2020 has been a wild ride for eCommerce, and Southeast Asia is no exception. CoViD has affected every part of daily life, and many industries continue to suffer. eCommerce has had highs and lows. The closure of many brick & mortar stores drove large numbers of people to online alternatives. But in some places, CoViD meant stock and delivery issues that limited eCommerce’s ability to take advantage of this.

In this article, we take a look at how each of our main five developing Southeast Asian countries are coping with CoViD, how regional platform kings Shopee and Lazada prepared for the 11-11 “Singles Day” sales event, and some product categories to keep an eye on when full sales data rolls out.

CoViD in the Main Developing Markets

CoViD-19 has affected almost every part of life and society the world over this year. CoViD’s impact has been felt throughout the Southeast Asian region, but different countries have been affected differently. From CoViD response poster boy Vietnam to the difficulties faced by the vastly populous Indonesia, it’s worth taking each market individually to see how the region stands at present.

Vietnam

Vietnam has been widely praised for its fast, efficient and comprehensive response to the pandemic. The government put effective shut downs in place early on, and again in July to ward off a second wave. As a result, Vietnam is mostly holding up well in 2020 and is expected to post moderate growth. However, the continuing pandemic outside its borders means that Vietnam’s tourism industry is still suffering.

Thailand

Thailand was the first Southeast Asian country to report a confirmed case of CoViD after the global pandemic began, but since then the country has done well to curb the outbreak. Today, Thailand remains under a state of emergency but new cases have been minimal since September and were entirely absent for months prior. This has meant that for many business, it’s back to business as usual – though as with its neighbors, tourism has taken a severe hit.

Malaysia

Malaysia had the most cases of CoViD-19 in SEA in March, as the virus spread to every province. After a brief period of relaxing lockdowns beginning in May, the country is now on high alert as it tries to tackle the second wave. With traditional Ramadan bazaars closed, many traders have turned to selling on social media platforms like Facebook and WhatsApp.

Philippines

The Philippines is currently suffering from huge numbers of cases (the 2nd most in SEA, and 7th most in Asia). A national state of calamity has been declared, which has hurt businesses due to associated restrictions. Even online businesses are suffering from limited delivery times.

Indonesia

Indonesia is the hardest-hit country in Southeast Asia. While the country hasn’t seen the nationally enforced lockdowns of many of its neighbors, numerous retail locations have decided to voluntarily shut down due to shrinking foot traffic.

