Getting things from A to B can be a real challenge in South and Southeast Asia. Whether it is because of geographical reasons (such as transportation difficulties between Indonesia’s islands) or a lack of infrastructure, this area is still underdeveloped.

In this article, we take a look at some common and distinct characteristics of logistics throughout India, Indonesia, Malaysia, Singapore, Thailand and Vietnam. In the table below, we provide the latest ratings and country rankings from the World Bank's Logistics Performance Index (FPI), an in-depth global analysis that cross-compares dozens of countries to rate and rank their logistics capabilities.

Urbanization and eCommerce Demand Improvements

All these countries are currently experiencing rapid urbanization, which typically leads to increased demand for infrastructure and consumer goods. There is definitely significant room for improvement, since the overall infrastructure is still poor.

A Deloitte report shows that India’s poor infrastructure leads to extended and inconsistent cargo transit times, inefficient use of resources, and poor fleet management. Selection of transport mode, or even storage and terminal handling protocols, is rarely linked to cargo characteristics such as distance of travel, parcel size, density, etc. This results in an overuse of high-cost modes like road transport at the expense of cost-effective and sustainable modes like inland waterways and railways.

For Southeast Asian countries, eCommerce serves as an important driver for infrastructure development. Infrastructure is key to the efficient distribution of goods from vendors to warehouses, and then the delivering of them to customers in individual parcels. The process is further complicated by the growing number of suppliers and warehouses, while customers remain spread across multiple disparate locations. Additionally, it is necessary to tackle geographical challenges such as Indonesia’s islands, or to quickly and safely navigate the sometimes dangerous traffic conditions in countries like Vietnam and Thailand.

Technology Pushes Change

Logistics companies need to catch up with rising demand and support the flourishing economic activity of each country. Adapting to the fast-changing technology is necessary to deliver efficient solutions, however. Good management of a logistics process requires efficiency and reliability. Therefore, logistics companies need to acquire technology which can streamline the entire supply chain.

The amount of deliveries across Southeast Asia has grown from about 800,000 per day in 2015 to more than 3 million per day in 2018. In India, Amazon India alone already had 1.2-1.3 million deliveries daily in 2018. This number can rise to a height of 4.5 million during peak periods. Last-mile delivery in particular remains challenging throughout the region, mainly due to a lack of new technology and automation. This is again caused by a lack of information on the one hand and and a shortage of skilled staff on the other.

But eCommerce players are already turning these challenges into business opportunities. eCommerce players in Singapore like Lazada Express and Redmart are investing in further developing their own logistics networks. Other eCommerce players rely on third-party services, who consequently are further developing eCommerce-specific services. This includes well-established logistics companies like DHL, JNE, and SingPost as well as startups like NinjaVan and J&T. All these parties have already built systems specifically catered to handle eCommerce deliveries. India’s logistics sector is also likely to adopt increased process automation by using robotics and artificial intelligence in transportation and warehouse. This will also reduce reliance on and the need for human intervention.

South and Southeast Asian-specific Developments

Below, we look at each of the 6 countries and how logistics developments differ throughout the region.

