Japan boasts one of the world’s most mature consumer markets, with eCommerce sales reaching approximately US $110 billion in 2023—and continuing to grow steadily. Fueled by high disposable incomes, a strong preference for domestic and premium goods, and near-universal internet access, Japan ranks as the fourth-largest eCommerce market globally.

Within this landscape, Rakuten remains a cornerstone of online shopping behavior. With over US $30 billion in annual transaction volume and a sprawling digital ecosystem that spans shopping, finance, travel, and mobile services, Rakuten’s loyalty-driven model makes it a strategic priority for both domestic brands and cross-border sellers aiming to expand in Japan.

For overseas brands considering market entry, refining product strategy, or monitoring local competitors, keeping up with category shifts and fast-moving trends is crucial.

To support these goals, TMO Group now offers a Japan. eCommerce sales estimates (March 2025)TMO Group presents sales estimates from Rakuten, one of the largest e-commerce platforms in Japan. The report covers the SKUs, sales volume and revenue, price ranges, and best-selling products for major categories.sample Rakuten Data Pack (March 2025)—a free downloadable resource summarizing:

- Sales performance by product category and subcategory

- Top-selling products and their price range distribution

- Notable brand activity and high-performers

These reports provide a strategic snapshot of the platform—but they’re also just the beginning. Each data pack serves as a sample of our larger data capabilities, which include long-term category monitoring, competitor benchmarking, and custom eCommerce intelligence tailored to your brand’s goals.

For full-scale tracking, brand-specific monitoring, and tailored market dashboards, explore our Marketplace Intelligence Data Services.

