Cross-border eCommerce has opened the door to nutritional health products outside China. Endless healthcare products are rushing into the market. At the same time, the venture capital of China is so active recently to perform conglomerations. However, how does the China Policy and Blue Hat Sign restrict this booming market and import the healthcare product?

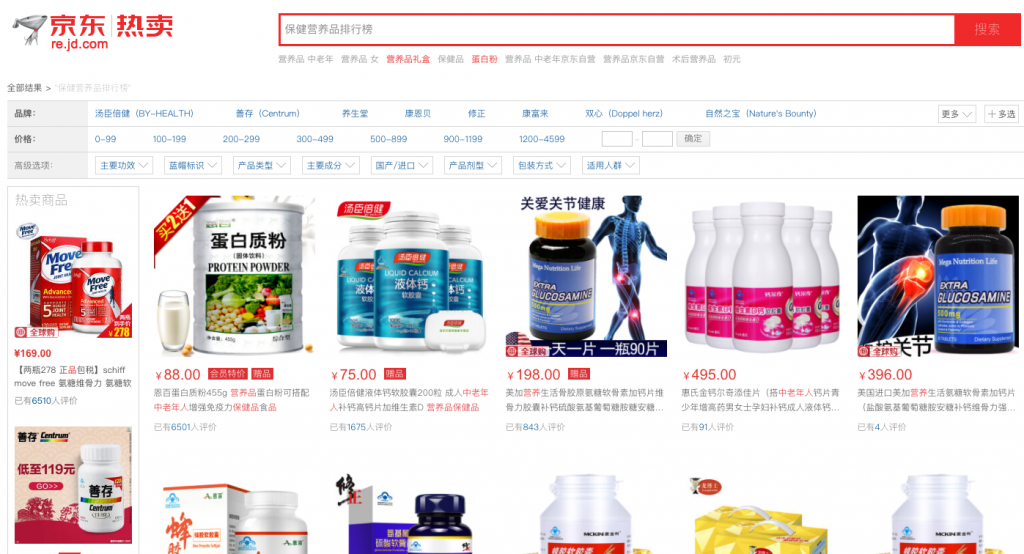

From 2005 – 2015, the nutritional health product market’s annual growth rate was 13%, which ranked the first worldwide. The estimated annual growth rate from 2015 – 2020 will be at 8%, and the market size will grow from 120 Billion in 2015 to 180 Billion.

A rough investigation shows that there were already 14 acquisitions in the nutritional health product industry from 2010 to 2016. For example, 新希望 New Hope Group acquired Australian Naturalcare, and 合生元 Biostime completely held Swisse last year. It will be a good opportunity for both the Chinese and foreign enterprises to re-arrange all the resources via conglomeration and seek the cross-border eCommerce opportunity.

On the other hand, there is also a strict restriction from the Chinese government regarding the eCommerce and trade of nutrition and food products. How can the nutrition and healthcare product enterprise get a license for their product, and how can they sell through the eCommerce channel?

‘4.8 New Customs Policy’ – The China Policy Control

Executed on 8 April 2016, ‘4.8 New Customs Policy’ limited a list of commodities that can be transacted via the B2C eCommerce channel. For the nutritional health product, the list merely covered some vitamins, coenzyme, and fish oil, i.e., roughly 90% of goods cannot be sold. There were undoubtedly great bounces and voices in the market, which made the policy postpone by 1 year, and the transition period was extended by the end of 2017.

On 17 March 2017, the authority confirmed the cross-border retail eCommerce belonged to the category of ‘personal goods’, and the new policy will be effective from 1 January 2018 onwards. This confirmation brought positive news to the industry, meaning that nutritional health products’ current sales will not be affected.

eCommerce & Blue Hat Sign

With the rise of eCommerce in China, foreign nutritional health products and dietary supplements embrace the golden times. Normally, most foreign healthcare products must take the ‘Blue Hat Sign‘ (蓝帽子) Healthcare Product registration at the China Food and Drug Administration (CFDA) to import to the China market. However, most healthcare products could be sold via the channel as ‘normal food‘ through eCommerce. Of course, the product could be regarded as ‘food’ when the food composition fits in the Food Raw Material Directory of China. For example, ‘evening primrose’ does not exist in the ‘Food Raw Material Directory’, so it cannot be imported via the normal food channel.

