Over the past few years, the boundaries between online and offline sales have blurred. As the Internet and the Internet of Things (IoT) have become ubiquitous in China, a new era has begun. The era of New Retail.

In the second half of 2019, the 'Wild West' period of the New Retail era is coming to an end. Both brands that have yet to dive in and those who've already embraced New Retail must now re-examine the market as the era stabilizes. Refinement and standardization are bringing order to the previously chaotic era, and companies may have to change to keep up.

O2O vs New Retail: Maximizing User Traffic Activation

Six years ago, Online to Offline (O2O) took China by storm. Online was taken to be the core, with offline an extension of a company's online presence. The concept was successful at the time, offline supporting the core online business, but just three years later was faltering. China's eCommerce growth dropped and the cost of customer acquisition had risen considerably by 2016. Therefore, the concept of online being at the core held less weight.

That's when the New Retail concept emerged. In this new model, offline became the core, with online being the complement. Through closer-than-ever integration between offline and online stores, "1+1 equals more than 2" synergistic results began to be realized.

New Retail is more immersive across the three main modern user scenarios than O2O. These three are online, store-based, and offline:

- Online: Internet-enabled delivery service (making purchases online, with the goods then delivered to your home)

- Store-based: Internet-arranged store visit (booking an appointment or reserve a product online, then visiting the store in person for a more traditional in-store experience)

- Offline: Traditional in-store experience (visiting the store, making a purchase in-store, and then either taking the product then and there or arranging for it to be delivered to your home)

In the New Retail era, consumers focus on the efficient and coordinated use of their time and effort. For example, during their morning commute they might order a coffee from a store that they will pass along their way so that they can pop in and it will be ready for pick up when they arrive - saving them from having to queue up, place their order, then wait for their order to be prepared. This frees up more time for the consumer to sleep in or get more done in the morning before work, or allows them the time to buy a coffee during their commute where it may not have been possible before.

So a big part of New Retail is about making shopping as convenient as possible for consumers. But it's also about realizing that 'convenient' can mean different things to different people.

Step 1: Efficient delivery, warehousing, logistics, and collaboration

Unlike the past, where warehouses on the edge of the city were the norm, New Retail has seen each offline store act like a small warehouse all by itself. This way it can enhance the convenience and efficiency of order processing.

One way to increase efficiency for the customer is to integrate multi-channel orders (orders through Mini-Programs, H5, apps, official websites, etc) through a unified hub. This hub appears to the consumer as a single unified front, but behind the scenes it needs to be able to open up order fulfillment processes, including delivery, order splitting, cancellation, refunds, etc, on each of the supported channels.

Additionally, for brands that run multiple stores and multiple warehouses, the system needs to be able to manage inventory according to the user's location (for instance, a user near to store A will be shown store A's inventory). The system can then realize inventory transfer when items are out of stock at the nearest store. The system must do this seamlessly to avoid bothering users with discrepancies.

For instance, if the user orders product X and Y, then the system must be able to check whether store A has both in stock, and if not, get store B (the next closest store with the product in stock) to send it. This may lead to instances where store A is sending product X, and store B is sending product Y, even as part of the same unified order - without the customer ever needing to know that this was anything more than a single order.

Step 2: Intelligent Analysis

CEO of Boxu, Hou Yiru, said: "For different business districts and different cities, you need to undertake institutional adjustments to meet the local consumer income levels and consumption habits."

This is especially important to keep in mind, because online platforms that have to manage multiple stores in multiple districts, cities, and regions will inevitably move towards unified management and strategies. But intelligent analysis on each of these divisions can be hugely beneficial in making sure that the right stores are stocking the right products for where they're located and for the customers that are likely to frequent them. Then Internet-enabled inventory management can facilitate intelligent restocking, and so online can enhance offline stores' performance even from consumers who never venture online.

Such optimization can even extend all the way up the supply chain to factory orders and the like.

Step 3: Smoothen Your Users' Mobile Shopping Experience

As mentioned before, offline stores act as the core of the New Retail concept. Online acts as an indispensable support for offline sales and inventory management. However, everything starts from the core of the offline store. The main responsibility of the online side is to make sure that customers buy more. Supporting this, a secondary responsibility is to remove any obstacles to this.

Usually online stores follow one of the following three models:

- Mini-Programs

- Progressive Web Apps

- Native Apps

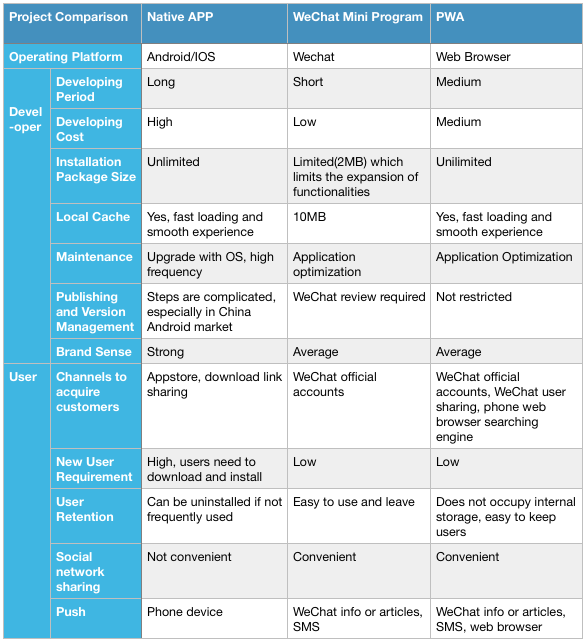

The table below breaks down the specific advantages of these three models:

When it comes to feasibility, TMO recommends opting for Mini-Programs. Their development cycle is short and they support functional iteration. Also, the user experience is close to native apps and social media costs are lower than apps of either kind. Mini-Programs are also becoming increasingly widespread, as Alibaba, Baidu, ByteDance and others jump on board following WeChat's pioneering success.

Progressive web apps are fairly future-proof. The ability to save them to your mobile desktop without needing to download a separate app brings another added convenience. However, for now these apps have yet to take off in popularity and are expensive to promote. As such, we mostly recommend them to companies looking to get ahead of the pack.

The user experience on native apps remains the best, but they are costly and cumbersome to develop and maintain. Such apps still make for a better fit for bigger brands that can leverage large, loyal consumer bases. Especially after they have tested the waters of New Retail with Mini-Programs or progressive web apps.

The early days of the New Retail 'Wild West' are drawing to a close. Now we can see the era shift, as the industry puts refined and standardized operations into practice. We're seeing enhancements across the entire chain from logistics and warehousing to user experience.