China became the world's second largest market for cosmetics back in 2013. However, some major brands have still chosen to stay out of the China market for a number of reasons. These reasons include the complicated license approval process, high costs associated with the general trade model, and a requirement on domestic brands that they test their products on animals. However, the cross-border eCommerce model provides a way around these issues. In fact, multiple overseas brands have taken advantage of this model to do just that in recent years. Kiko and Embryolisse are two that did so and found considerable success.

In this article we take a look at the current policies and regulations governing cross-border sales of cosmetics to Chinese consumers. We also make some quick comparisons with alternative models.

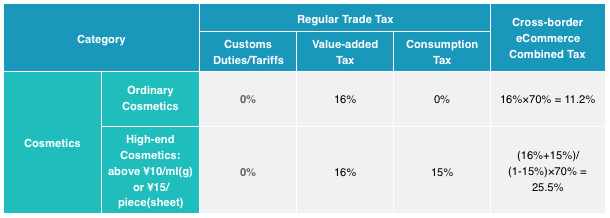

Tax Advantages of the Cross-Border Model

The Chinese government offers special tax rates on cross-border eCommerce retail imports that fall within the set limit for personal transactions. In 2018, China increased the single transaction limit from 2,000 RMB to 5,000 RMB and the annual transaction limit from 20,000 RMB to 26,000 RMB. This came as good news for buyers of high-priced foreign cosmetics products.

Cross-border eCommerce import tax rates

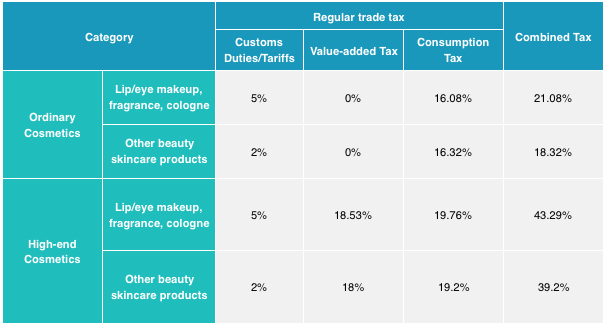

General trade tax rates

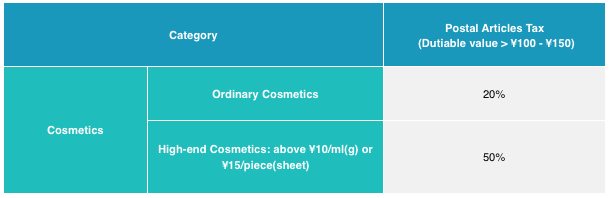

Personal Express model tax rates

*Taxable duty costs vary according to cosmetics product subcategories

Product Registration and Filing Advantages

Current regulations for cross-border retail eCommerce product filing

According to the current regulations on product filing for cross-border eCommerce found in "Announcement on Matters concerning the Supervision of Retail Imports and Exports in Cross-Border E-commerce", products brought in through the bonded warehouse and direct postage models (customs supervision codes 1210 and 9610, respectively) are supervised as personal goods, so long as the goods are of varieties that have been imported before. This means that companies do not need an import license, product registration or product filing in these cases. This can be advantageous for cross-border sellers, as it enables selling products to China from abroad without needing to go through the registration or filing processes.

It is worth noting however that in areas that still have many active CoViD-19 cases, the government may be temporarily suspending imports, especially in product categories with significant quality or safety risks.

Current regulations for general trade product filing

There are strict restrictions on the use of the general trade model to import cosmetics into China. Sellers must obtain the relevant filing certificates or administrative license approvals in order to use this model. Imported cosmetics fall under rules that require statutory inspection for imported commodities, as well as customs declaration and clearance.

According to current policy, there are two subcategories of cosmetics products: special cosmetics (which includes hair growth, hair coloring, perming, hair removal, breast enhancement, bodybuilding, deodorization, freckle removal, and sun protection products) and non-special cosmetics.

The filing and approval processes for importing special cosmetics is generally similar to domestic special cosmetics. It's generally a 7-10 month process from inspection, through declaration, to obtaining the approval certificate.

