The B2B eCommerce industry in China has seen a remarkable growth in recent years and shows no signs of slowing down. This presents an excellent opportunity to enter the market.

With over 10 years of experience as a digital commerce solution provider, TMO Group has helped numerous companies implement eCommerce successfully. Through our experience in various projects, we have identified that unlike in the business-to-consumer (B2C) field, most business-to-business (B2B) companies in every industry face similar challenges and misconceptions. To address this, we have initiated an eight-article series on the best practices for conducting B2B eCommerce in China. These articles will also form a part of a white paper, developed in collaboration with Adobe Commerce.

This first article in the series focuses on how companies can begin their digital transformation journey.

The Current State of China’s B2B eCommerce Market

The COVID-19 pandemic had a significant impact on global businesses in early 2020, causing many to halt their operations. However, China was able to recover relatively quickly and has continued to grow its eCommerce market. This trend was already underway but was accelerated by the pandemic, with more people shopping online for goods.

China's digital economy is thriving, with the eCommerce market estimated to be worth 39.2 trillion CNY in 2020, accounting for 38.6% of the country's GDP. According to the "2020 China Industrial eCommerce Market Data Report," the domestic B2B eCommerce market is experiencing unprecedented growth, reaching 27.5 trillion CNY in 2020 compared to 25 trillion in 2019.

The bulk commodity eCommerce market accounts for 80% of the entire market, with the eight major industries of chemical, energy, rubber and plastics, nonferrous metals, steel, textiles, building materials, and agriculture undergoing significant digitalization in recent years. The corporate procurement market increased by 58.21% year-on-year, and the industrial product eCommerce market increased by 17.69% year-on-year. The pharmaceutical market also saw a significant increase of 58.33%.

