In 2020, TMO launched the first version of “China Health & Food Supplements Industry Report”, presenting overseas brands with a handy guide to China, its consumers, and the state and future of its health supplements market. We didn’t only just gather data from trusted sources and prominent research organizations., but also did our own first-hand investigations on the country’s leading eCommerce platforms. With the improvement of the health literacy level of Chinese residents year by year, and the influence of the epidemic, the public has paid more attention to personal health. Therefore, in 2022, we’ve decided to thoroughly upgrade the report. If you want to learn the report details, you can go grab the report China Health & Food Supplements Industry ReportThis report takes a broad view of the market for health supplements in China, and how an overseas brand can seize the many opportunities it presents.right here, right now, and free of charge. But if you want to learn more, don’t go anywhere!

A Wealth of Data

Throughout the free report’s 90 pages, we present a wealth of data from numerous sources. We filled our report with charts, tables, and graphs, to present you with all the relevant facts. While not exhaustive, our data should enable overseas companies to get a feel for the state of the industry today.

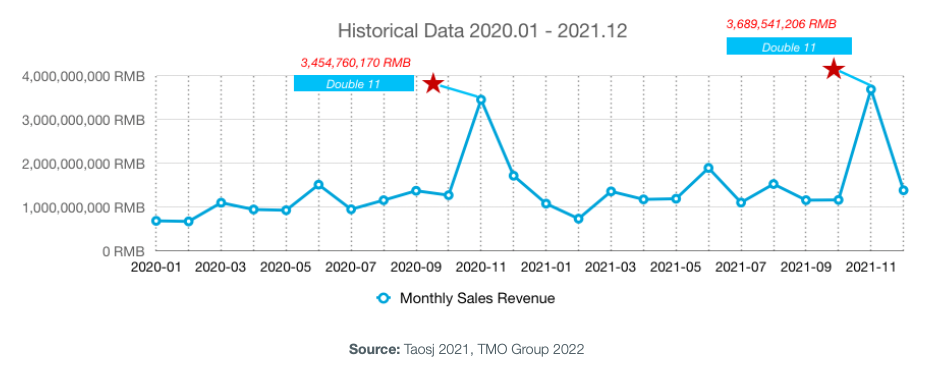

As part of our research, we didn’t just stop at talking to industry insiders or obtaining data from trusted providers such as Statista. We went a step further, by investigating sales data and search results on leading eCommerce platforms. Our focus was on Alibaba’s Taobao and Tmall Global, as respective examples of domestic and cross-border platforms.

In the 2022 version of report, we did a comprehensive data update so that you can get the latest market data and insights.

Competitors, CBEC and Regulations

Some chapters in the report focus on taking a closer look at the industry from specific angles.

In the Competitive Environment chapter, we look to the brands that perform well in China. This includes both domestic enterprises and overseas companies and covers four health supplement categories. Using real sales data gathered by hands-on research, we look at how some brands perform on specific platforms. To reinforce this we also referred to more wide-reaching data from publicly released figures from research agencies.

CBEC (Cross-Border eCommerce) is one of the most compelling options available to overseas brands hoping to sell to China. In recent years, the supervision of health supplements imported through cross-border eCommerce is not as strict as that of the domestic ones, and the market entry through CBEC has the advantages of quicker process, lower cost in terms of taxation and fast logistics services. For many overseas brands, these advantages provide convenient conditions for entering the China market. We devote a chapter to this exciting approach, filling you in on all the broad-strokes you should know.

Health supplements in China started in the 1980s and have gone through four stages, from the total chaos initially to the current stage of rapid development. Now the market is gradually moving towards a more standardized direction for development thanks to the strengthened supervision via a series of relevant laws and regulations promulgated. The chapter of Health Supplements Regulations lists milestone events or laws in China’s health supplement industry in recent years for your reference.

