WeChat is China’s everything app, home to over 1.4 billion active users as of 2025. For brands, one of its most valuable capabilities is mini programs. With over 4 million mini programs used by 1.1 billion monthly active users, they let people buy, redeem, pick up, reorder, get support, and engage inside a closed social ecosystem where users already do everything else, without the friction of downloading and registering for yet another app.

WeChat may look “not that popular” outside China at first glance. In practice, the ecosystem has expanded: brands such as Van Gogh Museum, FC Barcelona, Uber, and Cartier now offer live mini program services.

TMO helps international brands use Mini Programs as a conversion channel through WeChat Development Services.

In this article, we’ll walk through 10 successful overseas mini programs across the full traveler journey, from pre-trip planning to post-trip repurchase and the key learnings Travel & Hospitality, Transportation, F&B & Lifestyle, Retail & eCommerce brands should consider when designing a Mini Program.

If You Serve Chinese Users, WeChat Mini Programs Are Hard to Ignore

There are now 450+ active international mini program service providers across 108 regions. Adoption is not evenly distributed. Some markets are already operating at meaningful scale, with 1M+ monthly active mini program users in Japan and 7x GMV growth in Singapore over the last three years. Key markets have also seen 45% YoY growth in supported international mini programs:

- Asia: Hong Kong & Macau SARs, Japan, South Korea, Singapore, Malaysia, Thailand

- Europe: UK, France, Spain, Germany, Italy

- Pacific & North America: Australia, New Zealand, Canada, US

Why does this expansion matter? Because the demand signal is already there. Chinese outbound travel is set to reach 155M+ yearly trips, and WeChat has 100M monthly active users abroad as of 2025. Mini programs increasingly act as the practical bridge between interest and transaction outside China, without forcing travelers into local apps, local-language sites, or new account creation.

If you already serve a meaningful Chinese customer base, the business case becomes straightforward: you’re not adding a nice-to-have channel, but removing conversion friction in the interface many travelers already default to. The spillover from tourism is most visible in a few verticals, where purchase intent can be captured and completed quickly:

- Retail & e-commerce: duty-free, department stores, supermarkets, CBEC players

- Services & utilities: telecom providers, charging networks, luxury after-sales

- Travel & hospitality: passes, destination guides, hotel chains, resorts

- Transportation & mobility: railways, metros, buses, ride services, airports

- F&B & local life: restaurant reservations, scan-to-order, delivery platforms

Mini programs abroad tend to cluster around three moments in a Chinese traveler’s journey. The same mini program can touch more than one phase, but there’s usually a primary job it does best:

Pre-trip: plan, book, set things up

Before departure, travelers want certainty: where to go, what to book, and how not to get stuck on arrival. Mini programs reduce the need to fight local-language sites or generic OTAs.

- Travel planning: passes, guides, curated routes, and local discovery

- Travel & service booking: hotels, spa, restaurants, airport transfers

- Pre-order & duty-free: reserve products, pick up at airport or in-store

- Setup tasks: connectivity (SIM/data), memberships, warranties, service registration

During-trip: move, enter, navigate, order

On the ground, time and attention are tight. Travelers care less about marketing and more about execution: tickets, routes, entry, food, and shopping that just work.

- Transport: rail/metro tickets, scenic routes, passes, real-time info

- Destination guidance: attractions, tours, audio guides, area recommendations

- F&B and local life: scan-to-order, pickup, delivery, store locator

- Shopping on-site: outlet visits, supermarkets, in-mall offers and coupons

Post-trip: service, loyalty, re-purchase

After the trip, most offline touchpoints disappear. Mini programs that survive this phase give travelers a way to maintain and monetize the relationship from home.

- After-sales & repairs: warranty, service appointments, repair tracking

- Loyalty & membership: points, coupons, perks that live in WeChat

- CBEC re-purchase: buy again from overseas brands discovered on the trip

15 Popular WeChat Mini Programs Outside China

The mini programs below are all designed for Chinese travelers at different points of their journey. They span travel, retail, services, and cross-border e-commerce, and show how overseas brands are using WeChat not as a marketing channel, but as a practical interface for booking, navigation, ordering, and follow-up.