December: Rakuten eCommerce Highlights

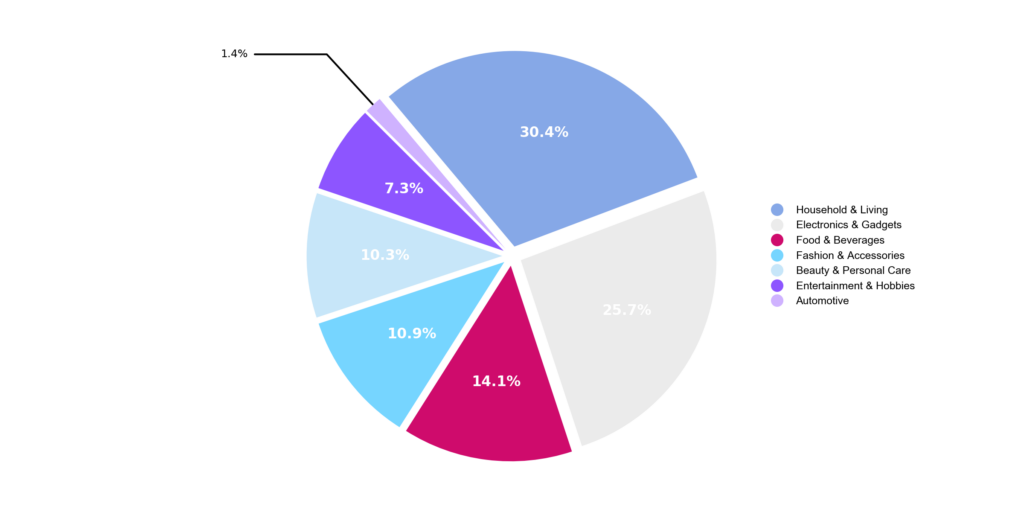

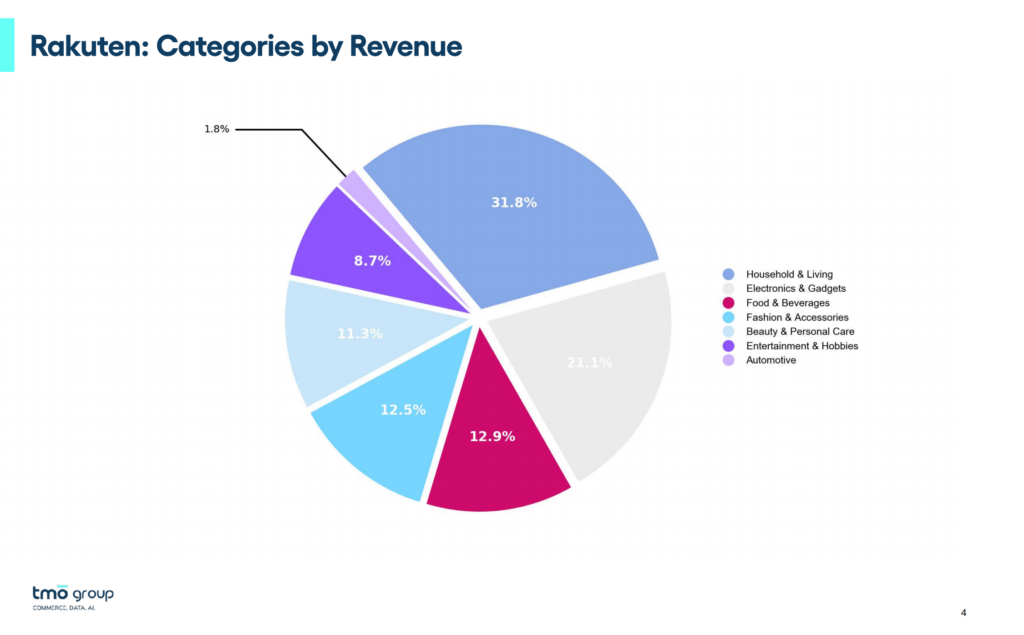

- Category Performance: Electronics & Gadgets (28.6%) became Rakuten’s top-grossing category in December, narrowly overtaking Household & Living (27.0%). From a volume perspective, however, Household & Living remained dominant, accounting for 28.2% of total sales, underscoring its role as Rakuten’s primary traffic and order driver. The split highlights Rakuten’s dual structure: Electronics driving revenue concentration, while Household & Living sustains scale through high-frequency purchasing.

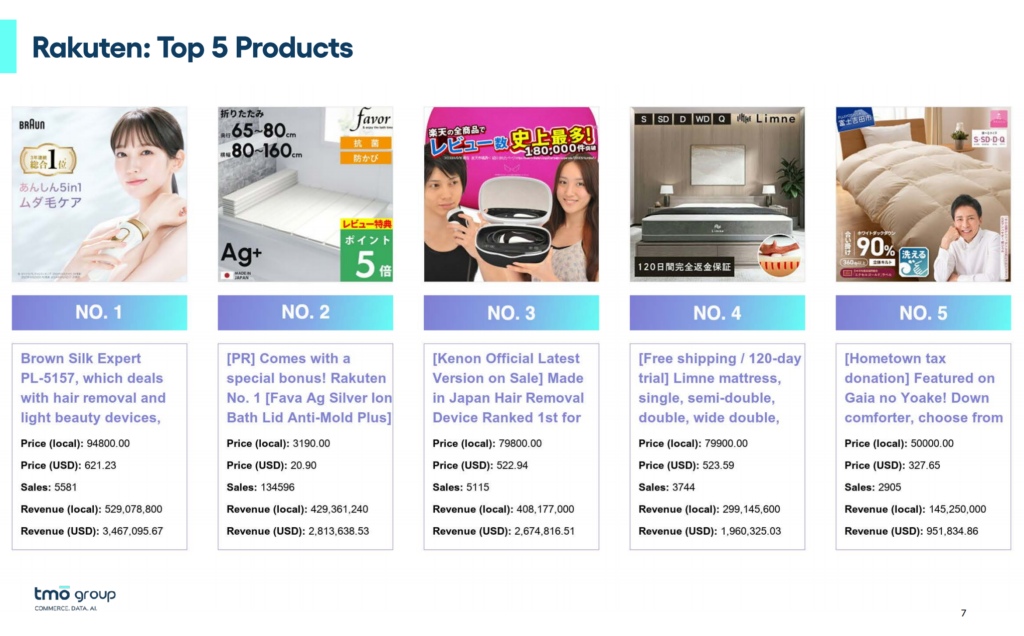

- Best-selling Products: December’s top sellers were heavily skewed toward Electronics, which occupied four of the top five SKUs overall. High-ticket personal devices such as hair removal appliances led performance, alongside selected Household & Living items including cooking pots and home-use goods. The ranking reflects Rakuten’s continued strength in specification-led, high-consideration purchases, particularly in personal electronics and functional household products.

