Southeast Asia’s dietary supplements market is on a steep growth trajectory. Industry projections estimate the region’s supplements market at over USD 10 billion in 2025, with continued expansion expected through the decade as health awareness rises alongside discretionary spending. In parallel, Southeast Asia’s eCommerce economy is forecast to exceed USD 330 billion this year, with online marketplaces playing a central role in product discovery and purchasing.

Across the region, consumers are increasingly proactive about preventive health, driving demand for vitamins, minerals, probiotics, and other functional wellness products linked to immunity, vitality, and lifestyle-related goals. For brands evaluating expansion into Southeast Asia, success depends less on brand familiarity and more on data-grounded positioning and the ability to adapt quickly to local preferences, price sensitivity, and platform dynamics.

This article highlights selected insights from the Health Supplements (Southeast Asia Outlook December 2025)This PDF report looks at the online health supplements market in Southeast Asia: market segments, price ranges, popular brands, and much more.Southeast Asia Health Supplements Outlook, which you can download to see the full data from our research.

Drawing on SKU-level marketplace sales data (Jan-Jul 2025) from TMO’s Market Insider platform for marketplace intelligence, this article examines top-performing categories, market-by-market differences, and the product-level attributes shaping health supplements eCommerce performance across Southeast Asia.

Category Performance: Where Demand Is Concentrated

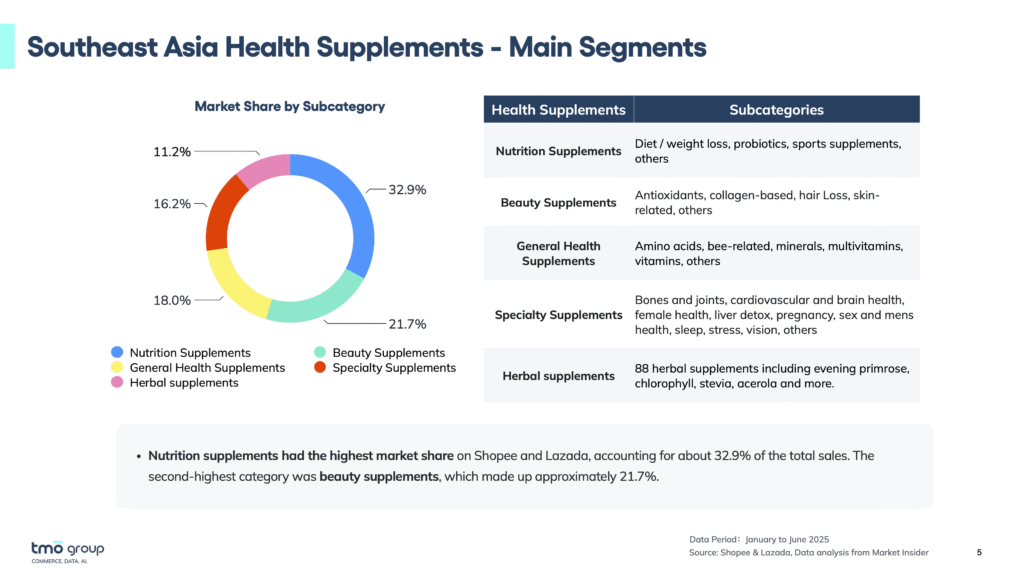

Health supplements demand in Southeast Asia is not evenly distributed. Marketplace sales data shows clear concentration, with a small number of categories accounting for the majority of online revenue across Shopee and Lazada.

- Nutrition Supplements dominate regional sales, driven by diet and weight management, sports nutrition, probiotics, and daily functional supplements. Their scale reflects both repeat purchase behavior and broad applicability across age groups.

- Beauty Supplements are firmly established as the second-largest category. Collagen-based and skin-related products account for the majority of sales, reinforcing the role of supplements as lifestyle products rather than purely medical solutions.

- General Health Supplements, including multivitamins and minerals, act as baseline or maintenance products, often functioning as entry points for new consumers.

