there are a lot of unsolved problems in the middle. Alipay ePass is here to solve.purchase products in yuan while abroad and on foreign websites. Travelers can even get tax refunds abroad through Alipay, which can save time at the airport.

Apple Pay: new player or late comer?

When Apple Pay first launched in China this Feburary, more than 30 million bank cards were connected to the service in only two days, marked as Apple Pay’s big success. By partnering with UnionPay, China's national card network, Apple gained access to China's largest banks and thus a majority of China's consumer class.

However, after almost 8 months, Apple pay is struggling in China. To start off, Apple Pay entered China after Alipay and WeChat Pay have gained favor; Besides, Chinese users find Apple Pay was not as seamless as local services. Apple Pay must offer something significantly easier or more secure to win people over.

Phone makers Jumping in

Xiaomi, the six-year-old Chinese mobile phone maker, recently announced the launch of its mobile payment service, Mi Pay, developed in consortium with Chinese banking network Union Pay. Besides Xiaomi, other phone makers such as Samsung Electronics, Huawei, Xiaomi and LeEco, the parent of Leshi Internet Information & Technology, are all making their splashes on mobile payments. For example, Samsung followed Apple by partnering with UnionPay and getting the backing of China's major banks for Samsung Pay, but Samsung has also integrated Alipay into its mobile wallet.

Conclusion

With all these mobile payment options battling in China market, there is one thing for certain: mobile payment is essential for your business in China, especially eCommerce.

With that being said, it is an opportunity for your eCommerce to integrate with major mobile payment methods in China. If you are looking for a eCommerce solution with full integration of China mobile payments, don’t hesitate to Contact us.