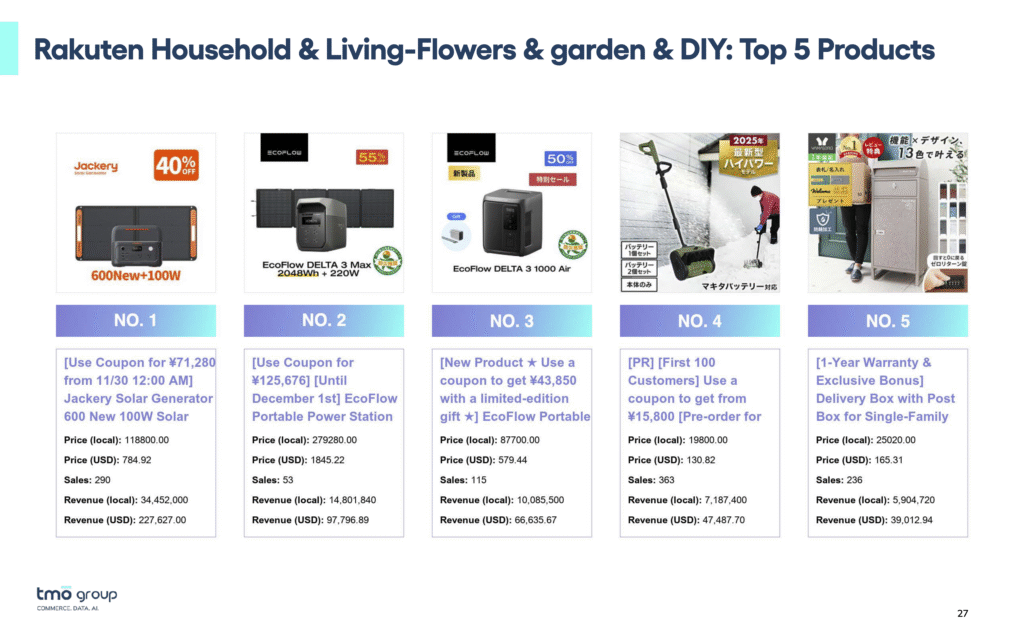

- Brand Performance: Outside of core electronics such as tablets, PCs, and smartphones, Western brand presence remained limited in December’s top rankings. Instead, leadership in Electronics and Household categories skewed toward a mix of local Japanese and Chinese brands, especially in personal devices and home-use appliances. That said, Western brands maintained clear visibility in select premium segments, notably portable power solutions (Jackery, EcoFlow) and Mom & Baby, where Cybex continued to stand out in child safety and mobility products. This reinforces Rakuten’s role as a platform where Western brands win selectively in high-trust, performance- or safety-driven categories rather than across mass electronics.

November: Rakuten eCommerce Highlights

- Category Performance: Household & Living remained Rakuten’s largest category in November, accounting for 29.6% of revenue, followed by Electronics & Gadgets (24.8%) and Food & Beverages (16.2%). Together, these three categories represented over 70% of platform revenue, reinforcing Rakuten’s strength in home-centric and high-ticket consumption. Health & Beauty-related categories continued to hold stable share, supporting Rakuten’s role as a platform for considered, brand-led purchases rather than impulse-driven spending.

- Best-selling Products: November’s top-selling products skewed toward durable home appliances and family-oriented goods. In Household & Living, Jackery solar generators and water-saving shower systems ranked among top performers, while Cybex child safety seats and strollers dominated the Kids, Babies & Maternity segment, occupying multiple top-five positions. In Electronics & Gadgets, small home appliances and grooming devices continued to outperform, reflecting sustained demand for practical, specification-led products on Rakuten.