- Specialty Supplements (e.g. cardiovascular health, joint support, sleep, stress) serve more targeted needs and typically operate at higher price points, with demand varying significantly by country.

- Herbal Supplements remain a smaller share overall, but retain importance in markets where traditional or plant-based health concepts are deeply embedded.

The category split itself is a strategic constraint. High-share categories offer faster demand validation but come with denser competition, while smaller or more specialized segments require sharper positioning and clearer consumer education. Market entry success is less about inventing new supplement concepts and more about aligning product strategy with where demand is already concentrated.

Health Supplements (Southeast Asia Outlook December 2025)This PDF report looks at the online health supplements market in Southeast Asia: market segments, price ranges, popular brands, and much more.

The Southeast Asia Health Supplements Outlook breaks these categories down further by country, subcategory, pricing structure, and brand composition, providing the context needed to translate category-level signals into concrete portfolio and go-to-market decisions.

While the category hierarchy is broadly consistent, country-level emphasis varies:

- Malaysia leads the region in health supplements eCommerce sales share, with strong demand spanning nutrition, beauty, and specialty products.

- Thailand ranks second, showing comparatively higher traction for general health and condition-specific supplements.

- Indonesia, supported by its large population base, generates the highest overall eCommerce sales value and represents long-term volume potential

- While Vietnam and Singapore skew more heavily toward nutrition-focused products, with Singapore showing stronger demand for premium and imported brands.

These differences underline the importance of aligning category focus with local demand patterns rather than applying a single regional playbook.

Brand Performance: International and Local Players Competing Head-to-Head

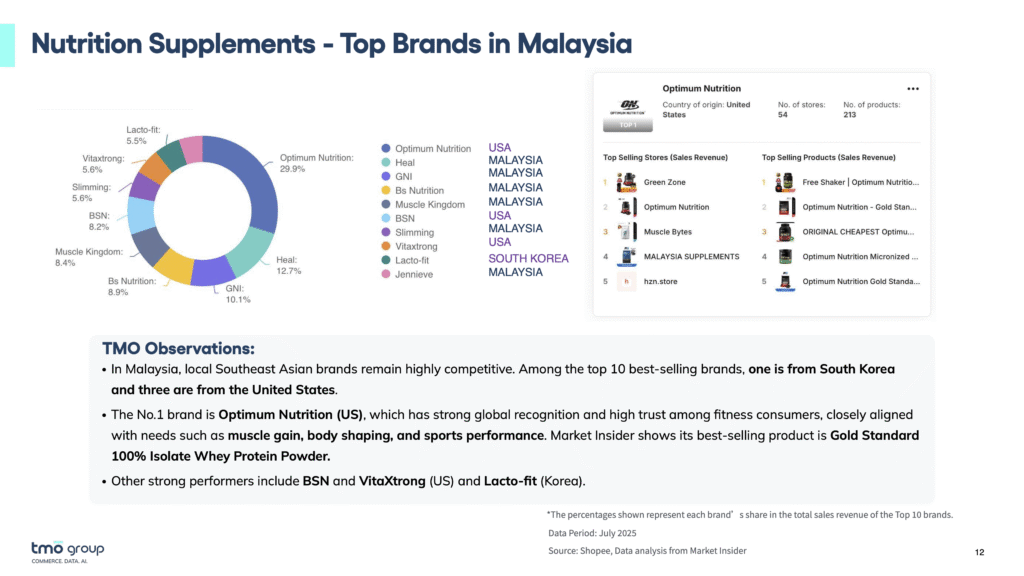

Health supplements eCommerce in Southeast Asia is shaped by direct competition between international and local brands, rather than clear dominance by any single origin. Marketplace sales data shows Western brands from the United States, Australia, and Europe consistently appearing among top performers across nutrition, beauty, and specialty supplement categories, while local and regional brands remain competitive by aligning closely with local demand and pricing expectations.

