Southeast Asia's huge demographic dividend, alongside its rising economy, Southeast Asia’s eCommerce Market in 3 Words: Growth, Social and Mobile (2023 Data)Southeast Asia’s internet economy could reach 200 billion USD by 2025. We map out the Southeast Asia eCommerce market's key aspects and opportunities.high investment in the digital economy, and the widespread popularity of mobile devices, have all built a huge market base for cross-border eCommerce in Southeast Asia. As can be seen from our Southeast Asia eCommerce Outlook 2024This free PDF takes a broad view of eCommerce across five of Southeast Asia's most exciting markets: statisics, market structure, trends, entry strategy.Southeast Asia eCommerce Outlook, Southeast Asian eCommerce has began to develop rapidly, and the overall sales of various countries are on the rise. Therefore, exporting to Southeast Asia is one of the choices that brands cannot miss when going overseas.

TMO's South East Asia Data Pack Series is released in the form of a free monthly downloadable as part of our comprehensive long-term data monitoring and collection services, and contain research data on SKUs, sales volumes, and revenue for major product groups sold on Lazada and Shopee, with this blog post acting as a one-stop hub that summarizes highlights from each release.

The country release plan for 2024 is as follows: Indonesia (January), Thailand (February), Malaysia (March), The Philippines (April), Vietnam (May), Indonesia (June), Singapore (July), Vietnam (August), Thailand (September), The Philippines (October), Singapore (November), and Malaysia (December).

Indonesia. eCommerce sales estimates (June 2024)Indonesia Shopee and Lazada data for June 2024: Number of SKUs, sales volume and revenue, and much more.June 2024 (Indonesia eCommerce Data)

Indonesia stands out as one of Southeast Asia's fastest-growing eCommerce markets. The country's population of 270 million, its young demographic, and an annual GDP growth rate of 5% are the main drivers behind Indonesia's eCommerce expansion. Additionally, Indonesia boasts approximately 97 million middle-class and affluent consumers, indicating substantial market potential.

In June 2024, the total sales revenue of the Shopee and Lazada in Indonesia reached approximately $1.16 billion, with a year-on-year growth of around 84%. Apparel & Fashion and Health & Beauty were the most popular categories. The following analysis will provide insights into the sales data for the month in Indonesia.

Highlights from this Issue

- Platform Performance: Shopee Indonesia generated approximately USD 1.08 billion in sales in June, ranking second among the six Southeast Asian countries. Lazada's sales revenue reached about $82.64 million. Stay tuned to TMO as we continue to monitor the trends in Vietnam's eCommerce market throughout the year.

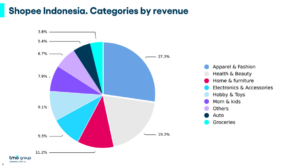

- In terms of categories, on the Shopee platform, Apparel & Fashion led with a market share of 27.3%, followed by Health and Beauty with a market share of 19.3%. On the Lazada platform, the most popular categories were Health & Beauty and Home & Lifestyle Supplies. These two categories accounted for nearly 40% of the market share.

- With regards to best-selling products: In the Health and Beauty category on Shopee, Indonesian consumers are primarily focused on exfoliation, sunscreen, anti-aging, and cleansing. Exfoliating essences and sunscreen were the best-selling items. In the Electronics and Accessories category, Chinese brands stand out. Smartwatches and smart phones from Xiaomi and Huawei made it to this month's best-selling products list. In Lazada's Health and Beauty category, matte lipsticks were selling exceptionally well. It's worth noting that in the Electronic accessories category, Xiaomi, a Chinese brand, also performed prominently, with its waterproof sports watches ranking in the top 5 best-selling products, showcasing its advantages in functionality and cost-effectiveness.