- Brand Performance: Local brands continued to lead Food and everyday household categories, benefiting from trust and long-established consumption habits. In contrast, Western brands maintained a clear advantage in Electronics, Home Appliances, and Mom & Baby, with players such as Jackery and Cybex consolidating their positions in premium, safety- and performance-driven segments. This dynamic highlights Rakuten’s appeal for global brands competing in high-consideration categories where brand credibility outweighs price sensitivity.

October: Rakuten eCommerce Highlights

- Category Performance: Rakuten’s October landscape continued to concentrate around three strategic pillars: Household & Living, Electronics & Gadgets, and Food & Beverages, which jointly captured approximately 70% of online revenue. Household & Living remained the leading category, while Electronics & Gadgets returned to the second position driven by traction in high-spec small appliances and personal-care hardware.

- Best-selling Products: October’s high-velocity SKUs leaned heavily toward premium Western brands in family-oriented and lifestyle-enhancing categories. In Kids, Babies & Maternity, German brand Cybex dominated Rakuten’s top rankings with child safety seats and strollers, supported by Japan’s strong preference for European safety standards and design credentials. In Personal Care & Small Appliances, U.S. brand Tria Beauty and German brand Braun ranked among the top sellers, capitalizing on diode-laser hair-removal devices, grooming tools, and high-precision beauty hardware.

- Brand Performance: Local Japanese brands sustained dominance across Food & Beverages and conventional household staples, reflecting entrenched consumer loyalty and category maturity. While Chinese entrants retain presence in certain device categories, the October dataset indicates that Western incumbents remain the primary growth engines in premium consumer-goods segments.

September: Rakuten eCommerce Highlights

- Category Performance: Food & Beverages climbed to become Rakuten’s second-largest category by revenue, overtaking Electronics in September. The category’s growth was driven mainly by meat, processed meat, and seafood products, which now rank among the platform’s highest-earning subcategories. Some SKUs from this segment even entered Rakuten’s overall top five products by revenue, highlighting how Japan’s online shoppers continue to prioritize high-quality fresh and specialty food purchases.

- Best-selling Products: September’s top performers reflected Japan’s blend of practical innovation and family-oriented consumption. EcoFlow and Jackery’s portable power stations remained among Rakuten’s most popular electronics items, driven by ongoing demand for emergency-ready and outdoor-use devices. In Household & Living, Cybex’s child seats and strollers led the Kids & Maternity segment. Meanwhile, pet supplies continued to perform strongly within Household & Living, showing that pet care spending remains one of Japan’s most resilient eCommerce segments.

- Brand Performance: Brand dominance on Rakuten remained highly category-dependent. In Food & Beverages, domestic manufacturers continued to lead overwhelmingly, with local brands maintaining consumer trust and familiarity. In contrast, Electronics & Gadgets remained consolidated around Western players, while Chinese entrants like EcoFlow have already secured a firm foothold in the portable power supply segment.

August: Rakuten eCommerce Highlights

- Category Performance: Household & Living, Electronics & Gadgets, and Food & Beverages were the leading categories in August. These three categories together accounted for almost 70% of the online market share.

- Best-selling Products: Portable projectors and mini-beam devices spiked, suggesting strong demand for home entertainment during summer months. Additionally, premium kitchen appliances (air fryers, bread makers) entered the top ranks, while pet products remained strong, but high-ticket items like $400+ pet strollers saw slightly lower growth vs. July, signaling a plateau after months of surge.

- Brand Performance: Anker, Xiaomi, and PETKIT continue to perform strongly in Electronics & Gadgets, with Anker holding the top spot. Local brands like MYTREX and Iris Ohyama fought back with aggressive discount campaigns, helping them capture share in small appliances. This suggests a competitive dynamic where cross-border brands win on price/value, while domestic brands focus on brand trust and after-sales service to defend share.

July: Rakuten eCommerce Highlights

- Category Performance: Home & Living, Electronics & Gadgets, and Food & Beverages were the leading categories in July. These three categories together accounted for more than 65% of the online market share.

