On Wednesday the 28th of March, 2018, it was finally time for the fourth and last DigiDutch E-Commerce Masterclass, “The Ins and Outs of ‘New Retail’: Diving Deeper into the Meaning and Purpose”. New Retail has been hyped as a game changer for China’s retail landscape since Alibaba’s Chairman Jack Ma first talked about the concept in October 2016. However, who actually knows what it means and what can we learn from it?

This session discussed how New Retail can help brands to create seamless integrated Brand Experiences. The experts from TMO Group, Vistra and Bonnard Lawson also touched upon which data you can collect Off-line as well as how New Retail can change the role your current offline presence plays. While also elaborating on the legal issues to which brands should pay attention to. With this article we hope to give you an overview of the topics discussed and how the DigiDutch experts may help you to establish your presence in China as well as the role which New Retail will play in this respect.

New Retail

Most retailers will understand that commerce will continue to evolve, combining both brick-and-mortar with online elements. The goal of New Retail is to arrive at an integrated process that gives consumers a seamless experience and allows companies to capture the maximum operational benefits across both their physical and digital operations. Until thus far, no retailer has achieved full integration. To capture the full benefit, however, companies will need to fundamentally rethink their processes and redesign integrated retail in new ways.

In essence, “New Retail refers to the integration of online and offline retail, and logistics across a single value chain, powered by data technology”, mentioned Dominiek Pouwer, Director of TMO Group. “It is expected to hold the solution for physical retailers and pure-play e-tailers and propel industry transformation”, he added.

The Vision of New Retail in China

New Retail in China is further along the way of integrating online and offline shopping due to several factors. Firstly, Chinese consumers tend to be younger, more digitally savvy, and more reliant on mobile commerce than their Western counterparts. Secondly, a dynamic infrastructure in which flexible manufacturing plays a role allows Chinese retailers to identify and react to new trends and individual consumer demands more rapidly. Also, the Chinese commerce market is highly concentrated, through a few massive platforms run by technology giants such as Alibaba, creates a network effect in which these platforms work directly to support brands and retailers as they digitalise.

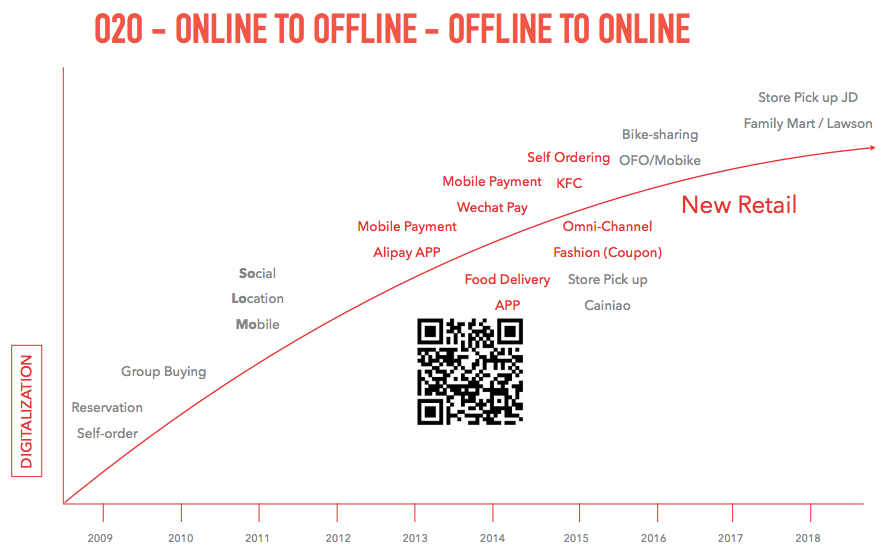

Key to the development of New Retail is Omni-channel commerce, or so called O2O solutions. Numerous factors in China such as the adoption of QR codes as well as mobile payment adoption and ongoing digitalisation (as can be seen in the figure below) have contributed to the speedy development of Online to Offline and Offline to Online solutions.

Challenges to Physical Retail in China

According to Dominiek Pouwer, China’s traditional retail environment will remain challenging as the country’s economic growth rate is decelerating, Chinese consumers grow more sophisticated, and as the country will continue to experience a growth of eCommerce, which is the main contributor to rise in retail sales. Where in 2016, total retail sales growth decelerated to 10.4%, while total online retail sales rose by 26.2%.

Although China’s domestic consumption is expected to increase, the growth of the department store industry is limited by its operating model as well as geographical constraints. More specifically, Mall traffic has been declining, not because the products for sale at the physical retailers are any less attractive, but because of the mobile internet and its impact on consumer behavior. Consumers no longer feel the need to go to malls to shop, because they can search for products online more efficiently.