Vietnam. eCommerce sales estimates (May 2024)Vietnam Shopee and Lazada data for May 2024: Number of SKUs, sales volume and revenue, and much more.May 2024 (Vietnam eCommerce Data)

The Vietnam eCommerce market has experienced strong growth in recent years, making it one of the most attractive cross-border markets in Southeast Asia. According to statistics on eCommerce and the digital economy, Vietnam's B2C eCommerce revenue surged from approximately $8 billion in 2018 to $20.5 billion in 2023. A report by the eCommerce data platform Metric also highlighted that Vietnam's top five eCommerce platforms (including Shopee, Lazada, Tiki, Sendo, and TikTok Shop) sold about 2.2 billion products, reflecting a 52.3% increase compared to 2022.

In May 2024, the total sales revenue of Shopee and Lazada in Vietnam reached approximately $1.49 billion, with a year-on-year growth of 35%. Electronics & Accessories, Health & Beauty, as well as Apparel & Fashion were the most popular categories. The following analysis will provide insights into the sales data for the month in Vietnam.

Highlights from this Issue

- Platform Performance: Shopee is the most popular eCommerce platform in Vietnam, generating approximately $1.47 billion in May, ranking first among six Southeast Asian countries. Lazada's sales revenue reached about $19.11 million. Stay tuned to TMO as we continue to monitor the trends in Vietnam's eCommerce market throughout the year.

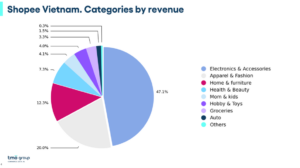

- In terms of categories, on the Shopee platform, Electronics & Accessories dominated the market with a market share of 47.1%, followed by Apparel & Fashion with a market share of 20.0%. On the Lazada platform, the most popular categories were Health & Beauty and Groceries & Pets. These two categories accounted for nearly 50% of the market share.

- With regards to best-selling products, in the Electronics & Accessories category on Shopee, Bluetooth earphones, Bluetooth speakers, and chargers were the most popular items. Vietnamese consumers showed a high acceptance of slightly higher-priced electronic products and accessories, with products priced over $50 generating more than $10 million in sales revenue. This indicates substantial growth potential in Vietnam's high-end electronics market. In Lazada's Health & Beauty category, medical supplies and men's care gained significant popularity. Chinese brand Flyco demonstrated excellent sales performance, with four Flyco products making it into the best-selling product list, including smart electronic thermometers, neck massage machines, and electric beard shavers.

The Philippines. eCommerce sales estimates (April 2024)Malaysia Shopee and Lazada data for March 2024: Number of SKUs, sales volume and revenue, and much more.April 2024 (Philippines eCommerce Data)

The Philippines, located in the western part of Southeast Asia, has a population of 118 million, making it the second most populous country in the region. With 64% of the population under the age of 35, this large and youthful demographic base provides significant potential for the growth of the eCommerce market. According to data from the Philippine Statistics Authority (PSA), despite a decline in the digital economy's share of the total GDP in 2023, eCommerce in the Philippines has shown remarkable performance. Over the past year, the Philippines’ eCommerce accounted for 14% of the digital economy, with a year-on-year growth of 18.5%, ranking among the top ten in global eCommerce traffic. This indicates that the Philippine eCommerce market is in a phase of rapid growth, which could be an ideal market for brands that are looking to expand.

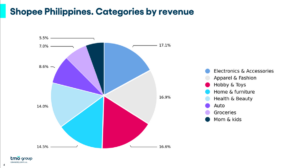

In April 2024, the total sales revenue of Shopee and Lazada in the Philippines reached approximately USD 630 million. Electronics & Accessories, Apparel & Fashion, and Hobby & Toys were the 3 most popular categories. The following analysis will provide insights into the sales data for the month in the Philippines.

Highlights from this Issue

- Platform Performance: In April 2024, the Philippines generated USD 405 million in sales on Shopee, ranking fourth among the six Southeast Asian countries. In contrast, Lazada is more popular in the Philippines compared to the other five countries, with monthly sales revenue reaching about USD 224 million. Stay tuned to TMO as we continue to observe the trends in the entire eCommerce market of the Philippines this year.

