Southeast Asia’s health and wellness sector is expanding quickly, but the operating environment remains structurally volatile. Consumer demand varies sharply by country, platform dynamics shift with marketplace incentives, and cross-border sellers create inconsistent price floors that complicate portfolio planning and margin protection. Even established brands struggle to maintain a coherent view of category structure, competitive intensity, and pricing behavior across the region.

Using sales data from TMO’s Market Insider, this article highlights several of the underlying market signals shaping Southeast Asia’s health categories today. We’ll look at measurable patterns such as ingredient demand clusters, SKU positioning shifts, pricing dynamics, and changes in competitive density: signals that help global brands assess market potential and commercial risk with greater accuracy.

For the last 2 years, TMO Group has been helping brands explore and successfully enter the SEA market with custom data intelligence and market strategy.

3 Data-driven Pillars of Product Strategy

To make sense of Southeast Asia’s fast-moving health categories, it helps to look at the market through three interconnected dimensions: price tier, channel, and narrative. These axes shape how consumers perceive value and determine whether a brand competes on price or succeeds in building a premium position. The interactions between them explain much of the volatility and the opportunity seen across different SEA markets.

1) Price Tier: How Consumers Interpret Value

Pricing in Southeast Asia doesn’t move uniformly. Some markets support a clear premium band for science-led or beauty-oriented SKUs, while others favor mid-tier products that balance perceived efficacy with affordability.

Understanding these movements helps explain why brands with identical positioning perform differently across markets.

- When a category is trading up or drifting toward commoditization

- Whether premium formats (e.g., powders, oils, beauty-led supplements) are gaining share

- How aggressively cross-border sellers are pulling price floors downward

2) Channel: How Distribution Shapes Perception

Channel structure heavily influences consumer trust and pricing power. Marketplace-led demand will look very different from DTC- or retail-led demand, and each SEA market has its own channel bias. Because channel effects compound over time, they are a critical part of reading long-term category behavior.

- Which platforms skew toward mass-volume SKUs

- Where premium SKUs capture stronger conversion

- How platform incentives distort or amplify certain categories

Demand patterns differ clearly by market. In the Philippines, categories like glutathione and beauty-led supplements over-index due to strong interest in whitening and brightening claims. By contrast, Malaysia and Singapore see higher performance in “chronic disease prevention” supplements such as Omega-3 and CoQ10, reflecting different health priorities and consumer expectations.

TMO offers Marketplace Intelligence Services that help global brands localize and compete smarter in Southeast Asia.

3) Narrative: How Ingredients and Claims Drive Preference

Despite regional proximity, SEA consumers respond to different stories because narrative is not just functional explanation; it’s a blend of cultural cues, lifestyle context, and the language consumers use to describe what they need. For example:

- Indonesia: Consumers show strong preference for traditional herbal concepts such as jamu. These cues carry cultural resonance and affect purchasing decisions even when modern supplement formats are available.

- Philippines vs. Singapore: Consumers in the Philippines heavily discuss beauty and skin-brightening, with “gluta” becoming a widely recognized shorthand for glutathione. Singaporean consumers focus more on stress, cardiovascular health, and job-related well-being, reflecting different urban lifestyles and health concerns.

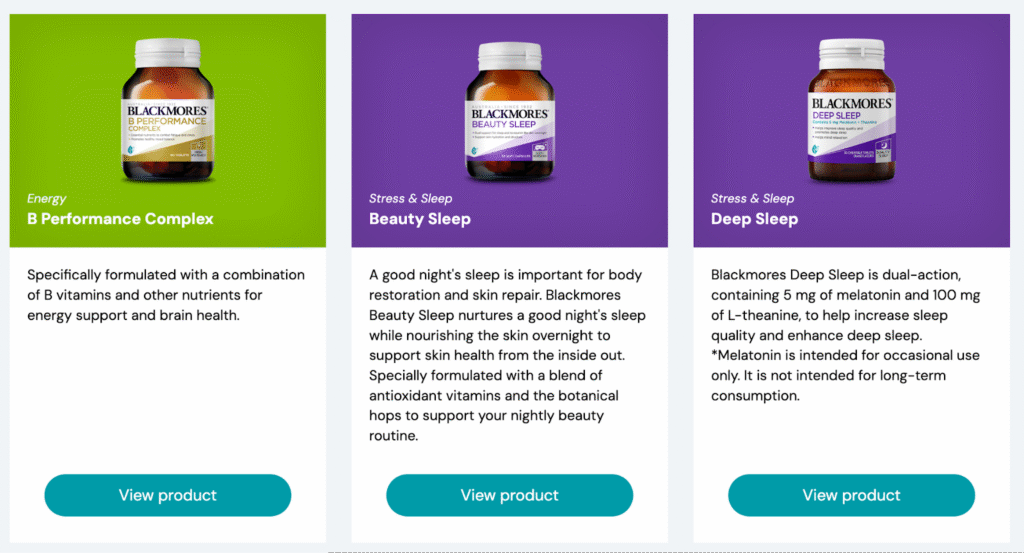

For example, Blackmores built a localized narrative in Singapore by emphasizing targeted sleep-support product positioning. This aligns with local demand for stress relief and sleep management, needs that differ significantly from markets where beauty or immunity drive supplement purchases. Monitoring narrative patterns helps identify:

- Which ingredient stories sustain demand

- Which claims resonate by country

- How new formulations gain or lose traction

Taken together, price tier × channel × narrative form a practical lens for interpreting the health market in Southeast Asia. Each dimension reveals a different part of the underlying demand curve, and the alignment (or misalignment) between them often explains why certain brands outperform, maintain stability, or struggle across the region.

