B2B eCommerce in China is going through a rapid growth period. In the post-pandemic era, consumer eCommerce experienced a major boost - as regular, offline shopping was seriously hampered by the restrictions. The B2B market followed suit and moved a large portion of its transactions online.

In this article we’ll review the B2B eCommerce landscape in China: market size, most promising segments, typical channels companies use, and much more.

B2B eCommerce market

According to 2020 data, the eCommerce market in China accounts for 39.2 trillion CNY (about 5.9 trillion USD), which makes it about 38.6% of the country’s GDP.

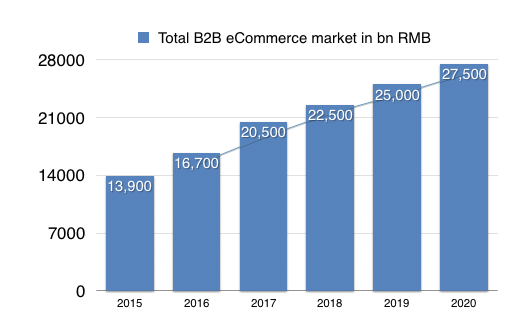

What may be surprising about this number is that most of it comes not from consumer goods, but from the B2B segment. According to the "2020 China Industrial eCommerce Market Data Report” released in May 2021, the value of China's B2B eCommerce market in 2020 reached 27.5 trillion CNY (4.1 trillion USD). Which means 7 out of every 10 yuans in the Chinese digital economy are generated by B2B sales.

B2B eCommerce is a segment that has been growing steadily in recent years: it doubled in the last 5 years, adding 10% even in 2020, when most other markets slowed down significantly.

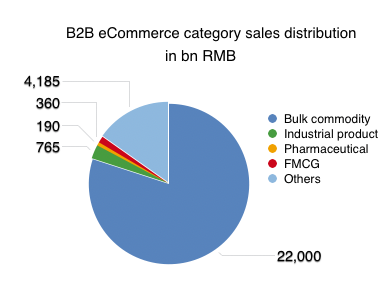

The largest segment of B2B eCommerce is the sales of raw materials and commodities – it takes up about 80% of the market volume, 22 trillion CNY.

Changes in B2B behavior

In the results of the 2019 survey about purchasing behavior in the Chinese B2B segment, you can see a venn diagram of businesses who use online or offline channels for B2B procurement. Significant portion of respondents, at least 64%, almost two thirds, are using online for purchasing in some way – either with combination with traditional channels or exclusively.

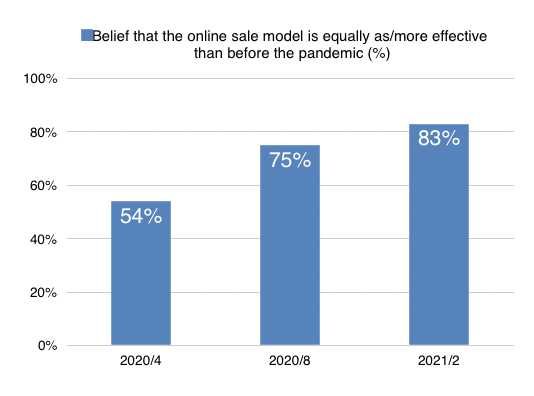

Another poll was conducted in China by iMedia in a few months before and after the pandemic started. The share of B2B suppliers who thought that the B2B model is either better or at least equally efficient as offline, grew dramatically: from 54% to 83%.

There are a few key factors that contribute to this shift: favorable government policies, development of distribution networks, new technologies, changes in purchasing habits – we’ll talk about some of these in this article.

Most promising segments of B2B eCommerce market

As we mentioned, Chinese B2B eCommerce is a market that steadily grows at a rate of about 10% yearly, overtaking the already fast GDP growth rate. However, inside of the B2B market some segments outpace even that rapid growth: here the rate is expected to be around 40-50% of yearly growth. Here are some of such industries.

MRO

MRO stands for Maintenance, Repair, Operations – and it represents a class of goods that are bought in addition to the main product: supplies, spare parts, service tools and so on.

Using online for such purposes makes absolute sense: usually the choice is already determined by the equipment company uses, supplies are needed regularly, sometimes urgently, purchasing and consuming MRO becomes a part of the regular business operation. It is only logical to do it online.

Electrical engineering

Low-voltage electrical equipment, cables and other widely used electrical items is another group of products that is poised for a huge growth in online sales.

Machinery auto parts

Products of the universal mechanical parts subsidiary is another group that is used across all types of other industries: bearings, fastenings, valves, pumps and similar items are experiencing significant growth.