India

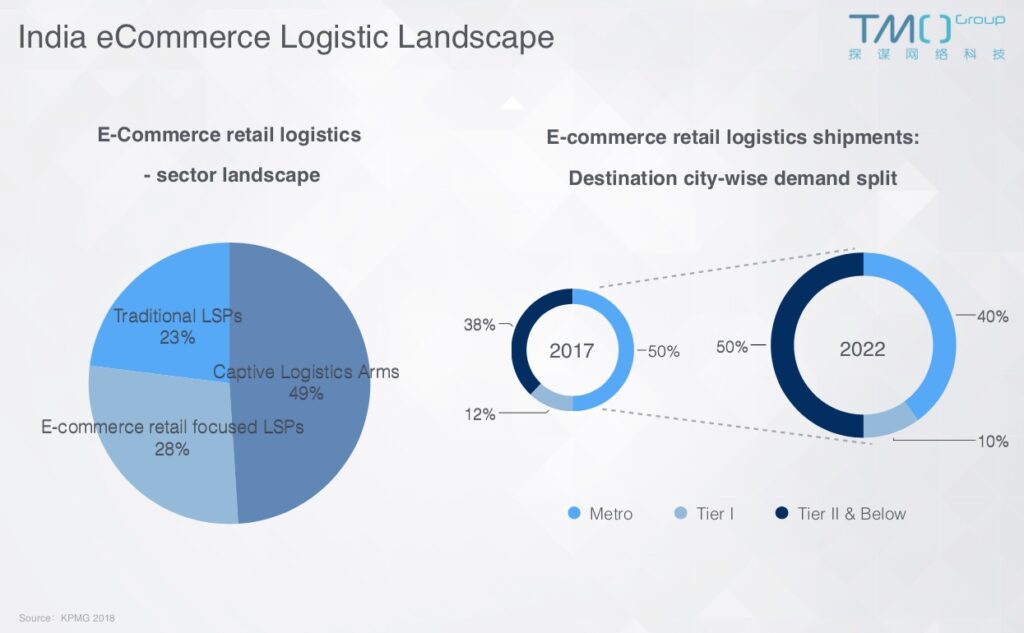

Logistics is a key enabler for the growth potential of Indian eCommerce. In 2018, the eCommerce retail logistics market was valued at 1.35 billion USD. It is projected to witness a growth of 36% over the coming 5 years.

KPMG reports that in-house logistic arms of large eRetailers execute over 70% of the deliveries. Especially when it comes to complex and/or high value shipments such as jewelry and furniture, eRetailers prefer to depend on their respective captive logistic arms for deliveries. This not only assures large volumes for the captive arms of eRetailers, but also enables them to also start actively providing services to other, external eRetailers. It is thus no wonder that these players take up nearly half of the market share at 49%.

According to the report, dedicated Logistics Service Providers (LSPs) for eCommerce retail also entered the market in the past few years. Using a technology-centric approach enables these players to scale up, remain efficient and still provide competitive prices to customers. Together, LSPs captured roughly 28% of the sector. Some players have grown at a rapid pace and quickly expanded their operations, reach and capabilities. A large influx of investments in start-ups and strategic tie-ups with eRetailers is further fueling these developments.

Indonesia

Developing the country's road infrastructure is one of the most urgent points on the Indonesian government's agenda. This is expected to create new opportunities for logistics firms in the country.

With the Indonesia logistics market currently in a growth stage, there are a variety of both organized and unorganized industry players. These consist of combined shipping and international freight forwarders, as well as courier providers which mainly engage in land transportation. Players are diversifying into the third-party logistics segment to enhance their market share. Therefore, express delivery logistics are also witnessing tremendous growth in Indonesia.

Currently, the following 13 players dominate the Indonesian logistics market: PT. Yusen Logistics, CEVA Logistics, Agility Logistics, Trans Pratama Logistics, JNE, DHL, FedEx, Keppel Logistic, TNT Express, Maersk Line, PT. Wahana Cold Storage, PT. Mega International Sejahtera, PT. POS Indonesia.

Malaysia

Although Malaysia’s logistics network used to be Southeast Asia’s eCommerce Market in 3 Words: Growth, Social and Mobile (2023 Data)Southeast Asia’s internet economy could reach 200 billion USD by 2025. We map out the Southeast Asia eCommerce market's key aspects and opportunities.very underdeveloped, in recent years the fragmented sector has seen a number of positive developments. PwC reports that logistics players have been acquiring third-party LSPs to increase their scale. Furthermore, both interest in courier, express and parcel (CEP) and the number of last-mile delivery (LMD) companies have witnessed significant growth. This has increased the focus on service and enabled international players to establish local logistics networks.

The Digital Free Trade Zone (DFTZ) will also help establish Malaysia as a regional logistics hub for eCommerce. Alibaba’s investment in the DFTZ could particularly give cross-border eCommerce trade between Malaysia and China a significant boost.