- In terms of categories, on the Shopee platform, Electronics & Accessories lead the sales with a market share of 17.1%, followed by Apparel & Fashion and Hobby & Toys, with market shares of 16.9% and 16.6% respectively. On the Lazada platform, the most popular categories were Home & Living, Health & Beauty as well as TV & Home Appliances.

- Concerning best-selling products: In the Electronics & Accessories category on Shopee, vacuum cleaners and robot vacuums were the best sellers. These products occupied four out of the top five spots in the sales ranking. The Chinese brand Xiaomi was particularly popular among Filipino consumers, with its robot vacuum ranking fourth on this month's best-seller list. In the Hobby & Toys category, speakers were the most popular products.

In the TV & Home Appliances category on Lazada, solar lights have shown outstanding sales performance. In addition, Filipino consumers have a strong demand for health and beauty products, with collagen supplements on Lazada being particularly popular, occupying two spots on the best-seller list.

Malaysia. eCommerce sales estimates (March 2024)Malaysia Shopee and Lazada data for March 2024: Number of SKUs, sales volume and revenue, and much more.March 2024 (Malaysia eCommerce Data)

The eCommerce market in Malaysia has experienced rapid growth in the past few years. According to Statista, the market size of eCommerce in Malaysia is expected to reach USD 19.84 billion in 2027. As the third-largest economy in Southeast Asia, Malaysians have a relatively high income compared with other 5 countries. According to research data, the average annual income per capita in Malaysia is 10,269 US Dollars, which ranked second just behind Singapore in the Southeast Asian region. In addition, 43.4% of the population of Malaysia are under 25 years old. This means that Malaysia may have great consumption potential and could be a good market for companies considering international expansion opportunities.

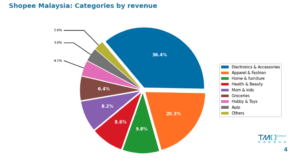

In March 2024, the total sales revenue of Shopee and Lazada in Malaysia reached approximately USD 530 million, showing an increase compared to December 2023. Electronics & Accessories, Apparel & Fashion, and Home & Furniture gained significant popularity in Malaysia. The following analysis will provide insights into the sales data for the month in Malaysia.

Highlights from this Issue

- Platform Performance: Shopee’s sales were higher than Lazada’s. In March 2024, Malaysia generated USD 500 million in sales on Shopee owing to the Ramadan promotion, ranking fourth among the six Southeast Asian countries. Malaysia has a large Muslim population. They reunite with their families and exchange gifts with relatives and friends during Ramadan, which may lead to a significant increase in consumer demand and drive eCommerce sales growth. Lazada’s sales revenue reached USD 31.3 million. Stay tuned to TMO as we continue to observe the trends in the entire Malaysian eCommerce market this year.

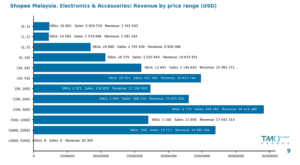

- In terms of categories, on the Shopee platform, Electronics & Accessories occupied the top spot in sales with a market share of 36.4%, followed by Apparel & Fashion and Home & Furniture, with market shares of 20.3% and 9.8% respectively. On the Lazada platform, the most popular category was TV & Home Appliances and Babies & Toys, accounting for a combined market share of approximately 76%.

- Concerning best-selling products: In the Electronics & Accessories category on Shopee, smartphones were still the most popular electronic products. Overseas brands are more attractive to Malaysian consumers, with Apple phones occupying four out of the top five spots in the sales ranking. In the Apparel & Fashion category, Muslim fashion clothing gained great popularity, accounting for 42.4% of the market share.

In the TV & Home Appliances category on Lazada, Malaysian consumers have the highest demand for vacuum cleaners. In the Babies & Toys category, milk formula and baby food were sold best. In the Electronics & Accessories category, the Chinese smartphone brand OPPO occupies both the first and second positions on the best-selling product list, indicating a strong appeal of Chinese brands to Malaysian consumers.

