In recent years, the cosmetics industry, and skincare and makeup especially, have undergone substantial development in China. In 2019, the growth rate of the beauty industry ranked second of all retail industries. For brands that plan to set up on local eCommerce platforms or hope to enter China through cross-border eCommerce, research into consumer trends is undoubtedly a top priority. In this article, we will walk you through the main trends and characteristics that define Chinese cosmetics consumers.

Consumer Overview

Shiseido proposed a widely accepted concept of China’s core cosmetics population. It defined this group as women over 20 years of age, living in major cities and earning an annual income of more than 30,000 RMB. This group is expected to reach 400 million people in 2020. However, the Chinese market has developed considerably. Domestic consumers’ increasing enthusiasm for improving their personal appearance has led to new demographics becoming significant cosmetics consumers. Men have become more comfortable with buying such products. Students and consumers from lower tiered cities, towns, and rural areas are also a key new demographic. These groups have begun to consume beauty products on a considerable scale. When these emerging groups are taken into account, the overall cosmetics consumer population far exceeds 400 million. In 2020 this number is more like 800 million, twice the size of Shiseido’s core cosmetics population.

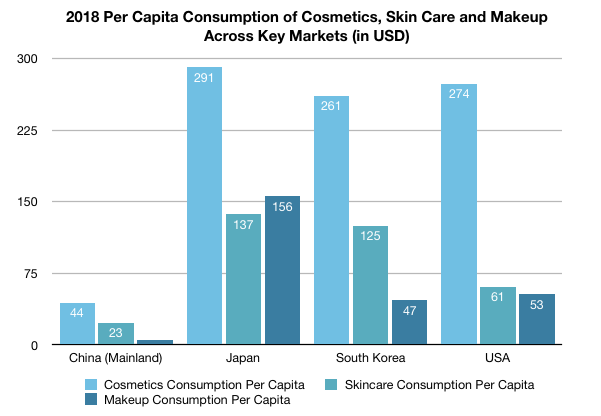

As a result, China’s cosmetics consumer population is huge, far surpassing other countries. However, per capita beauty consumption is significantly lower than other key markets. This means there is still a gap for the industry to grow to fill.

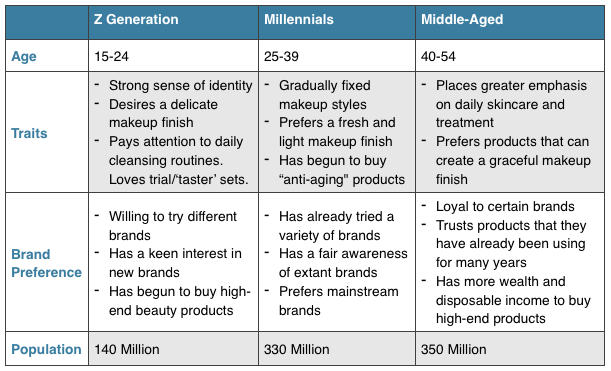

Judging from the demographic’s consumer behavior that has been observed so far, Generation Z is keen on experimenting and trying many different brands. The generation also has a strong interest in cutting-edge products, and has already begun to dabble in high-end beauty brands. Meanwhile the group aged between 30-40 has accumulated a fair amount of shopping experience and prefers mainstream brands. This group currently makes up the biggest cosmetics consumers population. Mature women prefer to stick with products and brands that they trust and have used for a long time. They also have more wealth and disposable income to support the consumption of high-end beauty products.

Makeup Consumer Trends

Generation Z

The main consumer group for makeup products in China is Generation Z, who highly value personal appearance and individual expression. As the first generation who grew up with developed digital world from an early age, Generation Z is an interesting population that worth studying when it comes to eCommerce behaviors.

Gen Z has grown up using a variety of social media platforms. Therefore it doesn’t make sense to separate Gen Z’s purchasing preferences from their online social behaviors. Before making a buying decision, Gen Z consumers tend to look online to inform their decision. They look at product reviews, impressions, and experiences posted on social platforms. After completing a purchase, they are then in turn more willing to share their own experiences. This then helps guide other people’s opinions.

