The first version of this article was published on our website in 2017. The Chinese eCommerce landscape is one of the fastest changing in the world – we have been updating this material yearly to keep up to speed with these dizzying developments. The latest update was in February 2022.

Surviving China's eCommerce landscape isn’t easy.

Amazon, ASOS, eBay, Groupon, Coach… What is a common thing among these companies, besides being widely successful internations online sales enterprises? They all failed in China. Through the years, they spent significant sums to get their collective feet in the proverbial door of the Chinese eCommerce market but it shut right in their faces. Why?

Well, as with most major failures – there are thousands of small things that end up stopping these companies in their tracks. Yet, among those, there is one major reason that stands out: they did not understand China's eCommerce market well enough, they couldn’t deliver the user experiences favored by Chinese online shoppers.

China is the biggest eCommerce market in the world, valued at 13 trillion CNY (about 2.1 trillion USD) in 2021, and projected to reach 20 trillion CNY (about 3.2 trillion USD) in 2024. The ecosystem of marketplaces, logistics solutions, payment gateways that supports this colossus is highly complex and difficult to compare with anything similar in any other country. For companies aiming to enter Chinese eCommerce, the key to success is to understand these unique elements.

In this article let’s have a high level overview of the main components of Chinese eCommerce, what’s unique about them and how they comprise one of the most unique and vibrant markets in the world.

Platforms

Let’s start with this: where do Chinese online shoppers make their purchases?

Two most common options are eCommerce marketplaces (JD, TMall etc) and brand eCommerce platforms. These are the two alternatives that a company trying to start an eCommerce business in China has to choose from. This might be one of the most consequential choices to make so let’s review the details of each option.

Marketplace platforms

Among all business-to-customer (B2C) platforms, Tmall and JD are hogging about three thirds of the market. According to Statista, in 2019 Tmall is a runaway leader with 50.1% share of retail eCommerce sales, with JD slowly catching up, but still significantly behind with 26.5%.

Coming third, Pinduoduo showed some significant growth lately - and may soon challenge JD for the silver medal. Closing the top 5 list of platforms are VIP Shop and Kaola. These two shouldn’t be ignored: while they are indeed much smaller than JD or TMall, their share becomes much more substantial if we look only at cross-border eCommerce.

Looking from an aspiring eCommerce business perspective, marketplace platforms sure look promising, however, there are still multiple limitations to consider. Application isn’t easy, a prospective seller is required to comply with a strict set of rules, has paperwork to fill, response time to wait, and most importantly, multiple fees to pay. Another key concern is that such platforms often cannot offer all the personalization and customization required by the brand.

Brand eCommerce platforms

Brand website is a standalone website that serves as an eCommerce platform for this particular brand. It is usually owned and managed by the brand itself. Only a few years ago a brand’s website in China was not typically seen as a sales platform, but thighs are changing fast. More and more brands are going in that direction after realizing the advantages of this approach.

Here are just some of those advantages:

- No limits on creating a unique storefront that best fits the audience - be it colors, visuals, unique UX/UI or user flow.

- Great starting place for a multi-channel approach. Since the brand controls everything, it can manage what the platform will look like as a desktop site, mobile site, native app, WeChat mini app – anything else suitable for the business model.

- With a branded website it’s the company who owns all the generated data: site browsing, cart behavior, sales; If you need to add some specific way to collect or analyze the data – there is no one to tell you you can’t.

- Which can be a pretty important thing in the era where data and analytics are playing an ever more significant role in business success.

Drawbacks of the branded eCommerce platform are quite obvious. You may have all the buttons and levers, but you are on your own using them. Whatever traffic you need to be landing on your brand platform has to be generated by your marketing team.

Traffic generation

Where are your online shoppers coming from? Almost anywhere in the world the most popular answer is “Google”, but that's certainly not the case in China.

Here are the main ways online customers find the product in China.

Search Engines

Similar to the rest of the world, search engines are often the main source of traffic. Search market in China, however, is totally different from the rest of the world. First, the market is not that monopolized – number 2 player, Sogou, has a very respectable 20% of the overall market, and is tied for first place in desktop search. Baidu, the leader, has some significant differences from Google too: for both organic search and paid ads. On top of that – everything is in Mandarin, which is linguistically quite different from any Indo-European language.

Describing Chinese SEO and how it is different from Google’s is definitely worthy of a separate article and we’ll write and publish such an article in the near future. Meanwhile, let's move on to the other channels through which Chinese online customers find places to shop.

Social Media

"Social commerce" plays a vital role in China, and WeChat is the biggest social platform you should focus on. You may have seen one of those memes “apps in China / apps in the rest of the world” – and it is absolutely true: WeChat is a newsfeed, a social media, a messenger, a payment app, and dozens more things. It is also a platform to run in-WeChat apps, so called mini-programs, so there is no wonder that Chinese smartphone users can spend hours without leaving WeChat at all. WIth this kind of popularity, it is one of the more crucial channels to use to get traffic.