How different brand groups compete

- International brands tend to perform strongly in segments where efficacy, ingredient credibility, and functional clarity are key purchase drivers. Examples include sports nutrition brands such as Optimum Nutrition, Australian wellness leaders like Blackmores and Swisse, and beauty-focused supplement brands such as Vital Proteins and Heliocare. These brands benefit from established global reputations and clear positioning around specific health outcomes.

- Local Southeast Asian brands compete effectively in mass and general health segments by offering familiar formulations, locally relevant claims, and accessible price points. Halal certification and everyday-use positioning often strengthen their appeal.

- Regional brands, particularly from markets such as South Korea and Singapore, frequently sit between the two, combining imported-brand perception with closer alignment to Southeast Asian consumer preferences.

For Western brands, the data reinforces a key reality: brand origin alone does not determine success. Competitive performance is shaped at the SKU level, where ingredients, claims, dosage forms, and pricing intersect with local consumer expectations. Western brands tend to outperform where consumers are willing to pay for perceived efficacy, but face stronger pressure in entry-level and maintenance categories where local players are structurally advantaged.

Product Attributes & Ingredients: What Actually Drives Conversion

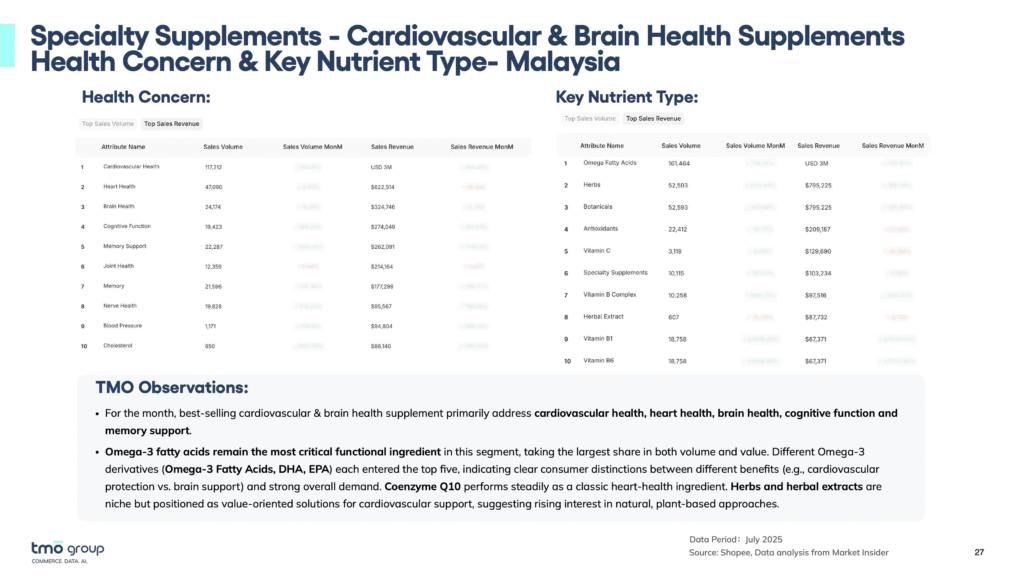

Across Southeast Asia, health supplement purchase decisions are driven less by brand storytelling and more by clear functional signals at the SKU level. Marketplace data shows that consumers respond strongly to products with familiar ingredients, explicit benefit claims, and dosage formats that fit daily routines. Rather than chasing novelty, top-performing SKUs tend to align with well-established ingredient expectations tied to specific health outcomes. Several ingredient groups consistently appear across high-performing products:

- Probiotics built around widely recognised strains such as Lactobacillus and Bifidobacterium, primarily positioned around digestive health, immunity, and weight management.

- Omega-3 fatty acids (EPA and DHA) dominating cardiovascular and brain health supplements, often paired with claims around heart health, cognitive support, and aging.

- Collagen as the core driver in beauty supplements, supported by antioxidants and skin-related functional claims.

- Vitamins and minerals, particularly vitamin C and multinutrient blends, forming the backbone of general health and immunity-focused products.

