This article was published in the lead up to our China Health & Food Supplements Industry ReportThis report takes a broad view of the market for health supplements in China, and how an overseas brand can seize the many opportunities it presents.China Health & Food Supplements Industry Report, available for free right now.

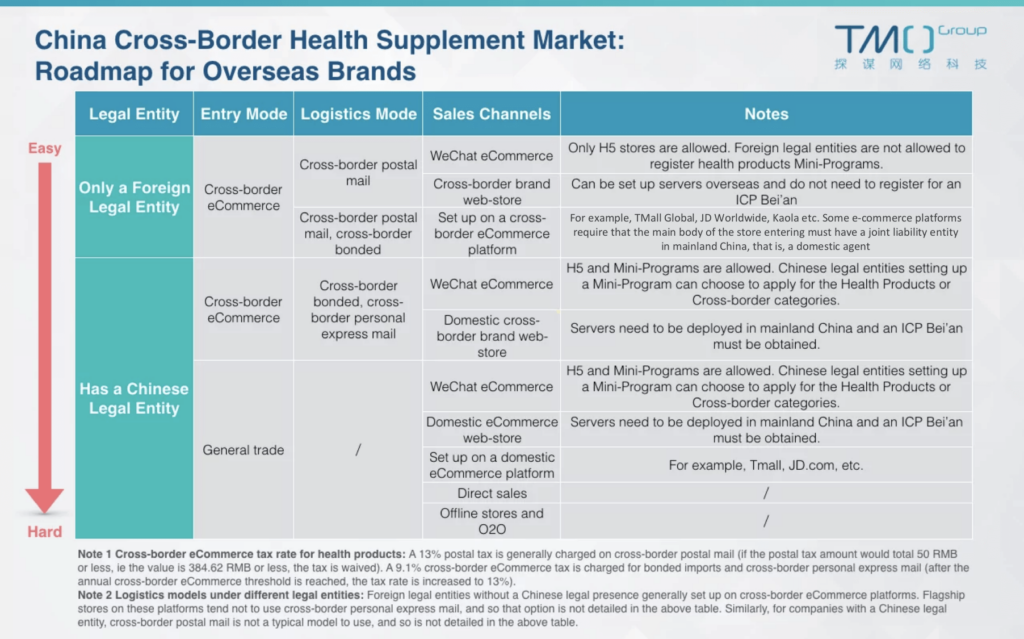

How can foreign health supplements brands successfully enter the China market? What are the best-suited channels and strategies for this? Looking at the challenges involved and effectiveness of several approaches, TMO has put together the following strategic roadmap. This roadmap aims to help foreign health supplements brands to enter the China market. Your strategy for entering this market depends on whether you have (or intend to set up) a domestic Chinese legal entity, and on whether you wish to adopt a cross-border strategy or sell through general trade.

Strategic roadmap for China market entry by overseas health supplement brands

Cross-border eCommerce sales by overseas legal entities

Currently, the Chinese government permits the sale of health supplements across borders. Under this model, international brands can sell directly to Chinese consumers from their overseas legal entity, without needing to set up a Chinese counterpart or subsidiary.

Ordinarily, a postal tax of 13% is levied on health products sent using the direct overseas mail model, in addition to a 9.1% cross-border eCommerce tax levied on goods in this category.