Chemical industry

Chemical industry is driven by the universal demand of such items as paint, plastics - things that are used in many of the manufactured products. This is why the growth in this segment is far higher than market average.

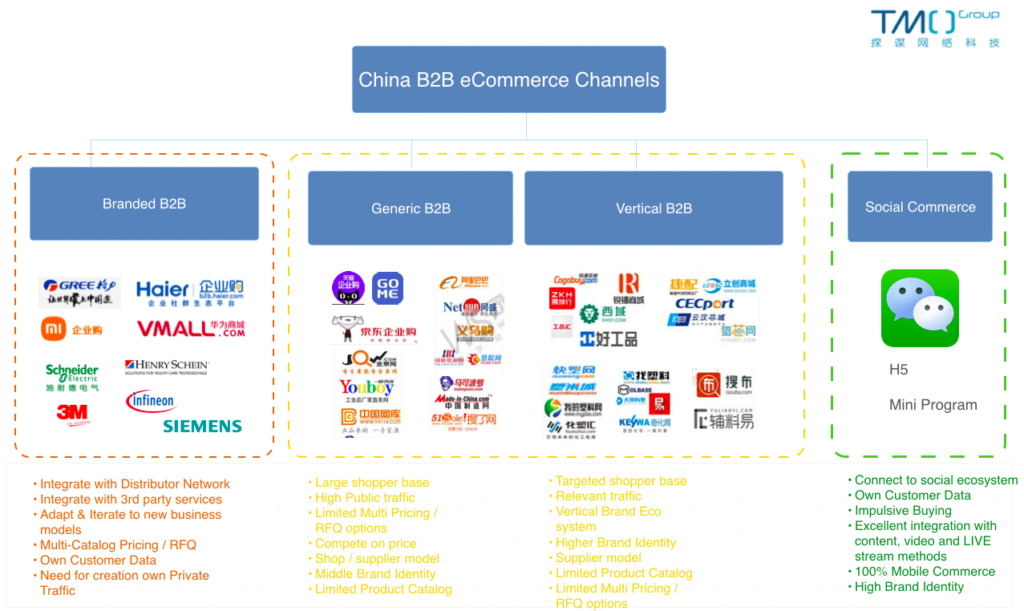

B2B eCommerce channels

When a B2B company establishes its presence on the Chinese market, it has to choose how to attract the majority of the customers. Here are the main options options.

