Southeast Asia’s eCommerce market continues to surge, projected to reach $370 billion by 2030 according to Google, Temasek & Bain. For global appliance brands, this presents both opportunities and risks. To succeed, it's not enough to know what sells: you must understand where, why, and how.

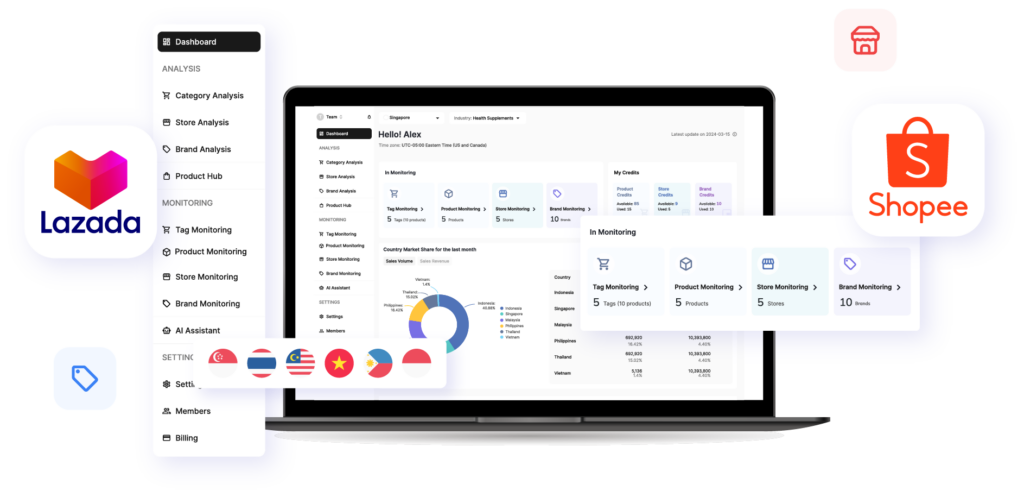

This article combines findings from our Home Appliances (Southeast Asia Outlook December 2024)This free PDF looks at the home appliances market in Southeast Asia: market segments, price ranges, popular brands, and much more.Home Appliance eCommerce Outlook (Oct 2024) and TMO's proprietary Market Insider platform data from Q1 2025, offering both a market-wide overview and country-specific product selection logic to inform go-to-market strategies across the region.

Consumers in this region show strong demand for portable small appliances (such as handheld fans), home cleaning tools (vacuum cleaners), and small kitchen appliances (rice cookers, juicers) from a combination of Europan, American, and Chinese brands alike, as well as some strong local competitors.

Now, let’s dive into the key takeaways from our research into Southeast Asia’s online retail landscape for the Home Appliance industry, its market structure, categories, best-selling brands, price ranges, and consumer trends across the 6 countries with the biggest online eCommerce markets: Indonesia, Malaysia, Thailand, Vietnam, the Philippines and Singapore.

For the last 2 years, TMO Group has been helping brands explore and successfully enter the SEA market with custom data intelligence and market strategy.