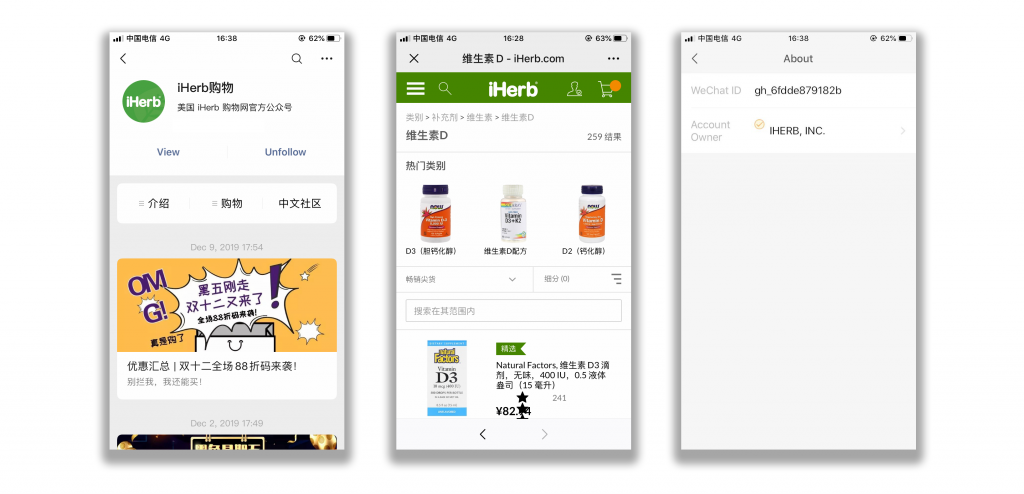

Setting Up an eCommerce Platform on WeChat

WeChat now allows foreign companies with no Chinese legal entity to register public accounts and run H5 stores. However, for now, such companies are not allowed to open a WeChat Mini-Program store in the health product category.

Popular health supplements eCommerce brand iHerb set up an official WeChat account with an H5 store, using its non-Chinese legal entity.

Using an Overseas eCommerce Web-store

Overseas eCommerce web-stores are better for companies to test the Chinese market than as a valid long-term strategy. Slow loading speeds in the mainland, low SEO friendliness for mainlanders searching for it, and barriers to consumer trust due to being based overseas and enforcement of consumer rights being difficult across borders are all issues that plague such web-stores. This makes it a poor long-term solution, as consumers have so many fast, convenient, and trustworthy options at home. If this is an approach you are considering using, be sure to make your site Chinese language-friendly. Few shoppers have the patience to navigate a foreign-language site in addition to the above issues.

Joining a Cross-border eCommerce Platform

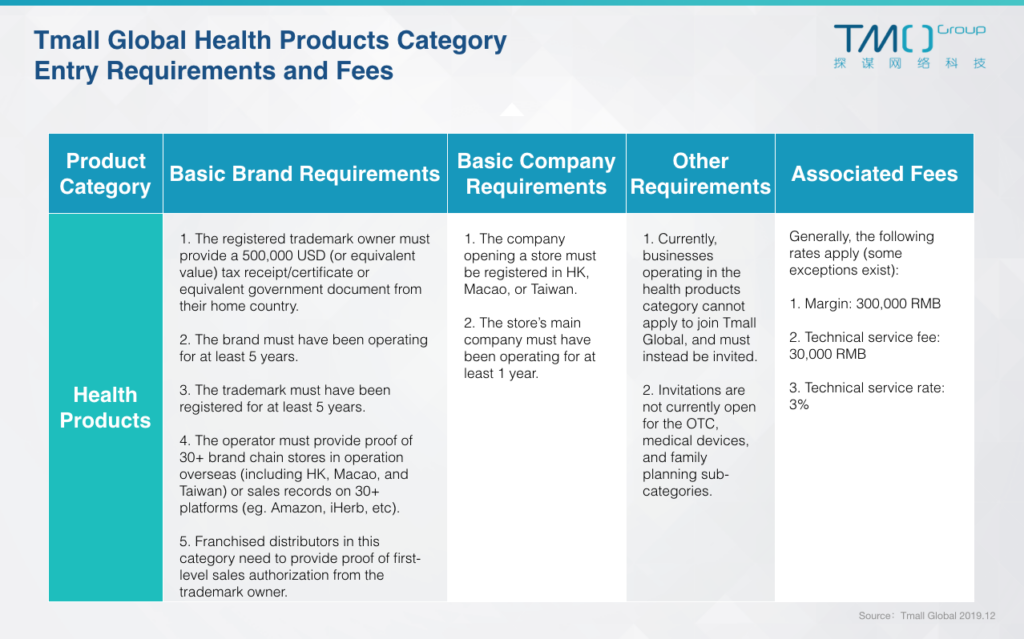

You can choose to set up a flagship store for your brand on cross-border eCommerce platforms such as Tmall Global and JD Worldwide. For those selling in the health products category, the restrictions on and conditions for eCommerce across borders are stricter. Below we take Tmall Global as an example, showing what criteria a company hoping to sell in this category must meet.

Currently, Tmall Global uses an invite-only system for the healthcare product category, which means that brands cannot apply to set up a store. Instead they must wait for an invite from the platform. The relevant criteria, fees, and requirements for setting up to sell cross-border are shown below.

Tmall Global Health Products Seller Requirements and Fees

Selling Cross-Border When You Have a Chinese Legal Entity

Registering a Chinese legal entity can simplify some difficulties involved with selling across borders. This model usually opts for one of two selling modes: cross-border bonded, and cross-border direct mail. Both modes are subject to the 9.1% cross-border tax for health products mentioned above.