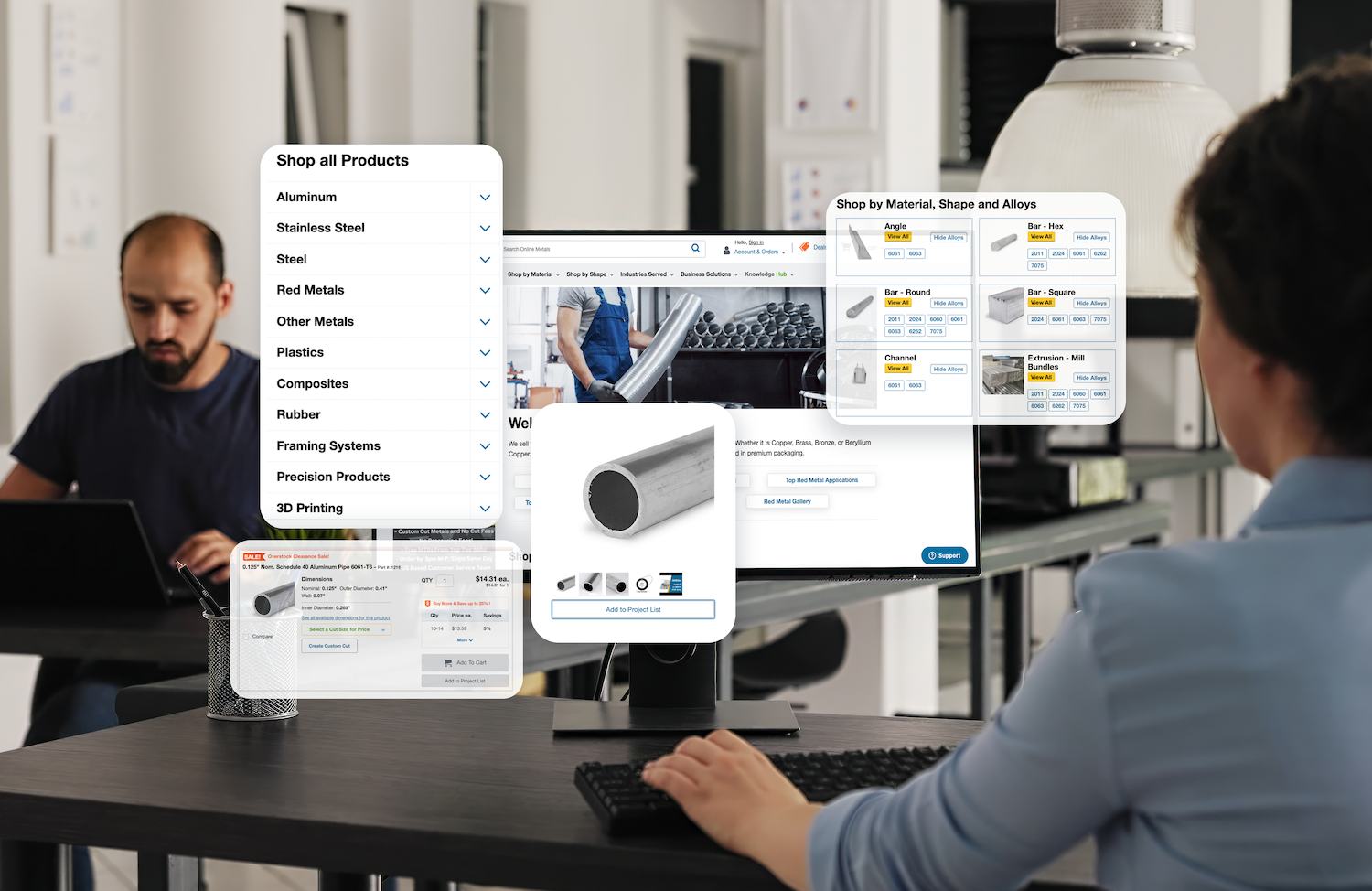

Branded B2B channel

For relatively large brands with complex eCommerce requirements, large catalogs, and non-trivial business models the best approach is to build their own online shop where they would sell their products. It does require a lot of things tobe taken care of: integration with distributor networks, building the website, driving their own traffic. Yet, this is the only option that allows brands to build online presence that would perfectly fit their identity and business approach.

Generic B2B marketplaces

Another option is to enter the market through setting up a shop in one of the popular online marketplaces. There are a number of prominent platforms on the Chinese B2B market that can be used for that.

Obvious upsides to this approach include lower costs and access to the existing shopper base. However, there are serious limitations: companies using a marketplace will not be able to implement a unique and creative brand identity: shop designs are chosen from a set of pre-defined options. There are limited options for building catalogs, price management, and fulfillment integrations. You often have very limited access to web-behavior and sales data too, limiting your abilities to data-driven decision-making.

Vertical B2B Marketplaces

These are similar to general B2B marketplaces, but each platform specializes on a certain or a type of commodity. The upside here is that the platform already has the audience interested in the relevant product. Often there is already the whole ecosystem that deals with different areas of the industry or different stages of production of certain products.

Social Commerce

This channel is somewhat unusual for B2B eCommerce, but it doesn’t mean there are no cases when it can be successfully used. Social commerce offers great opportunities when it comes to features like live streaming, using mobile devices, using geolocation services and so on.

