In this Southeast Asia eCommerce Insights article, we take a look at the five key markets identified in our Southeast Asia eCommerce Outlook 2025This free PDF takes a broad view of eCommerce across five of Southeast Asia's most exciting markets: statisics, market structure, trends, entry strategy.SEA Outlook to see how they stand after 2020 and where they might be headed in 2021.

The Key SEA eCommerce Markets After a Year of CoViD-19

The economies of Southeast Asia were hit hard by the pandemic. Most countries are still battling to keep CoViD-19 under control. Many traditional businesses suffered due to the virus's effects on foot traffic and high street safety. However, eCommerce helped many people get access to food and other key items.

The SEA region has overcome the initial challenges of running a digital economy. The region has succeeded by providing affordable internet access and increasing consumer trust in digital services. In 2020, 40 million more people used the internet in SEA than the previous year. This 70% internet penetration rate meant that more people were online to make the most of convenient and safe shopping from home.

Average time spent online in SEA also rose to 4.2 hours a day. This is understandable as more people worked from home, and helped further feed into eCommerce growth. Especially interesting is the significant growth in Internet usage from non-urban areas seen in Indonesia, Malaysia, and the Philippines. As seen in China in recent years, such areas have lots of untapped eCommerce potential.

Industry Breakdown

Though still in its infancy, SEA’s digital economy has already shown incredible resilience. Digital services such as eCommerce, food delivery, and online media have surged in popularity. SME (small and medium-sized enterprises) are transitioning to online platforms to do business and complete transactions.

Digital financial services are also becoming widespread, and the digital payments market will go from 600 billion USD in 2019 to reach 1.2 trillion USD in 2025. The online entertainment industry grew 22% in 2020, reaching a height of 17 billion USD. On the other hand, online tourism - one of the biggest eCommerce segments - suffered especially from the pandemic.

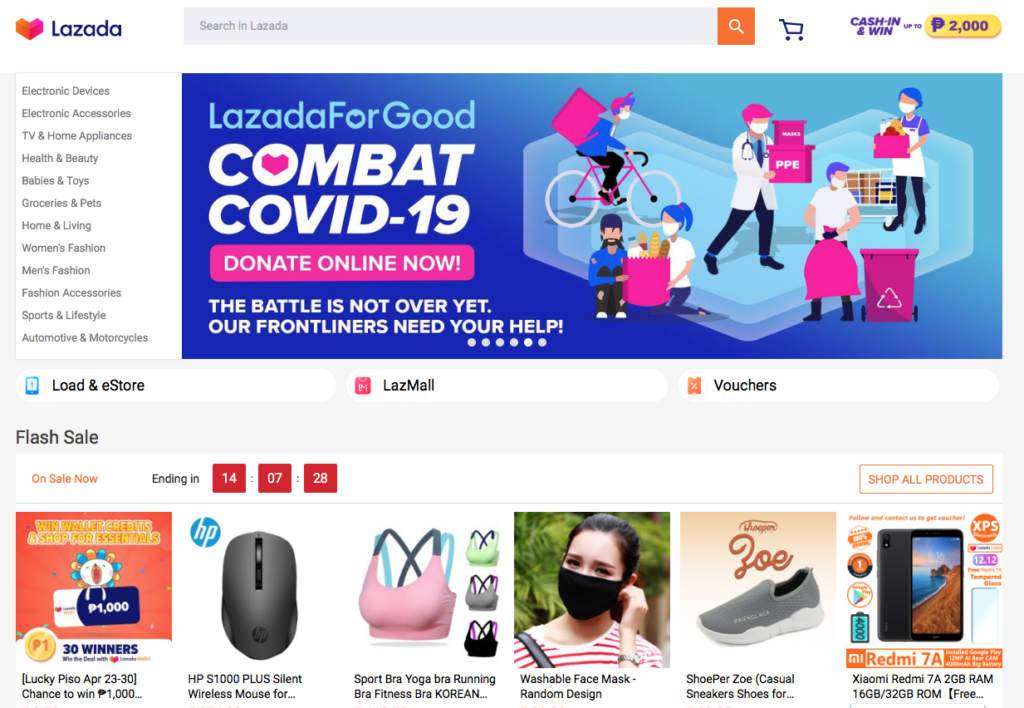

Southeast Asia's Top eCommerce Marketplaces

At present, most of the SEA eCommerce market is dominated by Lazada and Shopee, and the domestic eCommerce markets vary among SEA countries and are still fragmented. We expect that different eCommerce platforms in Southeast Asian countries will eventually integrate. This could lead to the formation of two or three distinct regional ecosystems. Many local eCommerce platforms in Southeast Asia have invested a lot of money in digital technology. Examples include Charoen Pokphand in Thailand, Salim in Indonesia, and Vingroup in Vietnam. Many local unicorn companies in Southeast Asia (Gojek in Indonesia and SEA in Singapore) have also launched their expansion plans to gain market share in the region. International eCommerce giants like Amazon, Alibaba, JD.com and Tencent are also beginning their initiatives to enter the Southeast Asian market.

Lessons From TMO's SEA Data Packs

In TMO’s December SEA Data Pack (reach out to TMO Group for details on how to get it), we discussed and analyzed the region in more detail, including the changes that occurred in December.

- Shopee's sales in the five Southeast Asian countries all showed positive growth trends.

- Shopee Vietnam posted the most significant growth in monthly sales (24.19), followed by the Philippines (17.39) and Malaysia (11.98%).

- The Philippines boasted the largest growth in the number of eShops (951.03%) and products (1131.46%) on Lazada.

