This article is based on the SEA Cosmetics Outlook, a free PDF that TMO Group published in the beginning of 2023. In our research we analyze sales information of about 300 thousand SKUs of the two leading eCommerce platforms in the region - Lazada and Shopee. Download the Outlook file for more details, or, if you are interested in a more in-depth research of your market – feel free to contact TMO Group to see how we can be of help.

Market size

Makeup and cosmetics market, especially its online sales segment, is a vibrant and growing one: it has been this way since the advent of online commerce and doesn’t seem to be slowing down any time soon.

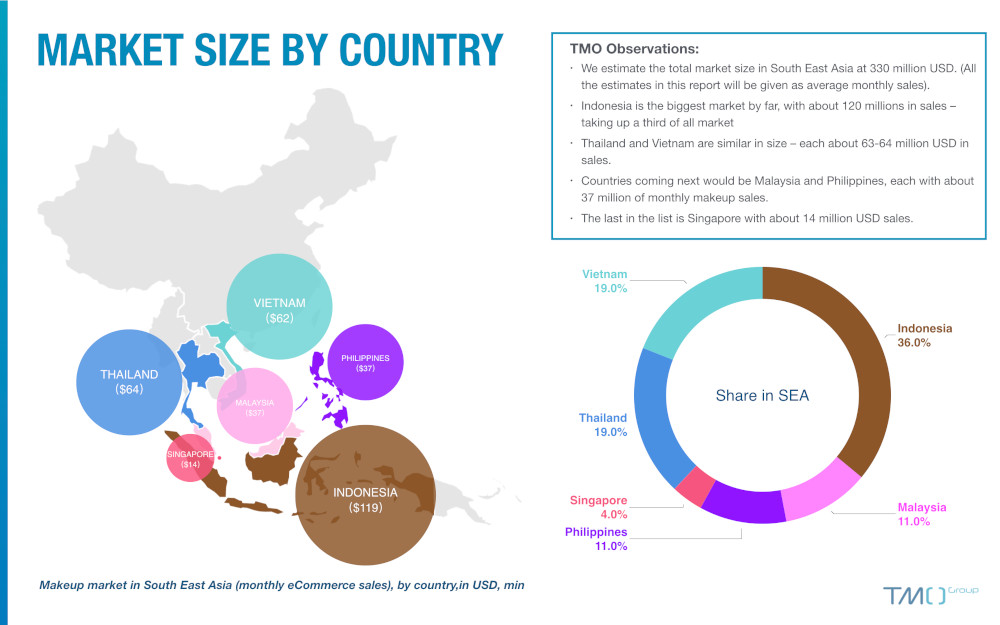

We estimate the total market size of cosmetics and makeup in South East Asia at about 330 million USD of average online sales in a month. (All the estimates in this article and in the report will be given as average monthly sales).

Indonesia is the biggest market by far, with about 120 millions in sales – taking up a third of all South East Asia market.

Thailand and Vietnam, which are somewhat similar in size – each about 63-64 million USD in sales – share second and third place.

Product categories

In our research we broke down the makeup market in 3 big categories: face, eye and lip makeup.

- Face makeup is the most popular category, taking up 41% of the market. It includes such products as foundations, concealers, blushes and other related products.

- Lips makeup is the second most popular category – generating about 21% of market’s revenue. It includes such items as lipsticks, lip glosses, lip tints, etc.

- Eye makeup is the final category and it is measured at 18% of the total market size. Products in this category include mascara, eyeshadow, eyeliner, eyebrow makeup and so on.

Remaining 20% are taken by items that didn’t belong to any of these three categories, it contains such items as makeup sets, makeup removers, tools etc.

Let’s look at each of those segments in more detail.