New Retail addresses the bottleneck of China’s stagnating traditional retail industry, which are identified by the DigiDutch experts to be low operational efficiency, mall supply that is below most developed markets and a supply-demand imbalance between the top-tier and lower-tier cities. These issues form the heart of a recent typical occurrence in China, namely hyper modern malls which are completely deserted.

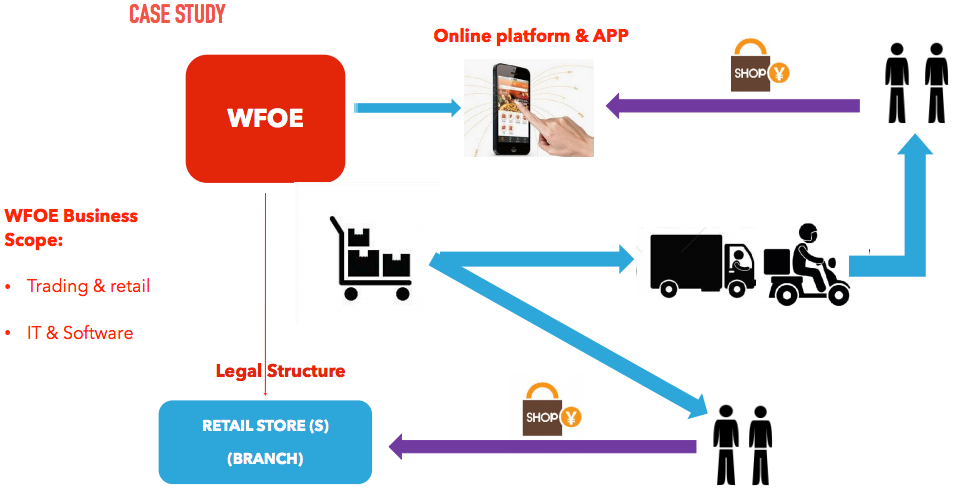

Offline Legal Entities and Online Licenses

An obvious point of consideration for business are legal requirements and licenses. To put it simple, “in order to engage in New Retail you must satisfy both online and offline legal requirements”, said Christine Wang, Manager of Business Development at Vistra. She continued by elaborating upon the legal structure of the WFOE, of which the business scope allows you to meet requirements for trading and retail as well as IT and software development.

She highlighted that in order to be able to open an online platform in China you must have a legal entity registered in the country and need to complete ICP registration. Furthermore, the costs associated with the AIC registration pose another entry barrier, as you are required to have a registered capital no less than 1 million RMB if a company is incorporated less than one year or a total revenue of 5 million RMB in the last financial year in all other situations.

The Role of the Physical Store

From the DigiDutch presentation it also became evident that there is a clear role for physical retail stores, however, the role they play varies depending on their category. These roles can be divided into functional, experiential, and a hybrid.

When a physical store provides after-sales service or serves as a staging point for last-mile delivery, it can be characterised as a functional store. This model is particularly applicable to categories in which products are standardised (for example, electronics, books, and grocery produce) or where speedy delivery is imperative (like the delivery of prepared food). For example, Xiaomi has recently opened physical stores in order to consult customers and better understand their needs. By integrating these specific insights over multiple channels, they are able to accelerate product innovation and respond rapidly to changes in consumer preferences.

On the other hand, we identified the experiential store which serves a more inspirational role. Generally, these stores sell nonstandard product categories where browsing and consultation elements are crucial (such as furnishing or fashion stores). In this case shoppers are less interested in efficiency and focus more on an in-store experience which is personalised and engaging. The most obvious example of such a store type is the Starbucks Flagship Roastery in Shanghai.