| Mini program | Vertical | Region / Market |

|---|---|---|

| Have Fun in Japan Pass | Travel passes & planning | Japan |

| Berjaya Hotels & Resorts | Hotels & resorts | SEA, UK, Japan, Iceland |

| Changi Airport | Airport services | Singapore |

| KingPower | Duty-free retail | Thailand |

| Shiseido THE GINZA SPA | Spa & beauty services | Japan |

| CMLink | Telecom | UK / overseas markets |

| Casa Batlló Barcelona | Tourism & ticketing | Spain |

| Switzerland Railway | Rail & scenic travel | Switzerland |

| Experience Abu Dhabi | Destination guide | UAE |

| Starbucks HK/MO | F&B, scan-to-order | Hong Kong & Macau |

| Bicester Village | Outlet shopping | UK |

| Big C | Supermarket retail | Thailand |

| Van Cleef & Arpels | Luxury CBEC & service | Global / China CBEC |

| Beautinow | Beauty CBEC | EU → China CBEC |

| iHerb | Health & supplements CBEC | Global → China CBEC |

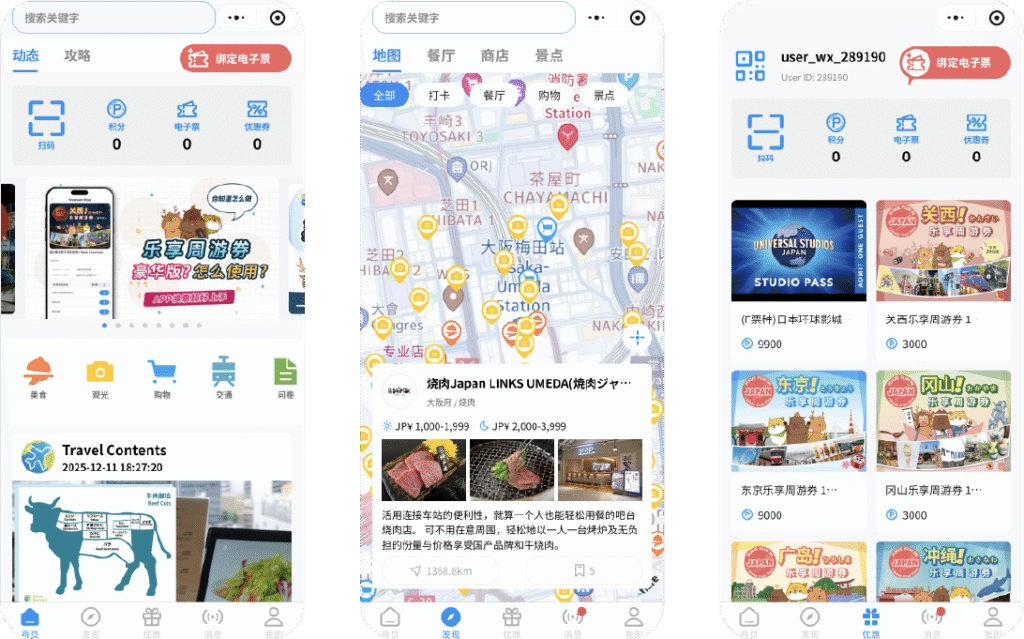

1) Have Fun in Japan Pass

Travel Contents' Have Fun Pass is a WeChat mini program built around Japanese regional travel passes for foreign visitors. It bundles travel guides, an e-ticket wallet (bind, view, exchange passes), and local discovery into one place, so users can plan routes and actually use their passes without juggling physical tickets, multiple apps or PDFs.

Beyond storing tickets, the mini program pushes deals and coupons, directory-style listings for attractions and services near each pass area, and a rewards and points system for repeat use. In practice, it turns the pass from a one-time voucher into a small ecosystem: users buy or bind the pass, discover where it’s worth using, and are nudged back into specific merchants through targeted offers.

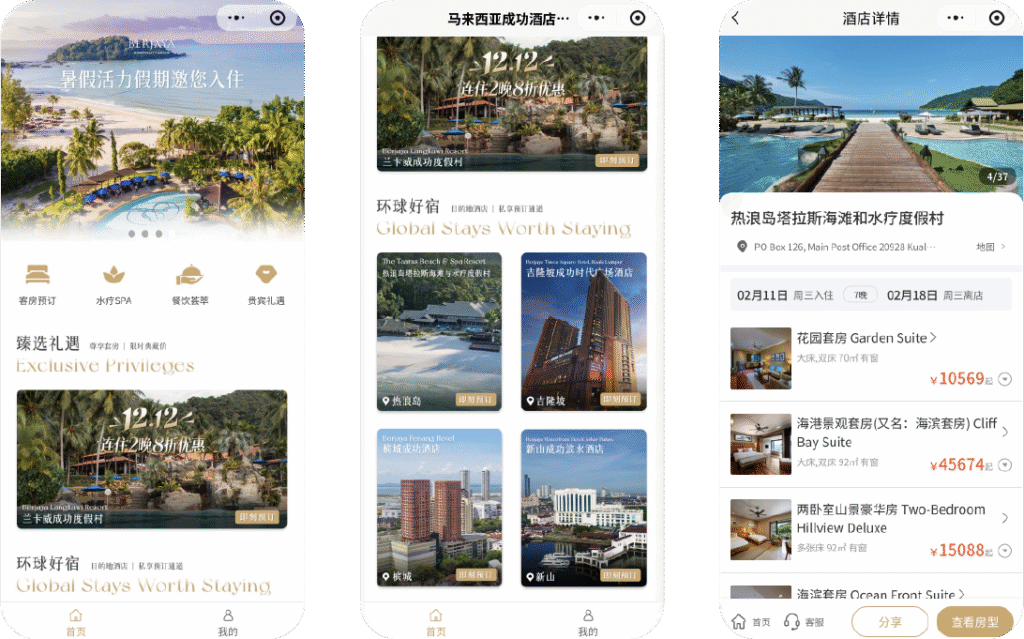

2) Berjaya Hotels & Resorts

Berjaya is a Malaysian group of hotels and resorts with properties across Southeast Asia, the UK, Japan, Iceland, and other destinations. That geography pairs nicely with the fact that Malaysia is the second country by monthly WeChat active users outside China, making WeChat a natural channel to reach Chinese travelers in and around its home market.

Similarly, TMO recently helped a Foreign Luxury Resort build a seamless unified journey on WeChat:

International Luxury ResortA French luxury resort brand partnered with TMO to create a localized WeChat Mini Program that optimizes complex processes and enhances the UX for Chinese users.

The mini program serves as a direct booking and service channel, pulling most of the pre-trip workflow into WeChat:

- Explore room types and packages without OTAs or local-language sites

- Book stays directly from within WeChat

- Reserve spa and dining services after booking

- Buy and redeem gift cards and access VIP-style perks

Instead of functioning as a simple booking widget, the mini program acts as a controlled environment where Berjaya can shape discovery, capture direct bookings, and surface upsell opportunities tailored to Chinese guests.