QQ, Weibo, Zhihu, Douban and other social media platforms, although miles behind WeChat, can be valuable sources for traffic in some specific situations.

Online video / live streaming services

Video-generated traffic is not a particularly new thing for eCommerce, but in China this channel is getting quite popular as a source of visitors for online shops – both as paid ads and naitive video content. Videos are a great way to present a brand/product and feature direct links to its eCommerce page. Youku, Tudou, and iQiyi are the most famous Chinese video sites.

Live streaming, and especially eCommerce live streaming, is a relatively new and fascinating phenomenon. It’s a strange hybrid of “TV shopping” and “celebrity sreamers”: the resulting “lifestyle with a commercial twist” streams found its way to millions of Chinese customers, also helping millions of yuans find a way out of their pockets.

Douyin, a Chinese version of TikTok (it’s actually the other way round, TikTok is a Western version of Douyin), is a clear leader not only in live streaming, but in short videos too. It's so massively popular, especially among the younger Chinese audience, that some analysts say Douyin is the most prominent contender to dethrone WeChat in some future.

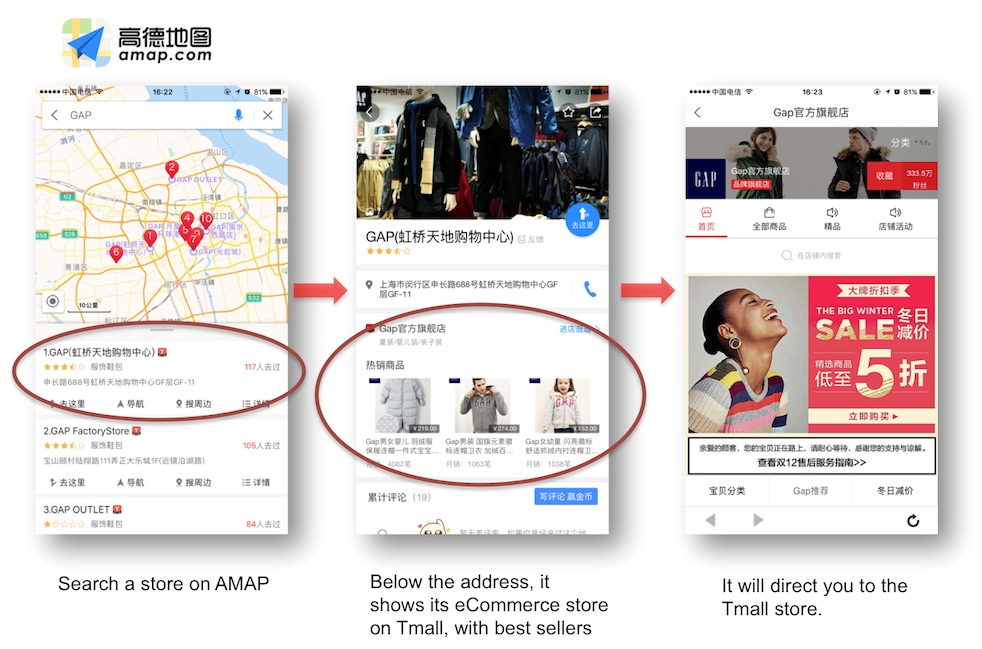

Map/navigation

Who would have thought that a navigation app could bring users to eCommerce? Chinese mobile app AMAP has integrated with Tmall, showing users eCommerce info even when they are searching offline stores.

Payment

While the credit/debit card remains the most popular payment method in Western world, in China it’s almost exclusively about mobile payment. Allowing users to connect their mobile payment account to their bank account, 3rd party payment solution providers save customers’ trouble of typing in credit/debit card info every time. A customer can complete the purchase by either scanning a specific QR code or simply tapping the payment button.

Alibaba’s Alipay and Tencent’s WeChat Pay are currently dominating China’s mobile payments market. Both are popular options amongst Chinese consumers, with 50.42% and 38.12% market shares. Hence - eCommerce businesses in China should always feature Alipay/WeChat payment options.

For foreign retailers that have not registered in China, collecting payment from mainland consumers used to be quite frustrating. This was solved a few years ago, when both WeChat Pay and Alipay provide cross-border payment options. They act as a third-party to settle foreign transactions on behalf of consumers and merchants, and Chinese shoppers can pay in RMB while retailers receive foreign currency hassle-free.

Logistics

Thanks to China’s eCommerce boom, China’s logistics industry has been making massive strides, year after year. If five years ago, in 2016, 30 billion parcels were delivered in China, in 2021 this number is at an all time high – 100 billion. More than 80% of them come from eCommerce orders.

