Southeast Asia’s Health & Beauty sector continues its upward climb, both in consumer demand and digital adoption. According to Statista, the industry is projected to exceed USD $34 billion in 2025, with a growing share shifting to online platforms like Shopee and Lazada.

Yet despite the size of the opportunity, the landscape is anything but uniform. Each country shows unique preferences shaped by climate, culture, price sensitivity, and consumer maturity. Understanding these nuances is key for International brands seeking to successfully enter or remain competitive in the region.

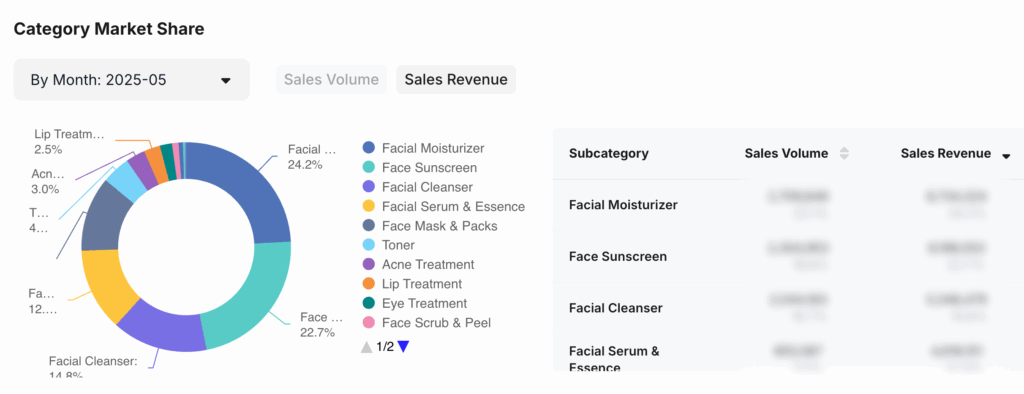

To help brands decode these shifts, TMO Group analyzed Q1 2025 sales data from our Market Insider platform, covering top categories, brand performance, and SKU-level trends across six countries. This article highlights what’s really selling and why, so global and regional brands can make smarter, data-driven entry and growth decisions across Southeast Asia.

For the last 2 years, TMO Group has been helping brands explore and successfully enter the SEA market with custom data intelligence and market strategy.

Indonesia and Vietnam Lead in Color Cosmetics and Skincare

The Beauty segment showed strong market-specific variation in Q1 2025, with Indonesia and Vietnam generating the highest GMV among the six Southeast Asian countries analyzed. Subcategory preferences differed materially, confirming that consumer demand is highly localized within the region.

Across markets, functional product labeling and format clarity (e.g., ampoules vs. serum; matte vs. dewy finish) were more predictive of sales than brand recognition. High-volume SKUs typically had concise titles, strong ingredient disclosure (e.g., niacinamide, hyaluronic acid), and platform-native language use. In addition, it is worth noting that high-performing beauty listings did not rely on deep discounting. Instead, conversion appears to be linked to clarity, relevance of product traits, and localized SEO optimization.

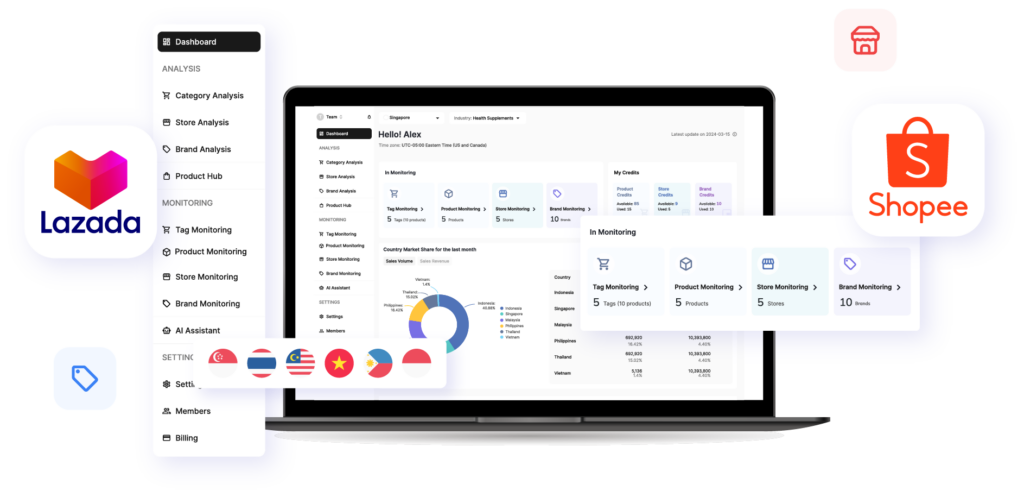

TMO's Market Insider is a paid enterprise-level data platform for the Health, Beauty & Personal Care Industries. Schedule a Market Insider Demo and discover how sales performance insights can guide your next move.

Indonesia: Color Cosmetics for Hot & Humid Conditions

- Base makeup products such as matte foundations, oil-control powders, and long-wear cushions, were consistent best-sellers.

- Waterproofing, sweat resistance, and anti-shine claims performed particularly well.

- Bundled SKUs (e.g., “foundation + sponge” or “powder + refill”) converted more frequently in official shops and influencer-linked stores.