Thailand. eCommerce sales estimates (February 2024)Thailand Shopee and Lazada data for February 2024: Number of SKUs, sales volume and revenue, and much more.February 2024 (Thailand eCommerce Data)

In the wave of cross-border e-commerce sweeping Southeast Asia, Thailand is considered one of the most promising markets in this region, mainly due to its sizable young consumer base and growing middle-class population. According to the “Thailand – Country Commercial Guide” released by the U.S. Department of Commerce International Trade Administration in January 2024, Thailand has approximately 43.5 million e-commerce users, with 17-36 year-olds being the main force, accounting for 62% of Thailand’s e-commerce market. The influx of more young users has played a significant role in driving e-commerce sales in Thailand. In addition, affluent Thai online shoppers have strong brand awareness, and as this group continues to grow, it is bound to inject new vitality and business opportunities into the Thai e-commerce market.

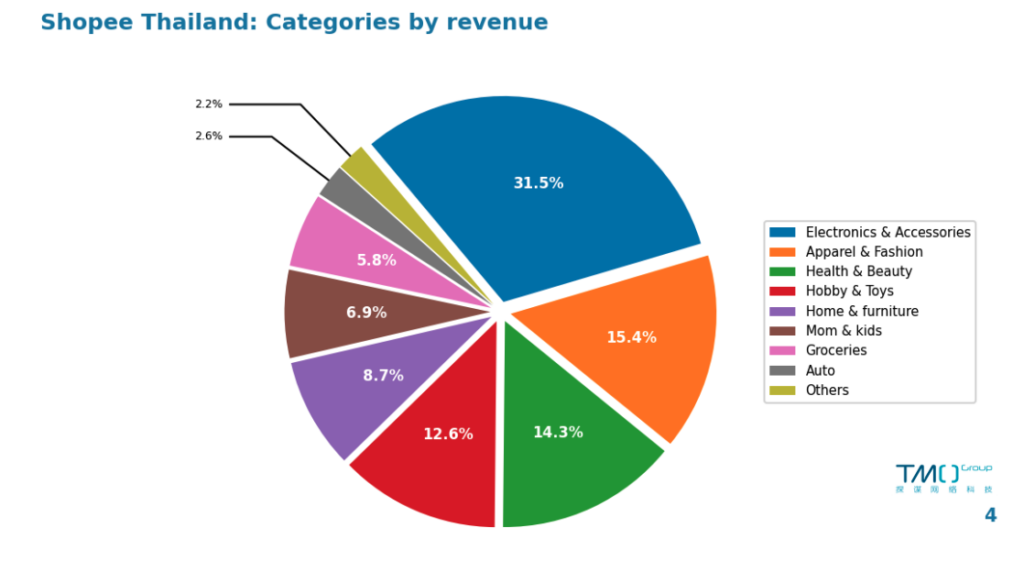

The cross-border e-commerce market in Thailand is vibrant. According to the “Thailand – Country Commercial Guide,” cross-border e-commerce accounts for 30% of the entire Thai e-commerce market, and nearly half of online shoppers have experience shopping on cross-border e-commerce platforms. In February 2024, the total sales revenue of the two main platforms Shopee and Lazada in Thailand reached approximately 762 million.

Highlights from this Issue

- Platform Performance: Shopee’s sales are higher than Lazada’s. In February 2024, Shopee’s sales in the Thai market were 650 million, ranking fourth among the six Southeast Asian countries. Lazada’s sales revenue reached 110 million, also ranking fourth among the six countries. Keep an eye on TMO as we continue to observe the trends in the entire Thai e-commerce market this year.

- In terms of categories, on the Shopee platform, electronic products and accessories occupy the top spot with a market share of 31.5%, followed by clothing and fashion, and health and beauty, with market shares of 15.4% and 14.3% respectively. On the Lazada platform, the most popular category among consumers is home and living, accounting for 19.1% of sales, followed by health and beauty (14.9%) and women’s fashion and accessories (11.0%).