At the same time, we outlined the best-selling product categories in Southeast Asia during this period (according to Shopee sales data):

- Thailand's top three categories for sales growth were home appliances (13%), beauty and personal products (12%), and mobile phones and accessories (11%).

- Philippines’ top three categories for sales growth are home life (15%), women's clothing (10%) and health and personal care (8%).

- Vietnam's top three categories are health and beauty (20%), home life (11%), and women's fashion (10%). Monthly sales have increased by 0.55%.

- Malaysia's top three categories are home life (19%), health and beauty (16%), mobile phones and devices (11%). Grocery and pet supplies surpassed household appliances to become the fourth.

- Indonesia's top three categories are beauty (13%), health (11%), mobile phones and accessories (10%).

Looking forward

Going into 2021, one strong positive is eCommerce retention. Even in areas where the pandemic faded, 94% of new eCommerce users continued to shop online. Services such as food delivery, entertainment, and online education proved especially strong.

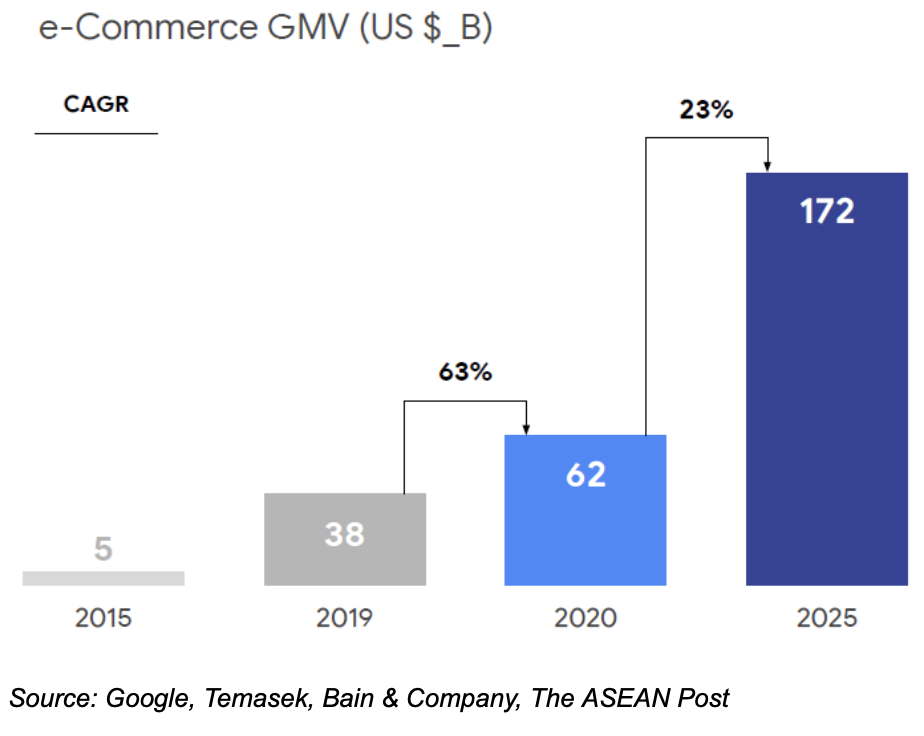

Countries worldwide experienced an economic downturn in 2020. However, in one recent report, ASEAN offered some Southeast Asia eCommerce insights, including its estimate that gross merchandise value (GMV) should surpass 100 billion USD in 2020, reaching as much 105 billion USD. The report asserts that the SEA eCommerce market will still confidently reach its 2025 goal of exceeding 300 billion USD in GMV.

Though online tourism was the sector hit hardest by the pandemic, transportation and logistics are expected to resume and recover in the first half of 2021 thanks to several SEA nations ending lockdown and loosening restrictions. By 2025, experts believe the logistics and food and beverage sectors will grow to reach a total market value of 42 billion USD.

Trends for 2021

- Digital Payments

- Compared to before the epidemic, cash payments by Southeast Asian consumers dropped from 48% to 37%. Conversely, eWallet usage rose from 18% to 25%. This is part of a gradual upward trend for cashless payment and mobile payment in Southeast Asia.

- Social Media Marketing

- Lazada and Shopee have launched in-app live-streaming functions in all regions. This enables the platforms to capitalize on the popularity of KOLs and KOCs.

- Social media platforms such as Facebook and Instagram continue to be hugely popular across the region.

- Social eCommerce

- This refers to doing eCommerce via social and messaging platforms such as Facebook or WhatsApp. This is a big trend, especially for B2C eCommerce.

- WhatsApp is currently actively working on a B2C platform and payment solutions.

- Research shows that direct communication leads consumers to establish lasting, positive brand relationships. Customers become more willing to accept personalized recommendations from sellers using social eCommerce.

- Voice Commerce

- Last year, PYMNTS and Visa jointly released "How We Will Pay 2020". The report estimates that there will be nearly 23 million consumers using voice assistants like Alexa for shopping by 2023. This would be an increase of 45% over 2018.

- Mobile Commerce

- Due to its mobile-first strategy, Shopee has managed to claim the top sport in SEA from rival Lazada. According to statistics, 95% of Shopee's total orders (1.2 billion) in 2019 came from mobiles.

- Personalized Consumption

- Consumption behavior changes throughout time. Gen Z now plays an increasingly significant role in online shopping, and looks for personalization. Fashion has been joined by electronic appliances and entertainment as hot cross-border eCommerce categories.

- According to Shopee, the average number of online products increased by 40% in 2020 from 2019. Products like drones and electric scooters have gradually become popular.

Learn More

For a more in-depth look into any of the markets we touched on in this article, check out the Southeast Asia eCommerce insights in our Market Localization Guides.