This article is the first part in our series "2018 China eCommerce Insights". Throughout this series we hope to provide you with a complete overview of China's eCommerce landscape and the crucial information necessary to successfully establish the online presence of your business in China.

China eCommerce

This year, the total number of internet users in the world reached 3.4 billion, or 46% of world’s population. Currently, the global eCommerce retail market is equal to 8.7% of the total global retail market. Interestingly, while the pace of growth of regular retail fell overall, eCommerce grew rapidly at around 23.7% over the past year.

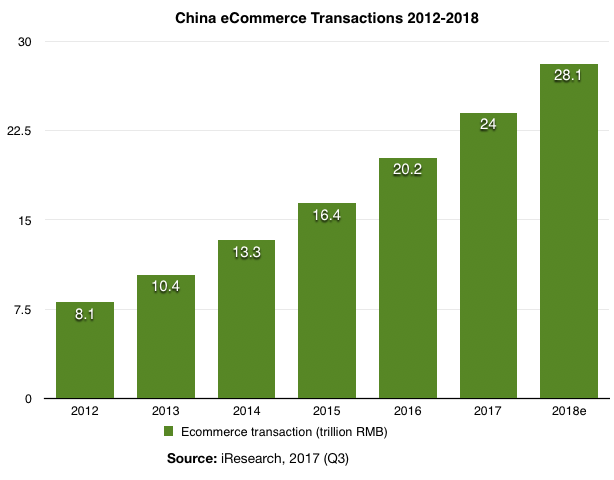

The United States and China dominate the global rankings thanks in large to eCommerce giants Amazon and Ebay as well as China eCommerce giant Alibaba. In recent years it has become impossible to eCommerce opportunities without mentioning the rapid growth of China’s eCommerce. The chart below shows the dramatic growth of the Chinese online retail market. According to the latest statistics from iResearch, the volume of eCommerce transaction amounted to 24 trillion RMB in 2017. Moreover, the country experienced an overall average growth rate of 23%. Although the growth of the eCommerce market is slowing down, it still boasts an impressive 18% growth annually compared to 10% in developed countries.

From ‘Regular’ eCommerce to CBEC

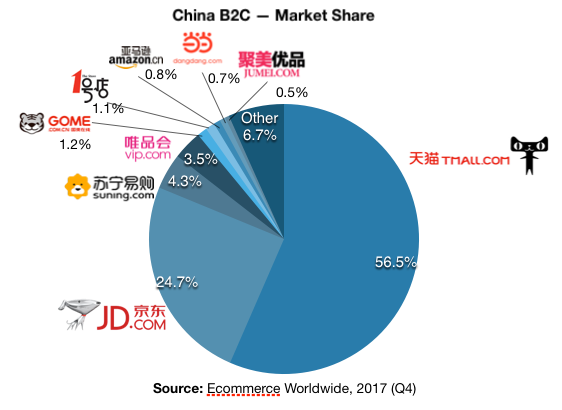

The local B2C eCommerce market is dominated by Chinese behemoths Tmall, part of China’s iconic Alibaba Group founded by entrepreneur Jack Ma, and its closest competitor Jingdong’s JD.com. Together they account for over 80% of the total China eCommerce market share. Furthermore, only a handful of other parties account for the remainder of the China eCommerce market share, whom typically are more specialised in particular product categories.

Traditionally, only large multinationals and smaller companies with business entities in China were able to offer their products through regular B2C eCommerce due to the nature of general trade to which it is applicable. In essence, via this methods products must be imported from abroad, which requires a legal entity in China. Similarly, opening a store on a regular domestic B2C eCommerce platform requires a company with a Chinese entity.

On the other hand, cross-border eCommerce (CBEC) offers a comparatively accessible entry strategy with two primary advantages. First of all, CBEC is subject to fewer import taxes. Moreover, particular products are subject to fewer product compliance checks which will result in an easier value chain. Specifically, in April, 2016, China issued two versions of the "Positive List" for cross-border eCommerce. These lists contain a total of 1.293 product categories which can be imported into one of 15 approved CBEC bonded warehouse zones across China or can alternatively be shipped from an overseas distribution centre linked to Chinese customs without applying for an import license or an import certificate.

If your product falls under the positive list you will enjoy a referential tax rate of 11.9% (calculated as a 30% discount on VAT). A new round of policy extensions was announced at the State Council Executive Meeting on September 20, 2017. Until the end of the transition period on December 31, 2018, products on the Positive Lists will generally be exempt from compliance China's product standards and import requirements. Are you curious whether your product is on the Positive List, then please visit TMO's "Positive List Helper".

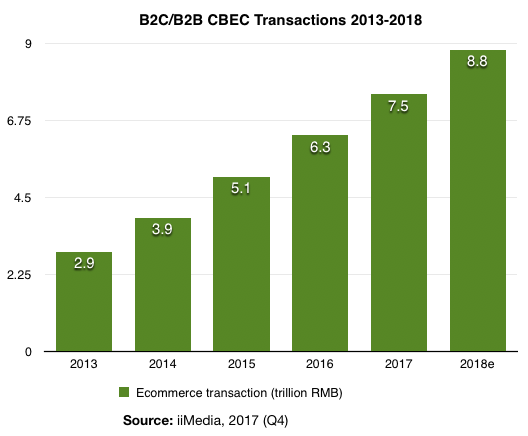

In recent years, the ever-increasing standards of living as well as greater exposure to foreign products contributed to upsurge in CBEC transactions as evidenced by the graph below. Also among CBEC transactions we observe an annual double digit growth rate, in this case ranging between 17% and 19%.