Eye makeup

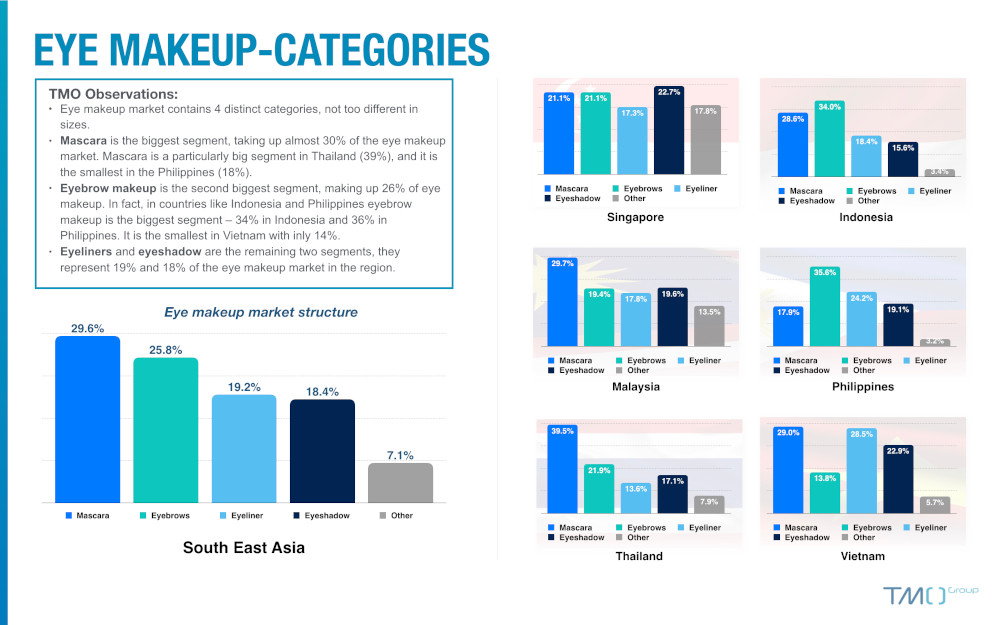

- Mascara is the biggest segment, it takes up almost 30% of the eye makeup market.

- Eyebrow makeup is the second biggest segment, making up 26% of eye makeup.

- Eyeliners and eyeshadow are the remaining two segments, they represent 19% and 18% of the eye makeup market in the region.

When it comes to the price range, in most of the SEA countries a peak of revenue comes from the 2-5 USD segment. Singapore has the most expensive items, with most of the revenue generated by the 10-20 USD segment.

Speaking of brands:

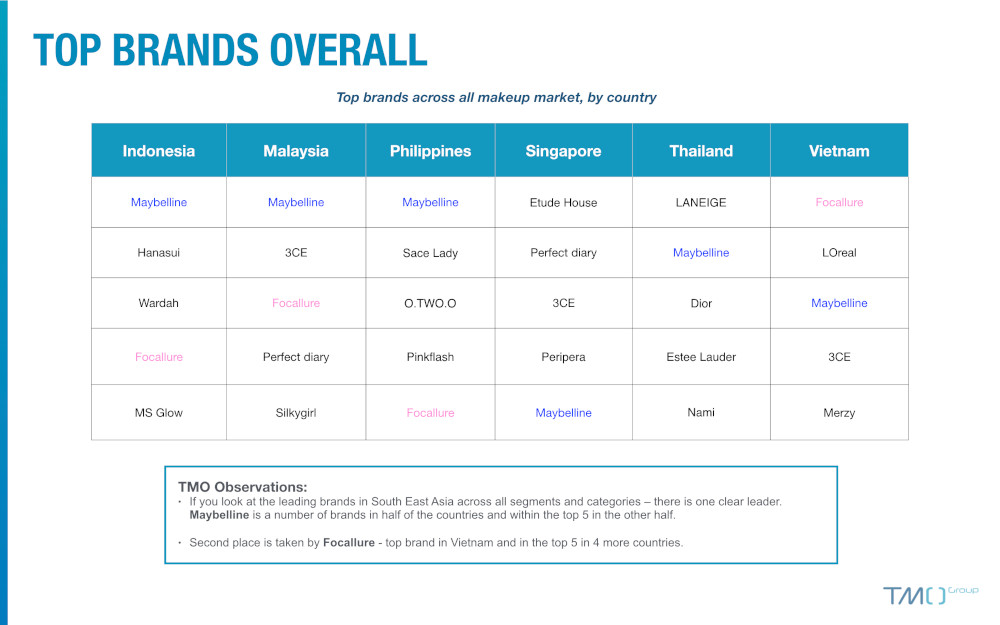

Maybelline is a clear leader in the segment: it is the most popular brand of eye makeup in Malaysia and Indonesia, and by leaps and bounds the most popular mascara brand.