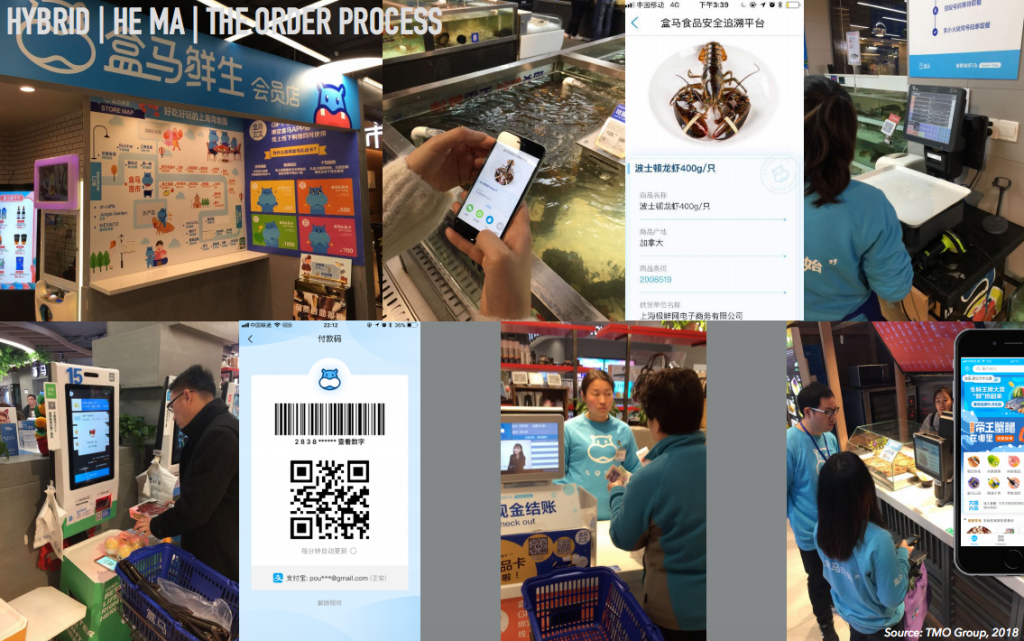

Grocery stores fall somewhere in the middle of the spectrum, creating a hybrid form. Some grocery products, such as packaged goods are standardised, whereas others, such as fresh and prepared foods are more experiential and encompass time-sensitive delivery. Hema Fresh, developed by Alibaba, is an example of such a grocery format with integrated retailing in mind.

Overall Takeaways

To summarise, Dominiek Pouwer mentioned that four key O2O initiatives will continue to drive the development of New Retail.

- Digital-isation: by digitalising the supply chain, companies seek to reduce the layers of suppliers and improve efficiency.

- Omnichannel-isation: by utilising big data and personalisation the omni-channel experience can emphasise customers’ needs.

- Platform-isation: granting online platforms access to a company’s offline inventory database will result in a broader product selection and drive fulfilment of online orders at physical stores.

- Entertainment-isation: entertainment activities create a relaxing shopping environment and increase brand awareness.

For the full presentation of “New Retail” check our presentation below:

About DigiDutch

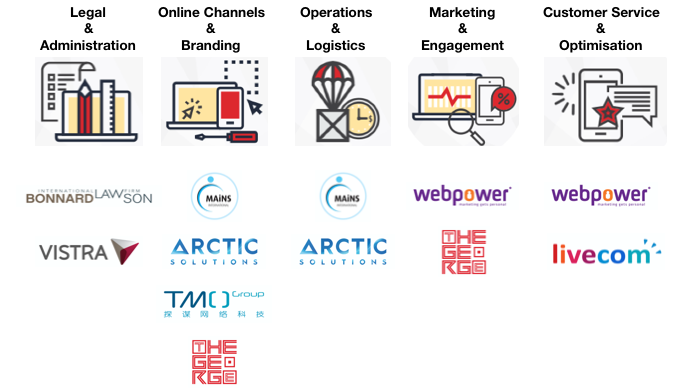

DigiDutch is an abbreviation on Digital Dutch and is a cooperation of Dutch companies or management engaged in different parts of the eCommerce process. The strength of DigiDutch is the trading/business DNA of the companies accelerated by the long time exposure to eCommerce in the Dutch home market. Furthermore, our teams bring a unique chemistry between Chinese and Dutch innovation spirit striving to deliver exceptional eCommerce experiences. The services offered by DigiDutch focus on eCommerce Strategy & Market Entry, Brand & Online Marketing Planning, Online Channel Development & Operations, and Marketing and Customer Services as you can observe down below. If you would like more information please visit the DigiDutch website.

About TMO Group

Since 2011, TMO has been at the forefront of new eCommerce & mobile developments in China. Deep understanding of the local eCommerce market enables the team to provide the best strategy and the most localised solution for your business. From innovative site management solutions to extensive platform features and outstanding customer support, TMO helps your online business flourish and help you exceed your customers’ expectations. By providing valuable industry expertise and innovation, TMO launched eCommerce sites in a wide variety of industries, such as FMCG, cross-border commerce, fashion, and luxury.

Would you like more information on New Retail or China cross-border eCommerce, or would you like to enter the Chinese market? Then feel free to contact us for a Market Opportunity Scan or for an eCommerce Strategy Development proposal at:

Email: info@tmogroup.asia Tel: + 86 (0)21 617 00 396