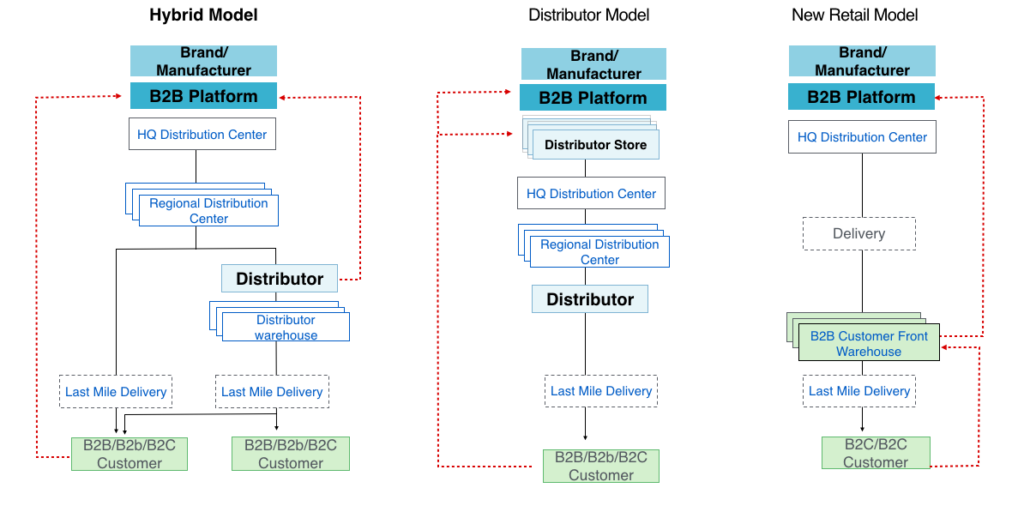

Distribution models

Distribution models that are used in China evolved a lot in the last few years. Traditional one, where goods are delivered to the customer directly from the centralized warehouse, is getting less and less popular, as it cannot keep up with the expectations of the Chinese customers.

In consumer eCommerce, it is not uncommon to receive a package on the next day, or, for more popular items – even within hours from the moment of placing an order. Expectations for the fast and reliable delivery affect how B2B customers want to receive their goods too. Providing this level of service can be achieved using several models. Let’s look at the most popular ones:

New retail model

To shorten the way a product has to reach the customer, the company can set up a network of warehouses where a large number of customers are located. It can be regional warehouses covering larger areas, like provinces, or city warehouses responsible for the big cities. In some cases, even a network or urban warehouses within a city can be used.

This model allows customers to receive the goods in a shorter period of time, as the goods are stored in warehouses close to them. The drawback of this approach is that the warehouse network requires quite a lot of resources to operate. To increase the efficiency, the company has to have a stable and predictable flow of orders, human and technological resources to maintain this complex logistical system.

Distributor model

In the distributor model the task of delivering product from regional distribution centers to end customers falls on distributors. Distributors, in turn, restock their inventory from the central warehouse.

Same as the new retail model, this approach allows for fast delivery, with most of the delivery handled by the distributor network. Distributors, being local entities, can leverage their local facilities and expertise to build a more efficient distribution system.

Hybrid model

In the Hybrid model part of the distribution goes through the distributor network, as in the Distributor model, but part of it goes through the centralized fulfillment, as in the traditional model. The division can be set up in a number of ways: by the product type, by location, by the type of the clients and so on.

Ecosystem of B2B brand eCommerce platforms

If you decide to go with the branded B2B online shop, you will have to build a platform that utilizes services that would make purchasing possible: payment services, logistical services, and if this is relevant to your business, financial services.

China offers a wide range of services that can make it possible. Online payment services include Wechat Pay and AliPay - two most popular payment systems used in China, and a set of other systems that can fit best to your business. Shipping is represented by two big groups. Traditional shipping allows you to conveniently send goods all across China, but if you need to ship in bulk - there are companies that specialize in that kind of cargo. Financial services would allow your customers to finance their purchase, providing a wide range of payment plans.

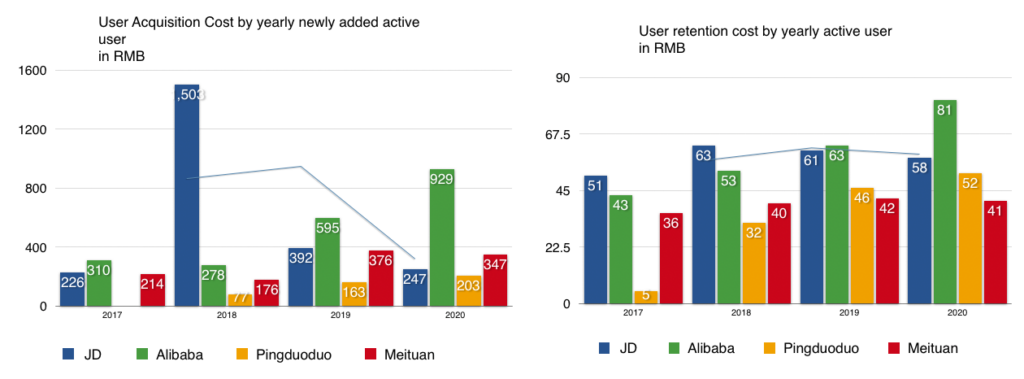

Acquisition and retention costs

When choosing the platform, one of the things you have to look at and account for is the cost of acquisition and retention of a customer.

While actual costs will significantly depend on the actual industry you are in and the product you are selling, there are statistics for the acquisition and retention costs for major Chinese platforms.

We hope you found this overview of the Chinese B2B landscape useful. For more information you can download the “China B2B Guide” (currently available in Chinese, but we are working on the English version). Feel free to get in touch with us to discuss how we can help you develop your next B2B eCommerce project in China.