Focallure is the second most popular brand. It tops the list of most popular eyebrow makeup brands in the region. In the segment of eyeshadow, it shared the second place with Pinkflash, the third popular brand of eye makeup.

Face makeup

When it comes to face makeup, foundation is by far the biggest category – taking virtually half (48%) of this segment. Remaining categories include such things as Acne/spots removal products (9%), concealers (7%) and blush (5%).

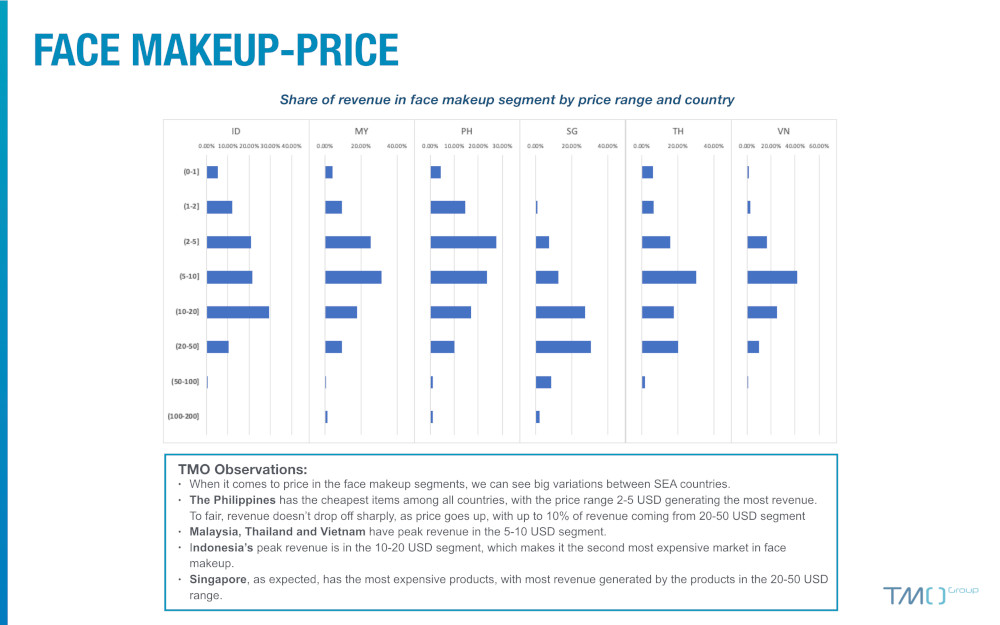

Speaking of the average SKU price in the face makeup segments, we can see big variations between SEA countries. From price range 2-5 USD generating the most revenue in the Philippines, to 5-10 USD being the peak in Malaysia, Thailand and Vietnam. Most expensive items make up most of the revenue in Indonesia (peak revenue is in the 10-20 USD range) and Singapore (20-50 USD).

Maybelline and Focallure are again the most popular brands, but this time with a few brands following very closely behind: MS Glow, Wardah (both very popular in Indonesia), Laneige (top face makeup brand in Thailand).

Lip makeup

Main two categories in the lip makeup segment are lipsticks (takes up about 41% of the segment) and lip tints, taints, glosses and glows. Latter occupies about 39% of the segment.

Price ranges that generate the most revenue vary from 2-5 USD in Indonesia and Philippines, to 5-10 USD in Malaysia, Vietnam and Thailand, to 10-20 USD in Singapore.

With lip makeup, Maybelline once again is a #1 brand in South East Asia. The runner up is Hanasui, a very popular Indonesian lip tint brand. Third popular brand in South East Asia is 3CE - and it is the top brand in half of the SEA countries - Thailand, Vietnam, SIngapore.

There is much more information about cosmetics and makeup market in South East Asia in our SEA – you can download a copy for free on our website.

If you are interested in a more detailed analysis of the cosmetics and makeup market, you can download a free copy of South East Asia Cosmetics Outlook on our website. If you are interested in looking into any other market in South East Asia – feel free to reach out to TMO Group to discuss your project and how we can provide the data service for it.