Southeast Asia is a region of former lesser-developed nations that are now experiencing explosive growth. That means the eCommerce story here over the past few years has been one of upheaval and rapidly rising stars.

This ranking covers the largest eCommerce platforms in Indonesia based on findings from our eCommerce Marketplace Monitoring Services in Southeast Asia

In this article, we will outline some general trends about each regional market taken from our Southeast Asia eCommerce Outlook 2024This free PDF takes a broad view of eCommerce across five of Southeast Asia's most exciting markets: statisics, market structure, trends, entry strategy.Southeast Asia eCommerce Outlook 2024, break down the top ten most visited eCommerce marketplace websites in Southeast Asia as a whole, look at their visit numbers, and finally explore whether or not Amazon is used for online shopping in the region.

Trends from popular eCommerce Platforms across Southeast Asia

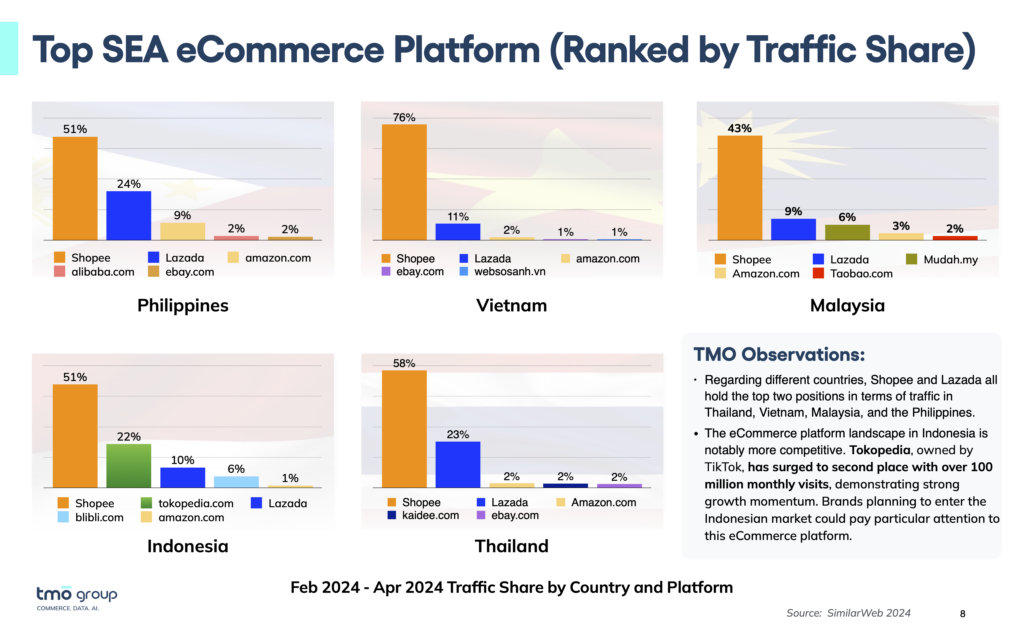

*Updated in 2024 according to platform visits from February to April published by SimilarWeb

It is not difficult to find that Lazada and Shopee appear in most Southeast Asian countries. It is worth noting that Shopee is particularly outstanding this year, occupying the leading position in the markets in the aforementioned countries.

For a full overview of each market, including legal requirements for cross-border eCommerce, download our free Southeast Asia eCommerce Outlook 2024This free PDF takes a broad view of eCommerce across five of Southeast Asia's most exciting markets: statisics, market structure, trends, entry strategy.Southeast Asia eCommerce Outlook 2024

Competition among e-commerce platforms in the Indonesian market is more intense. Tokopedia, which is controlled by Tiktok, has exceeded 100 million visits per month and has a strong development momentum. Brands planning to enter Indonesia can focus on this platform.

The ranking of platforms in other countries has not changed much. There are also some unique e-commerce platforms with local characteristics on the list, such as Malaysia's Mudah.my, which was originally launched in 2007 and is a well-known online classified advertising market in Malaysia. It has since been acquired by another online platform Carousell.

The bigger the country, the more complex the business landscape, and the higher the entry and operating costs. Indonesia is not an easy market to operate. On the contrary, countries such as Thailand and Malaysia have moderate eCommerce volumes and are friendly to cross-border eCommerce and foreign investment policies. They are easy to enter, can be piloted first, and can radiate into opportunity markets in other countries. Thailand and Malay are comparable, the former is better in population and the latter is better in economy.

Although Vietnam's population pyramid has a narrow base, it is full of vitality and dynamism. It is the country with the fastest GDP growth in Southeast Asia and one of the countries with the lowest labor costs in the world. It is also the second-largest Foreign Direct Investment (FDI) destination in Southeast Asia after Singapore.

Top 10 eCommerce Platforms in Southeast Asia Ranked

Now, let's dive into the top ten popular eCommerce platforms in Southeast Asia according to the corresponding main markets and rank them based on traffic data.