Singapore

For nearly half of Singaporeans, the primary reason for not buying online is delivery concerns. Research suggests that the number of parcels delivered within ASEAN will grow at an annual growth rate of 23% between 2016 and 2020. eCommerce growth will be one of the main reasons for this growth.

Currently, market regulation for Singaporean courier services is still on the lower end. This enables state-owned providers like SingPost to perform last-mile delivery. Although SingPost is available on all major marketplaces, it still has difficulties with unconsolidated deliveries and high delivery failure rates. Therefore, consumers often prefer store pick-up at this moment to ensure the product is in a good state and received in a timely manner.

Thailand

Thailand extensively invested in transport infrastructure under the 12th National Economic and Social Development Plan. This plan aims to cut the country's logistics costs to 12% of GDP by 2021 from 14%. Moreover, under Thailand 4.0 the government envisions a new economic model to bring the country to the forefront of the global digital economy.

However, issues such as fuel pilferage, lack of adherence to safety rules and regulations, and dangerous driving remain major industry obstacles in Thailand. These problems entail an inherent cost for fleet operators ordinarily passed on to end consumers in the form of delivery fees. Technology is helping with tackling these challenges. Internet of Things (IoT) technology and telematics allow devices to send and receive information across large distances. This allows LSPs to track vehicle performance, driver behavior, unscheduled stops, and so on.

Vietnam

Logistics costs in Vietnam are high, accounting for about a fifth of GDP, compared to 10-14% in developed economies. Recent government decisions and plans to develop logistics aim to bring in business and investment opportunities for investors. The government wants to develop roads linking seaports, economic corridors, and belts, as well as construct railway routes connecting the national seaport network.

Through heavy investments in technology, LSPs actively contribute to the development of Vietnamese eCommerce and trade. Unlike in the past, with mainly physically-focused investments, logistics businesses now pay attention to innovation. Such investments are creating growing numbers of asset-light logistics firms, with few physical assets such as vehicles and warehouses. They earn their keep primarily via tech-enabled facilitating of cargo flows for others.

South and Southeast Asia eCommerce

Do you want to know more about the developments and trends in South and Southeast Asian eCommerce? Then check out our complete 6-part series providing an overview, as well as details about all aspects of eCommerce in this booming region.

- Most Important South and Southeast Asian eCommerce Market Developments - Pt.1We delve into the South and Southeast Asian eCommerce volume and market potential of India, Indonesia, Malaysia, Singapore, Thailand and Vietnam.Most Important South and Southeast Asian eCommerce Market Developments - Pt. 1

- Most Important South and Southeast Asian eCommerce Market Developments - Pt. 2We delve into other South and Southeast Asian eCommerce developments in India, Indonesia, Malaysia, Singapore, Thailand and Vietnam.Most Important South and Southeast Asian eCommerce Market Developments - Pt. 2

- Defining South and Southeast Asian eCommerce ConsumersWe provide a detailed profile of South and Southeast Asian eCommerce consumers in India, Indonesia, Malaysia, Singapore, Thailand and Vietnam.Defining the South and Southeast Asian eCommerce Consumers

- South and Southeast Asian eCommerce Marketplaces: Who's WhoAn overview of the most popular South and Southeast Asian eCommerce Marketplaces in India, Indonesia, Malaysia, Singapore, Thailand and Vietnam.The Most Popular South and Southeast Asian eCommerce Marketplaces

- Cash or Digital? South and Southeast Asian Payment MethodsPayment methods are a developing part of the South & Southeast Asian eCommerce sphere - we analaysed the current state & trends on paymentsCash or Digital? South and Southeast Asian Payment Methods

You also might be interested in our Southeast Asia eCommerce Outlook 2024This free PDF takes a broad view of eCommerce across five of Southeast Asia's most exciting markets: statisics, market structure, trends, entry strategy.Southeast Asia eCommerce Outlook, which gives a broad overview of some of Southeast Asia's most exciting markets.