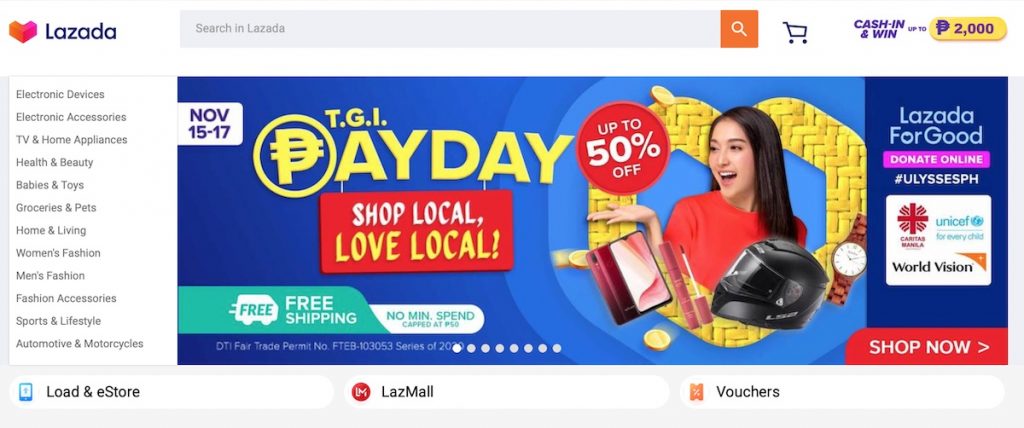

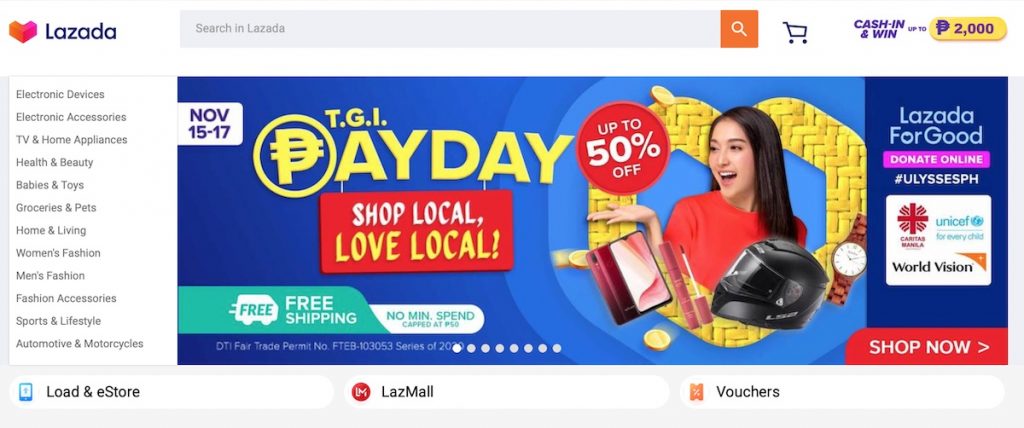

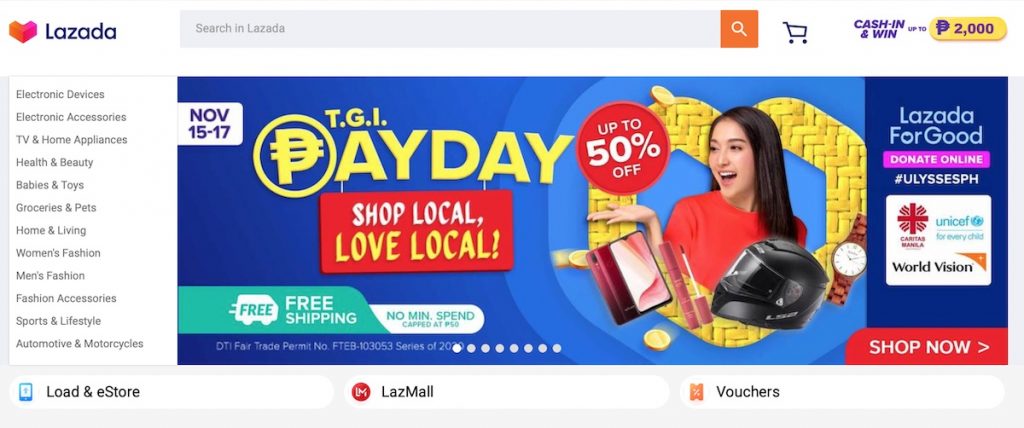

Lazada & Shopee’s Singles Day Plans

Lazada and Shopee are the twin giants of eCommerce in Southeast Asia. Each of them frequently appears in the top 3 marketplaces of each of the five countries we cover here, in many cases taking the top spot. And it is thanks in great part to these two platforms that the Chinese 11.11 “Singles Day” sales festival has expanded to the region.

The Shopee Singles Day event was planned well in advance this year, launching new shipping lines in both Malaysia and the Philippines to assist with regional logistics integration. This particularly helped with the shipping of large household goods such as furniture. They also enabled the international sale of traditionally difficult-to-transport goods such as large liquids (shampoo, disinfectant, etc), kitchen knives, and charged products (such as power banks).

Lazada laid out plans for a month-long event, starting from pre-orders and early discounts in mid-October where brands could get an early start or test consumer interest before the main event on the 11th. The period will continue until November 18th, when the last of the associated sales will conclude. Lazada also made a range of sweeping commission rate adjustments throughout the region. In general these were more competitive in each territory than the previous rates. Finally, the Lazada Singles Day campaign also implemented a ‘gamification’ rewards system for its users during the sale to encourage participation and repeat purchases.

Key Product Categories

Previous sales data gave us a good indication of which products were in a good position going into the sales. We expect the typical sales performers of the region to do well as usual – fashion, cosmetics, household items, mother & baby products, and electronics.

As part of a continued trend, and perhaps further boosted by CoViD, mobile phone and tablet sales soared in September, an increase of 90% over the previous year. This was especially good news for Chinese brand Xiaomi, whose affordable quality smartphones are popular across the region. Additionally, laptops also experienced significant sales upticks in 2020, with September sales increases of 100% over 2019. Again, the rise of ‘work from home’ during CoViD likely helped this along.

Other product groups looking to do well included camera and recording equipment such as microphones (likely linked to the growth in popularity of video-based social media like TikTok/Douyin), smart devices such as watches, and video game products.

Sales Performance

As noted above, the ‘Singles Day’ sales period has expanded beyond the 11th into a month-long sales event. It has built up from mid-October and will continue for a week or so past the 11th itself. As such, we won’t have a 100% picture on sales performance until later in the month. Stay tuned to TMO’s blog, and keep an eye on our monthly Data Pack series to stay on top of the data as it comes in. Next month’s data packs, on Health Supplements and Cosmetics, will focus on the impact of the 11-11 sales.

If you’d like to learn more about Southeast Asian markets in the meantime, check out our free ResourcesSEA Outlook, or take a look at our Southeast Asian eCommerce Guides for more country-specific insights!