In this model, you need to pay special attention to the development of cross-border eCommerce functions such as customs interconnection, identity and personal data management, cross-border logistics, cross-border tax rates, and threshold and limit calculation.

Setting Up an eCommerce Platform on WeChat

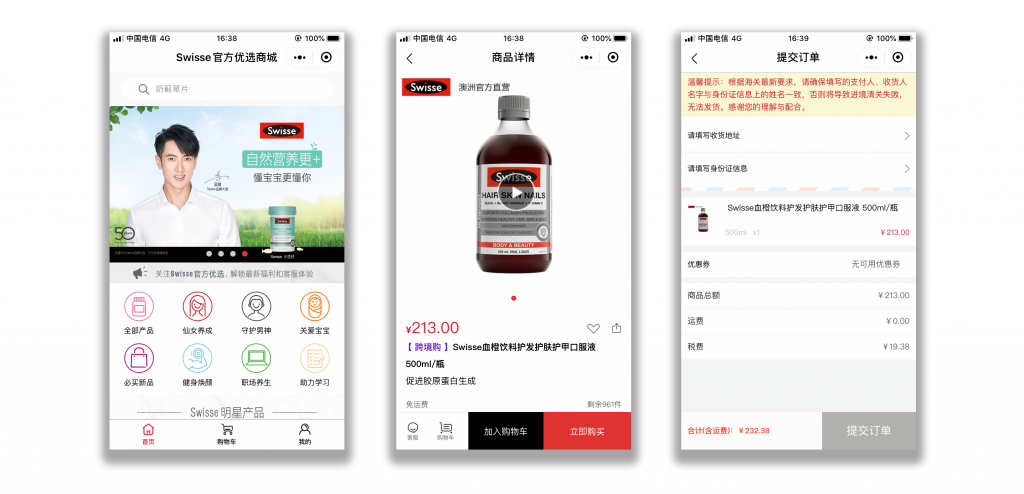

You can set up either an H5 store or a Mini-Program store for cross-border eCommerce on WeChat if you have a Chinese legal entity.

The Swisse Mini-Program sells healthcare products to Chinese consumers using a cross-border model. In the image, the Mini-Program prompts a user to enter their name and identification information on the settlement page, to facilitate customs clearance.

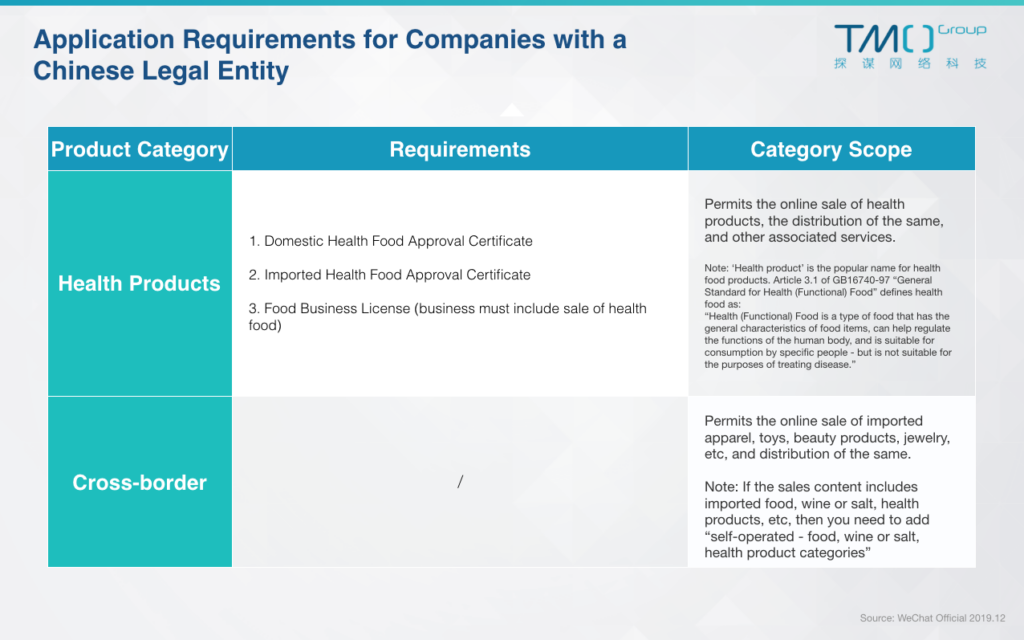

When applying to set up a WeChat Mini-Program, companies with a Chinese legal entity have two main options: applying to operate in the health product category or the cross-border sales category.