1. Shopee

- Active in: ID, VN, TH, PH, MY, SG

- Monthly Visits (Web): 560M

Singapore-based Shopee is a chain of eCommerce websites—each dedicated to its own market—with 11 major sites for markets in Southeast Asia, Taiwan, and Latin America. Despite not having gained significant traction in the West besides Brazil (where it launched in 2019), Shopee remains a shopping empire in Southeast Asia.

Already selling on Shopee? Boost your eCommerce Market Intelligence with our Customized Marketplace Reports containing data on sales volume and revenue by SKU, brand, merchant, and categories.

Shopee provides sellers with its own supply and logistics solutions, as well as language-specific customer service. Another unique feature that allows Shopee to differentiate itself is an escrow service called “Shopee Guarantee”, which provides payment security for both sellers and buyers.

Shopee’s parent company Sea (formerly Garena) is, apart from eCommerce, a leader in digital financial services and digital entertainment across Southeast Asia. Sea owns the highest-grossing mobile game in the region, “Free Fire”. Sea boasts backing from (and is partially owned by) China’s Tencent. Tencent has engaged in a sort of “proxy war” with mainland rival Alibaba through its support of Shopee, as Alibaba has injected money into the platform’s regional rival Lazada.

Shopee’s eCommerce marketplace is first and foremost mobile-focused. Asked which factors contributed to their growth in the SEA Region, Agatha Soh, Head of Regional Marketing for Shopee in Southeast Asia said “A mobile-first approach [that] helps attract the online consumers who are bypassing desktops, and going straight from offline shopping to mobile shopping.”

2. Lazada

- Active in: ID, MY, SG, VN, TH, PH

- Monthly Visits (Web): 140M

Another multinational Southeast Asia giant eCommerce marketplace is Lazada. For much of the past decade, Lazada reigned supreme in Southeast Asian eCommerce. Recently beaten to the top spot as the largest online marketplace by Tencent-backed Shopee, Lazada still represents a formidable presence in the region.

If you want to know about the eCommerce landscape in Indonesia, make sure to check out our eCommerce Market Localization Guides available in Free Starter and Paid Premium Versions and based on our 20+ years of experience in eCommerce market entry strategies.

Launched in 2012, Lazada operates in Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam. The platform boasts more than 155,000 local and international sellers, as well as 3,000 brands serving the 560 million consumers in the region.

With over 300 million SKUs available, Lazada offers a wide range of products. Categories range from consumer electronics to household goods, toys, fashion, sports equipment to groceries. They focus on customer experience, offering multiple payment methods — including Cash on Delivery (COD) — and returns through their own first and last-mile delivery arm supported by more than 100 logistics partners.

Following Alibaba's investment in 2016, Lazada’s platform structure quickly shifted to resemble Ali’s ecosystem in mainland China — complete with Lazmall to complement TMall, and a cross-border suite as the local equivalent to Tmall Global.

Lazada has received seven capital injections from Alibaba, totaling approximately US$5.8 billion. Alibaba’s holding ratio currently reaches 83%, almost completely controlling Lazada, which proves the potential and importance of Lazada and cross-border eCommerce in Southeast Asia.

3. Tokopedia

- Active in: ID

- Monthly Visits (Web): 110M

Local eCommerce platform Tokopedia has achieved significant dominance in the large Indonesian market. It was founded in 2011 by two Indonesian entrepreneurs from a small Indonesian city with the aim of redressing imbalances throughout Indonesia and democratizing commerce. The name for their startup came from the Indonesian word “Toko”, meaning “Shop” and “encyclopedia”. Over the years, Tokopedia has gone from strength to strength, attracting investment from multiple global VCs and more recently by China’s Alibaba and Japan’s SoftBank.

Apart from being the staple of the Indonesian eCommerce market, Tokopedia is famous for its boisterous marketing campaigns, which include celebrations with international and local pop stars. Among guest celebrities are such prominent bands as SM*SH and BTS.

Tokopedia’s yearly GMV is estimated at US$14-15 billion. Tokopedia and Shopee are now two main players and fierce competitors in the Indonesian eCommerce market. In December 2023, TikTok acquired a 75% stake in Tokopedia after Indonesian government’s ban on direct e-commerce on social media platforms.

4. Blibli

- Active in: ID

- Monthly Visits (Web): 27.2M

Yet Another Indonesian platform, Blibli has a reputation for highlighting local Indonesian brands on its marketplace. It also notably runs all its logistics efforts in-house to ensure two-day delivery. In 2019, Blibli made a special effort to stand out from the rest of the pack. It became Indonesia’s first eCommerce site to integrate video streaming. Blibli Play offers on-demand sports streaming as well as integrations with the eCommerce platform.

5. Orami

- Active in: ID

- Monthly Visits (Web): 21.72M

Orami mainly focuses on maternal and infant, baby, household, and personal care products, and also provides food and nutritional products, toys and accessories as well as other related products. Being a country with a highly youthful population structure, Indonesia's maternal and infant market has considerable potential.