Gen Z Consumer Profile

Usually, Generation Z are open to trying new things, do not have strong brand stickiness, and like to spend ahead of time. Multiple payment gateways/methods can significantly increase their interest in finally making a purchase.

Gen Z is positive and enthusiastic about buying makeup products. The pursuit of a delicate makeup finish and a ‘complete’ look has created a simultaneous demand among consumers for a variety of different beauty products. This led many brands to launch “All-in-One make-up kits” which contain several necessary makeup items. For example, foundation, lipstick and cosmetics tools all bundled together in one kit.

The Night-Owl Generation?

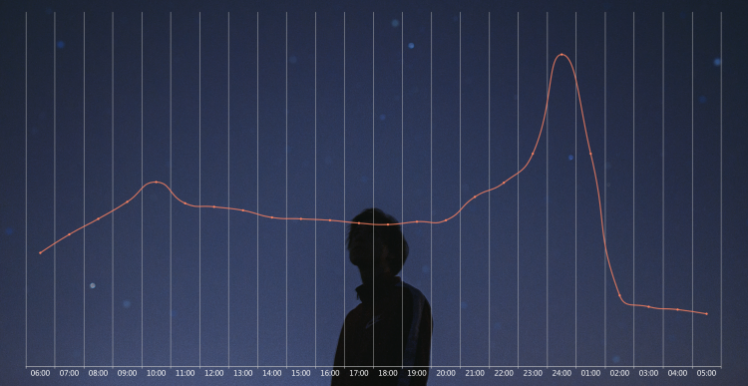

Since 2016, members of Gen Z have been reaching adulthood and taking their first steps into adult society. Some of them choose to stay up late to fit in their desired amount of entertainment time despite working long hours. Survey shows that 35% of those born since '95 go to bed after midnight. For those born since ‘90, this figure is 48%. This results in bad skin and a lack of time to put on makeup the next morning. Concealer products and so-called “lazy products“ have started to become popular among those born since ‘95. This has led to the rise of what some have dubbed the “stay-up-late economy".

There's another interesting side-effect of this phenomenon of Gen Z staying up late. The peak hours of cosmetics product purchases have actually shifted to later in the day.

Chart showing the peak hours for cosmetics purchases by those born after '95

Domestic Product Loyalists

Big international brands which entered China early guard their established positions jealously. Their position is strong, given their comprehensive product ranges and powerful brand presence. This forces domestic makeup brands to continuously upgrade their product lines and marketing strategies. But "New National Brand" and "New National Product” have proved to be trending topics in recent years. We're seeing domestic makeup brands slowly earning themselves good reputations in recent years.

Local brands have managed to carve out a niche but loyal audience. These consumers take pride in the emergence of quality local brands, the same way many consumers did when Huawei and Xiaomi phones started to take over that market. Looking at the different sub-categories of domestic brands, we can see that the SKU prices of lipsticks and eye shadows have increased significantly, proving that consumers are willing to pay more for Chinese brands and no longer see them as just cheap alternatives.

Try Before They Buy

In part due to the influence of KOLs on both social media and eCommerce platforms, consumers are developing a growing desire to try out new products. For Generation Z, which has a strong demand for makeup products but not enough money to purchase multiple products in the same subcategory at the same time, portable and relatively affordable ‘mini-sized’ makeup products have become popular. This is especially true when it comes to lipstick products, where different brands have launched mini-kits containing 2-10 lipsticks for consumers to try out different colors. L'Oreal has also latched onto this trend, and launched an online lipstick color test function on its official website and app, allowing consumers to quickly and cost-effectively discover colors that suit their style.