Entry requirements for Chinese legal entities setting up a Mini-Program in the healthcare products category

Making Your Own Chinese eCommerce Web-store Using Normal Trade Imports

This option involves creating your own Chinese website and adding cross-border eCommerce functionality. In addition, you will need to apply for ICP Bei'an registration for your site, use servers based in China, and pay close attention to China's Cyber Security Law and China's eCommerce Law to ensure your site is in full compliance.

General Trade Through Your Chinese Legal Entity

China is temporarily supervising cross-border eCommerce purchases intended for personal use. Also be aware that even if you have completed all necessary quarantine requirements in your goods' country of origin, these may not be enough to match Chinese standards. For general import trade, foreign companies need to go through a series of procedures (such as 'Blue Hat' registration or filing for health food products, customs declaration, and inspection and sales compliance) in order to be valid for sale in the Chinese market.

Number of health products registered per year from 1996-2017

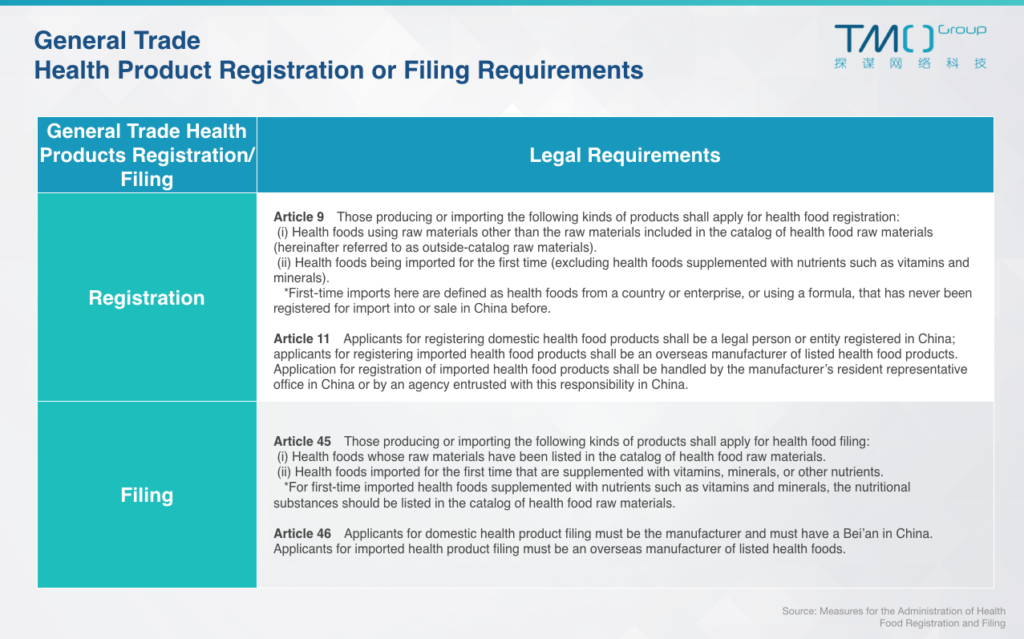

In addition, the Administrative Measures for the Registration and Filing of Health Food, implemented in July 16, 2016, included the following provisions for domestic and imported health products:

General import trade registration/filing requirements

Setting Up an eCommerce Platform on WeChat

Operating through a Chinese legal entity enables you to set up an H5 store or a Mini-Program store on WeChat, as mentioned above. The rules and requirements for setting one up are also the same as explained above, and so are not repeated here.

Making Your Own Chinese Cross-Border eCommerce Web-store

Creating your own Chinese eCommerce web-store is a simpler option when operating via general import trade. This is because you don't need to setup cross-border functionality. However, as noted above, you will still need to apply for ICP Bei'an registration for your site, use servers based in China, and pay close attention to China's Cyber Security Law and China's eCommerce Law to ensure your site is in full compliance.