1. SEA Home Appliance Market: Top Categories & Best-Selling Segments

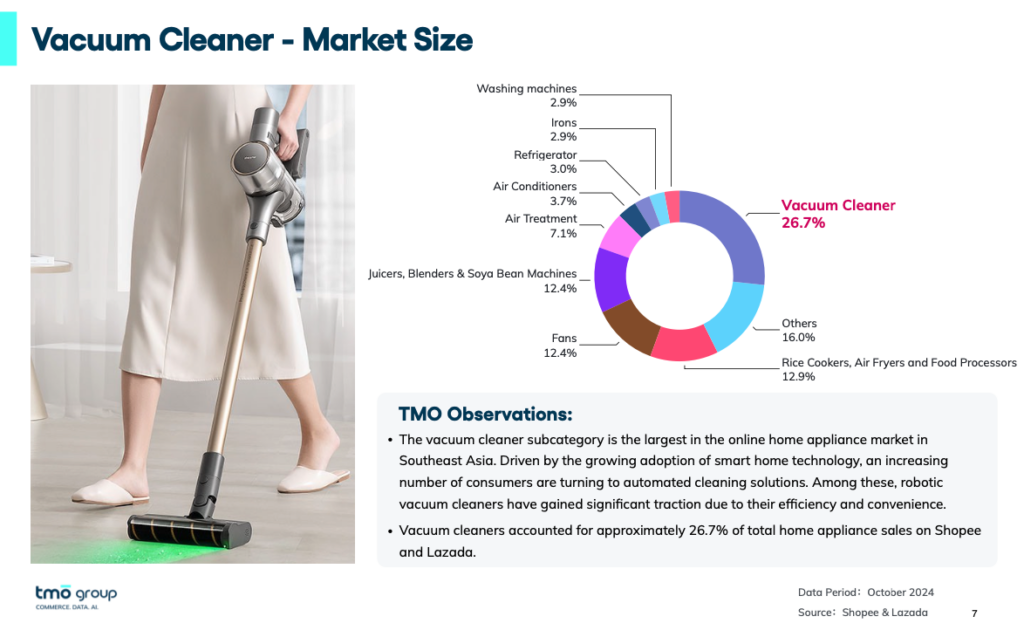

Our 2024 data, sourced from over 380,000 SKUs on Shopee and Lazada, identified 9 key appliance subcategories:

- Vacuum Cleaners

- Rice Cookers, Air Fryers and Food Processors

- Fans

- Juicers, Blenders & Soya Bean Machines

- Air Treatment

- Air Conditioners

- Refrigerators

- Irons

- Washing Machines

Top Performers

- Vacuum Cleaners dominated with 26.7% of total sales, especially Ordinary Vacuum Cleaners (76.6% within the subcategory). In terms of price, the US $50-100 range is the core price range of the overall vacuum market.

- Rice Cookers, Air Fryers & Food Processors accounted for 12.9%, led by Air Fryers (56.7% share), particularly hot in Thailand and the Philippines.

- "Fans" and "Juicers, Blenders & Soya Bean Machines" are tied as the third most-popular categories at 12.4%.

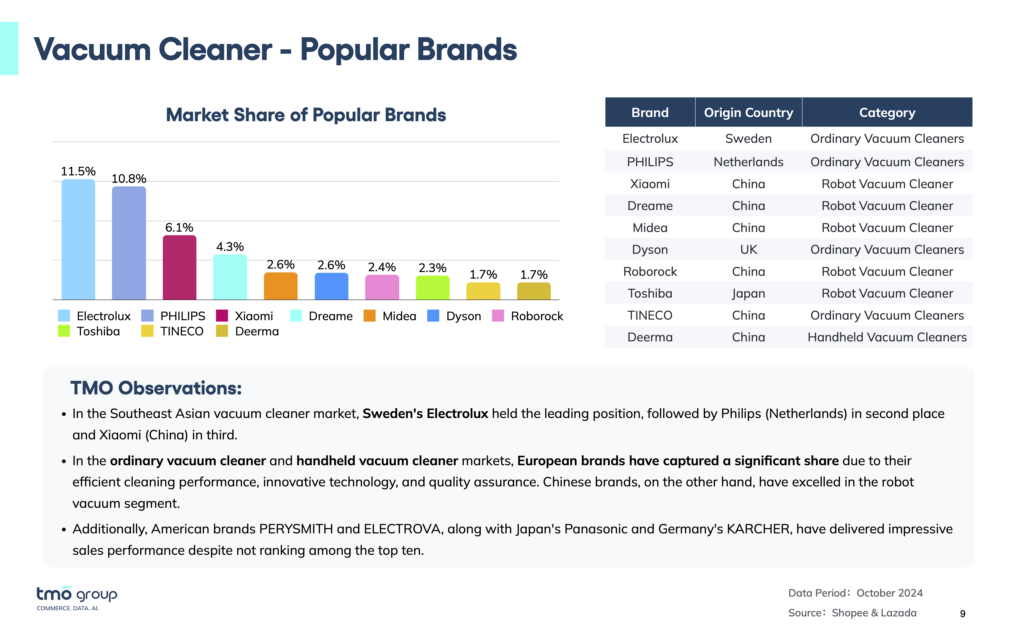

Leading Brands

Chinese brands like Xiaomi, Dreame, Midea, and Roborock excel in categories like Vacuum Cleaners and Sweeping Robots, with Xiaomi leading Air Treatment (8.6% share). In Air Conditioners, TCL, Hisense, and Haier dominate, while Samsung and Hisense are key players in Refrigerators.