- Best-selling Products: High-end pet products such as cat litter boxes and pet strollers, priced at US $400 and above, were in high demand for July, showing Japanese consumers' preferences for high-quality pet products.

- Brand Performance: Chinese brands such as PETKIT and Ulike show good acceptance from local consumers, particularly in Electronics & Gadgets due to its competitive pricing. Anker and other projector or audio equipment brands are also among top sellers next to local brands such as MYTREX.

June: Rakuten eCommerce Highlights

- Category Performance: Home & Living, Electronics & Gadgets, and Food & Beverages were the leading categories in June. These three categories together accounted for more than 70% of the online market share.

- Best-selling Products: Hair removal devices from brands like Braun and Ulike stood out as top-selling products, featuring up to 40% discount for June and a selling price of US $650 & $450 respectively

- Brand Performance: Local brands exhibit strong performance across the main categories. Sino-german stroller brand Cybex dominated the Kids, Babies, and Maternity segment, with 3 of their products appearing among the 5 most-sold products. Other Chinese brands, particularly on Electronics & Gadgets, also stood out in June, such as projectors from EcoFlow.

May: Rakuten eCommerce Highlights

- Category Performance: Home & Living, Electronics & Gadgets, and Food & Beverages were the leading categories in May. These three categories together accounted for more than 65% of the online market share.

- Best-selling Products: The portable solar panel supply sets from the Chinese brands EcoFlow and Jackery are top performers in the Home & Living category. Chinese brands occupy three of the top five best-selling products in this category.

- Brand Performance: American and European daily necessities and clothing brands such as Crocs and LEVI’S still have a certain degree of competitiveness, but in terms of "portable electronic devices" and "new lifestyle products", the cost-effectiveness advantages of Chinese brands are gradually emerging.

April: Rakuten eCommerce Highlights

- Category Performance: Household & Living, Electronics & Gadgets and Food & Beverages were the leading categories in April, together accounting for over 60% of the online market share.

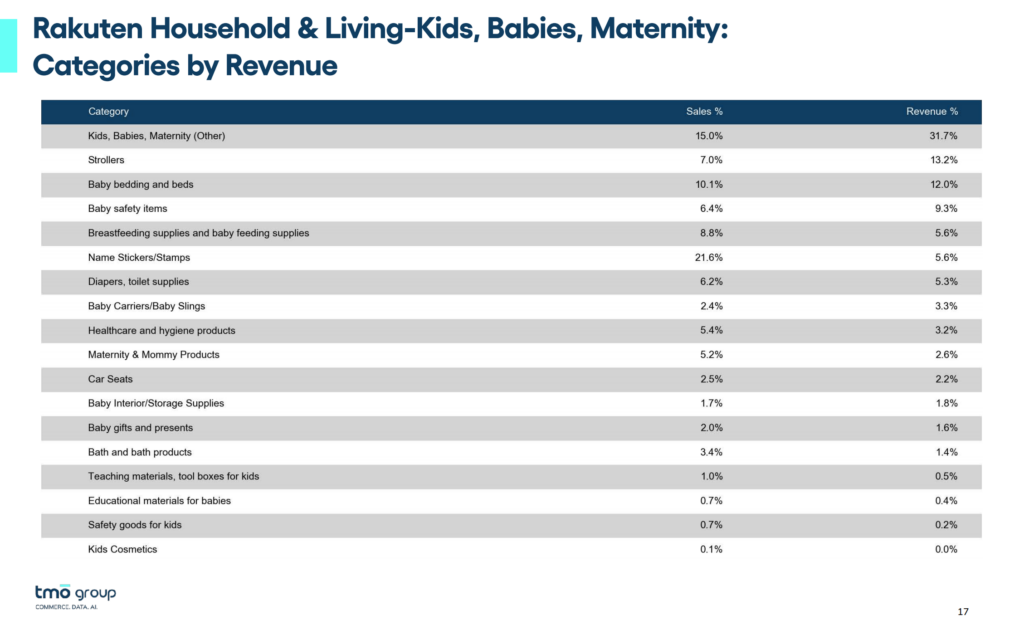

- Best-selling Products: Within the best-selling category Home & Living, accounting for 31% of total sales, in the “Kids, Babies, and Maternity” subcategory, products from the German premium brand Cybex occupied four out of the top five best-sellers. The brand focuses on child safety travel gear and features higher price points, reflecting Japanese consumers' strong acceptance of high-quality overseas brands.