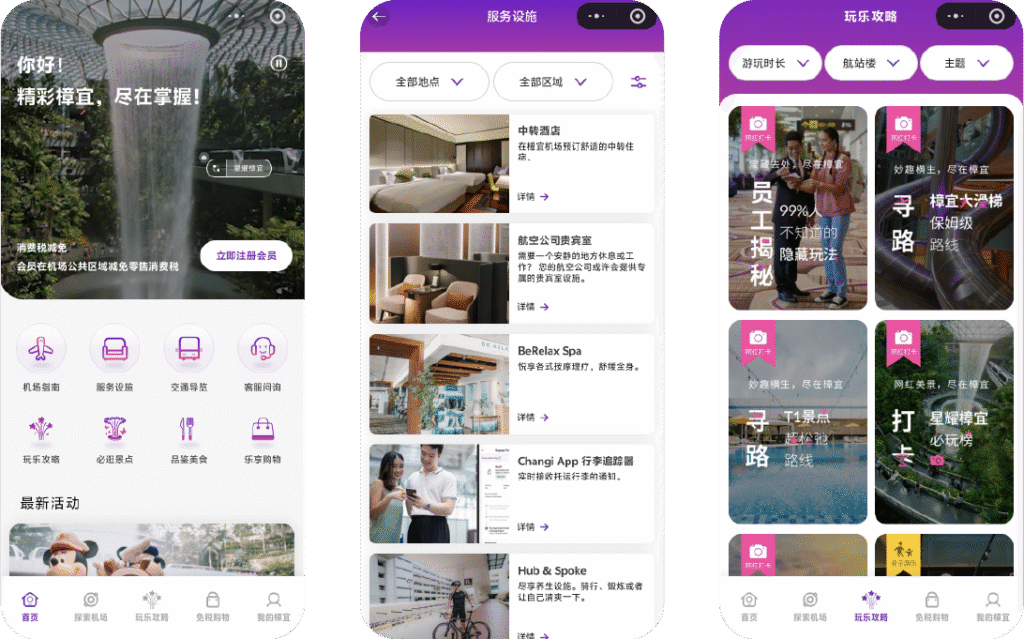

3) Changi Airport

Changi Airport is one of Southeast Asia’s main hubs for Chinese travelers, and its mini program turns all facility services into a single entry point to help visitors understand where to go, what’s available, and how to use their time in the airport.

The mini program focuses on airport logistics and services that matter during tight connections or long layovers:

- Check basic flight and terminal information without switching apps

- Browse and access airport facilities such as lounges or rest areas, plus practical services

- Find transport options and transfers to and from the airport

- Discover shopping and F&B options, along with promotions and featured stores

- Reach airport support when something goes wrong or plans change

For Chinese travelers, this compresses a messy, multi-screen experience into one WeChat surface: plan how to move through the airport, decide where to spend time and money, and get help when needed, all without dealing with unfamiliar local apps or websites.

4) KingPower

KingPower is Thailand’s flagship duty-free retailer, and its mini program brings the pre-departure shopping experience directly into WeChat. Instead of browsing in-store at the last minute, Chinese travelers can explore products, compare prices, and line up purchases long before arriving at the airport.

The mini program streamlines the duty-free workflow:

- Browse categories and flagship brands with China-facing content

- Access exclusive coupons and promotions reserved for WeChat users

- Pre-order products for airport pickup, so travelers don’t lose time at departure

- Use loyalty and membership features to stack additional savings

- Receive updates tied to store hours, locations, and travel schedules

For travelers, this replaces the stressful, time-constrained airport shop visit with a more deliberate, predictable process. For KingPower, it shifts discovery and intent formation into WeChat, where Chinese travelers already spend their time, and captures purchases that might otherwise be lost to queues or rushed departures.

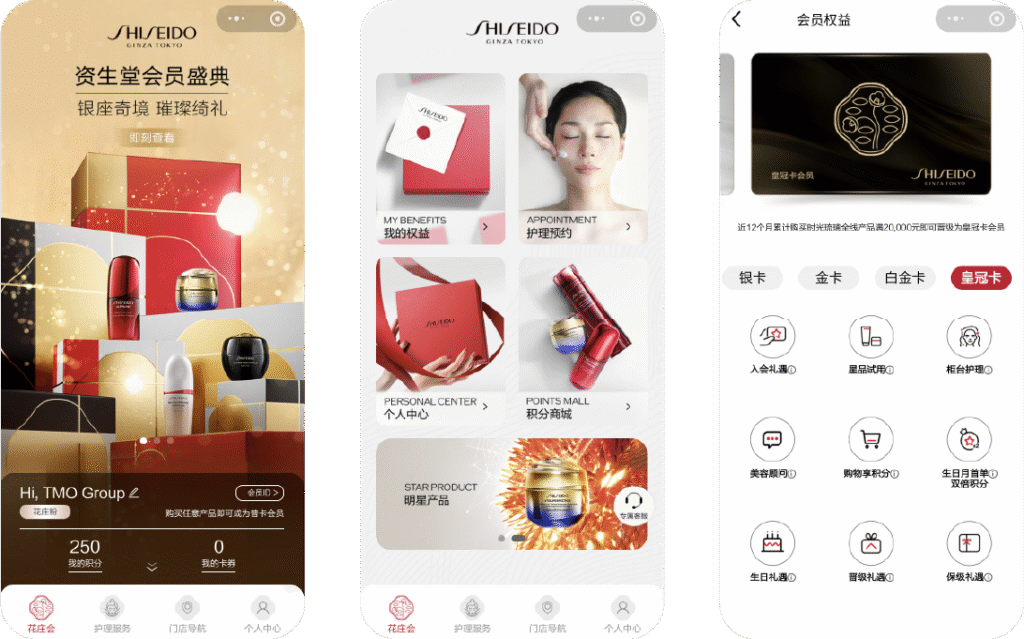

5) Shiseido THE GINZA SPA

Shiseido’s THE GINZA SPA mini program extends the brand’s premium beauty experience into WeChat, giving Chinese travelers a way to plan treatments and store visits before they even arrive in Japan. Instead of navigating local-language booking systems, travelers can explore services and reserve appointments directly in a familiar environment.