Looking to boost your eCommerce competitive intelligence? Our Customized Marketplace Reports are tailored to support your brand’s data needs with detailed analysis.

2. Country-Specific Product Selection Logic

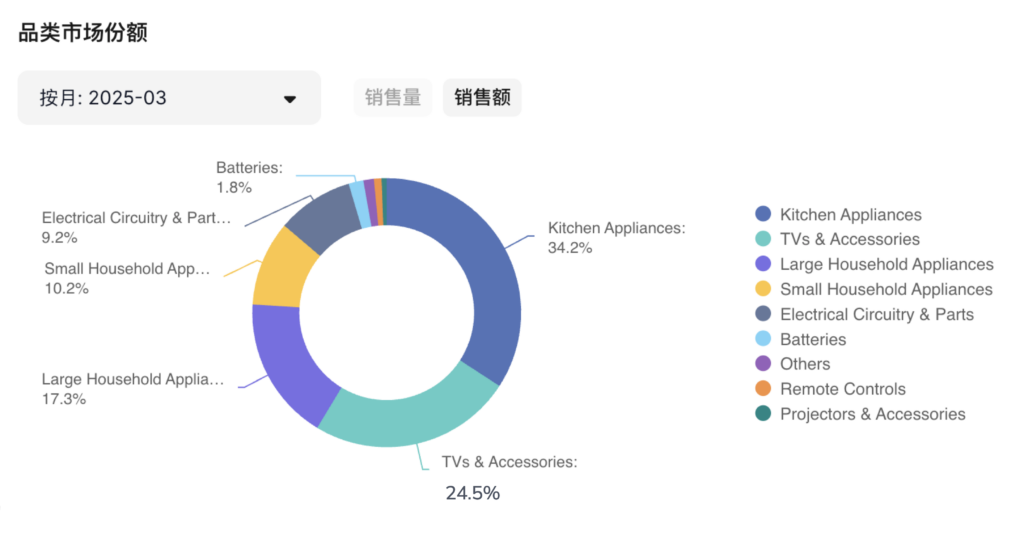

Using Market Insider’s Q1 2025 real-time data, we break down product strategies by country, highlighting user preferences, pricing sensitivity, and feature expectations. As an example, let's look at Indonesia's category breakdown data from March:

Tailoring product selection logic to each country is critical for defining a successful go-to-market SKU strategy in Southeast Asia, where consumer preferences, income levels, cultural norms, and usage scenarios vary widely across markets. A one-size-fits-all approach risks misalignment with local demand: what appeals to tech-savvy, design-conscious consumers in Singapore may fall flat in the highly price-sensitive Philippine market, or miss the mark entirely in Malaysia where halal compliance and dual-tier consumption matter.

Want to explore hidden growth opportunities? Schedule a Market Insider walkthrough and discover how real-time sales data can guide your next move.

By adapting SKUs to reflect these country-specific nuances, brands can improve conversion rates, reduce returns, and build trust with local consumers, ultimately ensuring that marketing efforts and inventory investments are both efficient and impactful.

Thailand: Feature-Rich, After-Sales Sensitive

- Consumers prefer international brands (Japanese, European), with some trust in Chinese names like Xiaomi.

- Product fit: Multifunctional kitchen appliances (steam + air fryer + oven).

- Messaging tip: Emphasize warranty, service guarantees, and bilingual (EN/TH) packaging that emphasizes energy-saving and environmental protection functions.

Malaysia: Dual Market, Culturally Nuanced

The Malaysian market is characterized by the coexistence of mid to high-end consumers and mass price-sensitive users . When selecting products, brands should make precise deployment based on target customer positioning.

- Middle class seeks tech-savvy designs; mass market values price and efficiency.

- Halal sensitivity: Products like easy-to-clean, smoke-free air fryers are a hit.

- Strategy: Offer both smart, app-linked models and all-in-one value appliances.