How Brands Shift From Defensive to Value-creation Strategies

Marketplace data across Southeast Asia shows that health brands are not locked into fixed price tiers or static consumer segments. When observed longitudinally, several upward trajectories become visible, movements that often contradict the assumption that SEA is a permanently price-sensitive region. These signals point to clear opportunities for brands able to read and react to underlying shifts.

a) Potential for Price-Tier Upgrading

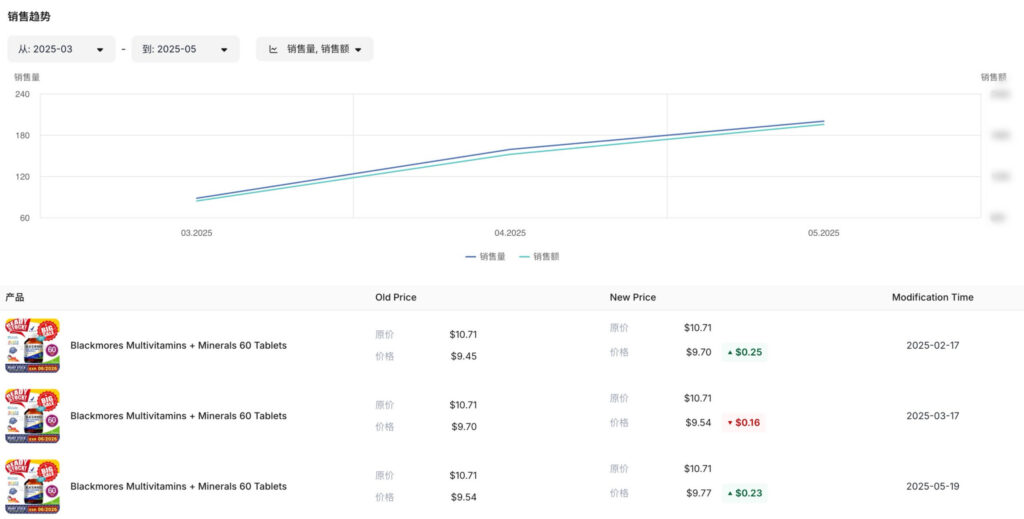

Long-term data monitoring shows that categories once dominated by low-tier SKUs can gradually trade up as consumer understanding deepens.

- Collagen powder: In Vietnam, several protein SKUs entered the market at low price points but gradually shifted into mid-tier pricing as consumers became more familiar with protein’s functional benefits.

- Gut health to broader immunity: Products originally positioned narrowly around “gut health” (especially for children) are now extending into adjacent claims such as “immune support” or “workplace wellness,” opening space for higher-tier formulations.

These movements indicate that upgrading is possible when consumer awareness matures. In such cases, data helps brands identify when an ingredient or function is ready to move beyond low-tier positioning.

b) Channel and Country Contrasts

Marketplace data also reveals sharp contrasts between platforms and countries, especially regarding price elasticity, promotional responsiveness, and consumer willingness to pay. Longitudinal comparisons across platforms can show:

- Which countries respond aggressively to discounting

- Which platforms over-index in premium sales

- Where bundles, convenience formats, or trial-size SKUs gain traction

These contrasts help brands decide whether a category is fundamentally “promotion-led,” “elastic,” or “value-stable.”

Channel elasticity curves expose highly promotion-sensitive markets or markets willing to pay a higher premium for wellness or convenience-oriented SKUs. Such differences suggest that not every country or platform should be evaluated using the same assumptions about price or competitive pressure.

c) Narrative-Driven Value Creation

Data also reveals opportunities where cultural cues or scenario-based storytelling create pricing power that pure functional claims cannot. Let's look at an example where single-function claims alone limited value-creation potential. When these products are reframed within a specific consumption scenario, performance increases:

Thailand’s Takabb Anti-Cough Pill evolved from a traditional household remedy for older consumers into a youth-oriented supplement. By refreshing packaging, incorporating “traditional herbal” and “warming” cues, and leveraging local lifestyle trends, the brand built strong emotional resonance and significantly expanded its audience. The upgrade wasn’t driven by formulation changes, but by vernacular narrative cues and cultural symbolism.

This illustrates that narrative shifts, when anchored in local context, can materially influence price-tier mobility and review volume.