- Brand Performance: In the “Pet Food & Supplies” subcategory, the WAHL dog grooming clipper from the U.S. and indoor cat food from Royal Canin (France) were both ranked in the top 5 best-sellers. This highlights Japanese consumers’ willingness to purchase premium overseas products for their pets and indicates significant opportunities for international brands in this segment.

March: Rakuten eCommerce Highlights

- Category Performance: Household & Living, Electronics & Gadgets and Food & Beverages were the leading categories in March, together accounting for over 60% of the online market share.

- Best-selling Products: Electronics and Gadgets also garnered significant consumer interest, contributing to 21% of total sales. Japanese consumers showed particular enthusiasm for home appliances within this segment. Notably, a facial beauty hair removal device, priced at approximately $555 and boasting a claim of "ranked number one for 563 consecutive weeks," secured the second spot among the platform's top-selling products. This indicates a strong willingness among Japanese consumers to invest in personal image management. Additionally, two sewing machines within this subcategory ranked among the platform's top five best-selling products, reflecting a sustained interest in home crafting and DIY activities.

- Brand Performance: Within the Household & Living category, among Pet subcategory top selling products, a probiotic kidney health supplement named Azodyl, designed specifically for pets (primarily dogs and cats) and originating from France, stood out. This trend underscores Japanese consumers' heightened attention to pet health and their recognition of high-quality overseas products.

February: Rakuten eCommerce Highlights

- Category Performance: Household & Living, Electronics & Gadgets, and Food & Beverages were the leading categories in February, together accounting for over 60% of the online market share.

- Best-selling Products: Among the top-selling Home & Living categories on Rakuten in February (accounting for 34.3% of total sales), Japanese consumers showed strong interest in the Interior & Storage; Household Goods, Stationery & Crafts; as well as Kids, Babies & Maternity categories. Notably, a mold-resistant bathtub cover ranked among the platform’s overall top 5 best-selling products. Other popular items included mattresses, washable carpets, and recliners.

- Despite Japan’s declining birth rate, which has continued for nine consecutive years as of 2024, household spending on parenting remains high—particularly on high-quality and smart products. In February, the subcategory of Kids, Babies & Maternity performed remarkably well.

- Brand Performance: Two child car seats from Cybex, a premium German brand , ranked in the top five best-sellers within this subcategory. The relatively high unit prices of Cybex products reflect Japanese consumers’ strong preference for high-quality international brands.

Why These Insights Matter

Each month’s Rakuten snapshot offers more than just trendspotting. For brand owners, category managers, digital strategists, and others, the data can support you in navigating the Japanese eCommerce landscape:

- Evaluate Market Entry Potential: Understand which categories are growing, what price points are winning, and where gaps exist—before investing in localization or inventory.

- Optimize Product Strategy: Identify fast-rising formats, ingredient trends, and feature preferences at a subcategory level. Use this to guide R&D, messaging, and packaging decisions.

- Monitor Competitors & Brand Share: See who’s climbing the ranks each month. Benchmark against leading players—both domestic and international—across multiple subcategories.

- React to Shifts in Consumer Demand: Track real-time changes in what customers are buying, when, and at what price. This is especially critical for seasonal campaigns and product launch planning.

Showcase: Read how SanofiSanofi's custom data architecture allows continuous monitoring of product categories, brands, and competitors across multiple mainstream eCommerce platforms.TMO supports global brands with long-term data monitoring and a custom data architecture to standardize analysis across regions and platforms.

TMO helps brands like yours stay ahead of the market with tailored eCommerce datasets and monthly monitoring dashboards that help inform market entry and competitive strategies. While these data packs offer a high-level view, if you are interested in tracking competitor SKUs, localizing product attribute mapping, and monitoring long-term trends across platforms and countries, reach out to us for a custom proposal!