Philippines: Affordability & Simplicity Win

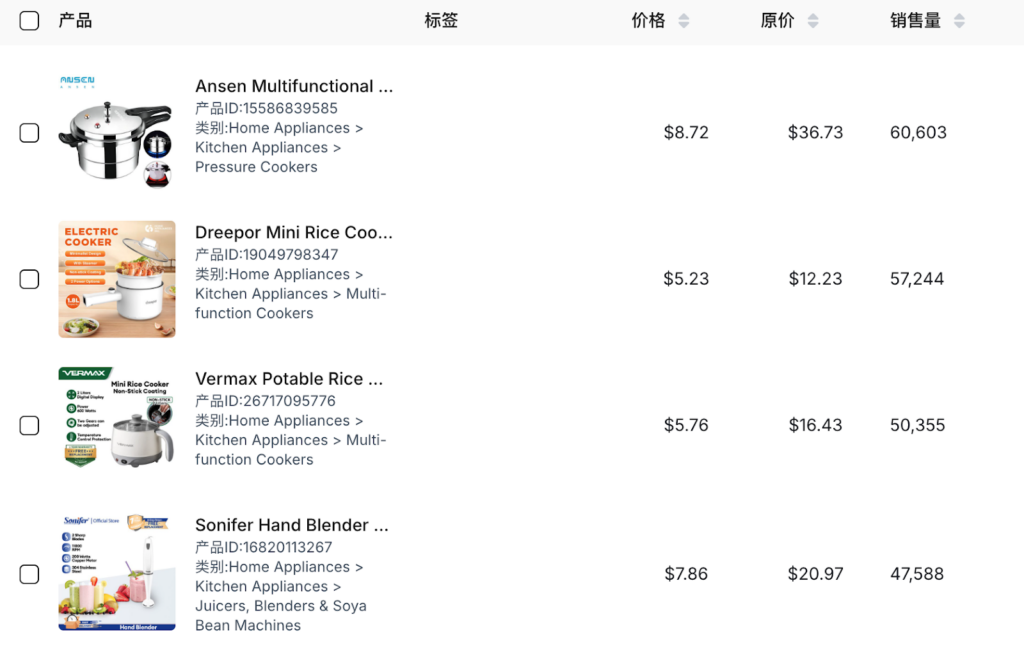

Filipino home appliance consumers are highly price sensitive , and most families have lower-middle incomes. As a result, they prefer home appliances that are inexpensive, high-quality, and easy to maintain, and are highly receptive to Chinese products. What can we learn from looking at the best selling products in Philippines for this time period?

- Highly price-sensitive market with preference for small, space-saving, easy-to-clean appliances.

- Top sellers: portable rice cookers, handheld blenders, multifunction pots.

- Tactic: Highlight scald-proof, voltage-safe, low-delivery-cost packaging.

Indonesia: Demographic Scale Meets Practical Needs

Indonesia is the most populous country in Southeast Asia. E-commerce is penetrating rapidly, and home appliance consumption is showing a trend of popular and rigid demand growth .

- Demand leans toward basic, safe appliances (electric fans, mosquito zappers, rice cookers).

- Pain point: Power instability highlights the need to promote low-voltage, overheating-proof features.

- Tip: Include local plugs, Bahasa Indonesia instructions.

Vietnam: Youth-Led, Social-Driven Demand

Vietnam has one of the youngest consumer groups in Southeast Asia. Family structures tend to be smaller and more urbanized , and users generally pursue "light luxury" home appliances that can improve their quality of life.

- Young, urbanized consumers favor “lazy tech” and aesthetic appliances.

- Popular: cordless vacuums, sweeping robots, USB fans.

- Launch tip: Combine TikTok/Facebook marketing with kits like "smart starter packs".