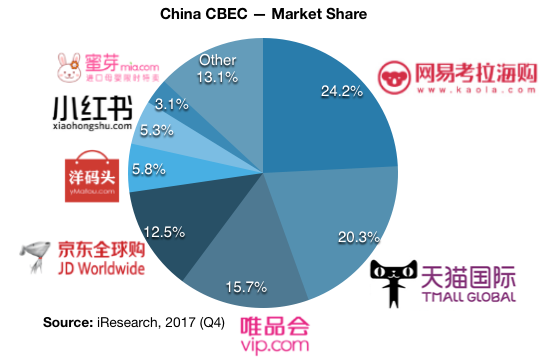

However, CBEC brings along its own challenges as the competitive environment differs significantly from regular eCommerce. In particular, the emergence of online shopping and the huge number of foreign merchants created a fragmented market (see the chart below) with numerous online sales channels.

New players such as Kaola and VIP.com are topping Tmall and JD, while other new players like YangMaTou and XiaoHongShu are gaining market share quickly. The majority of cross-border transactions are performed by firms from other Asian countries including Japan and Korea, followed closely by the United States. Especially cosmetics is a popular category, whilst childcare, nutrition, and healthcare products are increasingly becoming of interest to the Chinese consumer.

Sales Channels & Entry Strategies

Currently there are three channels through which foreign brands may consider to sell their products via CBEC, namely: through a stand-alone web shop, marketplaces, and WeChat stores. Where the marketplaces can be further divided into shop fronts on online malls, hypermarkets, vertical specialty marketplaces, and flash sale websites. Although all of these channels allow you to sell your products in China without the necessity to obtain a Chinese business license, the success of your company is dependent on numerous factors upon which we will touch throughout the series.

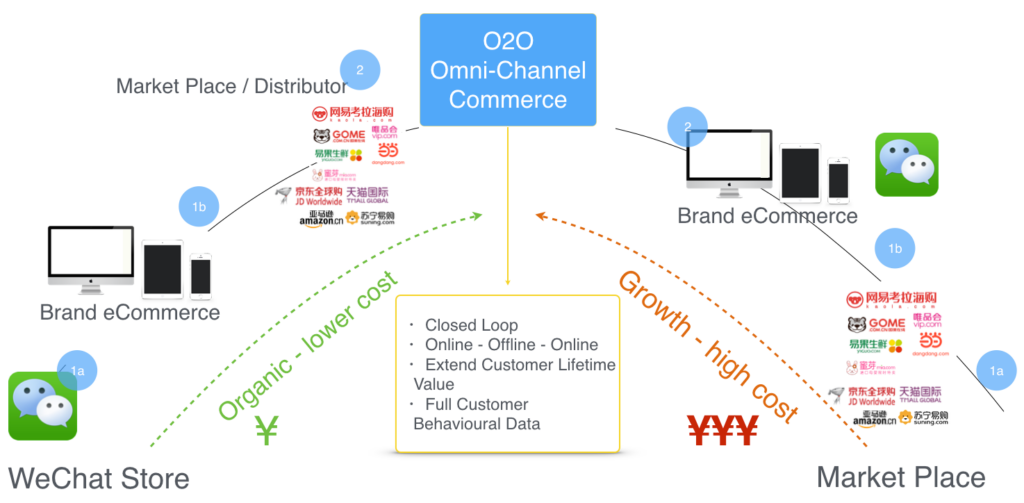

In order to determine how foreign business can use the differing sales channels to their advantage, we can broadly define two business development strategies.

- Fast Growth Strategy (high costs, higher growth).

- Organic Growth Strategy (lower costs, slower growth).

Eventually the aim is to develop an omni-channel sales strategy whereby one may sell their products both off- and online. Omni-channel eCommerce software solutions allow for the creation of a connection between existing information systems and a unified eCommerce platform.

Would you like to know what strategy will suit you best? Or has this article spiked your interest in China's eCommerce environment? Then please stay up to date as we will continue our 2018 China eCommerce Insights series by elaborating upon which marketplaces are your best choice for success in China’s eCommerce market.

In the following post we will discuss the benefits and downsides of Tmall Global as well as the steps required to establish your presence in the country’s largest cross-border eCommerce platform. If you would like to know more, take a look at our second article How to Sell in China Online with Tmall Global Cross-Border (Updated 2024)Tmall Global is one of the central channels to enter Cross Border eCommerce in China. Here are the main things you need to know to start.Drive your Business in China: How to sell on Tmall Global.

Throughout the series we will also touch upon several other marketplaces in China's eCommerce environment as well as interesting topics such as mobile commerce, logistics issues, payment methods, Intellectual Property Rights protection, marketing, and legal regulations.