4 Steps to Adjusting Product Strategy

While each Southeast Asian market behaves differently, marketplace data reveals a consistent sequence that brands follow when applying the price × channel × narrative framework. The goal is not to prescribe a rigid process but to provide a structure for how teams interpret signals, test hypotheses, and scale what works.

| Step | Objective | Focus |

|---|---|---|

| 1. Build the Monitoring Layer | Establish visibility across markets and platforms | Price tiers, platform mix, narrative patterns |

| 2. Identify Trend Signals | Detect early indicators of demand shifts | Search volume, review themes, performance gaps |

| 3. Test in High-Potential Markets | Validate willingness to pay + positioning | Premium SKUs, bundles, adjusted messaging |

| 4. Scale Across Countries | Transfer successful tactics into new markets | Pricing strategy, packaging, seasonal formats |

Step 1: Build the Monitoring Layer

Regional decisions rely on comparable signals across countries. Brands typically track:

- Price-tier benchmarks such as P25/P50/P90, promotional elasticity, and tier migration.

- Channel contrasts like platform sales mix, GMV concentration, and where premium SKUs outperform.

- Narrative cues including search-term growth, review keywords, and emerging benefit-language.

This creates a stable foundation for evaluating whether categories are trading up, fragmenting, or drifting toward commoditization.

Step 2: Identify Trend Signals

Marketplace shifts often appear first as small indicators:

- When two or more countries show rising search volume for the same function or ingredient.

- When review sentiment and average rating climb alongside search interest.

- When identical SKUs diverge sharply between Shopee and Lazada, revealing which platform is more suitable for premium or value-led strategies.

These signals help teams judge whether a price-tier upgrade or narrative adjustment is commercially viable.

Step 3: Test in High-Potential Markets

Before scaling, brands typically run controlled experiments in markets with stronger spending power, such as Singapore or Malaysia. Tests may include:

- Introducing a premium SKU or upgraded bundle

- Adjusting pack size or function claims

- Tracking review volume, repeat purchase, and price acceptance

If performance holds, the same positioning can be adapted for more price-sensitive markets.

Step 4: Scale and Localize

Once a tactic proves successful:

- Extend the approach across multiple countries and platforms

- Use bundles, seasonal packaging, gift sets, or subscription-aligned formats

- Localize narrative elements to match cultural expectations and search behavior

This approach reinforces both price-tier strategy and channel positioning, helping brands expand consistently across Southeast Asia.

Turning Fragmented Signals into Decision-Ready Intelligence

Southeast Asia’s health market offers meaningful growth potential, but the region’s diversity creates a high-variance operating environment for global brands. Category structure shifts quickly, price tiers diverge across borders, and consumer narratives evolve through cultural and platform-specific cues. Understanding where real opportunity lies requires Requires consistent, comparable marketplace intelligence spanning price tiers, channels, and narrative signals.

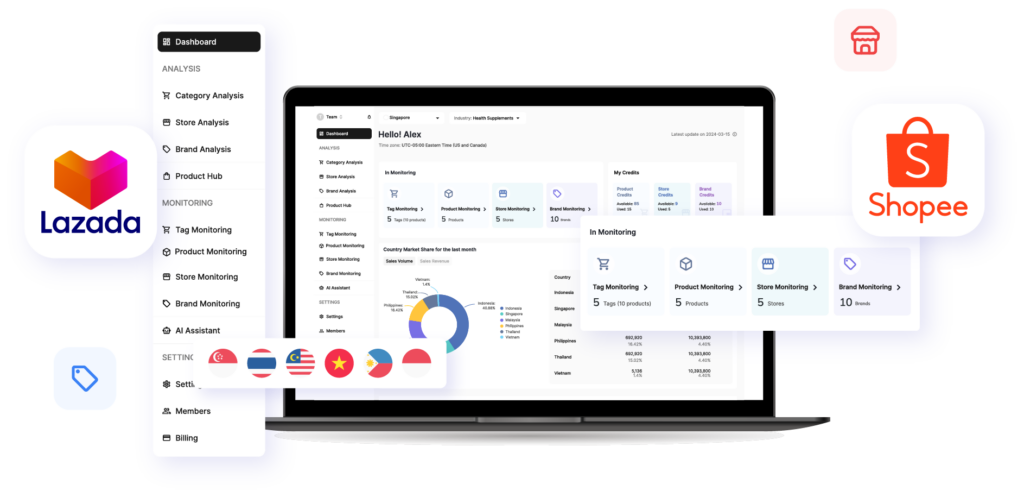

These insights are powered by Market Insider, TMO Group’s enterprise data platform that consolidates multi-country sales intelligence from Shopee and Lazada. By offering category snapshots, brand analytics, SKU-level tracking and long-term trend monitoring, Market Insider enables teams to read the market with clarity: which categories are trading up, where premium positioning holds, how narratives shift between countries, and where competitive pressure is intensifying.

Market Insider spans Beauty, Skincare, Health & Wellness, Food & Beverage, Home Appliances, Sports & Outdoor, Mother & Baby and Pet Care. The platform provides comprehensive category snapshots, brand-level analytics and SKU-level tracing across the entire competitive field, enabling brands to monitor emerging trends, assess competitive pressure and validate market-entry strategies with precision.

TMO's Market Insider is a paid enterprise-level data platform. Schedule a Market Insider Demo and discover how sales performance insights can guide your next move.