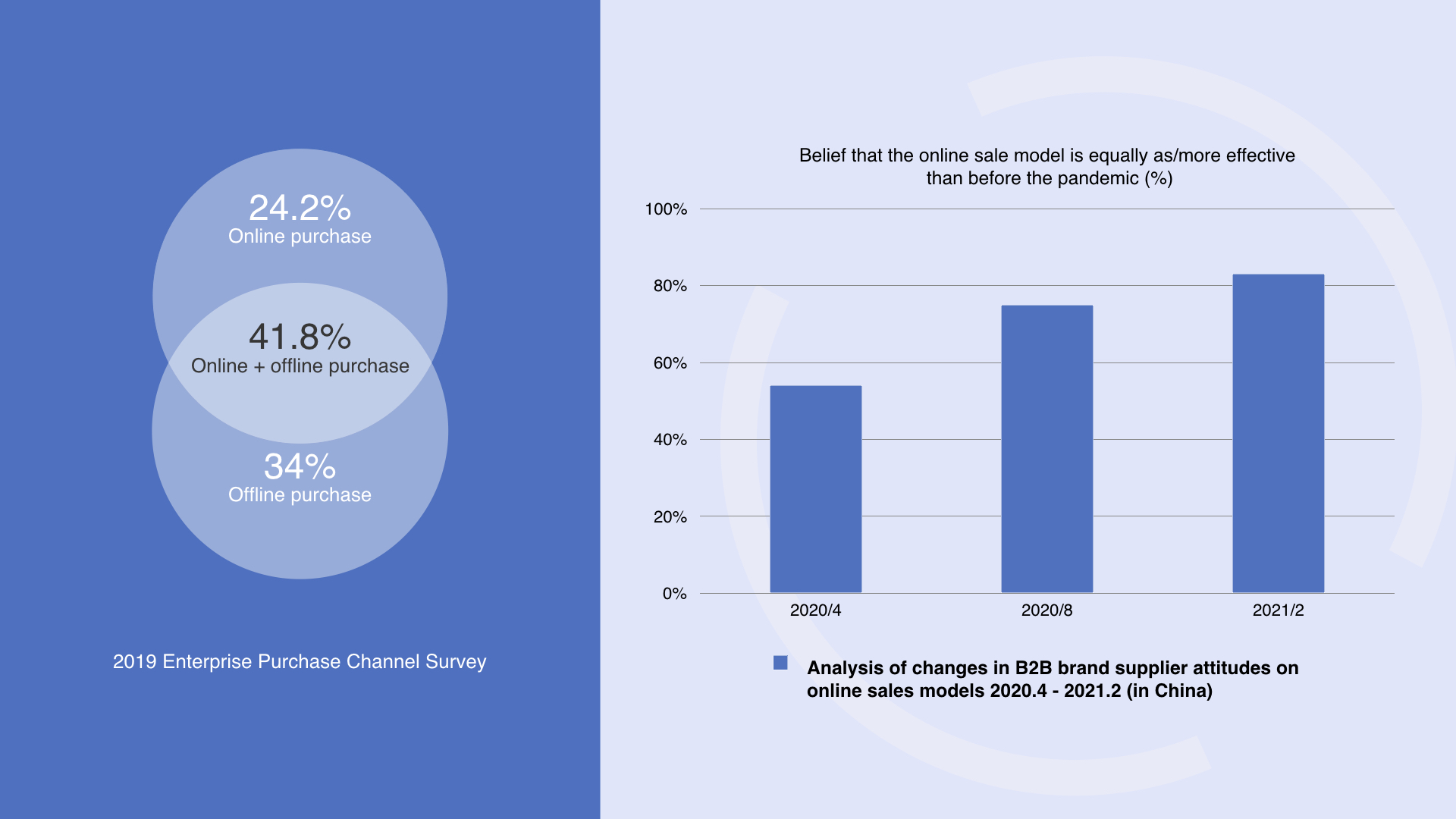

A survey conducted in 2019 showed that 24.2% of Chinese companies solely procured online, while 41.8% made both online and offline purchases, and 34% procured solely offline. However, a survey of B2B brand suppliers in China showed that 83% favored the online sales model in April 2021, indicating increased confidence in the online sales model post-pandemic.

Source: (left) 2019 enterprise purchasing channel survey by iiMedia Research, (right) analysis of changes in supplier attitudes towards online sales models by Makenzie, iiMedia Research

The COVID-19 pandemic accelerated the trend of online shopping habits that was already well underway before the pandemic hit. With physical stores closed or restricted, more people turned to online shopping for its convenience, and many have continued this habit even as restrictions ease. Other contributing factors to the growth of online procurement include government policies, rising business costs, contactless payment methods, technological advancements, improvements to the eCommerce infrastructure, and the digitalization of Chinese internet users. However, some industries, such as the chemical industry, still rely heavily on distributor networks, and disrupting this model may not be desirable for both parties.

Other Contributing Factors Accelerating the Trend of Online Procurement

However, as we’ve already established, the general trend towards online procurement was already well underway before COVID struck.

Other important contributing factors include:

- The favorable policies of the Chinese government towards online procurement

- The rising costs of running a business (with eCommerce and its decreased overheads being one way to reduce them)

- The development of online purchasing habits, with more companies now choosing to purchase through contactless payment methods (something which the pandemic has also accelerated)

- The advancement of new technologies that facilitate online procurement such as cloud computing, big data, the Internet of Things (IoT), and AI (artificial intelligence)

- Improvements to industry standards in the infrastructure of the eCommerce industry, which has led to a general improvement of the online user experience

- The digitalization of Chinese Internet users, especially the entry of those born in the 80s and 90s into the job market. This means there is now a whole generation of people with disposable income that have digital habits.

Despite the growing trend towards online procurement, some companies still face challenges in transitioning to digital channels. For instance, in industries like chemicals, sales depend heavily on distributor networks. Distributors have established strong customer relationships by providing various offline services, which makes it difficult for companies to change this model. As a result, there may be reluctance to disrupt a well-established system that has worked well for both parties.

B2B eCommerce Platforms Landscape

When it comes to B2B eCommerce retail platforms, what are the main ones used in China?