Joining a Domestic eCommerce Platform

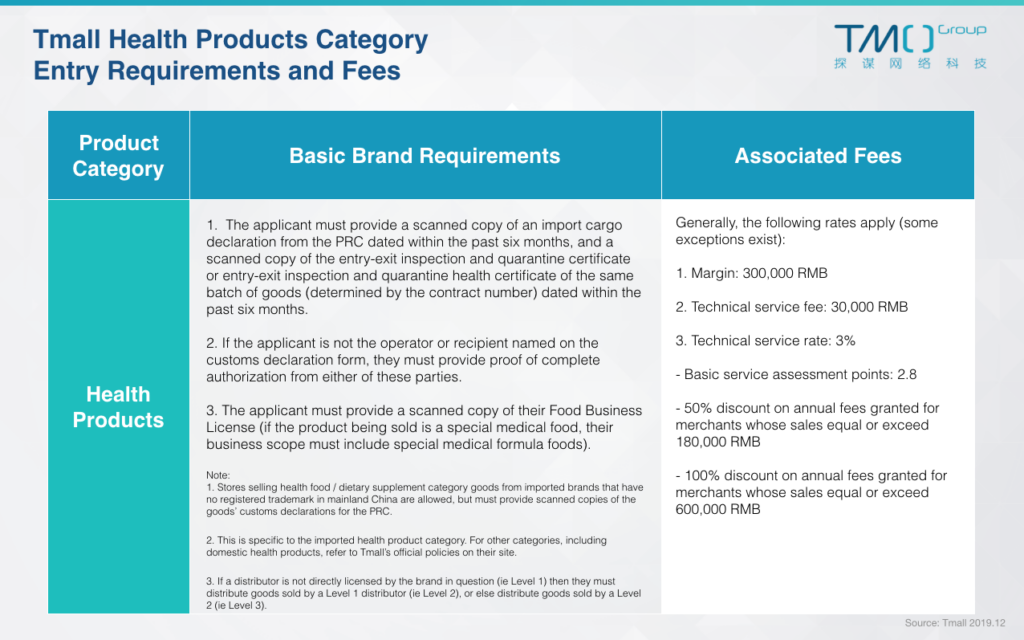

Setting up a store-front on a domestic eCommerce platform is relatively simple for those operating domestically. The costs on the more popular platforms (such as Tmall or JD.com) can be fairly high. Therefore while the potential rewards are considerable, this is not a market entry path we recommend. Below we show the requirements and criteria that must be met to set up on Tmall, as a representative example.

Requirements for setting up a storefront to sell health products on Tmall

Using a Direct Sales model

In 2005, the Regulations on the Administration of Direct Marketing came into effect. These regulations granted direct marketing and selling of health products legal status in China once more, after a break of some years. However, China demands a high standard and enforces strict requirements for those wishing to apply for a direct selling license. Successful applicants from overseas must be able to show strong financials, considerable direct selling experience elsewhere in the world. Additionally, they must prove that they have production bases and products that meet the country's high standards.

As far as the sales channel of health products in China is concerned, direct sales still account for 47.3% of the total. By the beginning of 2020, the Ministry of Commerce of China has announced that there are 90 enterprises qualified for direct selling (including 32 foreign-invested enterprises), and a total of 75 enterprises are engaged in health food sales-related business.

Offline Stores and O2O

Some brands also choose to open offline stores when they feel the time is right. Then they link their online and offline businesses through O2O strategies.

Chinese Health Product eCommerce Market FAQ

Is it necessary to obtain 'blue hat' registration for cross-border sales of health products?

If you don't promote your products' health benefits, you don't have to go through blue hat registration for these products. At present, most foreign health product manufacturers do not apply for blue hat registration. Generally, they sell their products as general food products through the cross-border eCommerce channel. Additionally, they only choose to emphasize the health benefits of specific ingredients or the like.

Are there any restrictions on advertising health products in China?

When selling health products in China, you need to pay attention to the compliance requirements for health products. These can be found in China's Advertising Law of 2015. A summary of key points can be found below:

Restrictions on advertising health products under Chinese law

Our Services

TMO Group has successfully helped many well-known healthcare brands to enter the Chinese market. We have also digitally empowered eCommerce development, mobile service development, and even direct sales and cross-border eCommerce businesses. Get in touch today to get your brand an exclusive localization plan for the Chinese health products market.

If you'd like to read more about health supplements in China, check out our free China Health & Food Supplements Industry ReportThis report takes a broad view of the market for health supplements in China, and how an overseas brand can seize the many opportunities it presents.China Health & Food Supplements Industry Report!

Disclaimer: all pictures in this article are sourced from copyright-free platforms. If however you believe that infringement has occurred despite this, please contact us and we will remove the offending image immediately.