The mini program blends service booking with a lightweight loyalty layer:

- Browse spa services and treatment menus with clear descriptions

- Reserve appointments without calling or navigating external sites

- Access membership tiers and perks, reinforcing the premium positioning

- Redeem trial services or introductory offers for first-time visitors

- Use the store navigator to locate nearby Shiseido counters or THE GINZA locations

It’s a focused example of how a service-heavy category like beauty can reduce friction for travelers: discovery, reservation, and brand touchpoints all sit inside WeChat, where expectations around convenience and personalization are already set.

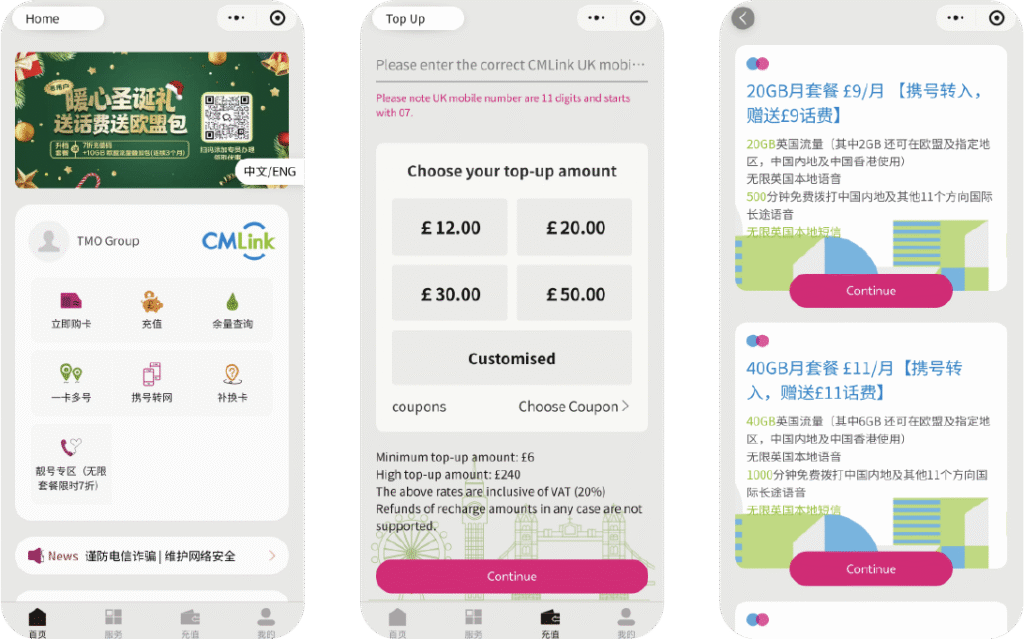

6) CMLink

CMLink is a China Mobile brand aimed at overseas users, and its mini program gives Chinese travelers a way to sort out connectivity before or as they arrive in markets like the UK and beyond. Instead of hunting for local SIM deals or wrestling with unfamiliar carrier sites, they can handle most telecom tasks directly in WeChat.

The mini program focuses on the essentials of staying connected abroad:

- Buy local or travel SIMs and starter packs targeted at Chinese users

- Recharge existing numbers with top-ups in familiar payment methods

- Browse and switch data plans suited to short trips or longer stays

- Transfer or bind numbers so users can manage multiple SIMs in one place

- Reach customer service without needing to call a foreign-language hotline

For Chinese travelers, CMLink effectively turns “sort out mobile service” into just another WeChat flow. Connectivity stops being a separate chore and becomes a pre-trip or arrival task they can handle in the same app they use for everything else.

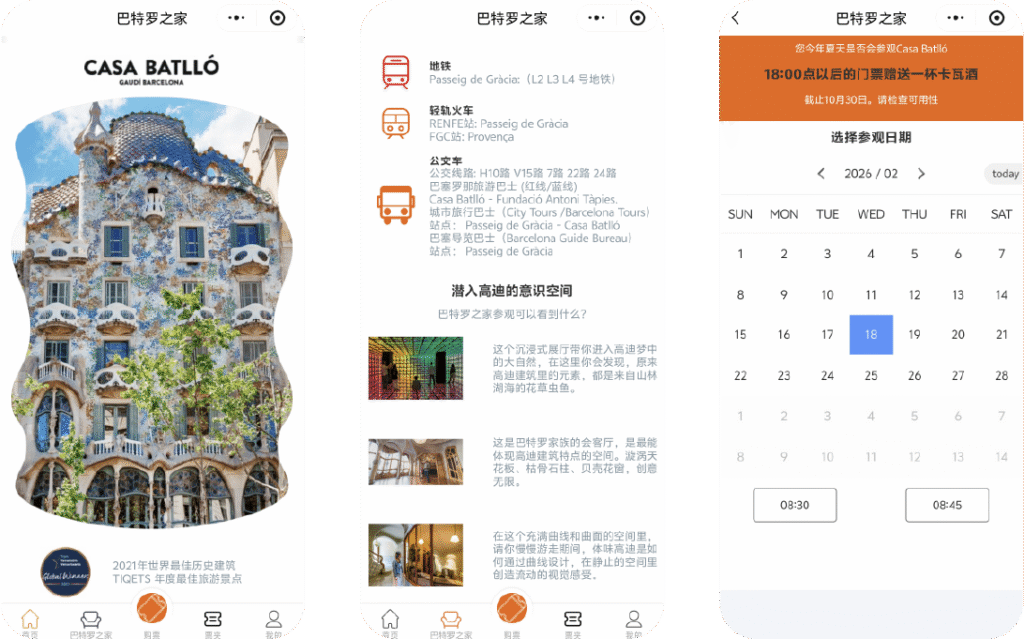

7) Casa Batlló Barcelona

Casa Batlló’s mini program gives Chinese visitors a simple way to plan a visit to one of Barcelona’s most famous Gaudí landmarks without fighting foreign-language sites or third-party ticketing platforms. Everything needed for the visit lives in a single WeChat flow.