Source: 2020 Chinese enterprise procurement eCommerce market industries, by iResearch

- The first category is procurement platforms derived from traditional B2C eCommerce, such as Taobao, Tmall, and JD.

- The second category is B2B eCommerce marketplace platforms. This type of platform can be further subdivided into one-stop B2B eCommerce platforms, such as 1688.com, and various industry-vertical platforms including those that focus on industrial products.

- The third category is platforms created by brands themselves, such as Gree, Haier Group, Schneider, and 3M. More and more brands have built their own platform in recent years. With the entrance of numerous new players into the market, companies are realizing the need to have their own eCommerce platform in order to stay competitive. Directly handling customers enables them to obtain real-time customer data, which was difficult to achieve in the past by relying on distribution models. This collected data can help companies provide customers with personalized services, improve product quality and sales, as well as customer satisfaction and loyalty.

The below model shows the service providers of the B2B ecosystem in China in different areas (payment, logistics and financial):

Source: 2020 Chinese enterprise procurement eCommerce market industries, by iResearch

Growth Potential of Industrial B2B eCommerce

The B2B eCommerce market in China is expected to experience substantial growth in the upcoming years, spanning various industries. B2B can be classified into three categories: downstream (products close to the consumer, such as clothing, medicine, and fast-moving consumer goods), midstream (products close to production, such as textiles, auto parts, and smelting), and upstream (products at the top end of production, including non-ferrous metals, steel, and petroleum).

Alibaba and consulting firm Bain's projections indicate that industrial product B2B eCommerce, which is in the midstream of the B2B landscape, is poised to experience the most substantial growth. By 2024, the industry's online transactions are expected to hit 2.3 trillion CNY, with a penetration rate of approximately 5% and a compound annual growth rate of 25-30%. Of these, MRO (maintenance, repair and operations), electrical engineering, mechanical auto parts, and chemical sub-industries are expected to have the highest growth rates, projected at 40-50%.

Out of the four sub-industries mentioned earlier, the MRO sub-industry is expected to have the highest penetration rate of online transactions. MRO products refer to supplies used in the production process that are not visible in the end products themselves, such as safety equipment, gloves, computers, and industrial consumables. Since this category includes a wide range of products, an MRO company's product range may have a large number of SKUs, making the sales process complicated and inefficient. Therefore, they stand to gain more from shifting online than some of the other sub-industries listed. Additionally, since MRO products are not directly linked to the production line, it is easier to make the shift to online channels than some of the other sub-industries.

According to forecasts, the growth in electrical engineering is expected to be mainly driven by low-voltage electrical equipment, cables, and other related products. On the other hand, growth in the mechanical parts sub-industry is expected to be driven by products such as bearings, fastenings, valves, and pumps. In the chemical industry, downstream products such as painting and plastics are expected to drive growth.

Common Branded eCommerce models of B2B companies

Branded B2B Platform Model (B2B)

The branded B2B model refers to a direct selling approach where companies offer their products to other businesses through their official website. This model enables companies to manage every aspect of the eCommerce process, including logistics, customer service, and product information. One of the advantages of this approach is that it allows companies to maintain high levels of customer service.

Distribution Model (B2B2C)

This model involves companies partnering with distributors to sell their products through the distributor's existing distribution channels. The company focuses on producing the product while the distributor handles fulfillment and customer relations. This model can be advantageous for both parties, with the company able to increase brand exposure and the distributor able to share in profits or receive commission from sales. It is a mutually beneficial relationship that can lead to increased sales and market reach for both the company and the distributor.

O2O Model

In the context of B2B, the O2O model can be used to leverage the distributor's local presence and expertise in providing value-added services such as installation, maintenance, and technical support to customers. This can help companies to establish a closer relationship with customers and improve customer satisfaction. In addition, the O2O model can also help to reduce logistics and delivery costs by leveraging the local distribution network.

Digital Transformation

Companies across the globe have been prioritizing digitalization as a crucial part of their growth strategy since the early 2000s. However, in more recent years, digital transformation has become even more critical. Thomas M. Siebel, in his Amazon best-selling book "Digital Transformation: Survive and Thrive in an Era of Mass Extinction," defines digital transformation as the convergence of cloud computing, big data, IoT, and AI, leading to exponential change and network effects, which he calls the fourth industrial revolution.