6. Carousell

- Active in: SG

- Monthly Visits (Web): 20.85M

In 2012, three Singaporean students returned home from their internship in Silicon Valley full of inspiration and excitement. They put their experience to good use, creating a platform called “Carousell” that would solve problems with technology. The main problem those young men had happened to be unused electronic equipment that they wanted to sell. Long story short, Carousell is now the second biggest marketplace in Singapore and a prominent player in Southeast Asia, operating in half a dozen countries.

While starting as a classified ads site, it has now evolved into a marketplace for both C2C and B2C. On April 18, 2023, the company was selected into the "2023 Hurun Global Unicorn List" ranking 983rd with a corporate valuation of 7.5 billion yuan.

7. Bachhoaxanh

- Active in: VN

- Monthly Visits (Web): 18.02M

Ranking fifth on the list of biggest online marketplaces, Bachhoaxanh is a grocery food retail chain with over 15,000 different items. Its eCommerce platform offers 2-hour delivery, free shipping on orders over VND 300,000, and multiple rewards at Gold and Silver membership levels. Their items include meat, fish, poultry, fresh seafood, high-quality and safe vegetables, maternal and infant food, and cosmetics among others, providing consumers with a diverse selection of goods and services, with the best quality and the most competitive prices Meet the daily shopping needs of all families.

8. Mudah

- Active in: MY

- Monthly Visits (Web): 7.03M

Originally launched in 2007, Mudah is a well-known online classifieds marketplace in Malaysia. It has since been acquired by Carousell, another online platform in our ranking. Almost everyone can buy and sell almost anything here, From luxury goods, fashion items, cell phones, computers, refrigerators, sofas, holiday accommodations, and even new and used cars, rental rooms, houses for sale, and part-time jobs.

9. Tiki

- Active in: MY

- Monthly Visits (Web): 7.02M

The most successful local B2C platform in the country, Tiki web-store began life in 2010 as an online bookstore (echoing global giant Amazon’s humble beginnings). Now it is second only to Singaporean regional player Shopee in terms of monthly traffic. But the company’s successes aren’t limited to its homeland – in 2018, Tiki received investment from JD.com (backed by Chinese behemoth Tencent) to the tune of US $44 million and launched a China-exclusive cross-border eCommerce service called Tiki Global.

Like Shopee, Tiki also targeted consumer hesitancy towards eCommerce, with a particular focus on customer service, successfully boasting the highest customer satisfaction and lowest return rate of any eCommerce platform in the country, and a glowing reputation among Vietnamese consumers as a whole . Tiki reinforced this by taking control of its entire end-to-end supply chain, leveraging its home-field advantage against challenges from overseas marketplaces.

10. Bukalapak

- Active in: ID

- Monthly Visits (Web): 5.34M

Bukalapak is yet another Indonesia-native platform on this ranking and is now a unicorn company that mainly caters to small and medium enterprises (SMEs). In 2019, the platform launched BukaGlobal, allowing sellers from regions like Singapore, Australia, Malaysia, Thailand, Hong Kong, Taiwan, and Mainland China, but has ceased operation due to the latest regulations.

Is Amazon popular in Southeast Asia?

- Estimated Monthly Visits (Web) in SEA: 25M

While Amazon.com does not have a dedicated website in any Southeast Asia country other than Singapore, it is still available and, to an extent, popular. Southeast Asia accounts for about 1% of traffic for amazon.com, and given how huge Amazon is, even 1% is a significant amount: about 25 million visits.

Users often have to rely on third-party delivery services to actually get the goods, and the speed and reliability of such deliveries can hardly compare with that of local marketplaces. Because of that, Amazon probably should not be considered a proper competitor of platforms like Lazada or Shopee. Still, Amazon often sells items that are not available to buy on local platforms, so there is a distinct demand for what Amazon has to offer.

Entering Southeast Asia's Online Market

Southeast Asia is home to some of the biggest mobile and social media users on the planet, and the region’s explosive economic growth in recent years has translated into huge opportunities for the eCommerce industry.

However, entering these markets is no easy task. Knowing what is the population, economic, and eCommerce market size; which product categories are suitable for selling on these platforms; what are the requirements for foreign direct investment and foreign legal entities in the region; and what should be considered regarding local tariffs, product certification, and logistics; are some of the essential considerations needed for a successful Southeast Asia market strategy.

If you are looking for an eCommerce agency to assist you in your Southeast Asia business expansion, or want to explore other alternatives to grow in the region, reach out to us to learn more about our Southeast Asia eCommerce services, from branded eCommerce website development to social commerce and other Scale to Asia Solutions.

**We published the first version of this article 6 years ago, in 2018. Since then, we have been updating it yearly, following the latest developments in the numbers and ranks of the key players in the online marketplace landscape in Southeast Asia. Our latest update summarizes the data from February through April 2024.