Skincare Consumer Trends

Ingredient Analysts

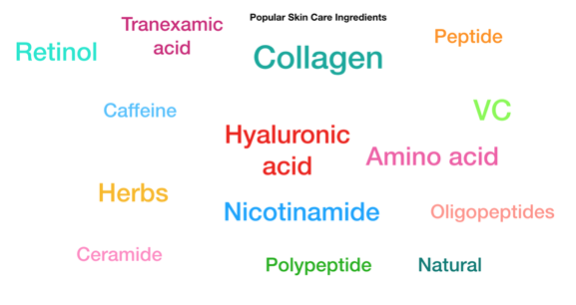

The skincare product market has gone through a long period of development in China. Today, Chinese consumers pay more attention to the ingredients of skin care products. Not only do they care about the safety of the ingredients used in the products, but they are also looking for functionality. Consumers in first-tier cities such as Beijing and Shanghai prefer Vitamin C, which has a whitening effect, and collagen, which prevents aging. Meanwhile, consumers in second-tier cities such as Chengdu and Chongqing prefer nicotinamide, which repairs skin. Herbal products are beloved by consumers of all ages because they are considered both natural and safe.

Sensitive Skin

Research from Mintel shows that 44% of Chinese female consumers who purchase facial skin care products consider sensitive skin to be the main reason for them to change or upgrade their skincare products. At the same time, one-third (34%) of Chinese consumers who use sheet masks are willing to pay higher prices for sheet masks that are made for sensitive skin.

More and more consumers are looking for cosmetic solutions for sensitive skin. Mintel research found that consumers search for professional advice when deciding the right skincare products for themselves. As many as three-quarters (73%) of Chinese consumers of beauty and personal care products said they would like sales assistants to make recommendations for skin problems. In China, about 36% of women are troubled with sensitive skin - that is, 1 in 3 people have sensitive skin - but only 1% of them are using corresponding products.

Anti Aging

Consumers are starting to worry about aging problems at a younger age than ever before. It isn’t just mature consumers buying anti-aging skin care products, those born since the 90s have also begun to join this group, determined to resist the onset of "early aging”.

Male Consumers

The male makeup market became a hot topic in 2019. But considering that the overall market is still small and the male makeup repurchase rate is not high, we selected online male skincare consumers as a more specific group to look into.

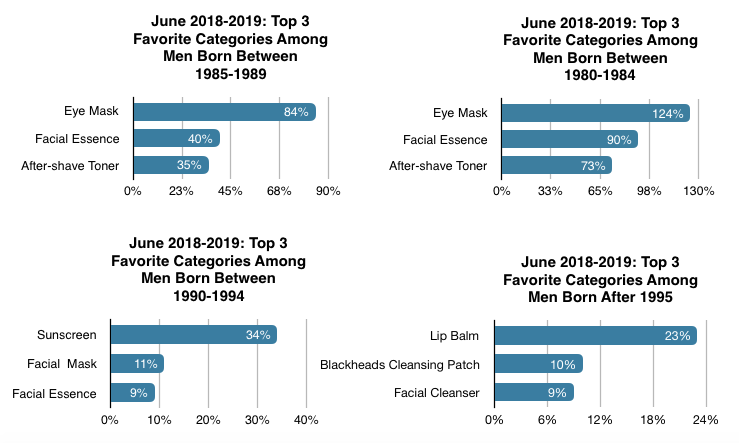

Men born in the 80s prefer functional eye masks, facial essences, and aftershave lotion. Those born in the 90s are keen on sun protection and use facial serums. Meanwhile, Generation Z focuses on daily cleansing, and uses lip balms that have soothing and moisturizing effects.

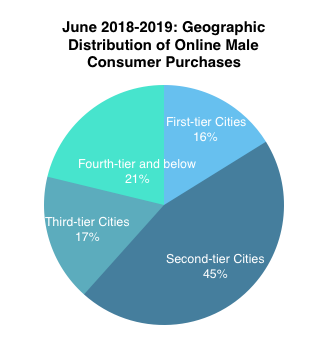

Online male buyers in second-tier cities contributed most to total male skincare consumption, while fourth-tier and below cities saw significant growth.

TMO has published the "China Cosmetics Industry ReportThis report takes a broad view of the market for cosmetics in China: trends, statistics, analysis; overview of China cosmetics market entry.Chinese Cosmetics eCommerce Industry Report" with more detailed information about cosmetics and makeup industry in China.

If you intend to enter the Chinese cosmetics market via eCommerce, please click here to contact us. We lead our customers from initial planning to development, and provide customers with long-term technical support and managed services enabled by intelligent marketing and cloud computing.