Traditional Industries at the Crossroads of Digital Transformation

China is currently undergoing a significant digital transformation in its traditional industries, especially in manufacturing. In the B2B sector, the model is expected to gain wider adoption is the consumer-to-manufacturer (C2M). In it, the end customer is connecting directly with the manufacturer to place orders, thus bypassing middlemen in the distribution process.

Once C2M model is implemented, manufacturers can reduce costs, increase efficiency, and minimize production waste. C2M also provides an opportunity for manufacturers to build long-term relationships with their customers through direct contact.

However, for C2M to work properly, company should undergo digital transformation. Such changes require long-term business strategy, careful planning and a clear vision of the company's future direction.

The World Economic Forum and Accenture presented a white paper in 2016 outlining the stages of digital transformation, which can serve as a useful reference for eCommerce companies. Each step will require varying amounts of time to complete, depending on the industry and location of the company.

The time required to complete these steps will vary from company to company as it depends on the industry as well as location.

Short-Term

This stage focuses on data collection, and user adoption and education (in all aspects of the business - customers, partners and employees)

- Build customer data sets: In the early stages of eCommerce, it's important for companies to collect as much customer data as possible to build customer profiles and understand their journey across various touchpoints.

- Integrate customer feedback: Departments should collaborate to collect customer feedback in an integrated manner, allowing them to gain a better sense of customer preferences and expectations.

- Integrate data flow on the supply chain: Real-time data integration of the entire supply chain can increase logistics efficiency, allowing suppliers and distributors to manage inventory more effectively and optimize production levels.

- Promote the benefits of digital to customers: Companies may encounter resistance from customers who are hesitant to shift from traditional sales models. By promoting the benefits of online purchasing, such as the ease of repurchasing, both parties can reap long-term benefits.

Mid-Term

This stage focuses on data management, user personalization and user activation.

- Use data-driven insights: Companies with comprehensive data sets can gain insights through big data analysis to inform decisions on marketing, eCommerce website development, and more.

- Personalize the customer experience: B2B eCommerce companies need to be user-focused to provide a customized experience that reflects customers' payment preferences and purchasing patterns.

- Adhere to data privacy and transparency regulations: As companies grow, they must prioritize data security and transparency to earn trust, which can be achieved by disclosing information about products and supply chains.

- Digitize the workforce: Digitalizing the workforce can improve communication, productivity, and workflows across departments.

- Shift to a product-as-a-service (PaaS) business model: Instead of selling just the product, companies charge for the services that come from it, focusing on the outcomes it provides. This model has become more prevalent with IoT technology, and companies like Cao Cao in China are planning to lease self-driving cars for their ride-hailing service, rather than selling the cars themselves.

Long-Term

This stage focuses on smart technology and the complete digitalization of all aspects of the company.

- Leveraging Smart Factories: In the Industry 4.0 model, smart factories utilize IoT technology to operate sensors that collect real-time data. This data can be used to manage processes and workflows in the manufacturing process, and robotic machines can now handle many manual processes. This allows for greater adaptability to different product flows and the production of customized products and services.

- Promoting Corporate Digital Responsibility: As companies become increasingly digitalized, they must consider the ethical implications of their actions. This includes ensuring data transparency and producing products that align with the ethical concerns of their customers, such as using environmentally friendly materials. Ethical considerations also extend to the handling and analysis of data, and companies must take responsibility for their digital actions.

If you have any questions about this article or would like a consultation, our team of experts are on hand to help you with your business needs.

B2B eCommerce Series Part 2: Assessing Digital Maturity for B2B eCommerceWant to assess where your company's digital maturity is right now? Look no further than part 2 of TMO Group's 6 part series on B2B eCommerce.In article 2 of the 8-part series of B2B eCommerce in China, we look at how companies assess can assess their digital maturity.