The mini program keeps the experience focused and practical:

- Book tickets for specific dates and time slots

- Check visit information including opening hours and tour options

- See how to get there with basic transport guidance from key areas in the city

Where it gets interesting is how this plugs into discovery. A traveler might see Casa Batlló in a WeChat Moments ad, an article, or shared content from a friend, tap the mini program card, and be one step away from booking. The same channel that creates interest also closes the loop, turning soft awareness into a confirmed visit without ever leaving WeChat.

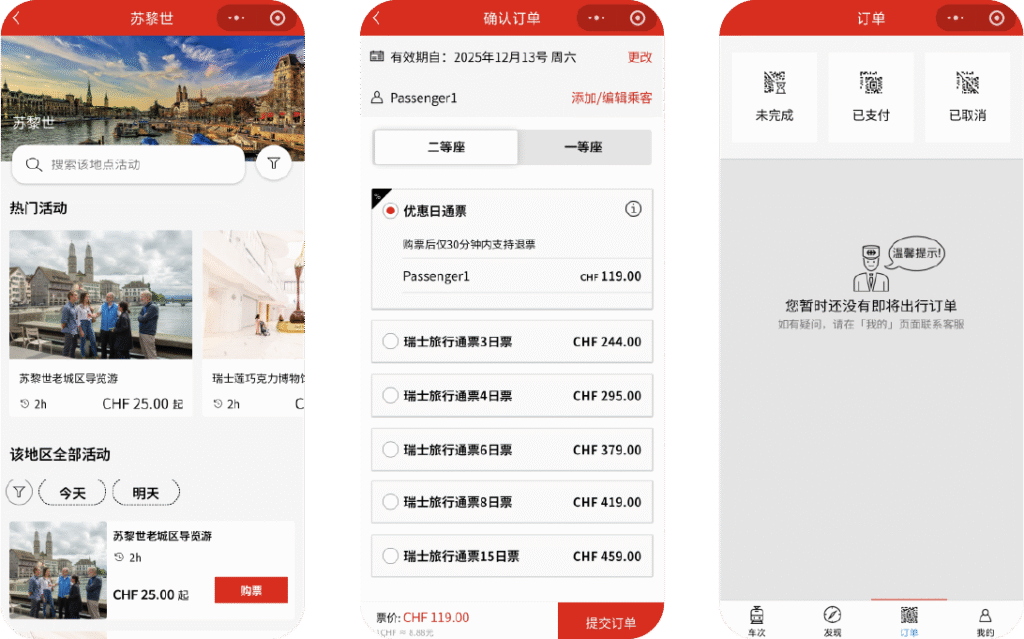

8) Switzerland Railway

Switzerland Railway’s mini program brings transit and sightseeing into a single interface for Chinese travelers exploring the country’s well-known scenic routes. Instead of navigating unfamiliar ticket machines or multilingual transport sites, travelers can plan journeys and manage bookings directly through WeChat.

The mini program supports the core actions needed to move around Switzerland:

- Explore scenic routes and rail passes, with descriptions in Chinese

- Book train tickets without switching to external platforms

- Store and retrieve bookings inside WeChat for quick access during travel

- Receive travel suggestions tied to major attractions along each route

For visitors, this removes the guesswork from navigating a foreign rail system. For Switzerland Railway, it channels a high-value tourism segment into a booking flow that is both familiar to Chinese travelers and more efficient than relying on general OTA traffic.

9) Experience Abu Dhabi

Experience Abu Dhabi is a destination mini program that helps Chinese travelers figure out what to actually do once they arrive in the UAE’s capital. Instead of piecing together blogs, maps, and random recommendations, they can browse curated options and logistics from inside WeChat.

The mini program acts as a lightweight city guide and planner:

- Explore tours, attractions, restaurants, and nightlife with structured listings

- Save or share points of interest to organize a loose itinerary

- Use audio tour guides at selected locations, reducing reliance on printed materials

- Check practical information like opening hours, basic directions, and weather

- Discover events or seasonal highlights that might not be visible on generic travel platforms

For Abu Dhabi, it’s a way to present the city as a coherent experience rather than a collection of disconnected spots. For Chinese travelers, it turns “what should I do next?” into a question they can answer directly in WeChat while they’re already on the ground.

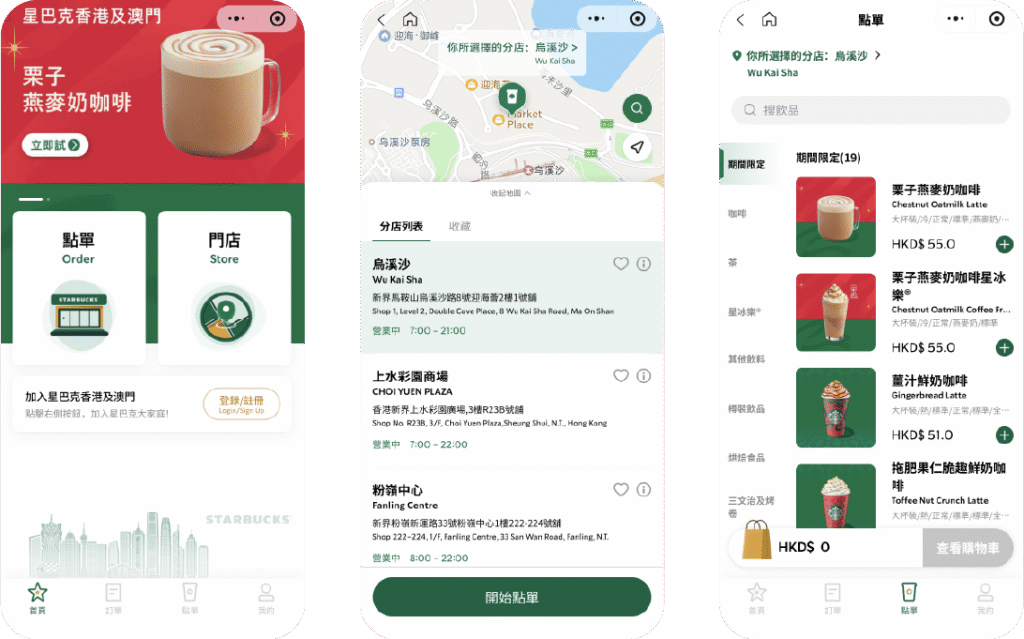

10) Starbucks HK/MO SARs

Starbucks’ Hong Kong and Macau mini program brings one of the most familiar F&B flows for Chinese travelers into a market where queues can be long and store density is high. Instead of waiting in line or navigating kiosk systems, travelers can order through WeChat, which keeps the interaction simple and fast:

- Locate nearby stores with real-time visibility on options

- Browse menus and place mobile orders for pickup, skipping queues entirely

- Use stored payment methods rather than juggling foreign cards or cash

- Receive order updates and pickup instructions without checking another app

For travelers, it reduces friction in a category they use daily. For Starbucks, it channels a loyal and high-frequency customer segment through a predictable ordering flow that shortens queues and increases throughput in busy urban locations.

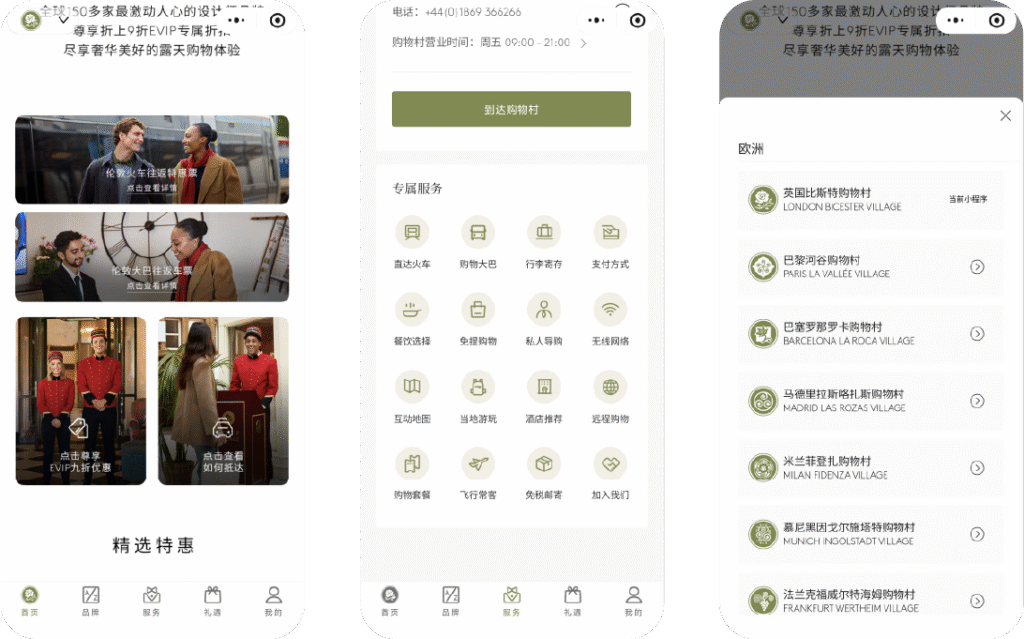

11) Bicester Village

Bicester Village is a well-known luxury outlet destination in the UK, and its mini program helps Chinese travelers plan and optimize a shopping trip that can otherwise feel chaotic and time-limited. Rather than arriving with no plan and wandering between boutiques, visitors can use WeChat to structure their visit in advance and react in real time once they’re on-site.

The mini program focuses on making outlet shopping more deliberate:

- Browse participating brands and boutiques before arriving

- Check current promotions and events, including China-facing offers

- Access concierge services, such as assistance, language support, or VIP services

- Save or plan preferred stores so high-priority visits are not missed

- Receive location and visit information to better time a stop during a wider UK itinerary

For Chinese travelers, this turns Bicester Village from a vague “go shopping there if you have time” recommendation into a concrete, planned activity. For the outlet, it increases the odds that high-intent, high-spend visitors hit the right stores and make use of services designed specifically for them.

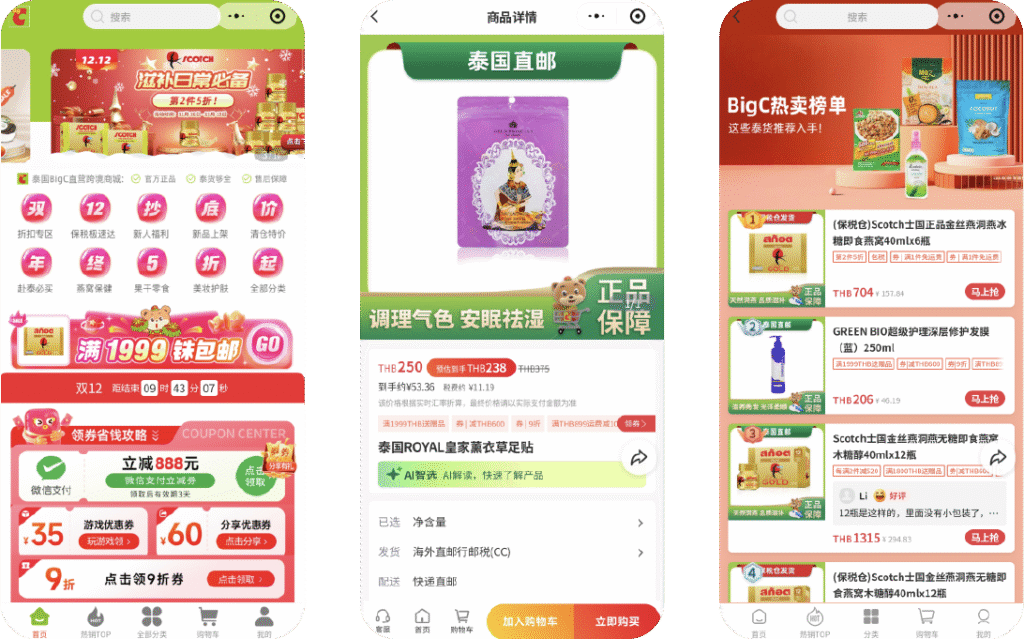

12) Big C

Big C is one of Thailand’s most visited supermarket chains, and its mini program gives Chinese travelers a clearer way to navigate everyday shopping abroad. Supermarkets are often where travelers pick up snacks, essentials, and local products, but the experience can be confusing when signage, promotions, and product information aren’t available in Chinese. The mini program makes the store easier to use and more rewarding:

- Browse product categories and discover popular items among Chinese visitors

- Check ongoing promotions and coupons, many tailored specifically to travelers

- Build a shopping list before visiting a store

- Find nearby branches without navigating local map apps

- Receive updates on special deals and seasonal items

For travelers, this lowers the friction of everyday shopping and highlights products they are more likely to enjoy or bring home. For Big C, it channels a high-volume tourist segment into targeted offers and helps convert casual browsing into planned purchases.

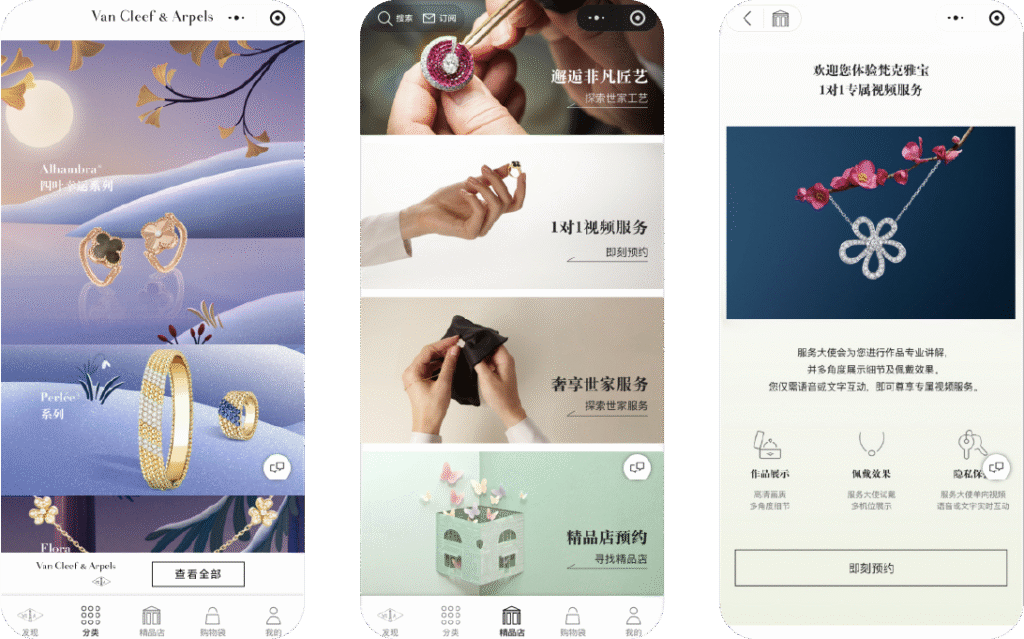

13) Van Cleef & Arpels

Van Cleef & Arpels uses its mini program to extend the luxury purchase far beyond the boutique, which matters when many Chinese customers buy pieces while traveling and only later need support or new items. Instead of treating each trip as a one-off sales event, the brand keeps the relationship anchored in WeChat.

The mini program covers both new purchases and post-purchase care:

- Browse and shop selected jewelry and watch collections via CBEC

- Book boutique or salon appointments for in-person visits

- Request 1:1 consultations or remote guidance from advisors

- Register products and manage service or maintenance requests

- Track repair or service status without chasing emails or calls

For Chinese travelers, it turns a luxury purchase abroad into something maintainable and extendable from home. For Van Cleef & Arpels, the mini program is a structured way to handle after-sales, cross-border shopping, and clienteling in the same channel.