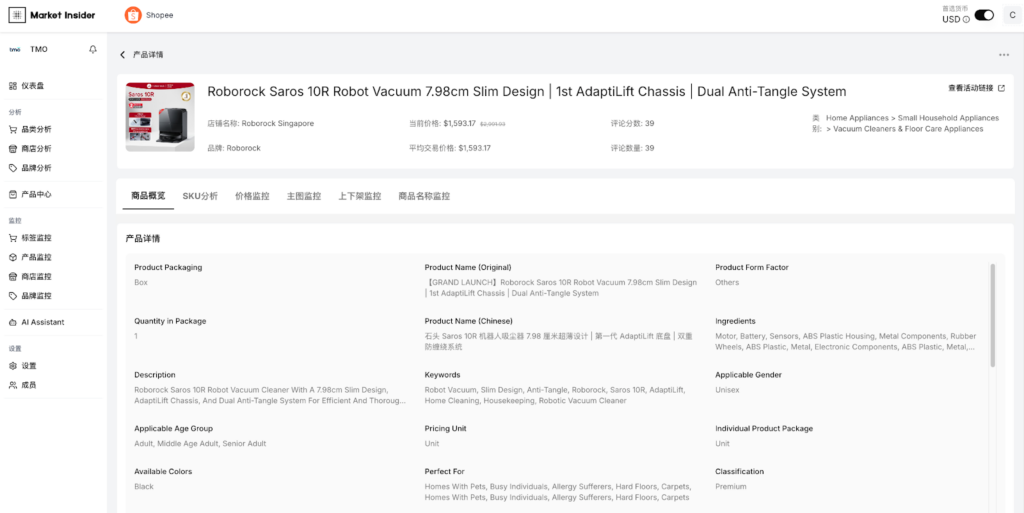

Singapore: Smart, High-End Market

Singapore is one of the mid-to-high-unit-price e-commerce markets in Southeast Asia. Consumers have strong purchasing power and a fast pace of life, and have extremely high requirements for intelligence, design, and after-sales service.

- Consumers expect: international quality, smart features, post-sale service.

- Hot items: smart dishwashers, robot vacuums, coffee machines with WiFi/voice.

- Notable brand: Roborock’s premium lines are strong on Shopee Singapore.

Book a Market Insider demo to see how our Southeast Asia eCommerce data platform can power your product strategy and market entry decisions.

3. From Red Ocean to Blue Ocean: Identifying Untapped Opportunities

One of the most common and costly mistakes overseas brands make when selecting products for Southeast Asia is relying solely on bestseller lists without assessing the competition intensity behind those rankings. While high-volume categories may appear attractive at first glance, they often mask saturated battlefields where price wars, ad fatigue, and commoditized product offerings erode profitability.

Take air fryers in Malaysia as a cautionary example. Although consistently topping category sales charts, this segment has become highly competitive. CPC bidding costs have surged on Shopee, and most listings suffer from undifferentiated visuals and overlapping features, leaving brands little room to stand out without slashing prices. Without a unique angle or added value, brands entering these "red ocean" categories are likely to struggle for margin and visibility.

In contrast, forward-looking brands are capturing "blue ocean" subcategories. These emerging niches where demand is rising but competition remains limited often align with shifting consumer lifestyles, space constraints, or social commerce trends, making them ideal entry points for new or differentiated products. Recent high-potential examples include:

| Emerging Subcategory | Growth Angle |

|---|---|

| Desktop water purifiers | Health trend + small space appeal |

| Folding hair dryers | Travel-friendly design |

| Wireless garment steamers | Viral on social platforms |

To systematically uncover these emerging opportunities, brands should leverage tools like TMO Group’s Market Insider platform to track not just what is selling, but how fast it's growing and how crowded the field is. Key data indicators to watch include:

- MoM sales growth by subcategory to identify surging interest before it peaks.

- Total listings vs. newly listed products to assess market saturation and entry momentum.

- Top keywords to understand what features or benefits consumers are actively searching for.

This combination of trend velocity and market density is critical to validating not only product-market fit but also entry timing and positioning strategy. In short, spotting the next breakout category relies heavily on anticipating what will be hot tomorrow, with the data to back it up.

4. Data-Driven Selection Is the Real Advantage

Southeast Asia's appliance market is diverse, fragmented, and full of potential, but brands can no longer rely on assumptions or apply a one-size-fits-all China strategy. The key is to:

- Combine macro-level category insights with micro-level local consumer behavior.

- Customize product offerings, messaging, and packaging by country.

- Track competition intensity and niche growth trends using tools like Market Insider.

Need help planning your SEA appliance market entry? Explore our eCommerce data services with custom solutions tailored to your category or book a Market Insider Demo.

Growing through Online Marketplace Monitoring & Research

As part of our comprehensive long-term data monitoring and collection services, TMO Group helps clients dive deeper into Southeast Asia’s eCommerce market with our thorough research and analysis, as well as customized reports for various industries, providing a deep understanding of your niche, including market structure, size, and emerging trends.

If you are looking for an eCommerce agency to assist you in your Southeast Asia business expansion, or want to explore other alternatives to grow in the region, reach out to us to learn more about our Consultancy & Strategy Services, from branded eCommerce website development to social commerce and other Cross-border eCommerce Solutions.