For Chinese eCommerce customers, cross border eCommerce has already become a widely accepted concept. In 2015, Chinese consumers has spent roughly 64.6 billion yuan, or around $10 billion on purchasing oversea products online, according to latest report from Chinese research firm Analysys international and web-only retailer JD.com. The report also indicated that total spending from consumers account for 31.3% of total buyings from both Chinese consumers and companies in 2015, compared with 22.5% in 2012.

It is estimated that China cross border eCommerce will top 611.84 billion yuan ($94.76 billion) in 2018, which would represent annual growth of more than 40% for the next three years.

China eCommerce giants are in the game

JD Worldwide and Tmall Global, cross border eCommerce platforms for JD.com and Alibaba

The rapid growth in consumer purchases through cross border eCommerce reflects the rising standard of living of many Chinese consumers, the report says. While China’s economic growth slowed to below 7% last year for the first time in many years, consumer spending increased to 66.4% of the country’s gross domestic product, while average personal income increased 33% in 2015 compared with 2012, also according to the report.

The cross border rules prompted big Chinese eCommerce companies like JD.com and chief rival Alibaba Group Holding Ltd. to open sections of their online shopping portals where foreign brands could take orders and then fulfill items via the free-trade zones or from warehouses abroad. Launched in April 2015, JD Worldwide, the cross border eCommerce platform of JD.com, now sells 3.3 million products from 8,000 brands through 2,000 storefronts, and the report says 10 million shoppers have visited JD Worldwide in the past year.

Meet Chinese cross border eCommerce consumers

Consumers between the ages of 26 to 45 represent 71% of shoppers on JD Worldwide, 83% of shoppers on the site have a college education and 86% are female, the report says. JD Worldwide shoppers like to try new products and look for products from well-known brands.

Chinese Consumers are digital-savvy. For example, 70% orders of JD Worldwide are placed via mobile devices. The report attributes this high mobile commerce penetration in large part to JD.com’s ties to Tencent Group, the Chinese Internet giant that operates the WeChat mobile social app that claims nearly 700 million users. Every WeChat user’s account includes a link to JD.com, making it easy to click from a message to JD.com.

Wondering what they like to buy?

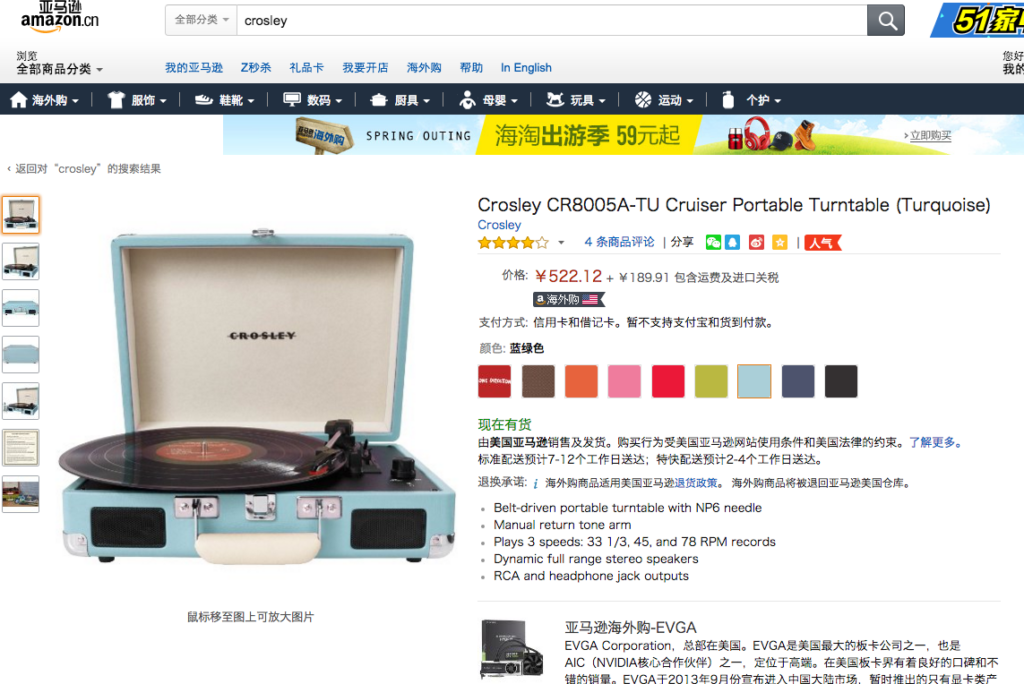

Popular product categories include children’s and maternity goods, cosmetics, food, nutritional supplements, electronics, watches, auto parts and housewares. The report says JD Worldwide helps overseas brands sell products not readily available in China, such as portable turntables from U.S. manufacturer Crosley or Star Wars-themed toy robots.

U.S turntable Crosley can be purchased on Amazon China site

However, when it comes to cosmetics, the report says, Chinese consumers prefer products from Korea, Japan, France, Australia and the United States, especially products specifically designed for Asians.

Apple, Kirkland Signature (Costco Wholesale Corp.’s house brand), Ferrero Rocher (Italian Chocolate brand), and Blackmores (Australian vitamins and supplements brand) are among those top-selling foreign brands in China.

Blackmores official store on Tmall Global