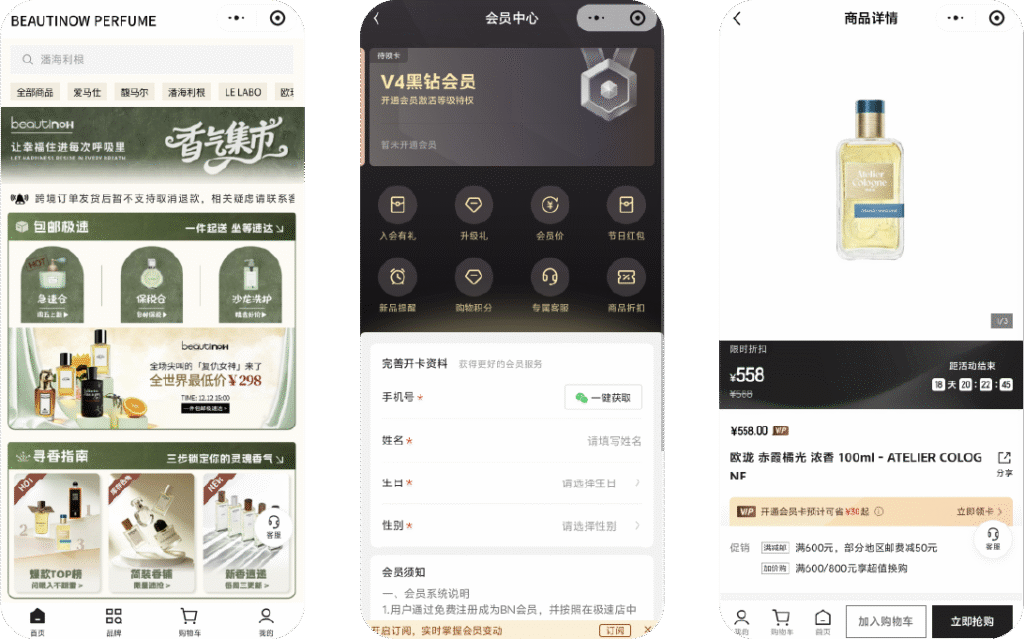

14) Beautinow

Beautinow is a beauty-focused CBEC player that leans on its mini program to turn “I discovered this brand abroad” into “I can keep buying it from home.” Rather than expecting customers to remember product names and hunt across generic marketplaces, Beautinow gives them a dedicated, WeChat-native storefront.

The mini program is built around repeat purchases and loyalty:

- Browse and buy international beauty brands via cross-border shipping

- Earn and redeem loyalty points on repeat orders

- Receive targeted coupons and promotions based on past behavior

- Access customer service for order issues, product questions, or returns

For travelers who first encounter certain SKUs or brands overseas, Beautinow becomes the continuity layer. For the platform, the mini program is a controlled environment to encourage replenishment and maintain a direct, data-rich relationship with Chinese customers.

15) iHerb

iHerb’s mini program brings its health, supplements, and personal care catalog into WeChat, letting Chinese users reorder products they might have discovered while traveling or browsing international channels. Instead of pushing them through a full web checkout each time, the mini program keeps the experience lightweight and familiar.

The feature set is designed for both discovery and efficient reordering:

- Search and browse product categories in a localized interface

- Scan product barcodes to pull up the exact item online

- Access coupons, promotions, and social bonuses that nudge repeat purchases

- Track orders and contact customer service without leaving WeChat

For Chinese consumers who trust iHerb’s assortment and sourcing but don’t want to fight a browser and foreign forms each time, the mini program simplifies the loop. It turns international health and supplement shopping into a repeatable WeChat habit rather than a series of one-off cross-border experiments.

Building Successful WeChat Mini Programs with TMO

Looking across the examples above, it is clear that successful mini programs aren’t the most complex ones. They’re the ones that remove friction at exactly the moment a traveler is ready to act. Here’s what the best implementations tend to have in common:

- 1) They remove an installation step: Mini programs win when the first action is immediate: view a route, buy a ticket, reserve a pickup, top up a plan, place an order. No app store detour, no new account, no “download to continue.”

- 2) They’re built around entry points, not just features: Mini program can be accessed from dozens of touch points, and the highest-leverage ones are usually QR codes, shares in chats, Discover/Search, and links from other mini programs or official accounts. The mindset shift is designing a cohesive path from discovery to intent and transaction rather than treating the mini program like a standalone app.

- 3) They focus on a small set of high-intent tasks: The strongest mini programs usually do 3–6 things exceptionally well: ticket purchase/QR entry, route planning, store locator/pickup instructions, scan-to-order/reorder, coupons that actually apply, support/after-sales, top-up/plan changes.

- 4) They turn downtime into conversion time: Airports, transit hubs, queues, and waiting time are where mini programs quietly outperform “brand websites.” Travelers browse, compare, reserve, then pick up later. It’s not marketing; it’s making dead time useful.

- 5) They keep the relationship alive after the trip: Post-trip is where many brands drop the ball. The best mini programs extend the lifecycle: warranty and service requests, loyalty and offer delivery, and CBEC re-purchase loops for products discovered abroad.

- 6) They localize just enough without overbuilding: Localization shouldn't just be about translating your website for Chinese. An effective approach can mean fewer free-text inputs, clear CTAs, simple flows, and payment/fulfillment steps that don’t require guesswork.

The best mini programs solve a time-sensitive job exactly where Chinese users already face friction: language, unfamiliar apps, unclear pickup rules, awkward payments, or no obvious support channel.

TMO helps brands validate the right use cases, map the traveler journey, and design mini programs that actually convert. That includes building from scratch or adapting an existing web experience into a WebView-based mini program, and integrating it with your current systems (booking engines, CRM, loyalty, payments, inventory, fulfillment, and customer support) so it operates like a real channel, not a brochure.

If you’re targeting Chinese travelers overseas, reach out to us for a tailored proposal. We’ll help you identify the highest-impact mini program use case, prioritize the flows that matter, and turn WeChat demand into measurable conversion.