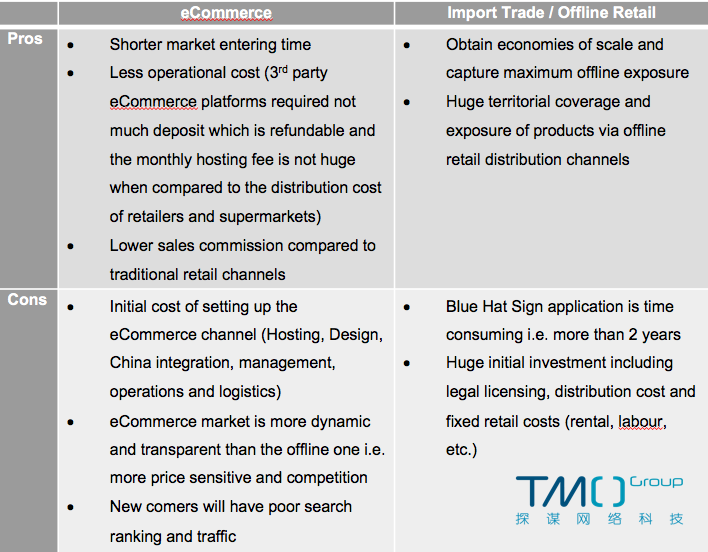

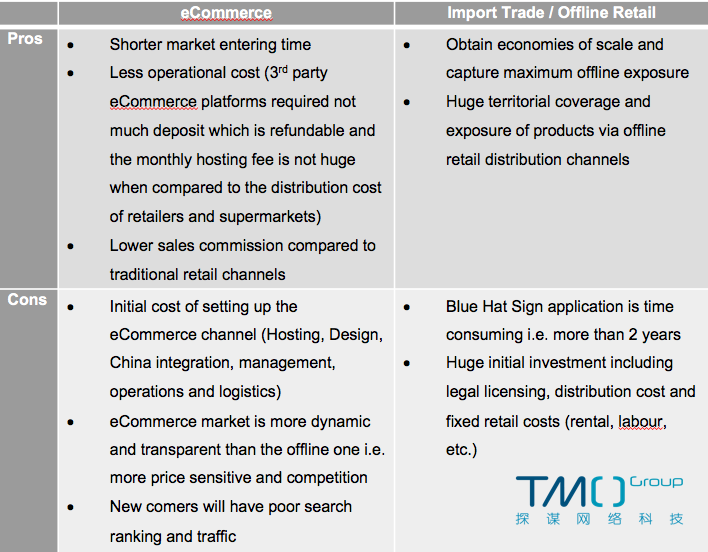

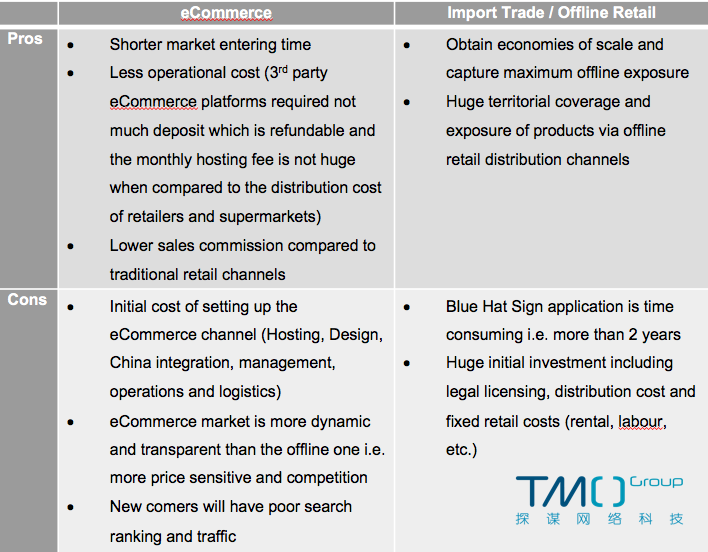

No one can indeed predict the upcoming eCommerce regulations and restrictions in the dynamic market. Many brands are still looking forward to entering China via importing trade, e.g., Swisse entered the offline retail sector from this March onwards. Despite the ease of entering the Chinese market via eCommerce, brands should not overlook the importance of normal trade. The business should be fully integrated online to offline and generate the highest yield and market exposure. While eCommerce targets the mobile-savvy and young middle class who are more accepting of new things worldwide, normal trade can bring a wider channel exposure and economies of scale for the brand.

Jason Zhang, the Managing Director of Atrium Innovation, APAC, mentioned in a previous interview,

Through cross-border eCommerce, we could service the Chinese consumers well, explore the market optential and identify product preference. After we selected products suitable for the China market, we would start to consider the offline trade channels which is more complicated than the online commerce.

Apply the ‘Blue Hat Sign’ is not easy. Until October 2016, the no. of imported Blue Hat Sign is 664 out of 15,703 in total. If you would like to promote the product advantage or make it sold offline legally, you should finish the application to become an official nutritional product in China. However, the overall cost of the application process is too high, and it is extremely time-consuming. Documentation is a great hurdle. Generally, it takes 3-4 years to register a single commodity, and it costs around 0.5 – 1 Million in RMB. It becomes unrealistic for brands to register all the products in China. That’s why the no. of imported Blue Hat Sign is far less than the local one.

Nutritional Health Product – the Current Practice

For those healthcare products not applying the ‘Blue Hat Sign’, entering the China eCommerce as ‘normal food’, they usually emphasize the benefit of the whole ingredient category but not the benefit of the specific product (which is not allowed).

For example, many clinical and literature reports about the benefit of fish oil on cardiovascular or memory. The brand can share these messages with the consumers while not specifying the product. In short, the Chinese authority will regard products with specific healthy functionality as nutritional products while those without special target function as normal food.

In conclusion, here is the summary of the pros and cons of eCommerce and offline retail for nutritional health product, respectively: