This article is based on the presentations that TMO Group’s managing partner Jing Zhou gave at the GOED-2022, a leading event for the Omega-3 industry and at Expo West 2022. On our website you can Trends in China’s Cross Border eCommerce for Health Supplement 2021All-incompasing overview of China Health Supplements Market in 2021. Analysis includes market size, trends, consumer characteristics and segmentation.download the presentation deck. For more information about the market, you can download our 2021 China Health Supplements Market Annual ReportThis report summarizes all the monthly sales data of China's overseas health supplements in 2021 from multiple dimensions and concludes the market highlights and trends throughout the year.Annual data report on China Health Supplements Market in 2021.

Note on the terminology. In this article we are discussing the health supplements market. In China, health supplements are a combination of two major product groups: functional foods (these usually need to obtain “Blue Hat” registration to be sold in China) and dietary supplements.

Market size

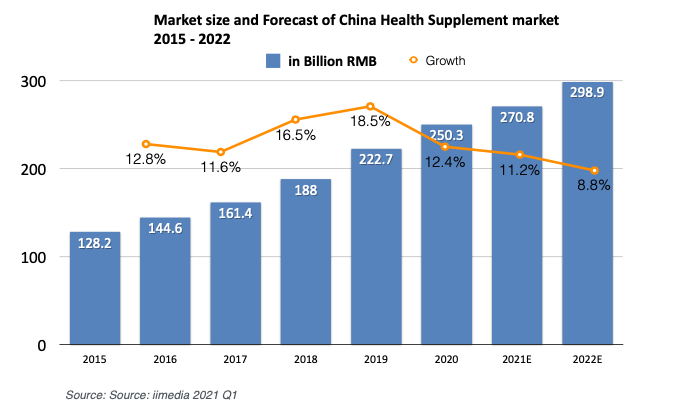

The market for Health Supplements in China is on the rise. In 2021 its size is estimated at 271 billion RMB. That’s about 34 billion USD, which is 2/3 of the US's market size. However, if the US health supplements market grows at the rate of 5-6% annually, the Chinese one seems to be on the growth spurt: in 2019, market size grew by almost 19%. And although growth rate is predicted to cool down, it is still expected to be in the vicinity of 10%. If this trend continues, we are looking at China becoming #1 health supplements market in the world by the end of the decade.

While growth rate started to taper off, the Chinese Health Supplements market is still on the rise

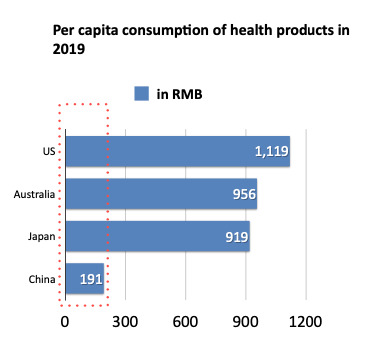

Another stunning distinction between the US and China health supplements market is how unsaturated the latter is. In the US per capita consumption is estimated at 177 dollars – and this is very close to the same metrics for other developed countries: 151 USD for Australia and 146 USD in Japan. The same parameter for the Chinese market is only 30 USD, indicating huge potential for further growth.

If we use developed countries as a benchmark, Chinese health supplements market has a lot of unrealized potential

Healthcare in China

Similar to many other countries, China’s population is aging. According to WordData, the median age is 38 years, putting China at the 1/3 mark in the list of all world countries – right between the USA and the UAE. 176 million people in China are 65 or older (as of 2019), which accounted for nearly 12.6% of its total population.

With that, the share of health issues like cancer and cardiovascular diseases starting to affect healthcare costs. There are estimates, saying that up to 75% of elderly are suffering from chronic diseases. Joint report made by the Chinese government and World Bank found that, if no measures are taken, the healthcare cost can skyrocket fivefold by the year 2035: from 500 billion to 2.5 trillion.

The Chinese government is implementing a number of policies to address this problem: from commitment to improve the healthcare level to popularization of fitness and healthy lifestyle. One of the measures aimed at raising Chinese citizens’ health is connected to the use of the internet and cross-border eCommerce.

Economic growth and rise of personal income is another reason for growing demand for health supplements products. Once high-end products and affluent gifts, health supplements now are viewed as everyday commodities by a growing number of consumers.

Finally, the epidemic played some role in cultivating healthcare needs, that particularly true for immunity enhancement products. TMall sales in this category jumped 47% in 2020, compared to the previous year.

Interest in immune-enhancing products skyrocketed in the first days of the pandemic

Sales Channels

Let’s look at the main channels customers use for purchasing health supplements products, going from oldest to newest.

Pharmacies

Drugstores have been around for decades. They continue to be the main channel for purchasing supplements for older consumer groups (60+), who tend to trust these brick and mortar establishments.

Modern pharmacies continue to increase their penetration rate into younger customer groups too. These are convenient chain stores with professional staff and a wide range of products, more akin to medical supermarkets rather than to small shops.

However, usually it can be challenging for a health supplement to enter a pharmacy chain due to additional regulations and insurance policies to comply with.

Direct sales

Direct sales started their success story in CHina in the mid-90s, and went through some turbulent times, restricting then laxing regulations. For the last 10 years it was the main channel for health supplements sales, accounting for up to 50% of the volume.

As it is with direct sales, sales representatives being both consumers and promoters, which helped build trust and establish long-lasting relationships, especially with elderly and middle-aged customers.

However, recent years saw a decline in this channel. More and more leading companies digitize their operations and deploy their eCommerce stores. New sales models, such as social commerce, is another reason for direct sales’ decline.

eCommerce

Following booming Chinese eCommerce, health supplements online sales are also experiencing rapid growth. In the last few years this sales channel became the biggest one, as its share increased from 22% to 40%.

Young consumers (millennials and GenZ’s) are the main driving force behind this growth. About 83% of shoppers are in the 19-40 age bracket. Favorable customs policies and simplified procedures for foreign brands also played a positive role in establishing the leading role of eCommerce as a channel for foreign brands to sell their products to Chinese customers.

Cross-border Health Supplements Sales

There are two main models that brands use to utilize eCommerce. The first one is building their own online store – which gives brands bigger freedom on presenting their products, controlling data, and defining sales processes. This approach, however, requires bigger investments and carries bigger risks.

Alternative model, a much popular one too – is to sell products on one of the cross-border marketplaces. There are a Top 5 Chinese Cross-Border eCommerce Platforms (Updated 2024)We take a look at the Top 5 cross-border eCommerce platforms in China for 2024, their history, market share, and special features.number of popular marketplaces to choose from, but three top players, TMall Global, Kaola and JD worldwide, collectively occupy about 60% of the market.

Let’s now look at the health supplement sales on the platforms, owned by AliBaba (that is TMall and Kaola).

Market dynamics

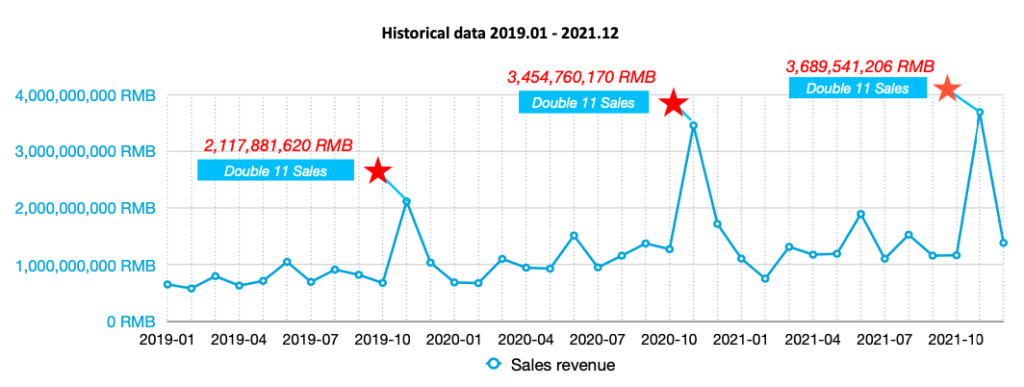

For the last three years sales volume shows steady growth – about 20% year-on-year. There is a very clear seasonal pattern, repeating each year: a very prominent peak in November (“Singles Day”, that generates up to 20% of yearly sales) and a smaller peak during June (“618” shopping festival).

Top brands

When it comes to health supplements, Chinese customers may exercise a fair bit of cautiousness, and tend to stick to familiar trustworthy brands.

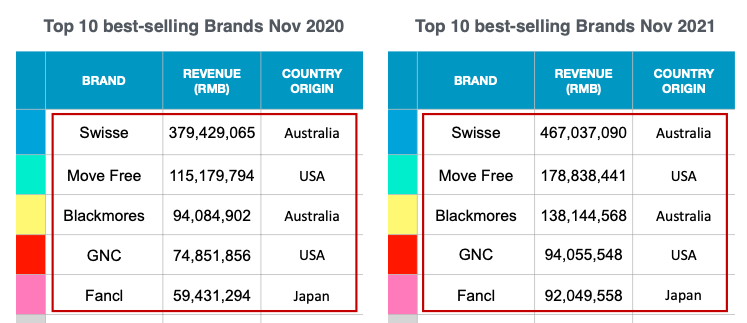

Evidence of that can be seen in the list of top health supplements brands sales in November 2020 and November 2021. Top five lines of both lists are occupied by exactly the same names. All five grew 20-30% in 2021 compared to the previous year.

However, there are other interesting metrics, providing insights into the buying process of Chinese customers.While overall brand sales are universally up, the sales through brand flagship stores are down (for all, except one brand – Move Free), meaning all the growth comes from the non-flagship lower price stores. Chinese buyers do appreciate the quality that familiar brand names can provide – but would pass on paying extra, if they can help it.

Catalog categories

In the second half of the 2021 product catalog of the health supplements section of TMall underwent a major overhaul. Up to that point products were listed by the active ingredients, their chemical formula or methods of production. Going from fall of 2021 forward, TMall catalog adopted an effect-based approach - grouping products by the effects they produce in the customers.

If previously centered around intimidating terms like “microbial fermentation” and “animal extracts” it is now full of user-friendly terms, like “Joint health” or “heart health”.

While this is obviously a great move to make health products more accessible to larger groups of people, it does add an extra layer of complexity to all analytical work. In the result of this major reshuffle, some of the analytical data on the market may be inconsistent, especially if you are trying to compare current and historical data.

Chinese Customers

FInally let’s discuss the main groups of customers who are buying health supplements. We can define three main scenarios that make the majority of purchases.

Elderly people

Elderly people (age 65 and older) are the main force behind the health supplement market - they are behind half of the market’s volume. Their purchasing power has no other way but to grow, together with the size of the pension industry in China.

Having said that, this group of customers is planning to get maximum bang for their buck: by far two most important considerations when purchasing health products are efficiency and price.

Another important insight into this group is that they make purchases themselves only in 20% of cases. 30% times it is done by a close relative, spouse or child, 50% by someone else. Therefore for a product aimed at older people, it is important to plan communication accordingly.

Young and Middle aged

Another factor that drives health products consumption is rapid urbanization, which, in turn, results in a growing number of 25-40 year olds with sub-heath issues.

Long working hours, stress, lack of exercise, combined with big city lifestyle (insufficient sleep, unbalanced diet, alcohol consumption, smoking) can lead to overall decline in vigor, that can’t be traced to any particular health problem.

This cohort is on the lookout for something to boost themselves with, and they are ready to spend money on it. This group occupies about 20% of the health supplement market.

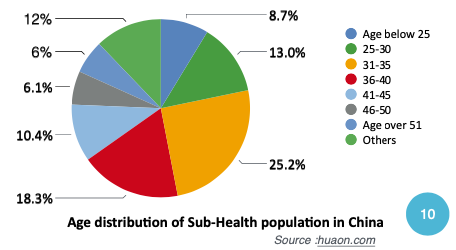

More than a half of the sub-health population falls in the relatively narrow 15 year range: 25-40 year old

Pregnant women

China is currently implementing a three-child policy (a policy that replaced the two-child policy that was in place from 2016 to 2021), along with other measures aimed at raising the birth rate. Following these changes markets, related to pregnancy and childbirth are in a steady upswing, and health supplements for pregnant women are no exception.

Pregnancy takes a very important place in the life of a Chinese family, and so Chinese women are ready for extra expenses during this stage in life. Around 90% of women would take some form of health supplements during pregnancy – mostly folic acid, multivitamins and Omega-3. Future mothers pay attention to the quality, safety and convenience of supplements, eagerly accepting advice not only from doctors, but from advertisements, social media, and KOLs.

We hope this overview of the Chinese Health supplements market was useful for you. If you have any questions - you can download our industry report packed with valuable information on the topic. Or feel free to reach out: we have years of experience under our belt and dozens of successful health supplements eCommerce projects in China and South East Asia and would be happy to help you with your next project.