The prevalence of these ingredients indicates a market that is already educated. Consumers are not experimenting blindly; they are repurchasing ingredients they understand and trust.

Beyond that, several product attributes repeatedly correlate with stronger sales performance:

- Dosage form: Powders, capsules, and tablets dominate across categories, balancing convenience, dosage control, and price efficiency.

- Functional clarity: Products with a single, clearly stated primary benefit consistently outperform those with diffuse or overly broad claims.

- Price positioning: Mid-range price bands tend to generate the highest sales value, while lower-priced SKUs drive volume, particularly in entry-level and maintenance categories.

For Western brands, the data highlights an important constraint: differentiation in Southeast Asia rarely comes from ingredient novelty alone. Instead, performance depends on how effectively familiar ingredients are packaged into clear use cases, priced within accepted ranges, and positioned against competing SKUs on marketplaces. Ingredient decisions that may feel obvious from a formulation standpoint often behave very differently once real marketplace sales data is applied.

Market Insider: Turning Marketplace Data into Confident Market Decisions

Health supplements eCommerce in Southeast Asia is defined by fast-moving demand signals and highly competitive marketplaces. For brands planning regional expansion or optimizing existing portfolios, understanding which categories, brands, and product attributes perform and where, is critical. Marketplace sales intelligence provides the foundation for informed market assessment, enabling brands to align product strategy with observable consumer behavior rather than assumptions.

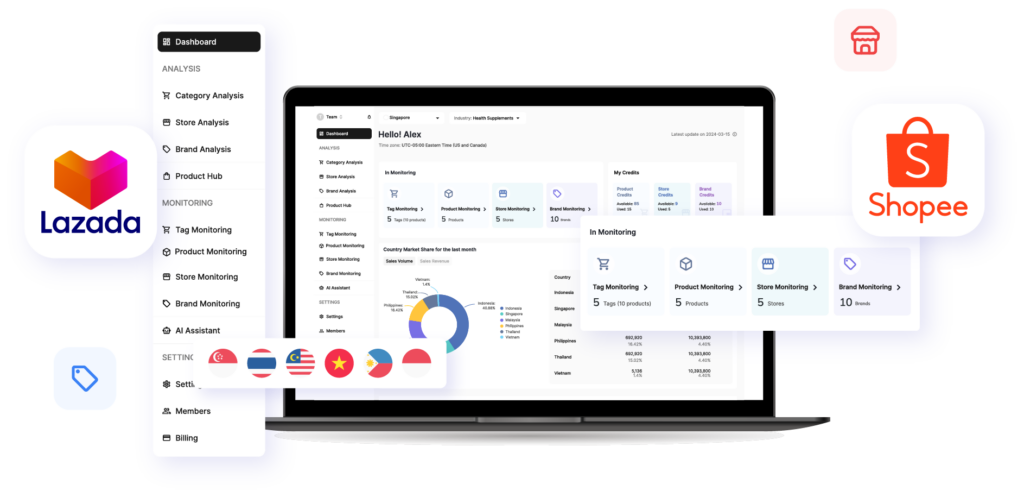

These insights are powered by Market Insider, TMO Group’s enterprise data platform that consolidates multi-country sales intelligence from Shopee and Lazada. By offering category snapshots, brand analytics, SKU-level tracking and long-term trend monitoring, Market Insider enables teams to read the market with clarity: which categories are trading up, where premium positioning holds, how narratives shift between countries, and where competitive pressure is intensifying.

Market Insider spans Beauty, Skincare, Health & Wellness, Food & Beverage, Home Appliances, Sports & Outdoor, Mother & Baby and Pet Care. The platform provides comprehensive category snapshots, brand-level analytics and SKU-level tracing across the entire competitive field, enabling brands to monitor emerging trends, assess competitive pressure and validate market-entry strategies with precision.

TMO's Market Insider is a paid enterprise-level data platform. Schedule a Market Insider Demo and discover how sales performance insights can guide your next move.