Channels to Entry

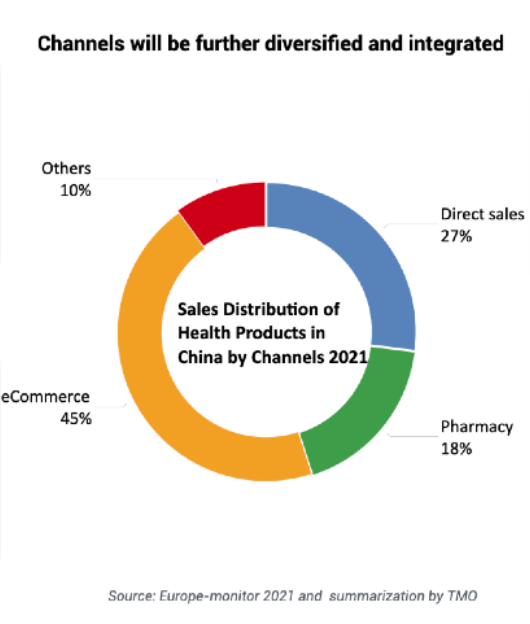

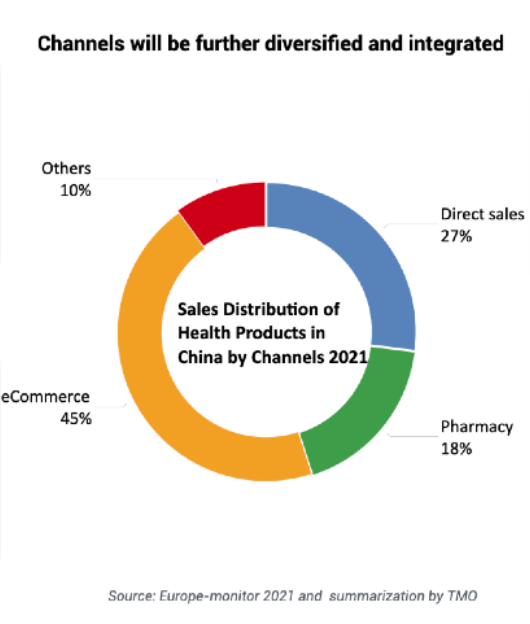

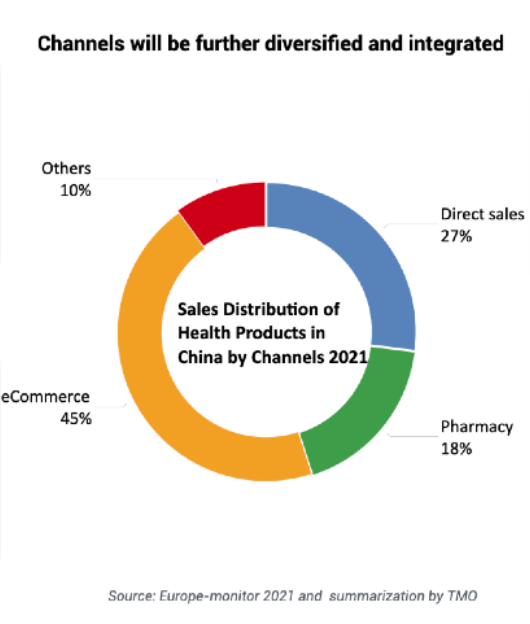

One of the interesting parts of the market to look at in China as it develops is how the different available sales channels have shifted in popularity significantly, even as the market remains in its relative infancy. With the rapid development of the eCommerce industry, the online marketing of young Chinese brands and the continuous impact of the epidemic, more and more consumers choose to make purchase online. Traditional pharmacies and grocery stores are facing crisis and the halo of direct selling is fading due to the suspension of the license release. In a dedicated chapter, we look at each of these channels in turn, how they are performing, and how they may do in the new decade.=

The Chinese Consumer

In the Chinese Consumer chapter, we draw up a profile of the modern health supplement consumers in China. This is no small task with such a huge and varied population! We took a broad look at demographics, consumer behavior, and attitudes to foreign products in this industry. By doing so, we hope to help you see how these buyers differ from those you may be used to. In addition, in the 2022 version, we added a brand-new section talking about the consumer groups. We conducted in-depth research on the consumers of health supplements in China and divided them into three main groups: the elderly, young & middle-aged women and Gen Z. For each group, the aspects of consumer needs, information & purchase channels and consumption trends are covered in detail.

Additionally, we provide a template roadmap that takes you through an example market entry and expansion process, to give you an idea of what market entry might look like for your company. Of course, no two companies are the same, and a personalized strategy can offer a lot more – if you’re interested in putting together a unique market entry strategy tailored to your company’s particulars, eCommerce Consultancy & StrategyEach market offers different opportunities. Before you enter a market, we can provide you with E-Commerce Consultancy & Strategy based on extensive reportscontact us about our consulting services.

If you’d rather start with the more general introduction provided by our industry report, then what are you waiting for? China Health & Food Supplements Industry ReportThis report takes a broad view of the market for health supplements in China, and how an overseas brand can seize the many opportunities it presents.Grab your free copy today!