Approvals for non-special cosmetics have been subject to significant changes as part of the 'license separation' reforms in recent years. These products have also benefitted from policies aimed at attracted more international brands to enter China. The administrative examination and approval model used previously took about six months to a year from preparing samples, undergoing inspections, preparing post-inspection application materials, form and technical reviews, review decision deliberations, and obtaining the approval certificate. The recent reforms have not changed the inspection processes but now require only filing (which takes about five working days) before importation can commence. Technical reviews and such then take place following this, greatly shortening the time needed to launch products in China.

Bonded Warehouse VS Direct Purchase VS Personal Express

Bonded Warehouse model

The "Bonded Warehouse model" (customs supervision code: 1210) refers to a cross-border eCommerce model wherein enterprises make use of special regional customs supervision policies and the bonded warehouse policy to transport goods intended for sale into one of a number of bonded warehouses around China that are supervised by customs for pre-sale storage. A department of the national customs agency responsible for bonded warehousing handles customs clearance for these goods, and a logistics company then handles distribution once sales of products stored in these warehouses take place.

This model means less choice in terms of logistics and storage when compared to the Direct Purchase model, but makes transportation cheaper and faster due to centralizing it within China. The Bonded Warehouse model enables sales over third-party eCommerce marketplaces like Tmall Global or WeChat Mini-Programs. However, companies wanting to set up their own eCommerce platform will need a Chinese legal entity to do so.

Direct Purchase model

The "Direct Purchase model" (customs supervision code: 9610) refers to a cross-border eCommerce model wherein stock is kept outside of China, and shipped to China directly from these overseas warehouses when an order is placed. The customs process begins when a customer makes an online purchase, and so when the goods reach special China customs entry points the customs officials are ready for them.

The Direct Purchase model is more coordinated and synchronized than the Personal Express model. However, the Bonded Warehouse model is even more so. Shipping is also slower and more expensive than the Bonded Warehouse model. This is because businesses ship goods from abroad only after a customer makes a purchase, rather than leaving them in China closer to the buyer. The Direct Purchase model enables sales over third-party eCommerce marketplaces like Tmall Global or WeChat Mini-Programs. However, companies wanting to set up their own eCommerce platform will need a Chinese legal entity to do so.

Personal Express model

You can also sell cosmetics products to Chinese consumers using the "Personal Express model", wherein the seller ships each purchase individually as personal mail rather than through any formal trade channel. Theoretically, businesses don't need a Chinese legal entity and product registration/filing for this model. However, there are value thresholds for shipping goods this way. Goods exceeding these thresholds count as cross-border trade rather than personal mail. These thresholds vary between countries - 800 RMB for Hong Kong, Taiwan and Macau, and 1000 RMB in most others.

Shipping via courier companies like DHL means you pay a standard tax rate of 50% of the postal tax rate. Meanwhile, shipping via EMS means that sometimes no tax is paid at all. This is because tax is typically charged on parcels that are randomly selected for inspection. If customs officials discover that goods exceed the threshold, they then charge tax at the usual rate for trade goods.

The Personal Express model enables sales over an overseas eCommerce website like or WeChat Mini-Programs. However, companies wanting to set up their own eCommerce platform will need a Chinese legal entity to do so.

Animal Testing

It's a hot question among potential importers. Do cosmetics products need to be tested on animals to be sold to Chinese consumers via cross-border eCommerce? This is because previously, this requirement has limited overseas brands who didn't want to test on animals from market entry. However, cross-border sales do allow companies to circumvent this domestic requirement. Therefore this avenue is now open to companies with this particular hang-up.

If you're interested in entering the Chinese cosmetics market via cross-border eCommerce, please contact us. We can tailor a unique eCommerce entry strategy to your business's specific needs. We can also provide custom eCommerce solutions should you wish to explore that route.

Want to learn more about the Cosmetics industry in China in particular? Check out our free 70-page China Cosmetics Industry ReportThis report takes a broad view of the market for cosmetics in China: trends, statistics, analysis; overview of China cosmetics market entry.China Cosmetics Industry Report!