- Concerning best-selling products: In the electronic products and accessories category on the Shopee platform, smartphones are still the most popular electronic products. Thai consumers have a high brand preference, with Apple smartphones occupying three out of the top five spots in the sales rankings. It is worth noting that the sales revenue of home appliances accounted for around 40% market share, which was almost the same as that of electronic products and accessories. Chinese brands TCL and Hisense have entered the top five in the sales rankings. In the health and beauty category, weight management products are the best-selling products, and perfumes have gained great popularity on Lazada.

Indonesia. eCommerce sales estimates (January 2024)Indonesia Shopee and Lazada data for January 2024: Number of SKUs, sales volume and revenue, and much more.January 2024 (Indonesia eCommerce Data)

For the beginning of the New Year, we have chosen the Indonesian market–which is the most popular among our readers–as the opening piece of this year’s Southeast Asia eCommerce data report.

According to the World Bank in its report “Indonesia’s Economic Prospects” for the second half of 2023, Indonesia’s economic growth remained strong, and in 2024, the economy is expected to grow by 4.9%, with inflation on a downward trend, which is set to decline further from 3.7% to an average of 3.2%, and a stable currency. Private consumption is expected to be the main driver of economic growth in 2024.

With a large and fast-growing population of over 270 million people and a large consumer base, Indonesia has made the country an attractive market for many cross-border outbound businesses. In January 2024, Indonesia’s Shopee and Lazada platforms had combined sales of more than US $1 billion.

Highlights from this Issue

- Platform Performance: Shopee’s sales are higher than Lazada’s. In January 2024, Shopee’s sales in the Indonesian marketplace were US $980 million, still occupying the top spot in Shopee’s six countries. On the other hand, it slipped to fifth place in Lazada’s sales rankings at US $510 million, due to local Indonesian e-commerce platforms Tokopedia and Tiktok joining forces and making a push to capture market share. Stay tuned to TMO as we continue to monitor the trends across the Indonesian market this year.

- In terms of categories, on the Shopee platform, apparel and fashion, electronics and accessories, and health and beauty ranked first, second, and third, respectively, with sales shares of 31%, 18.6%, and 18.5%. On the other hand, for Lazada, the overall category distribution is relatively even, the top three most popular categories are: Home and Living supplies, Health and Beauty, and Women’s Fashion and Accessories, with a sales share of 14.1%, 14% and 11.8% respectively.

- Concerning best-selling products: In the Electronics & Accessories category on Shopee, cell phones and accessories generated 67.8% of the sales value. Among them, various Xiaomi Redmi phones, as well as the Infinix Note 30 Pro made it into the top 5 sellers. in the Health & Beauty category, we note that two products from Canadian beauty brand SKINTIFIC made it into the top 5 sellers.

Indonesia. eCommerce sales estimates (January 2024)Indonesia Shopee and Lazada data for January 2024: Number of SKUs, sales volume and revenue, and much more.

If you are looking to dive deeper into Southeast Asia’s eCommerce market, look no further than our expert team! With our thorough research and analysis, as well as customized reports, you’ll gain a deep understanding of your niche, including market structure, size, and emerging trends. We’ll also provide invaluable insights on price ranges, top-selling items, and popular brands to help you stay ahead of the competition.

Get in touch today to learn more about how we can help you unlock the full potential of Southeast Asia’s eCommerce market!

Related Resources

- Southeast Asia eCommerce Market Guides by Country

- South East Asia. eCommerce sales estimates (2023 Collection)This data pack collection contains the South East Asia. eCommerce sales estimates from 2023, with monthly data for the number of SKUs, sales volumes, and revenue for all major product groups, sold on Lazada and Shopee.2023 Southeast Asia Data Pack Collection

- Southeast Asia eCommerce Outlook 2024This free PDF takes a broad view of eCommerce across five of Southeast Asia's most exciting markets: statisics, market structure, trends, entry strategy.Southeast Asia eCommerce Outlook