Keyword drivers: “oil control,” “matte finish,” “long-lasting,” “non-cakey,” “for oily skin”

Vietnam: Brightening Skincare and Sun Protection

- Vietnamese consumers showed strong preference for whitening serums, sunscreens (SPF 50+), and anti-acne care, products often marketed under the “clean beauty” or “sensitive skin safe” banners.

- SKUs that highlight ingredients like niacinamide, vitamin C, or Centella asiatica (cica) saw strong performance.

- Skin tone-evening and glow-enhancing benefits were often bundled with natural or herbal positioning.

Keyword drivers: “SPF 50 PA+++,” “non-comedogenic,” “lightweight serum,” “acne-safe,” “brightening,” “cica”

Brand Observations

- Global brands (L'Oréal, Garnier, Laneige) continued to dominate in base makeup and facial serums.

- However, regional upstarts, particularly those positioned around natural ingredients or dermatologist-tested claims, gained traction in Vietnam and Thailand.

Strategic Takeaway: Climate and skin concerns drive real differences in category demand. Brands should optimize SKUs not just by category (e.g., “serum”) but by format, claim, and skin concern. For example, a foundation SKU optimized for Indonesia might underperform in Vietnam unless it adds whitening or acne-prevention benefits.

What Winning SKUs Have in Common

While brands and subcategories vary across countries, the top-selling SKUs on Shopee and Lazada in Q1 2025 consistently shared a few key characteristics, especially in how they positioned value, addressed consumer concerns, and presented product information.

Looking to boost your eCommerce competitive intelligence? Our Customized Marketplace Reports are tailored to support your brand’s data needs with detailed analysis.

1. Mid-Tier Pricing Wins Across Categories

- For skincare and cosmetics, most top-performing SKUs were priced between $5–$15 USD.

- For supplements, successful listings often sat in the $10–$20 USD range, especially for bundled packs or products promoting daily use.

Why it matters: This pricing range strikes a balance between perceived effectiveness and affordability, particularly in markets like Indonesia, Vietnam, and the Philippines.

2. Packaging That Signals Functionality

- Best-sellers often used compact, travel-friendly formats (e.g., pouches, sachets, stick packs).

- Packaging highlighted functional claims, such as:

- “SPF50+ PA+++”

- “Halal-certified”

- “For sensitive skin”

- “Non-GMO / Sugar-free”

Labels with ingredient callouts (e.g., cica, niacinamide, collagen) were more likely to perform well especially when paired with “dermatologist-tested” or “natural” positioning.

3. High-Converting Keywords & Listing Optimization

- Titles used combinations of benefits + ingredients + format:

- “Brightening Niacinamide Serum 30ml – For Acne-Prone Skin”

- “Fat Burner CLA Capsules – 60-count / 1 Month Supply”

- Listings that included ingredient transparency, before/after photos, and usage tutorials had higher review volumes and better conversion.

Store strategy note: Products sold in multi-brand stores with strong local language SEO often performed equally or better than those in flagship stores, especially for emerging brands.

Takeaway: The most successful SKUs align price, promise, and presentation. For Health and Beauty brands entering SEA, retail readiness revolves around how that product speaks to the local consumer’s needs, expectations, and search habits.

Suggestions for Brands Targeting SEA’s Beauty Category

| Strategic Focus | Recommendation |

|---|---|

| Subcategory-Level Positioning | For high-traffic categories like facial makeup in Indonesia, use search-driven language (e.g., “blurred pores,” “soft-focus effect”) paired with KOL makeup demo videos and visual reviews to drive conversion and brand lift. |

| Product Claims for Vietnam | Emphasize “sun protection + whitening” with clean beauty positioning. Labels such as “fragrance-free,” “alcohol-free,” and “sensitive-skin friendly” increase trust among Vietnamese consumers. |

| Promotional Integration | Align social and eCommerce campaigns. Link TikTok/Facebook content to Shopee/Lazada campaigns using event-based themes like “Summer Makeup Challenge” or “Must-Have Sunscreen for Outdoor Commuters.” |

| Climate-Based Claims | Given SEA’s hot, humid climate, prioritize water-resistant, oil-control, and long-wear makeup formats. Incorporate everyday life scenarios like commuting to communicate relevance and performance. |

Using Real Data to Guide your Product Strategy

Southeast Asia has some of the world’s most dynamic Health & Beauty markets, but what sells, and why, changes by country, platform, and category. Q1 2025 data from Market Insider confirm that both Health and Beauty segments are shaped more by local use cases and claim logic than by brand strength or regional trends.

For brands expanding regionally, the implication is direct: do not lead with brand narratives or category averages. Lead with product attributes mapped to local behavior instead, and optimize listings for platform search, local language, and functional proof instead of aspirational copy. Avoid extrapolating from one market to another without reviewing SKU-level data.

TMO Group’s Market Insider platform helps brands and retailers track these shifts in real time across Shopee, and Lazada:

| Feature Module | Description |

|---|---|

| Hot-Selling Categories List | Filter top subcategories by country, platform, and time period. |

| Hot-Selling Brands and Stores | View rankings of top-performing brands and stores by country and platform. |

| Cross-Border Market Comparison | Compare sales performance of the same category across multiple countries. |

| Best-Selling Products Center | Track product-level attributes, rankings, and sales trends over time. |

Want to see what’s driving sales in your category? Book a Market Insider demo and take the guesswork out of your SEA go-to-market strategy.