One can say that Chinese eCommerce shoppers are spoiled by the quality of logistics services. Next day delivery is the norm, and popular items can be expected at the doorstep within hours. A unique item that has to be shipped across the country still can take a few days to arrive, but in this case users expect a convenient tracking service, that shows whereabout of the parcel and updates its status in real time.

While international express delivery services like DHL, FedEx, and UPS are widely available, merchants usually prefer domestic courier companies. Compared to International counterparts, local companies provide fast, secure, reassuring service at a lower cost. Competition between local logistics companies heats up, including private-owned SF Express, STO, YTO, ZTO, and state-owned EMS.

Import process

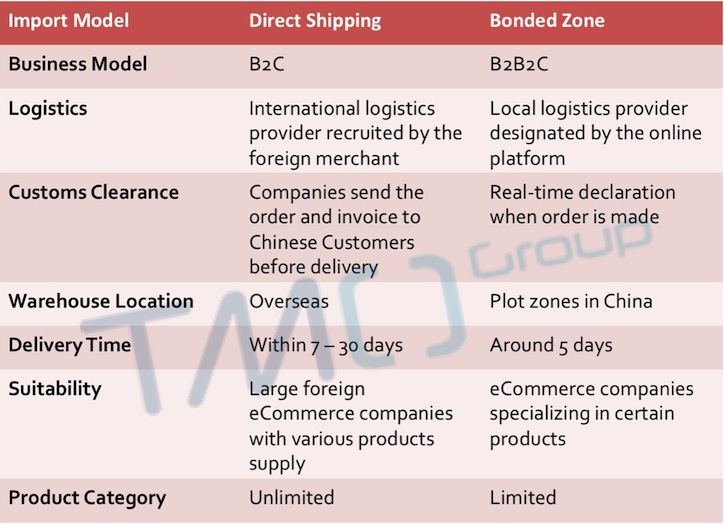

Before a local courier service takes your parcel on a highly efficient journey through the country to the end customer, there is one very crucial step your product should take: get into China. There are two main ways to do that, and this decision will have a major effect on your distribution process.

Direct shipping

With this model, you ship goods directly from your country (the country of manufacturing), whenever the order is made. You receive the payment and pay duty when the order is placed.

The main drawback of this approach is delivery time – depending on a number of factors (current goods location and difficulty of shipment), it may take anywhere from 7 to 30 days to arrive. Also, unless you have a large reliable stream of orders, you don’t get any economies of scale.

The upside, however, is minimized risks. If for some reason your product did not find a place in the hearts of Chinese customers, it will still be where it was before – in the country of origin.

Bonded zone / bonded warehousing

For a few years now Chinese authorities have been developing a system that would be more efficient and more attractive for cross-border sellers. The solution, so called “Bonded Zone Warehousing” or “Bonded warehousing”, is a way to streamline the process of getting your goods closer to Chinese customers, but with minimum additional risks for you.

This is how it works. After you receive an approval from Chinese authorities, you ship your goods to the special “bonded zone” in China where they are stored in the special warehouse under customs supervision. Whenever you receive an order from China, goods are shipped from the bonded warehouse to the customer.

This model significantly reduces customer’s waiting time. You can also save on shipping costs by delivering inventory to China in bulk, rather than shipping each purchase individually. FInally, custom duty has to be paid only when goods are leaving the warehouse – if things didn’t turn out as expected, you can just ship them out again, with no additional taxes paid.

Using a bonded warehouse comes with a cost – but as logistics is much more efficient, costs are usually lower than with direct shipping. Another thing to keep in mind – a bonded model only available for certain groups of products, included in a government issues so-called “positive list”. The list is quite extensive though, featuring about 14 hundred categories, you can check if your product is in it on our website in the “Positive List Helper” section.

Marketing & Social media

Similar to the rest of the world, in China social media plays an increasingly important role in eCommerce's evolution. Consumers more and more often turn to social media to seek recommendations for buying decisions. Unlike the rest of the world, however, you can forget about Facebook, Instagram, or Twitter (they are blocked here anyway) and focus your social eCommerce strategy on China's biggest social platform – WeChat.

WeChat is an all-in-one platform: it allows brands to send promotional articles/images/coupons through a WeChat account, display image/video ads to selected users, and operate their own “WeChat shop” with the help of WeChat Pay.

The exciting part of WeChat social eCommerce is: your consumers are much closer than you think. 50% of WeChat users spend at least 90 minutes a day in the app, so the chance they see your promotional message is very high. Plus, you can get access to and use your customers’ user data (gender, age, location, etc.) to maximize the effect.

As for other social media, Weibo, QQ, Douyin are other popular platforms in China. You should consider your presence there to expand your audience and target specific groups that can be different to reach otherwise. However, it’s almost always going to be WeChat that offers the strongest possibility of highest conversion for your eCommerce.

Interested in Chinese eCommerce? Want to know what it'll take for your business to thrive in this highly competitive sphere? Get in touch about our consulting services, and we'll find the solution that would fit your business best.